Press release

Personal Finance Essentials for PR Professionals at Every Career Stage

Managing finances well is a valuable skill for anyone, but this can be particularly essential for PR professionals. Public relations roles often bring fluctuations in income, especially for freelancers or those managing independent projects.From entry-level to top-tier positions, mastering personal finance can empower PR professionals to navigate these shifts confidently, preparing for opportunities and setbacks. This guide covers the fundamental aspects of personal finance every PR professional should prioritize, regardless of their career stage.

Financial stability offers security in public relations, where fast-paced and varied work environments are common. Learning to budget, save, and invest can help PR professionals stay afloat and thrive, setting up a strong financial foundation and supporting career growth. This journey requires knowledge and discipline, but the rewards can be transformative.

Budgeting: Tracking and Controlling Expenses

Whether just starting or leading PR initiatives, budgeting is a foundational personal finance skill. Creating a budget may seem simple, but sticking to it can be challenging, especially when unexpected work expenses or travel needs arise.

For entry-level PR professionals, budgeting can start small. List monthly expenses, including student loan payments, rent, and essential needs. Then, divide income across these categories, leaving a portion for savings. Tools like budgeting apps can simplify tracking expenses, making it easier to stay within limits and avoid overspending.

As professionals advance, budgeting becomes even more critical. With higher incomes and potentially larger expenses, maintaining a well-planned budget helps avoid lifestyle inflation. At this stage, a budget should reflect short-term goals like vacations and long-term goals like buying property or investing in retirement. Prioritizing a budget ensures financial goals remain within reach and that spending aligns with both career and personal ambitions.

Making Money: Supplementing Income with Side Projects

In PR, income can vary widely depending on role, experience, and job stability. Some PR professionals find that supplementing their income through side projects or freelance work enhances their financial resilience and provides new skills or industry contacts.

Freelance work is a great option for PR professionals looking to make money from home. Many take on projects that fit their skills, like writing, editing, or social media management. With freelance platforms, finding opportunities has become simpler, allowing PR professionals to build extra income streams from home or wherever they are. Websites like https://www.sofi.com/ even offer tools and resources that can help freelancers manage their income and investments, making it easier to track earnings and plan for financial growth.

At more advanced career stages, PR professionals might consider consulting, coaching, or developing digital products, like e-books or online courses. These endeavors can generate passive income, support long-term financial security, and offer a buffer when work may slow down. Additionally, side projects can serve as creative outlets, allowing PR professionals to explore areas outside their primary roles and build an even broader portfolio.

Emergency Savings: Preparing for the Unexpected

In the unpredictable PR field, emergency savings can be a lifeline. An emergency fund is a cash reserve for unplanned events, such as medical bills, car repairs, or even periods of job uncertainty.

For those in the early stages of their PR career, a modest emergency fund can cover at least three months of expenses. Even saving a small amount each month can grow into a meaningful fund over time. Using high-yield savings accounts for emergency savings is often wise, allowing funds to grow while remaining accessible.

Senior professionals might aim for a larger emergency fund, reflecting their higher income and possibly greater responsibilities. Financial planners often recommend setting aside six months' worth of expenses at this level. By preparing for the unexpected, PR professionals can face potential setbacks or career changes with greater confidence and fewer financial worries.

Debt Management: Tackling Loans and Credit Card Balances

Debt management is essential for maintaining financial health and minimizing stress. For many PR professionals, student loans and credit card debt can pose challenges, especially early in their careers.

An effective way to manage debt is by prioritizing payments based on interest rates. High-interest debt, such as credit card balances, can become unmanageable if not addressed. Early-career professionals should pay off these balances immediately, starting with the highest interest-rate debt. This approach minimizes the interest accrued, reducing total costs over time.

For mid-career professionals, managing debt might involve refinancing or consolidating loans to lower interest rates. Dedicating extra funds toward debt repayment can accelerate financial freedom as income rises, allowing PR professionals to focus on investments and other financial goals.

Investing: Building Wealth for the Long Term

Investing is crucial for building wealth and preparing for the future. Although investments carry risk, the right strategy can yield substantial rewards over time. For PR professionals who may experience fluctuations in income, investing can help build a safety net that grows with their careers.

Newcomers to the PR industry should start small, perhaps with employer-sponsored retirement plans like a 401(k) or individual retirement accounts (IRAs). Even minimal contributions can benefit from compound interest, leading to significant growth over decades. Automated investment apps also make it easy for beginners to start investing, even with small amounts.

As PR professionals advance in their careers, diversifying investments becomes essential. Exploring options like stocks, bonds, mutual funds, and real estate can provide additional growth opportunities. At this stage, consulting a financial advisor can help align investment choices with specific financial goals, ensuring that a growing portfolio supports both career and retirement aspirations.

Retirement Planning: Ensuring a Secure Future

Retirement may seem distant, especially for those just starting in the PR world, but the sooner professionals start planning, the more comfortable their retirement years can be. Effective retirement planning requires long-term commitment but offers peace of mind and financial freedom later in life.

For younger professionals, the key is to start early, even with small contributions. Participating in employer-sponsored plans like a 401(k) with matching contributions is an excellent starting point. Setting up a Roth IRA can be beneficial if employer options are limited. These accounts grow tax-free, allowing for significant gains over time.

As careers progress, maximizing retirement contributions becomes more manageable. Professionals at this stage can consider diversifying their retirement portfolios, with index funds or bonds. By setting aside a higher percentage of income, mid-career professionals can fast-track their retirement savings. Regularly reviewing and adjusting contributions ensures that retirement plans stay on track, reflecting changes in income and personal goals.

Financial Literacy: Continuing Education and Staying Informed

Financial literacy is a vital component of personal finance. Staying informed about economic trends, new investment opportunities, and tax implications can help PR professionals make smarter decisions.

Early-career professionals should focus on building foundational knowledge, through online courses or personal finance books. Many financial literacy resources are designed for beginners, breaking down concepts like budgeting, saving, and investing into manageable steps. Understanding the basics empowers individuals to make informed choices, laying the groundwork for future financial success.

For established PR professionals, ongoing education might involve advanced financial topics, such as portfolio management or real estate investment. Regularly engaging with financial news and trends helps maintain awareness of the broader economic landscape, allowing PR professionals to adjust their strategies as needed. In an evolving industry, knowledge is power, and continued learning ensures PR professionals can confidently adapt to changing financial circumstances.

Conclusion

Financial security is achievable for PR professionals with the right strategies and a commitment to continual improvement. Budgeting, debt management, and saving offer a strong foundation, while investing and retirement planning support long-term security. Each career stage brings unique financial challenges and opportunities, making it essential to adapt personal finance approaches over time. By mastering these essentials, PR professionals can enjoy a more stable financial future, allowing them to focus on career growth and personal fulfillment.

Marica 25 G Plovdiv, Bulgaria

ESBO LTD is one of the best local SEO internet marketing companies, specializing in helping companies from all industries.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Personal Finance Essentials for PR Professionals at Every Career Stage here

News-ID: 3764640 • Views: …

More Releases from ESBO ltd

Supporting Compliance with Law Firm Consultants

In the U.S., law firm non-compliance costs an average $14.82 million per year, nearly triple the cost of compliance. This can be attributed to the ever-expanding regulatory expectations and the evolution of professional standards. However, it's the responsibility of every law firm to treat compliance as a key part of how the organization operates, and not just as a background task.

As regulatory expectations expand across data protection, financial transparency,…

How to plan moving with kids

How to plan moving with kids

Moving is always a big event for a family, but when children are part of the picture, it can feel like you're juggling ten things at once. Between packing boxes, sorting paperwork, and saying goodbye to a familiar home, kids often pick up on the stress just as much as adults do. Some families choose to bring in professional help, like movers in Airdrie https://easymovingcalgary.com/airdrie-movers/…

How to Read Market Cycles Like a Professional Trader

Market cycles represent the natural rhythm of financial markets as they move through periods of growth, peak performance, decline, and recovery. These cycles occur across all timeframes, from short-term daily fluctuations to multi-year trends that shape entire economic eras. When you learn to identify these patterns, you gain a significant advantage in timing your trades and investment decisions.

Professional traders don't rely on luck or gut feelings. They study these…

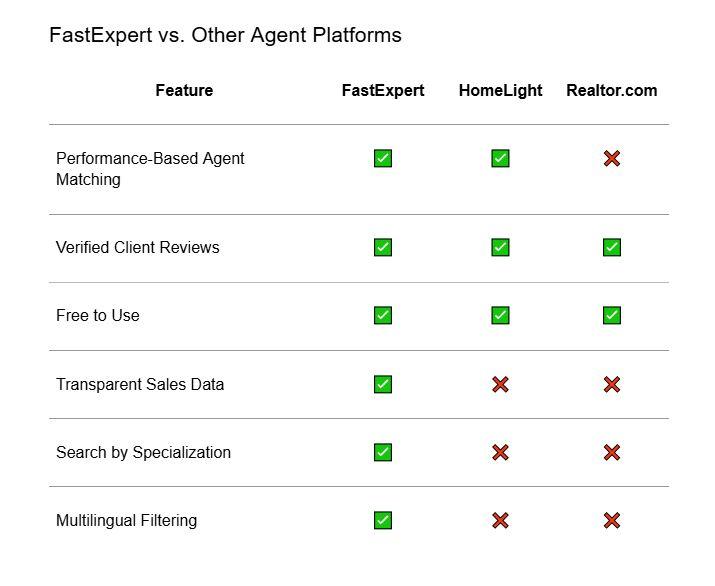

FastExpert Review: Is This Agent-Matching Platform Worth It?

When you're buying or selling a home, one of the most important decisions you'll make is choosing the right real estate agent. But with so many agents out there, how do you know which agents are experienced and right for what you need?

We've looked at countless online services that claim to help you find the best real estate agent. There are a lot out there, and they promise you the…

More Releases for Financial

Financial Leasing Services Market Share, Size, Financial Summaries Analysis from …

Infinity Business Insights has recently released a comprehensive research report titled "Financial Leasing Services Market Insights, Extending to 2031." This publication spans over 110+ pages and offers an engaging presentation with visually appealing tables and charts that are self-explanatory. The worldwide Financial Leasing Services market is expected to grow at a booming CAGR of 6.3% during 2024-2031. It also shows the importance of the Financial Leasing Services market main players…

Global Financial Aid Management Software Market Streamlining Financial Assistanc …

Overview for the report "Financial Aid Management Software Market" Helps in providing scope and definations, Key Findings, Growth Drivers, and Various Dynamics by Infinitybusinessinsights.com. This report will help the viewer in Better Decision Making.

At a predicted CAGR of 10.9% from 2023 to 2028, The Market for Financial Assistance Management Software will increase from USD 1.07 billion in 2022 to USD X.XX billion by 2030. The market's expansion can be attributed…

What will be Driving Growth Financial Leasing Market 2027 | Bank Financial Leasi …

Financial Leasing Market research is an intelligence report with meticulous efforts undertaken to study the right and valuable information. The data which has been looked upon is done considering both, the existing top players and the upcoming competitors. Business strategies of the key players and the new entering market industries are studied in detail. Well explained SWOT analysis, revenue share and contact information are shared in this report analysis.

Ask for…

Financial Leasing Market 2017 Analysis – CDB Leasing, ICBC Financial Leasing C …

A financial lease is a method used by a business for acquisition of equipment with payment structured over time. To give proper definition, it can be expressed as an agreement wherein the lessor receives lease payments for the covering of ownership costs. Moreover, the lessor holds the responsibility of maintenance, taxes, and insurance.

In this report, RRI studies the present scenario (with the base year being 2017) and the growth prospects…

Financial Leasing Market Is Booming | KLC Financial, SMFL Leasing, GM Financial, …

HTF MI recently introduced Global Financial Leasing Market study with in-depth overview, describing about the Product / Industry Scope and elaborates market outlook and status to 2023. The market Study is segmented by key regions which is accelerating the marketization. At present, the market is developing its presence and some of the key players from the complete study are Sumitomo Mitsui Finance and Leasing, Maldives, HNA Capital, KUKE S.A., KLC…

Financial Analytics Market: Banking & financial sector expected to make most of …

The Financial Analytics Market deals with the development, manufacture and distribution of financial analytics tools for enterprises of all kinds and sizes. Financial data analytics can be described as a set of tools, techniques and processes used to find out answers for various business questions as well as to forecast future scenarios regarding finance and the economy.

The services provided by the Financial Analytics Market are used for analyzing the equity…