Press release

Supply Chain Finance Market Size to Hit USD 15.2 Billion, Globally, by 2033 at 8.08% CAGR

𝐆𝐥𝐨𝐛𝐚𝐥 𝐒𝐮𝐩𝐩𝐥𝐲 𝐂𝐡𝐚𝐢𝐧 𝐅𝐢𝐧𝐚𝐧𝐜𝐞 𝐈𝐧𝐝𝐮𝐬𝐭𝐫𝐲: 𝐊𝐞𝐲 𝐒𝐭𝐚𝐭𝐢𝐬𝐭𝐢𝐜𝐬 𝐚𝐧𝐝 𝐈𝐧𝐬𝐢𝐠𝐡𝐭𝐬 𝐢𝐧 𝟐𝟎𝟐𝟓-𝟐𝟎𝟑𝟑𝐒𝐮𝐦𝐦𝐚𝐫𝐲:

● The global supply chain finance market size reached USD 7.5 Billion in 2024.

● The market is expected to reach USD 15.2 Billion by 2033, exhibiting a growth rate (CAGR) of 8.08% during 2025-2033.

● Asia Pacific leads the market, accounting for the largest supply chain finance market share.

● Banks account for the majority of the market share in the provider segment due to their established trust, extensive financial networks, and access to capital.

● Export and import bills hold the largest share in the supply chain finance industry.

● Domestic represents the leading application segment.

● Large enterprises remain a dominant segment in the market.

● The rise in demand for liquidity solutions in global supply chains is a primary driver of the supply chain finance market.

● Ongoing advancements for making supply chain finance more accessible, efficient, and secure are reshaping the supply chain finance market.

𝐑𝐞𝐪𝐮𝐞𝐬𝐭 𝐟𝐨𝐫 𝐚 𝐬𝐚𝐦𝐩𝐥𝐞 𝐜𝐨𝐩𝐲 𝐨𝐟 𝐭𝐡𝐢𝐬 𝐫𝐞𝐩𝐨𝐫𝐭: https://www.imarcgroup.com/supply-chain-finance-market/requestsample

𝐈𝐧𝐝𝐮𝐬𝐭𝐫𝐲 𝐓𝐫𝐞𝐧𝐝𝐬 𝐚𝐧𝐝 𝐃𝐫𝐢𝐯𝐞𝐫𝐬:

● 𝐈𝐧𝐜𝐫𝐞𝐚𝐬𝐢𝐧𝐠 𝐃𝐞𝐦𝐚𝐧𝐝 𝐟𝐨𝐫 𝐋𝐢𝐪𝐮𝐢𝐝𝐢𝐭𝐲 𝐒𝐨𝐥𝐮𝐭𝐢𝐨𝐧𝐬 𝐢𝐧 𝐆𝐥𝐨𝐛𝐚𝐥 𝐒𝐮𝐩𝐩𝐥𝐲 𝐂𝐡𝐚𝐢𝐧𝐬:

As businesses go global, they need flexible cash solutions. Supply chain finance (SCF) offers quick cash to suppliers. This allows early payments while keeping longer payment terms. Both suppliers and buyers benefit, improving cash flow. SCF is especially useful in sectors like manufacturing, retail, and agriculture. It helps these industries run smoothly without traditional debt. By unlocking cash in invoices, SCF boosts buyer-supplier relationships. This fosters a more cooperative supply chain. Ultimately, SCF reduces financial stress. It lets businesses focus on strategic plans, improve inventory, and respond better to market changes.

● 𝐆𝐫𝐨𝐰𝐢𝐧𝐠 𝐀𝐝𝐨𝐩𝐭𝐢𝐨𝐧 𝐨𝐟 𝐓𝐞𝐜𝐡𝐧𝐨𝐥𝐨𝐠𝐲 𝐢𝐧 𝐅𝐢𝐧𝐚𝐧𝐜𝐢𝐚𝐥 𝐒𝐞𝐫𝐯𝐢𝐜𝐞𝐬:

Technology is transforming supply chain finance (SCF). It's becoming more accessible, efficient, and secure. Innovations like blockchain, AI, and cloud computing simplify SCF. They streamline processes such as credit checks and transactions. Blockchain enhances trust in cross-border trade by being transparent and secure. This cuts out costly middlemen. AI helps banks by automating risk checks and predicting supplier health. This is crucial for smaller suppliers who often struggle to get loans. Cloud computing improves access, allowing real-time transaction monitoring and easy communication among partners. This creates a faster, more reliable SCF system, reducing fraud and errors. It encourages wider use. These technologies cut delays and provide instant insights. They help businesses create flexible supply chains that can adapt to market changes.

● 𝐈𝐧𝐜𝐫𝐞𝐚𝐬𝐞𝐝 𝐅𝐨𝐜𝐮𝐬 𝐨𝐧 𝐑𝐞𝐬𝐢𝐥𝐢𝐞𝐧𝐜𝐞 𝐚𝐧𝐝 𝐑𝐢𝐬𝐤 𝐌𝐚𝐧𝐚𝐠𝐞𝐦𝐞𝐧𝐭:

Recent global disruptions show the need for strong supply chains. Supply chain finance (SCF) is key in this shift. It offers stability and flexibility to suppliers, helping them handle demand changes or interruptions. SCF provides immediate cash, reducing suppliers' need for traditional loans, which can be hard to get or too expensive during economic downturns. This support keeps smaller suppliers committed and ensures steady production and delivery. Additionally, SCF makes cash flow more predictable, aiding in better planning for emergencies. For businesses aiming to build reliable and resilient supply chains, SCF is vital. It boosts adaptability and maintains stability in tough markets.

𝐁𝐮𝐲 𝐍𝐨𝐰 𝐑𝐞𝐩𝐨𝐫𝐭: https://www.imarcgroup.com/checkout?id=19065&method=502

𝐒𝐮𝐩𝐩𝐥𝐲 𝐂𝐡𝐚𝐢𝐧 𝐅𝐢𝐧𝐚𝐧𝐜𝐞 𝐌𝐚𝐫𝐤𝐞𝐭 𝐑𝐞𝐩𝐨𝐫𝐭 𝐒𝐞𝐠𝐦𝐞𝐧𝐭𝐚𝐭𝐢𝐨𝐧:

𝐁𝐫𝐞𝐚𝐤𝐮𝐩 𝐁𝐲 𝐏𝐫𝐨𝐯𝐢𝐝𝐞𝐫:

● Banks

● Trade Finance House

● Others

Banks exhibit a clear dominance in the market due to their established trust, extensive financial networks, and access to capital, which are essential for providing large-scale supply chain finance solutions.

𝐁𝐫𝐞𝐚𝐤𝐮𝐩 𝐁𝐲 𝐎𝐟𝐟𝐞𝐫𝐢𝐧𝐠:

● Letter of Credit

● Export and Import Bills

● Performance Bonds

● Shipping Guarantees

● Others

Export and import bills represent the largest segment as they are crucial in international trade, providing immediate liquidity for cross-border transactions.

𝐁𝐫𝐞𝐚𝐤𝐮𝐩 𝐁𝐲 𝐀𝐩𝐩𝐥𝐢𝐜𝐚𝐭𝐢𝐨𝐧:

● Domestic

● International

Domestic holds the biggest market share because companies prioritize managing cash flow and reducing risk within local supply chains.

𝐁𝐫𝐞𝐚𝐤𝐮𝐩 𝐁𝐲 𝐄𝐧𝐝 𝐔𝐬𝐞𝐫:

● Large Enterprises

● Small and Medium-sized Enterprises

Large enterprises account for the majority of the market share since they rely heavily on supply chain finance to manage extensive supplier networks and optimize cash flow, giving them a substantial share.

𝐁𝐫𝐞𝐚𝐤𝐮𝐩 𝐁𝐲 𝐑𝐞𝐠𝐢𝐨𝐧:

● North America (United States, Canada)

● Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

● Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

● Latin America (Brazil, Mexico, Others)

● Middle East and Africa

Asia Pacific dominates the market attributed to its strong trade environment, regulatory support, and financial infrastructure.

𝐓𝐨𝐩 𝐒𝐮𝐩𝐩𝐥𝐲 𝐂𝐡𝐚𝐢𝐧 𝐅𝐢𝐧𝐚𝐧𝐜𝐞 𝐌𝐚𝐫𝐤𝐞𝐭 𝐋𝐞𝐚𝐝𝐞𝐫𝐬:

The supply chain finance market research report outlines a detailed analysis of the competitive landscape, offering in-depth profiles of major companies. Some of the key players in the market are:

● Asian Development Bank

● Bank of America Corporation

● BNP Paribas

● DBS Bank India Limited

● HSBC

● JPMorgan Chase & Co.

● Mitsubishi UFJ Financial Group Inc.

● Orbian Corporation

● Royal Bank of Scotland plc (NatWest Group plc)

𝐀𝐬𝐤 𝐚𝐧𝐚𝐥𝐲𝐬𝐭: https://www.imarcgroup.com/request?type=report&id=19065&flag=C

𝐈𝐟 𝐲𝐨𝐮 𝐫𝐞𝐪𝐮𝐢𝐫𝐞 𝐚𝐧𝐲 𝐬𝐩𝐞𝐜𝐢𝐟𝐢𝐜 𝐢𝐧𝐟𝐨𝐫𝐦𝐚𝐭𝐢𝐨𝐧 𝐭𝐡𝐚𝐭 𝐢𝐬 𝐧𝐨𝐭 𝐜𝐨𝐯𝐞𝐫𝐞𝐝 𝐜𝐮𝐫𝐫𝐞𝐧𝐭𝐥𝐲 𝐰𝐢𝐭𝐡𝐢𝐧 𝐭𝐡𝐞 𝐬𝐜𝐨𝐩𝐞 𝐨𝐟 𝐭𝐡𝐞 𝐫𝐞𝐩𝐨𝐫𝐭, 𝐰𝐞 𝐰𝐢𝐥𝐥 𝐩𝐫𝐨𝐯𝐢𝐝𝐞 𝐭𝐡𝐞 𝐬𝐚𝐦𝐞 𝐚𝐬 𝐚 𝐩𝐚𝐫𝐭 𝐨𝐟 𝐭𝐡𝐞 𝐜𝐮𝐬𝐭𝐨𝐦𝐢𝐳𝐚𝐭𝐢𝐨𝐧.

𝐀𝐛𝐨𝐮𝐭 𝐔𝐬:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

𝐂𝐨𝐧𝐭𝐚𝐜𝐭 𝐔𝐬:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145 | United Kingdom: +44-753-713-2163

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Supply Chain Finance Market Size to Hit USD 15.2 Billion, Globally, by 2033 at 8.08% CAGR here

News-ID: 3768274 • Views: …

More Releases from IMARC Group

Vegetable Oil Processing Plant DPR & Unit Setup - 2026: Machinery Cost, CapEx/Op …

Setting up a vegetable oil processing plant positions investors in one of the most stable and essential segments of the food and agro-processing value chain, backed by sustained global growth driven by rising population, increasing consumption of edible oils, growth in packaged food demand, and expanding applications across food, personal care, and industrial sectors. As urbanization accelerates, consumer lifestyles shift toward convenience and packaged foods, and regulatory frameworks increasingly support…

Trinitrotoluene Production Plant DPR & Unit Setup 2026: Demand Analysis and Proj …

Setting up a trinitrotoluene production plant involves strategic planning, substantial capital investment, and a comprehensive understanding of production technologies. This critical explosive compound serves military and defense, mining and quarrying, construction and demolition, and industrial explosives manufacturing applications. Success requires careful site selection, efficient nitration processes, stringent safety protocols for handling hazardous materials, reliable raw material sourcing, and compliance with industrial safety regulations to ensure profitable and sustainable operations.

Market Overview…

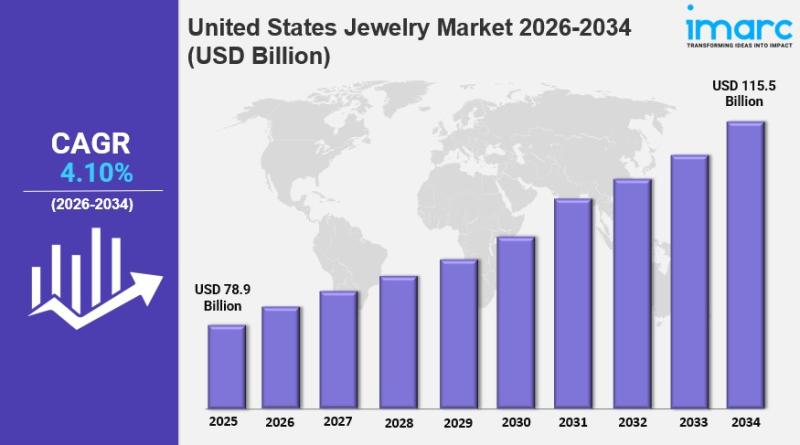

United States Jewelry Market Size, Share, Industry Overview, Growth and Forecast …

IMARC Group has recently released a new research study titled "United States Jewelry Market Report by Product (Necklace, Ring, Earrings, Bracelet, and Others), Material (Gold, Platinum, Diamond, and Others), and Region 2026-2034", offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

United States Jewelry Market Overview

The United States jewelry market size reached USD 78.9 Billion in 2025.…

United States Air Freight Market Size, Share, Industry Trends, Growth and Foreca …

IMARC Group has recently released a new research study titled "United States Air Freight Market Size, Share, Trends and Forecast by Service, Destination, End User, and Region, 2026-2034", offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

United States Air Freight Market Overview

The United States air freight market size was valued at USD 64.06 Billion in 2025.…

More Releases for SCF

Digital Supply Chain Finance (SCF) Solution Market Growth Opportunities in the G …

The global market for Digital Supply Chain Finance (SCF) Solution was estimated to be worth US$ 13650 million in 2024 and is forecast to a readjusted size of US$ 28940 million by 2031 with a CAGR of 11.5% during the forecast period 2025-2031.

A 2025 latest Report by QYResearch offers on -"Digital Supply Chain Finance (SCF) Solution - Global Market Share and Ranking, Overall Sales and Demand Forecast 2025-2031" provides…

Stem Cell Factor(SCF) Market Size, Trends, Growth Analysis, and Forecast | Val …

Stem Cell Factor(SCF) Market Size

The global Stem Cell Factor(SCF) market was valued at US$ 12900 million in 2023 and is anticipated to reach US$ million by 2030, witnessing a CAGR of 11.4% during the forecast period 2024-2030.

Get Free Sample: https://reports.valuates.com/request/sample/QYRE-Auto-10V18247/Global_Stem_Cell_Factor_SCF_Market_Research_Report_2024

The major global manufacturers of Stem Cell Factor(SCF) include PeproTech, Prospec, Proteintech, NeoScientific, STEMCELL Technologies, MP Biomedicals, AJINOMOTO, Enzo, FUJIFILM Irvine Scientific, SigmaAldrich, etc. In 2023, the world's top three vendors…

Dangerous Goods Container Market Size: 2022, Growth Strategic Assessment, Develo …

The Global "Dangerous Goods Container Market" report provides a comprehensive overview of the emerging market trends, drivers, and constraints. This report evaluates historical data on the Dangerous Goods Container market growth and compares it with current market situations. This report provides data to the customers that are of historical & statistical significance and informative. It helps to enable readers to have a detailed analysis of the development of the market.…

Slow Release Fertilizers Market 2018 Global Growth Analysis & Forecast to 2025 | …

UpMarketResearch offers a latest published report on “Global Slow Release Fertilizers Market Analysis and Forecast 2018-2023” delivering key insights and providing a competitive advantage to clients through a detailed report. The report contains pages which highly exhibit on current market analysis scenario, upcoming as well as future opportunities, revenue growth, pricing and profitability.

Get Free Exclusive PDF Sample Copy of This Report: https://www.upmarketresearch.com/home/requested_sample/5703

Slow Release Fertilizers Industry research report delivers a…

Global Control Release Fertilizers Market Size and Forecast 2025: Hanfeng, Prill …

Qyresearchreports include new market research report Global Control Release Fertilizers Market Professional Survey Report 2018 to its huge collection of research reports.

This report studies Control Release Fertilizers in Global market, especially in North America, China, Europe, Southeast Asia, Japan and India, with production, revenue, consumption, import and export in these regions, from 2013 to 2018, and forecast to 2025.

The global Control Release Fertilizers market is broadly shed light upon in…

Global Slow Release Fertilizers Market Insights, Forecast to 2025 : Hanfeng, Pri …

Researchmoz added Most up-to-date research on "Global Slow Release Fertilizers Market Insights, Forecast to 2025" to its huge collection of research reports.

This report researches the worldwide Slow Release Fertilizers market size (value, capacity, production and consumption) in key regions like North America, Europe, Asia Pacific (China, Japan) and other regions.

This study categorizes the global Slow Release Fertilizers breakdown data by manufacturers, region, type and application, also analyzes the market status,…