Press release

Fintech Lending Market Analysis and Forecast to 2033: Market Opportunities, Trends, and Pricing Analysis

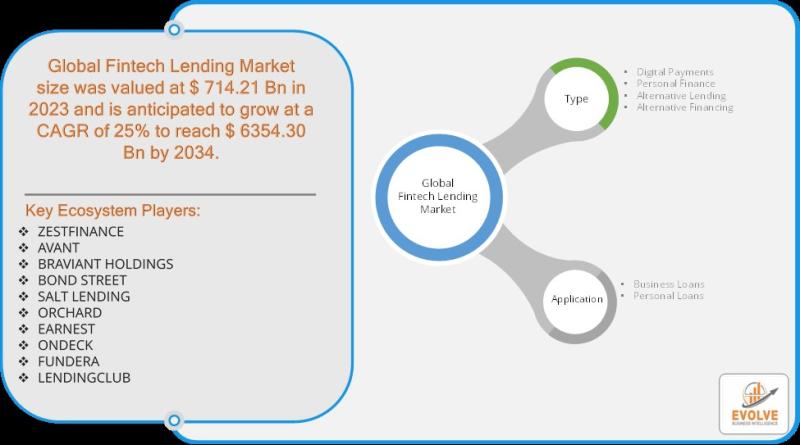

The Fintech Lending Market is experiencing robust growth, with an estimated market size of US$ 714.21 Billion in 2023 and a CAGR of 25% from 2023 to 2033. This growth is primarily driven by digital transformation and technological advancements in the financial services sector, as fintech companies leverage innovative technologies to streamline lending processes, enhance accessibility, and reduce operational costs. The widespread adoption of mobile platforms and online lending has contributed significantly to the expansion of this market, enabling borrowers to access loans with greater ease and flexibility. However, the market faces challenges, including high default rates and credit risks, which could pose barriers to its continued growth. These issues are often exacerbated by the absence of traditional credit histories in some markets, making risk assessment more challenging. Nonetheless, the rise of artificial intelligence (AI) and big data presents significant opportunities, as these technologies enable more accurate and dynamic credit scoring models. As AI and big data analytics improve lenders' ability to assess creditworthiness, they are likely to foster greater confidence in fintech lending, leading to expanded market opportunities and further growth in the sector.For More Information: https://evolvebi.com/report/fintech-lending-market-analysis/

The report includes 10 key players in the Fintech Lending market ecosystem that have been strategically profiled, along with the market ranking/share for major players. The key players profiled in the report are:

• ZESTFINANCE

• AVANT

• BRAVIANT HOLDINGS

• BOND STREET

• SALT LENDING

• ORCHARD

• EARNEST

• ONDECK

• FUNDERA

• LENDINGCLUB

The Fintech Lending market is highly competitive, with several key players leveraging advanced technologies to transform the traditional lending landscape. Companies such as ZestFinance, Avant, and Braviant Holdings are leading the charge by utilizing machine learning and AI to improve risk assessment and create more personalized lending solutions. Bond Street and Salt Lending focus on providing tailored financing solutions to small businesses and individuals, with a focus on ease of access and flexible terms. Orchard and Earnest are innovating by using big data to enhance the lending process, providing a more data-driven approach to credit scoring. OnDeck and Fundera offer small business loans and financing options, utilizing streamlined, digital platforms to facilitate quicker loan approval processes. LendingClub, one of the biggest players in the market, offers a peer-to-peer lending platform that connects borrowers and investors, expanding access to capital while reducing lending costs. These companies, by adopting cutting-edge technology and innovative business models, are contributing to the growing adoption of fintech lending solutions, addressing market demands for more efficient, accessible, and affordable credit options. However, as the market grows, companies must navigate challenges such as credit risk and regulation while continuing to refine their offerings.

For sample report pages - https://evolvebi.com/report/fintech-lending-market-analysis/

Market Segment By Type with focus on market share, consumption trend, and growth rate of Fintech Lending Market:

o Digital Payments

o Personal Finance

o Alternative Lending

o Alternative Financing

Market Segment By Application with focus on market share, consumption trend, and growth rate of Fintech Lending Market:

o Business Loans

o Personal Loans

Global Fintech Lending Geographic Coverage:

• North America

o US

o Canada

o Mexico

• Europe

o UK

o Germany

o France

o Italy

o Spain

o Benelux

o Nordic

o Rest of Europe

• Asia Pacific

o China

o Japan

o South Korea

o Indonesia

o Austalia

o Malaysia

o India

o Rest of Asia Pacific

• South America

o Brazil

o Argentina

o Rest of South America

• Middle East & Africa

o Saudi Arabia

o UAE

o Egypt

o South Africa

o Rest of the Middle East & Africa

For any customization, contact us through - https://evolvebi.com/report/fintech-lending-market-analysis/

Key Matrix for Latest Report Update

• Base Year: 2023

• Estimated Year: 2024

• CAGR: 2024 to 2034

Evolve Business Intelligence

C-218, 2nd floor, M-Cube

Gujarat 396191

India

Email: sales@evolvebi.com

Website: https://evolvebi.com/

Evolve Business Intelligence is a market research, business intelligence, and advisory firm providing innovative solutions to challenging pain points of a business. Our market research reports include data useful to micro, small, medium, and large-scale enterprises. We provide solutions ranging from mere data collection to business advisory.

Evolve Business Intelligence is built on account of technology advancement providing highly accurate data through our in-house AI-modelled data analysis and forecast tool - EvolveBI. This tool tracks real-time data including, quarter performance, annual performance, and recent developments from fortune's global 2000 companies.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Fintech Lending Market Analysis and Forecast to 2033: Market Opportunities, Trends, and Pricing Analysis here

News-ID: 3755613 • Views: …

More Releases from Evolve Business Intelligence

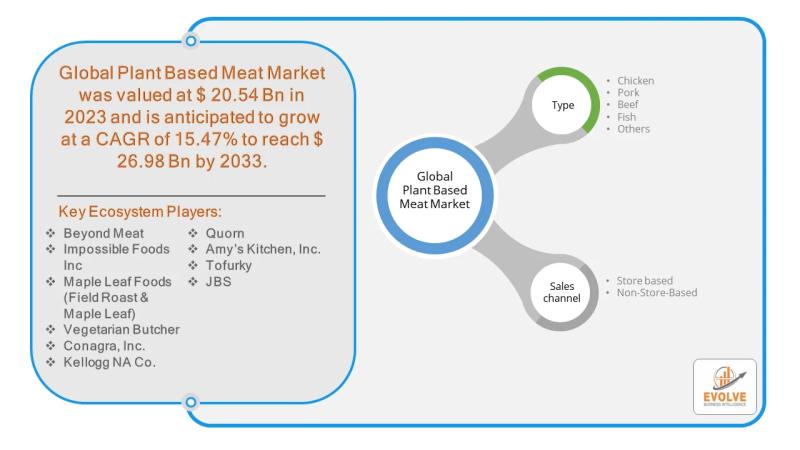

Plant-Based Meat Market Forecast to Reach USD 26.98 Billion by 2033

The plant-based meat market is at a pivotal point, marked by strong growth in the past decade but now facing headwinds. While traditional retail channels have seen recent slowdowns, the non-store-based segment, which includes direct-to-consumer (D2C) e-commerce, meal kits, and food service, presents a significant and largely untapped opportunity. This channel allows brands to bypass the challenges of traditional retail, such as intense competition for shelf space and high listing…

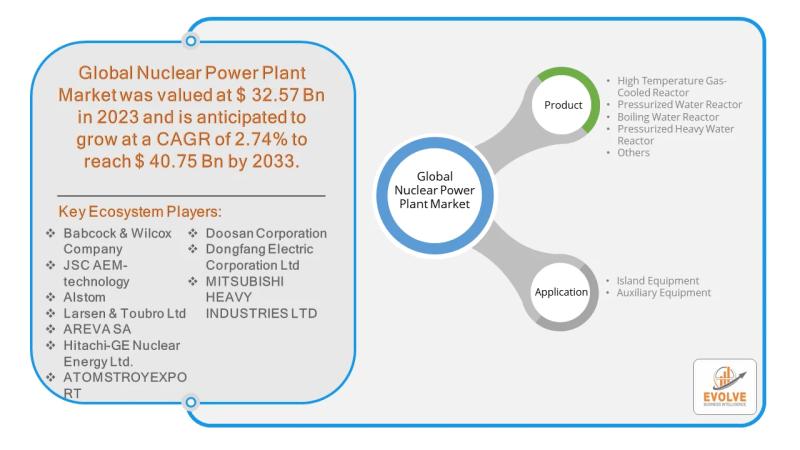

Nuclear Power Plant Market Forecast to Reach USD 40.75 Billion by 2033

As the world seeks a clean, reliable, and sustainable energy future, High Temperature Gas-Cooled Reactors (HTGRs) are emerging as a prime candidate to lead the next generation of nuclear power. This advanced reactor technology, which uses a graphite-moderated core and inert helium coolant, offers a unique blend of inherent safety and versatility that extends well beyond traditional electricity generation. While challenges remain, the opportunity for HTGRs to transform the nuclear…

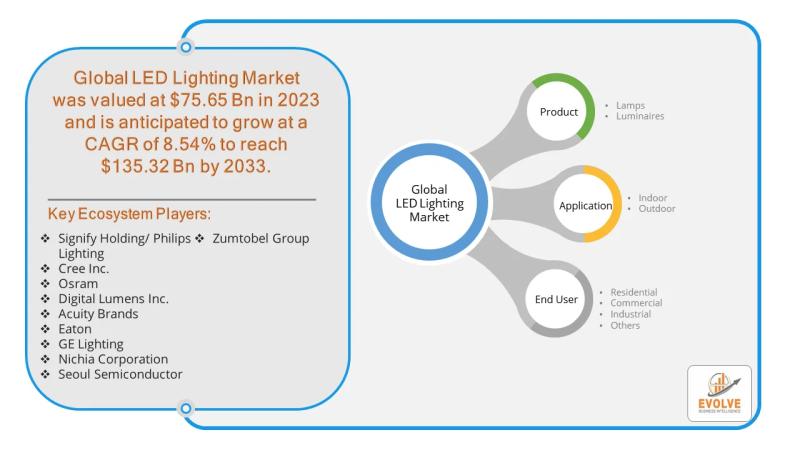

LED Lighting Market Forecast to Reach USD 255.92 Billion by 2035

The global LED lighting market is on a trajectory of significant expansion, fueled by the rising demand for energy-efficient and sustainable lighting solutions. While the market for LED lamps remains strong, luminaires-complete lighting fixtures with integrated LEDs-are emerging as the primary driver of future growth. Valued at an estimated USD 71.59 billion in 2023, the market is projected to surge to over USD 255.92 billion by 2035, with a compound…

Sensor Market Forecast to Reach USD 457.26 Billion by 2032

The global sensor market is at a pivotal point, poised for remarkable growth driven by the proliferation of smart devices, industrial automation, and the Internet of Things (IoT). The market, valued at an estimated USD 241.06 billion in 2024, is projected to expand significantly to approximately USD 457.26 billion by 2032, demonstrating a robust Compound Annual Growth Rate (CAGR) of about 8.5%. Within this dynamic landscape, a key player is…

More Releases for Lending

Mortgage Lending Market : Increased focus toward digitalizing lending process

According to the report published by Allied Market Research, the global mortgage lending market generated $11.48 billion in 2021, and is estimated to reach $27.50 billion by 2031, witnessing a CAGR of 9.5% from 2022 to 2031. The report offers a detailed analysis of changing market trends, top segments, value chain, key investment pockets, competitive scenario, and regional landscape. The report is a vital for leading market players, investors, new…

P2p Lending Market | Industry Overview 2021 | Worldwide Companies- CircleBack Le …

P2p Lending Market report will provide one with overall market analysis, statistics, various trends, drivers, opportunities, restraints, and every minute data relating to the Synthetic Fibers market necessary for forecasting its revenue, factors propelling & growth. The P2p Lending market study provides unique guidance in thoughtful details regarding the development factors and has used a top-down and bottom-up approach to keep it error-free and accurate. Our expert analysts have used…

Peer-to-peer Lending – Growing Popularity and Emerging Trends in the Market | …

Global Peer-to-peer Lending Market Size, Status and Forecast 2018-2025 is latest research study released by HTF MI evaluating the market, highlighting opportunities, risk side analysis, and leveraged with strategic and tactical decision-making support. The study provides information on market trends and development, drivers, capacities, technologies, and on the changing investment structure of the Global Peer-to-peer Lending Market. Some of the key players profiled in the study are CircleBack Lending, Lending…

Alternative Lending Market Is Booming Worldwide | Lending Club, Prosper, Upstart …

The ‘ Alternative Lending market’ research report added by Report Ocean, is an in-depth analysis of the latest developments, market size, status, upcoming technologies, industry drivers, challenges, regulatory policies, with key company profiles and strategies of players. The research study provides market overview, Alternative Lending market definition, regional market opportunity, sales and revenue by region, manufacturing cost analysis, Industrial Chain, market effect factors analysis, Alternative Lending market size forecast, market…

P2P Lending Market is Thriving Worldwide | CircleBack Lending, Lending Club, Pee …

Global P2P Lending Market Size, Status and Forecast 2025 is latest research study released by HTF MI evaluating the market, highlighting opportunities, risk side analysis, and leveraged with strategic and tactical decision-making support. The study provides information on market trends and development, drivers, capacities, technologies, and on the changing investment structure of the Global P2P Lending Market. Some of the key players profiled in the study are CircleBack Lending, Lending…

Canada Peer-to-peer Lending Market 2018-2022 Overview by CircleBack Lending, Len …

with the slowdown in world economic growth, the Peer-to-peer Lending industry has also suffered a certain impact, but still maintained a relatively optimistic growth, the past four years, Peer-to-peer Lending market size to maintain the average annual growth rate of 2.94% from 22 million $ in 2014 to 24 million $ in 2017, Research analysts believe that in the next few years, Peer-to-peer Lending market size will be further expanded,…