Press release

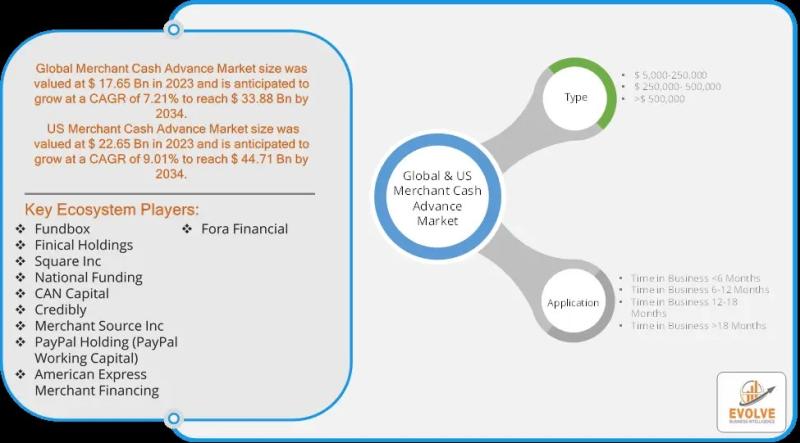

Global & US Merchant Cash Advance Market Analysis and Forecast to 2033: Market Opportunities, Trends, and Pricing Analysis

Global & US Merchant Cash Advance Market By Type ($ 5,000-250,000, $ 250,000- 500,000, >$ 500,000), By Application (Time in Business 18 Months), and By Geography-COVID-19 Impact Analysis, Post COVID Analysis, Opportunities, Trends, and Forecast from 2023 to 2033The Global and U.S. Merchant Cash Advance (MCA) market is projected to reach a size of US$ 17.65 billion in 2023, with a compound annual growth rate (CAGR) of 9.01% from 2023 to 2033. This growth is primarily driven by technological advancements, including the increasing use of data analytics, machine learning, and digital platforms in streamlining the MCA application and approval processes. These innovations enable quicker and more efficient financing options for small and medium-sized businesses (SMBs) that may face challenges securing traditional loans. However, the market faces some restraining factors, such as the perception of high costs and fees associated with MCA, which can deter potential borrowers. These concerns have led to cautious adoption, particularly among small business owners who may not fully understand the pricing models and terms of repayment. Despite these challenges, there are significant opportunities within the market, particularly the customization of financial products. Offering tailored MCA solutions, such as flexible repayment terms based on daily credit card sales or varying interest rates, can attract a broader range of businesses looking for financing options that align more closely with their unique cash flow needs. As such, the MCA market presents a dynamic landscape of growth potential, innovation, and evolving customer demand.

For More Information: https://evolvebi.com/report/global-us-merchant-cash-advance-market-analysis/

The report includes 10 key players in the Global & US Merchant Cash Advance market ecosystem that have been strategically profiled, along with the market ranking/share for major players. The key players profiled in the report are:

• Fundbox

• Finical Holdings

• Square Inc

• National Funding

• CAN Capital

• Credibly

• Merchant Source Inc

• PayPal Holding (PayPal Working Capital)

• American Express Merchant Financing

• Fora Financial

The competitive landscape of the Global and U.S. Merchant Cash Advance (MCA) market is dynamic, with several key players offering innovative financing solutions to small and medium-sized businesses (SMBs). Leading companies include Fundbox, which provides credit lines and funding solutions through data-driven risk assessment; Finical Holdings, offering quick, flexible cash advances; and Square Inc., known for its seamless integration of payment processing with financing options through Square Capital. Other notable competitors such as National Funding and CAN Capital focus on offering tailored financing solutions, with Credibly providing both working capital and long-term financing products. Merchant Source Inc. and PayPal Holding (PayPal Working Capital) leverage their established payment platforms to offer merchant cash advances directly to users, utilizing transaction data for risk evaluation. American Express Merchant Financing offers competitive financing options to its business clients, while Fora Financial also focuses on small business lending, providing both MCA and term loans. The market is highly competitive, with companies differentiating themselves through customized offerings, faster approval processes, and leveraging data analytics to assess risk and offer more favorable terms to borrowers. Technological innovations and strategic partnerships play a critical role in shaping the competitive dynamics, while consumer trust and transparent pricing models continue to be crucial for gaining a market edge.

For sample report pages - https://evolvebi.com/report/global-us-merchant-cash-advance-market-analysis/

Market Segment By Type with focus on market share, consumption trend, and growth rate of Global & US Merchant Cash Advance Market:

o $ 5,000-250,000

o $ 250,000- 500,000

o >$ 500,000

Market Segment By Application with focus on market share, consumption trend, and growth rate of Global & US Merchant Cash Advance Market:

o Time in Business 18 Months

Global Global & US Merchant Cash Advance Geographic Coverage:

• North America

o US

o Canada

o Mexico

• Europe

o UK

o Germany

o France

o Italy

o Spain

o Benelux

o Nordic

o Rest of Europe

• Asia Pacific

o China

o Japan

o South Korea

o Indonesia

o Austalia

o Malaysia

o India

o Rest of Asia Pacific

• South America

o Brazil

o Argentina

o Rest of South America

• Middle East & Africa

o Saudi Arabia

o UAE

o Egypt

o South Africa

o Rest of the Middle East & Africa

For any customization, contact us through - https://evolvebi.com/report/global-us-merchant-cash-advance-market-analysis/

Key Matrix for Latest Report Update

• Base Year: 2023

• Estimated Year: 2024

• CAGR: 2024 to 2034

Address

Evolve Business Intelligence

C-218, 2nd floor, M-Cube

Gujarat 396191

India

Email: sales@evolvebi.com

Website: https://evolvebi.com/

About EvolveBI

Evolve Business Intelligence is a market research, business intelligence, and advisory firm providing innovative solutions to challenging pain points of a business. Our market research reports include data useful to micro, small, medium, and large-scale enterprises. We provide solutions ranging from mere data collection to business advisory.

Evolve Business Intelligence is built on account of technology advancement providing highly accurate data through our in-house AI-modelled data analysis and forecast tool - EvolveBI. This tool tracks real-time data including, quarter performance, annual performance, and recent developments from fortune's global 2000 companies.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Global & US Merchant Cash Advance Market Analysis and Forecast to 2033: Market Opportunities, Trends, and Pricing Analysis here

News-ID: 3748103 • Views: …

More Releases from Evolve Business Intelligence

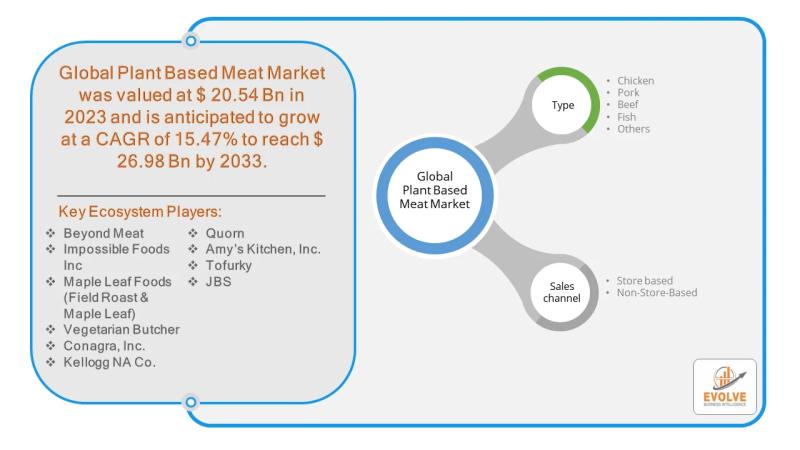

Plant-Based Meat Market Forecast to Reach USD 26.98 Billion by 2033

The plant-based meat market is at a pivotal point, marked by strong growth in the past decade but now facing headwinds. While traditional retail channels have seen recent slowdowns, the non-store-based segment, which includes direct-to-consumer (D2C) e-commerce, meal kits, and food service, presents a significant and largely untapped opportunity. This channel allows brands to bypass the challenges of traditional retail, such as intense competition for shelf space and high listing…

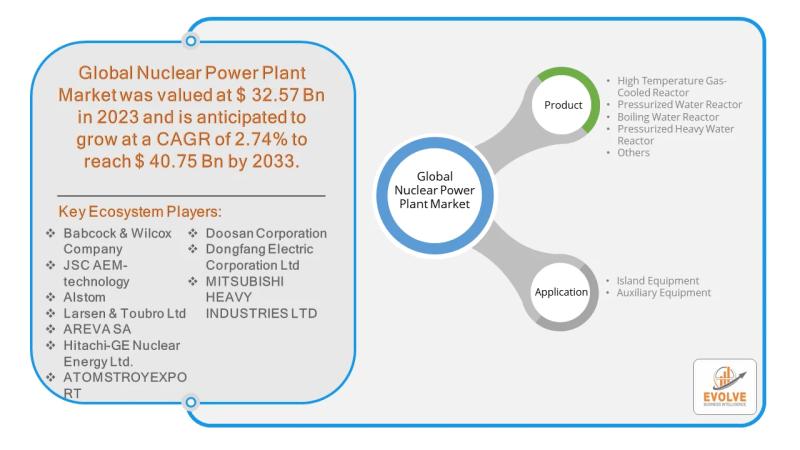

Nuclear Power Plant Market Forecast to Reach USD 40.75 Billion by 2033

As the world seeks a clean, reliable, and sustainable energy future, High Temperature Gas-Cooled Reactors (HTGRs) are emerging as a prime candidate to lead the next generation of nuclear power. This advanced reactor technology, which uses a graphite-moderated core and inert helium coolant, offers a unique blend of inherent safety and versatility that extends well beyond traditional electricity generation. While challenges remain, the opportunity for HTGRs to transform the nuclear…

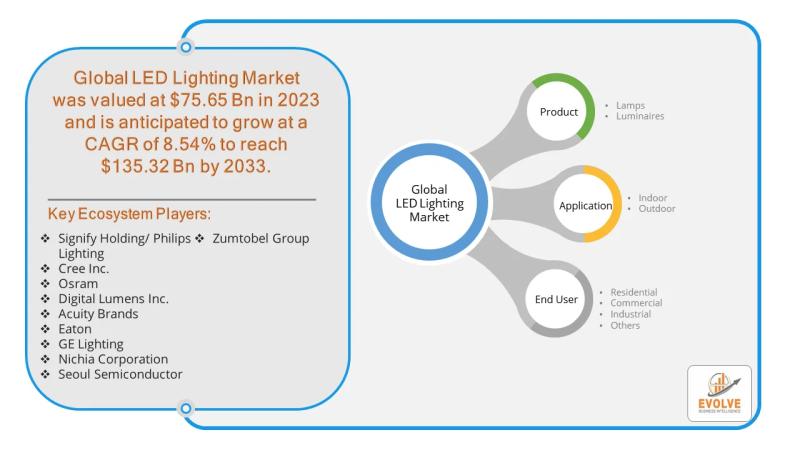

LED Lighting Market Forecast to Reach USD 255.92 Billion by 2035

The global LED lighting market is on a trajectory of significant expansion, fueled by the rising demand for energy-efficient and sustainable lighting solutions. While the market for LED lamps remains strong, luminaires-complete lighting fixtures with integrated LEDs-are emerging as the primary driver of future growth. Valued at an estimated USD 71.59 billion in 2023, the market is projected to surge to over USD 255.92 billion by 2035, with a compound…

Sensor Market Forecast to Reach USD 457.26 Billion by 2032

The global sensor market is at a pivotal point, poised for remarkable growth driven by the proliferation of smart devices, industrial automation, and the Internet of Things (IoT). The market, valued at an estimated USD 241.06 billion in 2024, is projected to expand significantly to approximately USD 457.26 billion by 2032, demonstrating a robust Compound Annual Growth Rate (CAGR) of about 8.5%. Within this dynamic landscape, a key player is…

More Releases for Merchant

Easy Merchant Funds Empowers Small Businesses with Fast and Flexible Merchant Ca …

In today's fast-paced business environment, access to quick and dependable funding can mean the difference between growth and stagnation. Easy Merchant Funds proudly announces its commitment to supporting small and medium-sized businesses through its streamlined merchant cash advance solutions, designed to deliver the capital entrepreneurs need - when they need it most.

Revolutionizing Business Financing

Traditional loans often involve lengthy applications, strict requirements, and slow approval times - challenges that small business…

Emerging Merchant Acquiring Market Trend 2025-2034: Strategic Alliance Enhances …

How Is the Merchant Acquiring Market Projected to Grow, and What Is Its Market Size?

The size of the merchant acquiring market has seen a swift expansion in the past few years. The market size is projected to increase from $25.43 billion in 2024 to $28.2 billion in 2025, exhibiting a compound annual growth rate (CAGR) of 10.9%. The substantial growth in the historical period is due to factors such as…

Merchant Services Market May Set New Growth Story: PayPal, Chase Payment solutio …

The capacity of the merchant services industry to respond to the quickly shifting payment environment has been a major growth driver over the past few years. The fast surge of digitization across sectors, which has boosted the use of non-cash payments internationally, has led to an increase in merchant acquirer multiples. The adoption of integrated payments, value-added services, mobile digital transactions, and eCommerce are some more important growth drivers for…

Merchant Acquiring Market Outlook 2021 | Covid19 Impact Analysis | Growth by Top …

Merchant Acquiring Market describes an in-depth evaluation and Covid19 Outbreak study on the present and future state of the Merchant Acquiring market across the globe, including valuable facts and figures. Merchant Acquiring Market provides information regarding the emerging opportunities in the market & the market drivers, trends & upcoming technologies that will boost these growth trends.

The report provides a comprehensive overview including Definitions, Scope, Application, Production and CAGR (%)…

Merchant account solutions

Acqualtscards As a favorable self-ruling Pro independent association of portion courses of appropriate action, we mutually support you at every independent movement of your business development.Since its private foundation, Acqualtscards has substantiated itself and to its potential clients to be one of the fundamental worldwide providers of re-appropriating and white imprint answers for electronic portion trades.

Acqualtscards offers Credit cards processing for Online business around the globe, including those for retailers/maker…

Prepared Food Wholesaler Receives Large $200,000 Merchant Cash Advance from Indu …

Merchant Cash and Capital, LLC www.merchantcashandcapital.com, a recognized leader in the merchant cash advance industry, recently advanced $200,000 to a wholesaler of prepared foods located on the west coast. Despite a series of past credit issues, MCC, upon careful research and working individually with the owner, found the business viable and made the merchant cash advance happen.

The business has operated for 24 years, although it did file (and emerge…