Press release

Fintech as a Service (FaaS) Market Trends, Top Companies, Share, Growth And Forecast 2033

The Business Research Company recently released a comprehensive report on the Global Fintech as a Service (FaaS) Market Size and Trends Analysis with Forecast 2024-2033. This latest market research report offers a wealth of valuable insights and data, including global market size, regional shares, and competitor market share. Additionally, it covers current trends, future opportunities, and essential data for success in the industry.Ready to Dive into Something Exciting? Get Your Free Exclusive Sample of Our Research Report @

https://www.thebusinessresearchcompany.com/sample.aspx?id=12612&type=smp

According to The Business Research Company's, The fintech as a service (faas) market size has grown rapidly in recent years. It will grow from $327.51 billion in 2023 to $386.39 billion in 2024 at a compound annual growth rate (CAGR) of 18.0%. The growth in the historic period can be attributed to digital transformation, mobile and internet penetration, regulatory changes, rise of apis, demand for efficiency.

The fintech as a service (faas) market size is expected to see rapid growth in the next few years. It will grow to $745.53 billion in 2028 at a compound annual growth rate (CAGR) of 17.9%. The growth in the forecast period can be attributed to ai and automation, open banking expansion, blockchain and cryptocurrency, globalization of services, data security and privacy. Major trends in the forecast period include embedded finance, api ecosystem growth, regtech and compliance solutions, evolving payment solutions, sustainable finance focus.

Get The Complete Scope Of The Report @

https://www.thebusinessresearchcompany.com/report/fintech-as-a-service-faas-global-market-report

Market Drivers and Trends:

The increase in the shift towards digital banking and payments is expected to propel the growth of fintech as a service market going forward. Digital banking refers to banking done using a digital platform, eliminating all paper-based transactions, including demand drafts, pay-in slips, and checks. Fintech as a Service (FaaS) plays a significant role in digital banking by providing mobile applications, web-based platforms, APIs, and more sophisticated applications that use artificial intelligence and machine learning to provide financial advice. FaaS also offers digital banking solutions, which enable companies to provide their customers with online banking services. For instance, in July 2023, according to a report shared by Finder.com, an Australia-based independent comparison website, an estimated 93% of Brits were using online banking in 2022. Around another 5.3 million Brits (10%) intend to get a digital-only bank account in 2023. By 2028, the number of digital-only bank account holders is predicted to be 22.6 million (43%). Therefore, the increase in the shift towards digital banking and payments is driving the growth of fintech as a service market.

Technological innovations are a key trend gaining popularity in the fintech as a service market. Major companies operating in the fintech as a service market are focused on innovating technologically advanced solutions to strengthen their position in the market. For instance, in April 2023, Valley National Bank, a US-based regional bank holding company, launched a new fintech innovation platform powered by NayaOne. Through a straightforward and user-friendly onboarding process, the platform is already integrated with the goods and services of numerous financial businesses. It offers a set of tools for producing and using synthetic data, enabling Valley and its fintech partners to quickly test-drive novel solutions in a controlled, secure environment.

Key Benefits for Stakeholders:

• Comprehensive Market Insights: Stakeholders gain access to detailed market statistics, trends, and analyses that help them understand the current and future landscape of their industry.

• Informed Decision-Making: The reports provide crucial data that support strategic decisions, reducing risks and enhancing business planning.

• Competitive Advantage: With in-depth competitor analysis and market share information, stakeholders can identify opportunities to outperform their competition.

• Tailored Solutions: The Business Research Company offers customized reports that address specific needs, ensuring stakeholders receive relevant and actionable insights.

• Global Perspective: The reports cover various regions and markets, providing a broad view that helps stakeholders expand and operate successfully on a global scale.

Major Key Players of the Market:

Stripe Inc., Rapyd Financial Network Ltd., Visa Inc., Mastercard Incorporated, Fiserv Inc., Block Inc., Fidelity National Information Services Inc., Global Payments Inc., NCR Corporation, Broadridge Financial Solutions, Worldline SA, Diebold Nixdorf Incorporated, Coinbase Global Inc, WEX Inc., Jack Henry and Associates Inc., Chime Financial Inc., Finastra, Green Dot Corporation, Envestnet Inc., Adyen NV, Temenos AG, Revolut Ltd., Marqeta Inc., Airwallex Pty Ltd., Plaid Inc., Finix Payments Inc., Square Capital LLC, Dwolla Inc., Synctera Inc., Solid Financial Technologies Inc.

Fintech as a Service (FaaS) Market 2024 Key Insights:

• The fintech as a service (faas) market size is expected to see rapid growth in the next few years. It will grow to $745.53 billion in 2028 at a compound annual growth rate (CAGR) of 17.9%.

• The Surge Of Digital Banking And Fintech Synergy

• Rising Popularity Of Technological Innovations In Fintech

• North America was the largest region in the fintech as a service market in 2023

We Offer Customized Report, Click @

https://www.thebusinessresearchcompany.com/Customise?id=12612&type=smp

Contact Us:

The Business Research Company

Europe: +44 207 1930 708

Asia: +91 88972 63534

Americas: +1 315 623 0293

Email: info@tbrc.info

Follow Us On:

LinkedIn: https://in.linkedin.com/company/the-business-research-company

Twitter: https://twitter.com/tbrc_info

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ

Learn More About The Business Research Company

The Business Research Company (www.thebusinessresearchcompany.com) is a leading market intelligence firm renowned for its expertise in company, market, and consumer research. With a global presence, TBRC's consultants specialize in diverse industries such as manufacturing, healthcare, financial services, chemicals, and technology, providing unparalleled insights and strategic guidance to clients worldwide.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Fintech as a Service (FaaS) Market Trends, Top Companies, Share, Growth And Forecast 2033 here

News-ID: 3767654 • Views: …

More Releases from The Business research company

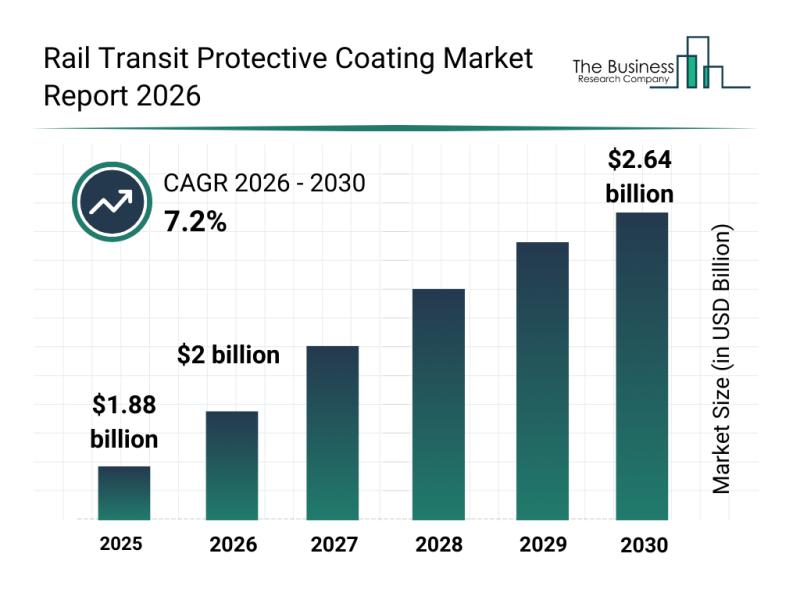

Rail Transit Protective Coating Market Overview: Major Segments, Strategic Devel …

The rail transit protective coating sector is positioned for significant expansion in the coming years, driven by technological advancements and increasing infrastructure investments. This market is evolving rapidly as stakeholders prioritize durability, sustainability, and efficiency in rail transit systems. Let's explore the market's valuation projections, leading companies, emerging trends, and detailed segment analysis to get a clearer understanding of its future trajectory.

Expected Market Size and Growth Outlook for Rail Transit…

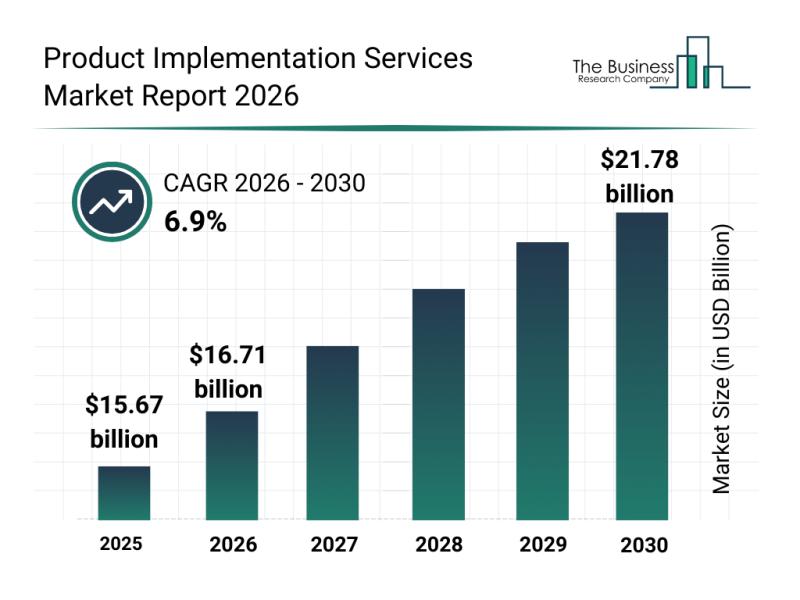

Analysis of Segments and Major Growth Areas in the Product Implementation Servic …

The product implementation services sector is on the verge of significant expansion, driven by evolving technology needs and increasing enterprise adoption of sophisticated systems. Understanding the current market size, key contributors, emerging trends, and segment breakdowns offers valuable insights into what lies ahead for this dynamic industry.

Market Size and Expected Growth Trajectory in the Product Implementation Services Market

The product implementation services market is projected to experience strong growth…

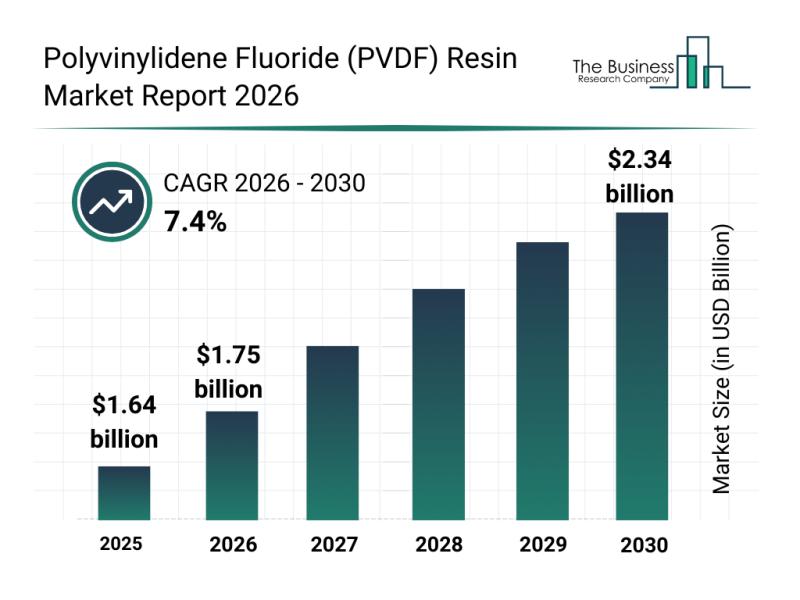

Key Strategic Developments and Emerging Changes Shaping the Polyvinylidene Fluor …

The polyvinylidene fluoride (PVDF) resin market is on track for significant expansion over the coming years. Driven by various technological advances and rising demands across multiple industries, this sector is expected to evolve rapidly. Let's explore the anticipated market growth, influential players, key trends, and detailed segmentation shaping the future of PVDF resin.

Projected Growth and Market Size of the Polyvinylidene Fluoride Resin Market

The PVDF resin market is forecasted…

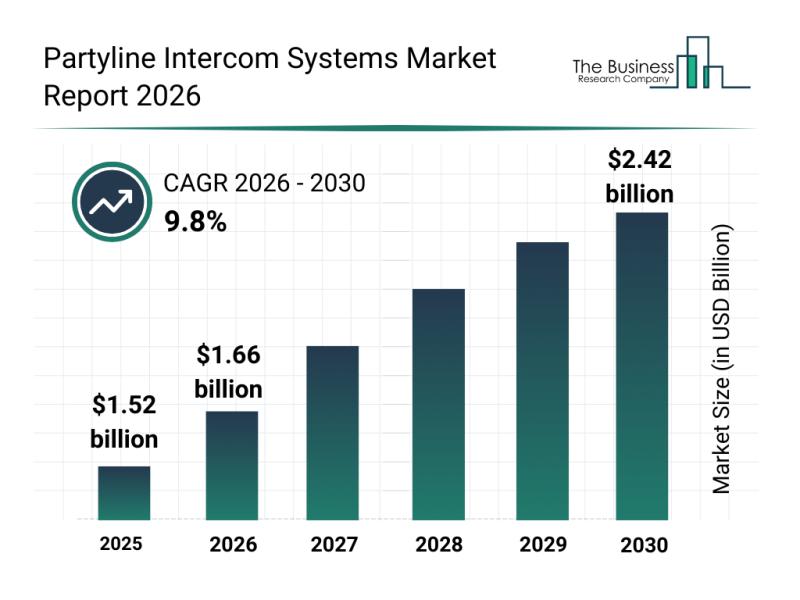

Leading Companies Fueling Innovation and Growth in the Partyline Intercom System …

The partyline intercom systems market is gearing up for significant expansion as communication needs evolve across various industries. With increasing demand for more versatile and efficient communication tools, this sector is set to witness rapid advancements and growing adoption over the coming years. Let's explore the market size projections, key drivers, major players, emerging trends, and important segments shaping this dynamic industry.

Projected Market Size and Growth Trajectory of the Partyline…

More Releases for Fintech

EMBank Reinforces Fintech Leadership at Baltic Fintech Days 2025

As fintech innovation accelerates across Europe, Vilnius once again positioned itself as a central hub for forward-thinking financial dialogue during Baltic Fintech Days 2025. Held over two impactful days, the conference attracted over 1,000 stakeholders, bringing together startup leaders, financial institutions, regulators, and technology innovators from across the Baltics and beyond.

The event's agenda was shaped by more than 60 expert speakers who addressed emerging topics such as AI-powered banking, embedded…

Seoul Fintech Lab Accelerates Global Expansion with Participation in Singapore F …

Image: https://www.getnews.info/uploads/5b520c858c856e54cadb7d57558b7209.jpg

Seoul Fintech Lab successfully participated in the Singapore Fintech Festival from November 6 to 8, 2024. The event was organized to promote overseas investment and market entry for its resident, membership, and graduate companies, with a particular focus on Seoul-based fintech companies established within the last seven years.

A total of 10 companies participated in the event. The five resident companies were Antok, Whatssub, Ipxhop, MerakiPlace, and Korea Securities Lending,…

Seoul Fintech Lab and 2nd Seoul Fintech Lab Successfully Participate in Korea Fi …

Seoul Fintech Lab and 2nd Seoul Fintech Lab achieved great success by showcasing innovative solutions from 22 resident companies, attracting approximately 1,000 visitors to their booth during Korea Fintech Week 2024.

Image: https://www.getnews.info/uploads/e73eea3a5c8a6a46e5b43375b2a156be.jpg

Seoul Fintech Lab and the 2nd Seoul Fintech Lab jointly participated in the 'Korea Fintech Week 2024,' held at Dongdaemun Design Plaza (DDP) in Seoul, South Korea, from August 27 to 29. The event was a huge success, with…

FinTech in Insurance

The market for "FinTech in Insurance Market" is examined in this report, along with the factors that are expected to drive and restrain demand over the projected period.

Introduction to FinTech in Insurance Market Insights

The futuristic approach to gathering insights in the FinTech in Insurance sector integrates advanced technologies such as artificial intelligence, big data analytics, and blockchain. These tools enhance data collection from diverse sources, enabling insurers to gain deeper,…

BW Festival Of Fintech: A Comprehensive Fintech Colloquy

Business World’s Festival of Fintech is a two-day informative summit that will inform, illustrate and recognize the changes in the dynamic Fintech industry.

Business World brings forth Festival of Fintech, an exclusive conclave on Fintech innovation and growth on the 12th and 13th of February, 2021. The event will include expert panels and an industry award ceremony that recognizes excellence in all the ambits of the Fintech field.

The…

Bouchard Fintech

Information provided by Bouchard Fintech

The US, at least this current administration, has mystified its European Union business and political partners. The EU represents one of the very largest economies on the planet. The EU is also very much a trusted ally of the US. The EU market continues to be a fertile ground for US exports. So, it was quite a surprise that the US seemed to be picking a…