Press release

Risk Management Market Witnesses 12.48% CAGR Growth Fueled by Increasing Cyber Threats and Cloud Computing Adoption

The latest report by IMARC Group, titled "Risk Management Market Report by Component (Software, Service), Deployment Mode (On-premises, Cloud-based), Enterprise Size (Large Enterprises, Small and Medium-sized Enterprises), Industry Vertical (BFSI, IT and Telecom, Retail, Healthcare, Energy and Utilities, Manufacturing, Government and Defense, and Others), and Region 2025-2033", offers a comprehensive analysis of the industry, which comprises insights on the market. The global risk management market size reached USD 13.5 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 38.9 Billion by 2033, exhibiting a growth rate (CAGR) of 12.48% during 2025-2033.Factors Driving Growth in the Risk Management Industry

The risk management industry is experiencing significant growth due to a confluence of factors:

• Increasing Regulatory Complexity:

As regulatory landscapes become increasingly complex, organizations face heightened scrutiny and potential penalties for non-compliance. The globalization of business operations has further complicated this issue, as organizations must now navigate a patchwork of regulations across different jurisdictions. To mitigate these risks, organizations are investing in advanced risk management solutions to ensure compliance and protect their reputation. For example, the financial services industry is subject to a wide range of regulations, including Basel III, Solvency II, and Dodd-Frank. These regulations impose strict capital requirements, stress testing requirements, and risk management standards. To comply with these regulations, financial institutions must implement robust risk management frameworks that can identify, assess, and mitigate a wide range of risks, including credit risk, market risk, operational risk, and reputational risk.

• Cyber Threats and Data Privacy Concerns:

The increasing frequency and sophistication of cyberattacks, coupled with stringent data privacy regulations, have elevated cybersecurity to a top priority for organizations. Data breaches, ransomware attacks, phishing attacks, and social engineering attacks can have devastating financial and reputational consequences. To safeguard their digital assets and maintain customer trust, organizations are implementing robust cybersecurity measures, such as firewalls, intrusion detection systems, encryption, and access controls. This includes conducting regular security assessments, employee training, and incident response planning. Additionally, organizations are investing in advanced security technologies, such as artificial intelligence and machine learning, to detect and respond to cyber threats more effectively. For example, AI-powered security solutions can analyze large volumes of data to identify patterns of suspicious activity and predict potential attacks.

• Technological Advancements and Integration Challenges

Technological advancements, such as artificial intelligence (AI), machine learning, and big data analytics, are transforming risk management by enabling more sophisticated risk assessment, real-time monitoring, and predictive analytics. These technologies can help organizations identify emerging risks, predict potential threats, and make data-driven decisions to mitigate risks proactively. For example, AI-powered risk management solutions can analyze large volumes of data to identify patterns of suspicious activity, predict potential fraud, and optimize risk mitigation strategies. Machine learning algorithms can be used to develop predictive models that can forecast future risks based on historical data and current trends. This enables organizations to take preemptive measures to mitigate potential risks before they materialize. Big data analytics can be used to analyze large datasets to identify trends, anomalies, and correlations that may indicate potential risks. This can help organizations to identify emerging risks early on and take steps to mitigate them.

For an in-depth analysis, you can request the sample copy of the report: https://www.imarcgroup.com/risk-management-market/requestsample

Competitive Landscape:

The competitive landscape of the market has been studied in the report with the detailed profiles of the key players operating in the market.

• ACTICO GmbH

• Broadridge Financial Solutions Inc.

• Fidelity National Information Services Inc.

• International Business Machines Corporation

• LogicManager Inc.

• MetricStream Inc.

• NAVEX Global Inc.

• Oracle Corporation

• Qualys Inc.

• Risk Edge Solutions

• SAP SE

• SAS Institute Inc.

• ServiceNow

• Thomson Reuters Corporation

Risk Management Market Report Segmentation:

By Component:

• Software

• Service

Software solutions dominate the market, offering automated and streamlined risk management processes, ensuring accurate risk assessment and compliance monitoring.

By Deployment Mode:

• On-Premises

• Cloud-based

On-premises deployments are the most common, providing greater control over sensitive data and enabling compliance with stringent regulatory requirements.

By Enterprise Size:

• Large Enterprises

• Small and Medium-sized Enterprises

Large enterprises, with their complex risk profiles and extensive resources, are the primary drivers of the risk management market.

By Industry Vertical:

• BFSI

• IT and Telecom

• Retail

• Healthcare

• Energy and Utilities

• Manufacturing

• Government and Defense

• Others

The BFSI sector is the largest end-user, facing high regulatory scrutiny and financial risks, necessitating robust risk management practices.

Regional Insights:

• North America (United States, Canada)

• Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

• Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

• Latin America (Brazil, Mexico, Others)

• Middle East and Africa

North America leads the global risk management market due to its strong regulatory environment, advanced technological adoption, and high awareness of risk management practices.

Global Risk Management Market Trends:

The global risk management market is experiencing significant growth as organizations increasingly prioritize risk identification, assessment, and mitigation. This trend is driven by heightened awareness of regulatory compliance requirements, cybersecurity threats, and financial uncertainties. The integration of advanced technologies, such as artificial intelligence, machine learning, and big data analytics, is transforming risk management practices, enabling more accurate risk prediction and real-time monitoring. As organizations increasingly adopt remote work and digital transformation, new risks emerge, necessitating sophisticated risk management solutions. The demand for risk management services is particularly strong in sectors like finance, healthcare, and energy, where the stakes are high.

Ask Analyst for Customization: https://www.imarcgroup.com/request?type=report&id=6990&flag=C

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services. IMARC offerings include a thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape, and benchmarking analyses, pricing and cost research, and procurement research.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Risk Management Market Witnesses 12.48% CAGR Growth Fueled by Increasing Cyber Threats and Cloud Computing Adoption here

News-ID: 3780990 • Views: …

More Releases from IMARC Group

India Two-Wheeler Loan Market to Reach USD 14.55 Billion by 2033 | 6.43% CAGR | …

India Two-wheeler Loan Market Report Introduction

According to IMARC Group's report titled "India Two-Wheeler Loan Market Size, Share, Trends and Forecast by Type, Provider Type, Percentage Amount Sanctioned, Tenure, and Region, 2025-2033" the report offers a comprehensive analysis of the industry, including market share, growth, trends, and regional insights.

Free Sample Download PDF (Exclusive Offer on Corporate Email): https://www.imarcgroup.com/india-two-wheeler-loan-market/requestsample

Note : We are in the process of updating our reports to cover…

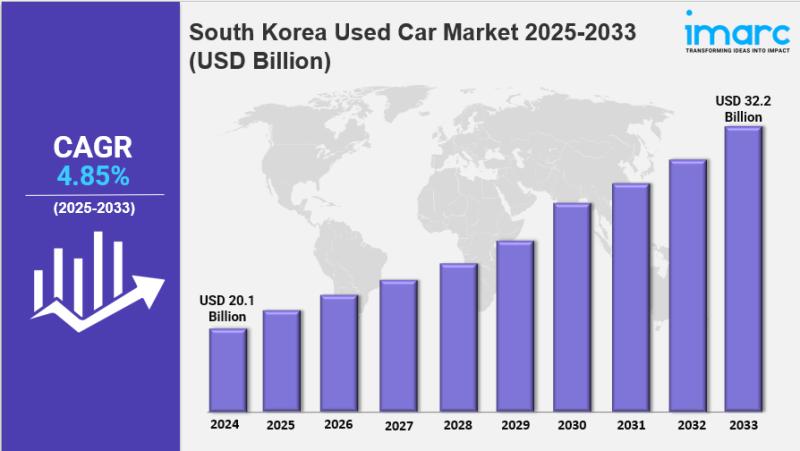

South Korea Used Car Market Size, Share, Industry Overview, Trends and Forecast …

IMARC Group has recently released a new research study titled "South Korea Used Car Market Report by Vehicle Type (Hatchback, Sedan, Sports Utility Vehicle, and Others), Vendor Type (Organized, Unorganized), Fuel Type (Gasoline, Diesel, and Others), Sales Channel (Online, Offline), and Region 2025-2033", offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

South Korea Used Car Market…

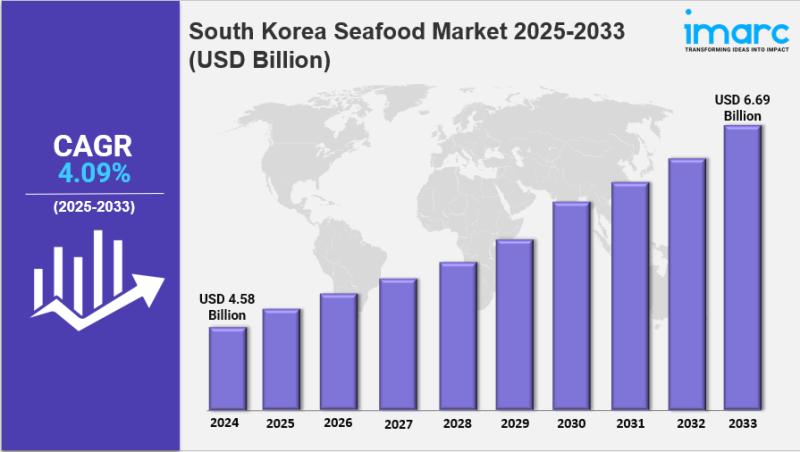

South Korea Seafood Market Size, Share, Industry Overview, Trends and Forecast 2 …

IMARC Group has recently released a new research study titled "South Korea Seafood Market Size, Share, Trends and Forecast by Type, Form, Distribution Channel, and Region, 2025-2033", offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

South Korea Seafood Market Overview

The South Korea seafood market size was valued at USD 4.58 Billion in 2024 and is forecast…

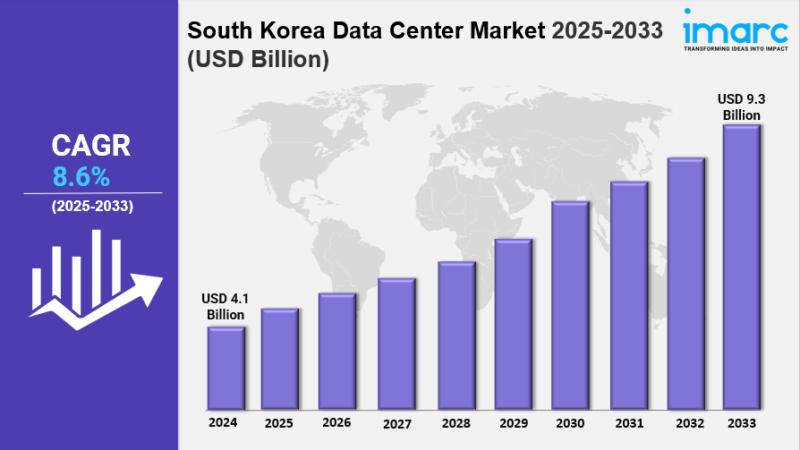

South Korea Data Center Market Size, Share, Industry Overview, Trends and Foreca …

IMARC Group has recently released a new research study titled "South Korea Data Center Market Report by Data Center Size (Large, Massive, Medium, Mega, Small), Tier Type (Tier 1 and 2, Tier 3, Tier 4), Absorption (Non-Utilized, Utilized), and Region 2026-2034", offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

South Korea Data Center Market Overview

The South…

More Releases for Risk

RiskWatch Launches Risk Management Software: Streamlined Risk Assessments and In …

RiskWatch International, a leading provider of compliance and risk management solutions, has announced the launch of its comprehensive Risk Management Software. This user-friendly platform empowers organizations of all sizes to proactively identify, assess, and mitigate risks, fostering a culture of resilience and success.

RiskWatch Risk Management Software delivers a robust suite of features, including:

● Comprehensive Risk Templates: Build a customized library of risk templates tailored to your specific needs, encompassing…

SMARTER RISK LAUNCHES REVOLUTIONARY AUTOMATED RISK CONTROL SOLUTION

Winston-Salem, N.C. - Smarter Risk, a risk control solutions provider, is proud to announce the launch of its newest product, Automated Risk Control (ARC) - a first-of-its-kind scalable risk control platform designed for the insurance industry.

ARC delivers unmatched speed, efficiency, and cost savings by automating the entire risk assessment process, from data collection to reporting. With assessments taking just 15 minutes and turnaround times of two business days, ARC…

Construction Risk Software Market is Booming Worldwide : Risk Decisions, Sword A …

2020-2025 Global Construction Risk Software Market Report - Production and Consumption Professional Analysis (Impact of COVID-19) is the latest research study released by HTF MI evaluating the market risk side analysis, highlighting opportunities, and leveraging with strategic and tactical decision-making support. The report provides information on market trends and development, growth drivers, technologies, and the changing investment structure of the Global Construction Risk Software Market. Some of the key players…

Future Growth In Risk Analytics Market - Segmented By Material Type (Software An …

The global risk analytics market was valued at, and is expected to reach a 2023 at a CAGR of +13%, during the forecast period (2018-2023). The market is segmented by type of offering, applications, end-user vertical, and geography. This report focuses on adoption of these solutions for various applications various regions. The study also emphasizes on latest trends, industry activities, and vendor market activities. Approximately 73% of the banks are…

Risk Analysis and Risk Management for Public Private Partnerships

Practical Seminar, 21st – 22nd March 2013, Berlin

For many public institutions that plan new projects in the sectors of public buildings, infrastructure or energy and waste, Public Private Partnerships are an attractive alternative to traditional tender and delivery strategies. However, risks in PPPs have to be identified, analysed and allocated to the right partner before embarking on a project.

• What is risk

• What types of risks exist for which type of…

Online Risk Check Analyzes Weighing Risk in Minutes

Mettler Toledo, the leading manufacturer of precision instruments, developed the Risk Check: An online tool to analyze the weighing risk of balances from all kinds of manufacturers. The Risk Check defines the weighing risk to optimize the performance and quality of a balance. It is based on the international weighing guideline Good Weighing Practice (GWP), which is appropriate for persons in charge of quality management in the pharmaceutical, chemical and…