Press release

Fraud Detection and Prevention Market to Soar with a 17.5% CAGR, Expected to Reach USD 1,58,196.5 Billion by 2033

At a compound annual growth rate (CAGR) of 17.5% between 2023 and 2033, the fraud detection and prevention industry is anticipated to expand quickly. Notably, there was a 15.4% increase between 2018 and 2022, indicating the growing need for efficient fraud detection tools. Forecasts indicate that the market value will rise from US$ 31,447.6 million in 2023 to US$ 1,58,196.5 million in 2033, indicating the considerable growth potential and increasing significance of fraud detection and prevention strategies in a range of sectors.The market for fraud detection and prevention is critical for protecting people and organizations against fraudulent activities such as identity theft, financial fraud, and cybercrime. A growing amount of sophisticated fraud schemes and more digitization have made effective fraud detection and prevention solutions more crucial than ever.

The growing awareness among organizations about the financial and reputational hazards connected with fraud is one of the primary drivers in the fraud detection and prevention industry. As a result, organizations are investing in advanced fraud detection technology and solutions to detect and prevent fraudulent activity. Furthermore, the growing use of artificial intelligence (AI) and machine learning (ML) technology has greatly improved the capabilities of fraud detection and prevention systems, allowing them to spot trends, abnormalities, and suspicious behavior in real-time.

Request a Sample of this Report:

https://www.futuremarketinsights.com/reports/sample/rep-gb-14865

However, the market is also constrained by various constraints and problems. The intricacy and sophistication of current fraud schemes, which continually change and adapt to avoid detection, is one of the key constraints. Continuous innovation and investment in enhanced fraud protection technology are required.

Another difficulty is striking a balance between fraud protection and client experience. The correct balance must be struck to eliminate false positives and provide a seamless and frictionless client journey.

Despite these obstacles, the fraud detection and prevention business offers several development potentials. The growing use of mobile and digital payments, the expansion of e-commerce, and the emergence of online banking and financial services provide a fertile environment for fraudsters, fueling the need for sophisticated and comprehensive fraud detection and prevention solutions. Furthermore, the evolving regulatory landscape, which includes higher compliance requirements, creates an opportunity for market participants to provide solutions that help organizations achieve regulatory duties while lowering fraud risks.

Key Takeaways

• The United Kingdom is predicted to develop at a CAGR of 16.8% through 2033, owing to the rising sophistication of fraud schemes and the necessity for enhanced security measures.

• In India, the market is expected to develop at a rapid 22.1% CAGR by 2033, owing to increased digitalization of financial services and a greater emphasis on fraud prevention in the banking sector.

• In the United States, the market captured a CAGR of 17.5% in 2022 in the global market.

• Japan's market has a compound annual growth rate of 6%, as per the forecast for 2022 in the global market.

• China's fraud detection and prevention market is expected to develop at an 18.9% CAGR by 2033, owing to increased awareness of fraud risks and the adoption of severe regulatory frameworks.

Competitive landscape:

The fraud detection and prevention market is competitive, with numerous significant firms offering cutting-edge solutions and technology. IBM, SAS Institute, FICO, NICE Actimize, and Experian are some market's prominent rivals. These firms provide a variety of fraud detection and prevention solutions, including AI-based analytics, real-time monitoring, machine learning algorithms, and predictive modeling.

They serve a variety of industries, including banking, insurance, retail, and healthcare, by assisting organizations in mitigating the risks connected with fraud and financial crimes. These organizations seek to stay ahead of the market by providing their clients with powerful and complete fraud detection and prevention solutions, emphasizing innovation and continual development.

Recent Developments:

• IBM provides a complete fraud detection and prevention platform that uses sophisticated analytics, artificial intelligence, and machine learning algorithms to detect and prevent fraudulent actions in various industries, including banking, insurance, and retail. Identity and access management, transaction monitoring, and anomaly detection are among their products.

• SAS Institute offers fraud detection and prevention solutions that use data analytics, machine learning, and predictive modeling to identify and minimize fraud risks. Insurance fraud, payment fraud, healthcare fraud, and cybersecurity are all addressed by their solutions. They provide real-time monitoring, pattern detection, and risk grading.

Segments

By Components:

• Solutions Fraud Analytics, Authentication, Government, Risk and Compliance

• Services {Professional Services, Managed Services}

By Fraud Type:

• Check Fraud

• Identity Fraud

• Internet/Online Fraud

• Investment Fraud

• Payment Frauds

• Insurance Fraud

• Others

By Deployment Mode:

• Cloud

• On-premises

By Organization Size:

• SMEs

• Large Enterprises

By Vertical:

• BFSI {Banking and Financial, Insurance}

• Retail and Commerce

• Government

• Healthcare

• Manufacturing

• Ravel

• Transportation

• Others

By Region:

• North America

• Latin America

• Europe

• Asia Pacific

• The Middle East and Africa

About Future Market Insights (FMI)

Future Market Insights, Inc. (ESOMAR certified, recipient of the Stevie Award, and a member of the Greater New York Chamber of Commerce) offers profound insights into the driving factors that are boosting demand in the market. FMI stands as the leading global provider of market intelligence, advisory services, consulting, and events for the Packaging, Food and Beverage, Consumer Technology, Healthcare, Industrial, and Chemicals markets. With a vast team of over 400 analysts worldwide, FMI provides global, regional, and local expertise on diverse domains and industry trends across more than 110 countries. Join us as we commemorate 10 years of delivering trusted market insights. Reflecting on a decade of achievements, we continue to lead with integrity, innovation, and expertise.

Contact Us:

Future Market Insights Inc.

Christiana Corporate, 200 Continental Drive,

Suite 401, Newark, Delaware - 19713, USA

T: +1-347-918-3531

For Sales Enquiries: sales@futuremarketinsights.com

Website: https://www.futuremarketinsights.com

LinkedIn| Twitter| Blogs | YouTube

Read More@https://www.futuremarketinsights.com/reports/fraud-detection-and-prevention-market

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Fraud Detection and Prevention Market to Soar with a 17.5% CAGR, Expected to Reach USD 1,58,196.5 Billion by 2033 here

News-ID: 3781561 • Views: …

More Releases from Future market Insights

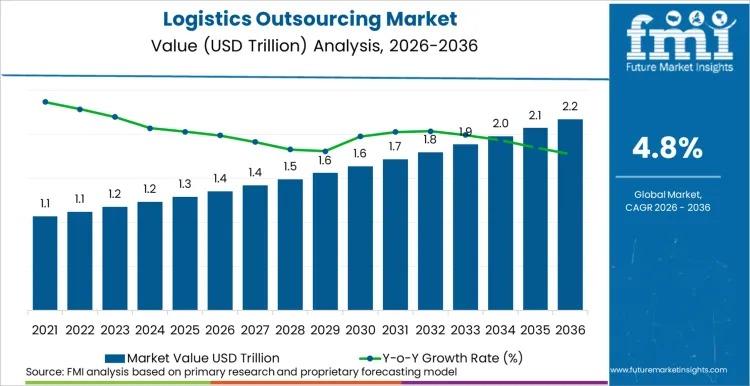

Global Logistics Outsourcing Market to Reach USD 2.2 Trillion by 2036 at 4.8% CA …

The global Logistics Outsourcing Market is projected to expand from USD 1.4 trillion in 2026 to USD 2.2 trillion by 2036, registering a CAGR of 4.8% during the forecast period. According to Future Market Insights (FMI), enterprises are accelerating outsourcing strategies to enhance supply chain resilience, digital transparency, and operational flexibility in an increasingly volatile global trade environment.

Demand dynamics are heavily influenced by the need for end-to-end visibility, omnichannel fulfillment…

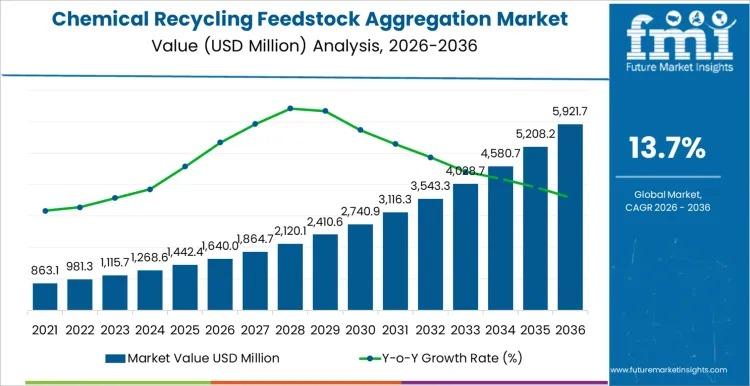

Chemical Recycling Feedstock Aggregation Market to Reach USD 5,921.7 million by …

The global Chemical Recycling Feedstock Aggregation Market is projected to grow from USD 1,640.0 million in 2026 to USD 5,921.7 million by 2036, registering a CAGR of 13.7%. The expansion reflects structural scaling of chemical recycling plants that depend on consistent, specification-aligned plastic waste streams rather than fragmented sourcing models.

As pyrolysis and depolymerization capacities expand worldwide, aggregators are investing in centralized hubs that integrate pre-sorting, blending, contamination control, and logistics…

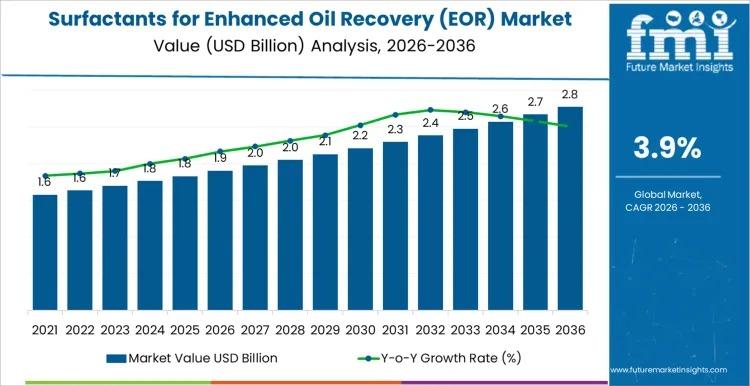

Global Surfactants for Enhanced Oil Recovery Market to Reach USD 2.9 Billion by …

The global Surfactants for Enhanced Oil Recovery (EOR) Market is projected to grow from USD 1.9 billion in 2026 to USD 2.9 billion by 2036, registering a CAGR of 3.85%. Market expansion is closely tied to mature oilfield economics, where incremental recovery gains justify chemical investment. Rather than broad upstream expansion, growth is concentrated in technically validated, project-specific deployments.

Long evaluation timelines, pilot testing requirements, and reservoir heterogeneity slow rapid scale-up,…

UK Hydrocarbon Accounting Solution Market to Reach USD 110.7 Mn by 2036 at 5.8% …

The Demand for Hydrocarbon Accounting Solution in United Kingdom is projected to expand from USD 63.0 million in 2026 to USD 110.7 million by 2036, registering a CAGR of 5.8% over the forecast period. The market's growth trajectory reflects accelerating regulatory oversight, digital oilfield deployment, and enterprise-level data governance initiatives across upstream and midstream operations.

As operators confront tightening volumetric reporting standards and emissions accountability frameworks, hydrocarbon accounting solutions are becoming…

More Releases for Fraud

GrayCat PI Joins Global Effort to Spotlight Fraud During International Fraud Awa …

Image: https://www.abnewswire.com/upload/2025/11/dc16cdb8496c72daf00c6802941e27f3.jpg

International Fraud Awareness Week runs November 19-22, 2025 worldwide Oaxaca, Oaxaca, Mexico. $3.1 billion lost to fraud. That figure comes from Occupational Fraud 2024: A Report to the Nations, the latest study from the Association of Certified Fraud Examiners (ACFE), based on 1,921 occupational fraud cases worldwide. The report is available at https://legacy.acfe.com/report-to-the-nations/2024/.

Because fraud remains a persistent and costly threat, GrayCat PI has joined International Fraud Awareness Week [https://graycatpi.com/fraud-week-mexico-2025/],…

New York City Fraud Attorney Russ Kofman Releases Insightful Guide on Welfare Fr …

New York City fraud attorney Russ Kofman (https://www.lebedinkofman.com/are-you-being-investigated-for-welfare-fraud-in-nyc/) of Lebedin Kofman LLP has recently published an enlightening article addressing the complexities surrounding welfare fraud investigations in New York City. The article, aimed at individuals who may be under investigation for welfare fraud, offers crucial legal insight and guidance for navigating this challenging process.

Welfare fraud is no minor offense. It comprises various fraudulent acts to unlawfully obtain public assistance benefits. This…

Fraud Increased by 3% in 2021 - Says Shufti Pro's Global ID Fraud Report

AI-powered digital identity verification solution provider, Shufti Pro, revealed new data in its Global ID Fraud Report 2021 which shows insights from ample research of 11 months of verification. The report highlights the changing fraudulent activities and advanced manipulation techniques that the company faced in 2021. Experts from Shufti Pro have also made fraud predictions that will threaten the corporate sector in 2022.

The ceaseless increase in ID and…

IPTEGO Launching PALLADION Fraud Detection and Prevention for a Real-Time Protec …

IPTEGO presents PALLADION Fraud Detection & Prevention, an innovative protection for CSPs and their customers against toll fraud.

Berlin, Germany, February 08, 2012 -- IPTEGO presents PALLADION Fraud Detection & Prevention, an innovative protection for CSPs and their customers against toll fraud.

With PALLADION Fraud Detection & Prevention, IPTEGO provides an answer to a growing demand for more network security when it comes to toll fraud. Today’s Communication Service Providers (CSPs) are…

Online Fraud Prevention – Sentropi

Are security nightmares causing you sleepless nights? Are you worried about how secure your I.T infrastructure is? Sentropi aims to address these ever present security concerns with its uniquely different identification and tracking solution. Sentropi's innovative technology allows you to identify your users with pinpoint accuracy and lets you track fraudsters on any platform, any browser, any time and any where! Hunt down fraudsters by tracking down their computers rather…

Fight Private Placement Program Fraud - PPP Fraud!

Stand up to private placement program fraud!

To set an undertone for the following summary; logic begets logic. No trading platforms nor programs, whether public or private have the freedom of complete exclusion from regulatory oversight, licensing, and governance.

Our firm has significant interest in a few platforms, as principals. There are indeed private financial offerings which have historically delivered very significant performance using "Institutional Leverage, Traders, Risk Management, Clearing & Execution"…