Press release

Payment Processor Market: Powering the Digital Economy

The payment processor market has experienced significant growth in recent years, driven by the increasing adoption of digital payments and e-commerce. Payment processors facilitate seamless transactions between buyers and sellers, ensuring secure and efficient payment processing.Market Size and Growth

The global payment processor market is estimated to be worth billions of dollars, with a significant portion of the growth coming from developed and emerging economies. The rapid digitalization of economies, coupled with the rising popularity of mobile payments and online shopping, has fueled the expansion of the market.

Data Bridge Market Research analyzes that the global payment processor market which was USD 49742.53 million in 2023, is likely to reach USD 110008.04 million by 2031, and is expected to undergo a CAGR of 9.22% during the forecast period.

For more information, visit https://www.databridgemarketresearch.com/reports/global-payment-processor-market

Market Share

Several key players dominate the payment processor market, including established financial institutions, technology companies, and specialized payment processors. These companies offer a wide range of payment processing solutions, such as credit card processing, debit card processing, and mobile payments. However, newer entrants and innovative fintech companies are also making significant strides, challenging the traditional market leaders.

Market Opportunities

The payment processor market presents numerous opportunities for businesses and investors. Some of the key areas of growth include:

Mobile Payments: The increasing adoption of mobile payment solutions, such as mobile wallets and mobile point-of-sale (mPOS) systems.

Cross-Border Payments: Facilitating seamless cross-border payments for international businesses and consumers.

Blockchain Technology: Leveraging blockchain technology to enhance security, transparency, and efficiency in payment processing.

Biometric Payments: Using biometric authentication, such as fingerprint and facial recognition, to secure payments.

Emerging Markets: Expanding into emerging markets with growing consumer spending and increasing internet penetration.

Market Challenges

Despite its growth potential, the payment processor market faces several challenges:

Cybersecurity Threats: Protecting sensitive payment data from cyberattacks is a major challenge.

Regulatory Compliance: Adhering to complex regulatory requirements, such as PCI DSS and GDPR, can be burdensome.

Fraud and Chargebacks: Preventing fraud and managing chargebacks are ongoing challenges for payment processors.

Competition: The market is highly competitive, with numerous players offering similar services.

Technological Advancements: Keeping up with rapid technological advancements and emerging payment technologies can be challenging.

Market Demand and Trends

The demand for payment processing services is driven by a variety of factors, including:

E-commerce Growth: The increasing popularity of online shopping and e-commerce.

Mobile Payments: The widespread adoption of mobile devices for making payments.

Digital Wallets: The use of digital wallets to store and manage payment information.

Cashless Transactions: The shift towards cashless transactions and digital payments.

Cross-Border Commerce: The growth of cross-border trade and e-commerce.

Some of the key trends in the payment processor market include:

Mobile Payments: The continued growth of mobile payments, including mobile wallets and QR code payments.

Blockchain Technology: The application of blockchain technology to improve security, transparency, and efficiency in payment processing.

Artificial Intelligence and Machine Learning: The use of AI and ML to detect fraud, personalize payment experiences, and optimize operations.

Biometric Authentication: The adoption of biometric authentication methods to enhance security and convenience.

Open Banking: The integration of open banking APIs to enable seamless and secure payment experiences.

Browse Trending Reports:

Global Total Ankle Replacement Market - Industry Trends and Forecast to 2031 https://www.databridgemarketresearch.com/reports/global-total-ankle-replacement-market

Global Traffic Road Marking Coatings Market - Industry Trends and Forecast to 2031 https://www.databridgemarketresearch.com/reports/global-traffic-road-marking-coatings-market

Global Transport and Logistics Market - Industry Trends and Forecast to 2031 https://www.databridgemarketresearch.com/reports/global-transport-and-logistics-market

Global Urology Supplements Market - Industry Trends and Forecast to 2031 https://www.databridgemarketresearch.com/reports/global-urology-supplements-market

In conclusion, the payment processor market is a dynamic and growing industry with significant potential to shape the future of digital commerce. By addressing the challenges and capitalizing on the opportunities, businesses and investors can contribute to the development of innovative and secure payment solutions.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email: Corporatesales@databridgemarketresearch.com

About Data Bridge Market Research:

Data Bridge set forth itself as an unconventional and neoteric Market research and consulting firm with unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Payment Processor Market: Powering the Digital Economy here

News-ID: 3754440 • Views: …

More Releases from Data Bridge Market Research

Scented Candle Market Shows Strong Growth Driven by Wellness and Home Décor Tr …

The global scented candle market is on track for significant expansion, increasing from an estimated USD 3.60 billion in 2024 to USD 6.00 billion by 2032, registering a strong CAGR of 6.60%. Rising consumer interest in home ambiance, wellness, and premium lifestyle products continues to drive market demand.

Get More Detail: https://www.databridgemarketresearch.com/reports/global-scented-candle-market

Market Growth Drivers

The scented candle market has evolved beyond being just a decorative item. Key growth factors include:

Home Fragrance &…

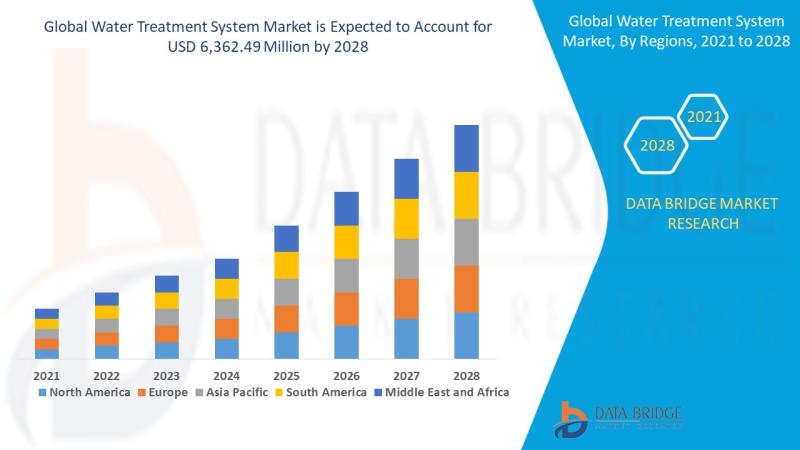

Water Treatment System Market: Sustaining the Future of Clean Water

Introduction

Understanding Water Treatment Systems

Water treatment systems are designed to purify and disinfect water for various uses-drinking, industrial processes, irrigation, and wastewater reuse. These systems eliminate contaminants such as bacteria, viruses, heavy metals, chemicals, and particulates, making water safe and sustainable for consumption and use.

Importance in Global Sustainability

Clean water is essential to life and industrial progress. With growing water demand and pollution, water treatment systems are now critical infrastructure across the…

Veterinary X-Ray Market Size, Analysis, Scope, Demand, Opportunities, Statistics

According to Data Bridge Market Research The global Veterinary X-Ray market size was valued at USD 915.19 million in 2024 and is projected to reach USD 1576.00 million by 2032, with a CAGR of 7.03 % during the forecast period of 2025 to 2032.

With increasing globalization and digital disruption, the Equine X-Ray Solutions Market is expanding across multiple industries, . Market research data indicates that businesses in the Companion Animal…

Veterinary X-Ray Market Size, Analysis, Scope, Demand, Opportunities, Statistics

According to Data Bridge Market Research The global Veterinary X-Ray market size was valued at USD 915.19 million in 2024 and is projected to reach USD 1576.00 million by 2032, with a CAGR of 7.03 % during the forecast period of 2025 to 2032.

With increasing globalization and digital disruption, the Equine X-Ray Solutions Market is expanding across multiple industries, . Market research data indicates that businesses in the Companion Animal…

More Releases for Payment

Evolving Market Trends In The Bitcoin Payment Ecosystem Industry: NFC-Enabled Cr …

The Bitcoin Payment Ecosystem Market Report by The Business Research Company delivers a detailed market assessment, covering size projections from 2025 to 2034. This report explores crucial market trends, major drivers and market segmentation by [key segment categories].

What Is the Expected Bitcoin Payment Ecosystem Market Size During the Forecast Period?

The market size of the Bitcoin payment ecosystem has seen swift acceleration in the past few years. Its growth is projected…

Payment Security Market : Increased Adoption of Digital Payment Modes Leading pl …

According to a recent report published by Allied Market Research, titled, "Payment Security Market by Component, Platform, Enterprise Size and Industry Vertical: Global Opportunity Analysis and Industry Forecast, 2021-2030," the global payment security market size was valued at $17.64 billion in 2020, and is projected to reach $60.56 billion by 2030, growing at a CAGR of 13.2% from 2021 to 2030.

Download Free PDF Report Sample :

https://www.alliedmarketresearch.com/request-sample/10390

Payment security software is used…

Hosted Payment Gateway Segment dominates Payment Gateway Market - TechSci Resear …

Government initiatives towards digitization and surging popularity of digital payment to drive global payment gateway market through 2024

According to TechSci Research report, “Global Payment Gateway Market By Type, By Enterprise Size, By End-User, By Region, Competition, Forecast & Opportunities, 2024”, global payment gateway market is projected to grow at a CAGR of over 8% during 2019-2024, on account of increasing internet penetration, which is aiding growing demand for online transactions.…

Digital Payment Market by Component (Solutions (Payment Processing, Payment Gate …

Magarpatta SEZ, Pune, “ReportsnReports”, one of the world’s prominent market research firms has released a new report on Global Digital Payment Market. The report contains crucial insights on the market which will support the clients to make the right business decisions. This research will help both existing and new aspirants for Digital Payment Market to figure out and study market needs, market size, and competition. The report talks about the…

Digital Payment Market by Payment Gateway Solutions, Payment Wallet Solutions, P …

Digital Payment Market 2019-2025: In 2018, the global Digital Payment market size was xx million US$ and it is projected to surpass xx million US$ by the end of 2025, growing at a CAGR of 18.1% during 2019-2025.

Things Covered in Sample Report

> Deep Dive Strategy & Competition

> Deep Dive Data & Forecasting

> Executive Summary & Core Findings

Get a Quick Sample report at https://decisionmarketreports.com/request-sample?productID=1008739

The key players covered in…

Online Payment Gateway Market Analysis By 2028 | Amazon.com, Avenues India Pvt. …

Future Market Insights (FMI) has recently published a new research report on the online payment gateway market titled “Online Payment Gateway Market: Global Industry Analysis (2013-2017) and Opportunity Assessment (2018-2028).” The report states that the growing prevalence of third party payment processes is expected to have a positive impact on the growth of the global market. Websites have always been a good source for channel merchants for generating revenue. Concentrating…