Press release

Emerging Merchant Acquiring Market Trend 2025-2034: Strategic Alliance Enhances Merchant Acquiring Services

How Is the Merchant Acquiring Market Projected to Grow, and What Is Its Market Size?The size of the merchant acquiring market has seen a swift expansion in the past few years. The market size is projected to increase from $25.43 billion in 2024 to $28.2 billion in 2025, exhibiting a compound annual growth rate (CAGR) of 10.9%. The substantial growth in the historical period is due to factors such as rising interest in cross-border e-commerce, the evolution of peer-to-peer (p2p) payment systems, expansion of digital banking and fintech innovations, e-commerce growth, and the increasing need for alternatives to cash.

In the ensuing years, swift expansion is predicted for the merchant acquiring market. This growth is anticipated to reach a market size of $42.16 billion by 2029, exhibiting a compound annual growth rate (CAGR) of 10.6%. This stellar growth during the forecast period can be traced back to several factors including the widespread use of smartphones and mobile payments, increased acceptance of contactless payments, a surge in demand for digital payments, a growing necessity for secure and fraud-resistant payment methods, and augmented investment in payment technology. The trends to watch for in this period include technological development, artificial intelligence integration, subscription-based models, digital currencies, and contactless wearables.

What Are the Key Drivers Behind the Growth of the Merchant Acquiring Market?

The growth of merchant acquiring is predicted to be fueled by the burgeoning need for digital payments. Digital payments, which involve the electronic transfer of funds between parties using digital methods, eliminating the need for physical cash or checks, is seeing a surge in demand due to a variety of factors. These include the expansion of e-commerce, the adoption of contactless payment methods, and the universal accessibility of the internet. Merchant acquiring benefits from digital payments by simplifying transactions, minimizing the need for cash handling, and improving payment security, resulting in enhanced business efficiency. For example, in September 2023, according to the Consumer Financial Protection Bureau, a US government organization, American consumers spent $65.2 billion at retail outlets using Google Pay, a mobile payment service developed by Google for in-app, online, and contactless purchases. This was a substantial increase from the $24.8 billion spent in 2021. Consequently, the escalating demand for digital payments is spurring the growth of the merchant acquiring market.

Get Your Free Sample Now - Explore Exclusive Market Insights:

https://www.thebusinessresearchcompany.com/sample.aspx?id=19582&type=smp

Who Are the Major Industry Players Fueling Merchant Acquiring Market Expansion?

Major companies operating in the merchant acquiring market are Commercial and Industrial Bank of China, JPMorgan Chase & Co., Bank of America Merchant Services, Citi Merchant Services, American Express Company, ING Group N.V., Banco Bilbao Vizcaya Argentaria S.A., Fiserv Inc., Fidelity National Information Services Inc., Global Payments Inc., Sberbank, The Royal Bank of Scotland plc, Shift4 Payments Inc., Worldpay Group plc, Heartland Payment Systems Inc., Adyen N.V., Paysafe Group, Elavon Inc., Crédit Agricole S.A., Zettle by PayPal, Chase Paymentech Solutions LLC, PayCommerce Inc.

Which Key Developments Are Influencing the Merchant Acquiring Market?

In the merchant acquiring market, leading firms are keen on creating strategic alliances to cement their market presence. Such strategic collaborations typically involve financial establishments, payment processors, and tech providers, with the ultimate goal of bolstering payment solutions and broadening market penetration. For instance, in July 2024, a clear illustration of this was seen when Shift4 Payments, Inc, a payment processing firm based in the US, entered a partnership with Phos, a Bulgaria-based software enterprise. This alliance was aimed at improving Phos' acquiring proficiency as well as accelerating the application of its SoftPOS solution among European merchants. This alliance allows Phos's clientele to leverage Shift4's international acquiring and payment processing amenities, thus enabling them to process payments via international card networks and digital wallets.

How Is the Segmentation of the Merchant Acquiring Market Defined?

The merchant acquiringmarket covered in this report is segmented -

1) By Type: Digital Commerce, Traditional Commerce

2) By Payment Method: Visa, Mastercard, American Express, Discover, Japan Credit Bureau, Local Card Networks, Alternative Payment Models

3) By Sales Channel: Direct Channel, Distribution Channel

4) By Application: Small And Medium Enterprises, Large Enterprises, Other Applications

Subsegments:

1) By Digital Commerce: E-commerce Payment Gateways, Mobile Payment Solutions, Online Point-of-Sale (POS) Systems, Digital Wallet and NFC Payments, Subscription-Based Payment Solutions, Peer-to-Peer (P2P) Payment Platforms

2) By Traditional Commerce: In-Store POS Systems, Card-Not-Present (CNP) Transactions, Retail Payment Solutions, Contactless Payment Solutions, Terminal-Based Payment Systems, Multi-Channel Payment Processing

Pre-Book Your Report Now For A Swift Delivery:

https://www.thebusinessresearchcompany.com/report/merchant-acquiring-global-market-report

What Is the Leading Region in the Merchant Acquiring Market?

North America was the largest region in the merchant acquiring market in 2024. The regions covered in the merchant acquiring market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa.

What Is Covered In The Merchant Acquiring Global Market Report?

- Market Size Analysis: Analyze the Merchant Acquiring Market size by key regions, countries, product types, and applications.

- Market Segmentation Analysis: Identify various subsegments within the Merchant Acquiring Market for effective categorization.

- Key Player Focus: Focus on key players to define their market value, share, and competitive landscape.

- Growth Trends Analysis: Examine individual growth trends and prospects in the Market.

- Market Contribution: Evaluate contributions of different segments to the overall Merchant Acquiring Market growth.

- Growth Drivers: Detail key factors influencing market growth, including opportunities and drivers.

- Industry Challenges: Analyze challenges and risks affecting the Merchant Acquiring Market.

- Competitive Developments: Analyze competitive developments, such as expansions, agreements, and new product launches in the market.

Unlock Exclusive Market Insights - Purchase Your Research Report Now!

https://www.thebusinessresearchcompany.com/purchaseoptions.aspx?id=19582

Connect with us on:

LinkedIn: https://in.linkedin.com/company/the-business-research-company,

Twitter: https://twitter.com/tbrc_info,

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ.

Contact Us

Europe: +44 207 1930 708,

Asia: +91 88972 63534,

Americas: +1 315 623 0293 or

Email: mailto:info@tbrc.info

Learn More About The Business Research Company

With over 15,000+ reports from 27 industries covering 60+ geographies, The Business Research Company has built a reputation for offering comprehensive, data-rich research and insights. Our flagship product, the Global Market Model delivers comprehensive and updated forecasts to support informed decision-making.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Emerging Merchant Acquiring Market Trend 2025-2034: Strategic Alliance Enhances Merchant Acquiring Services here

News-ID: 3869460 • Views: …

More Releases from The Business Research Company

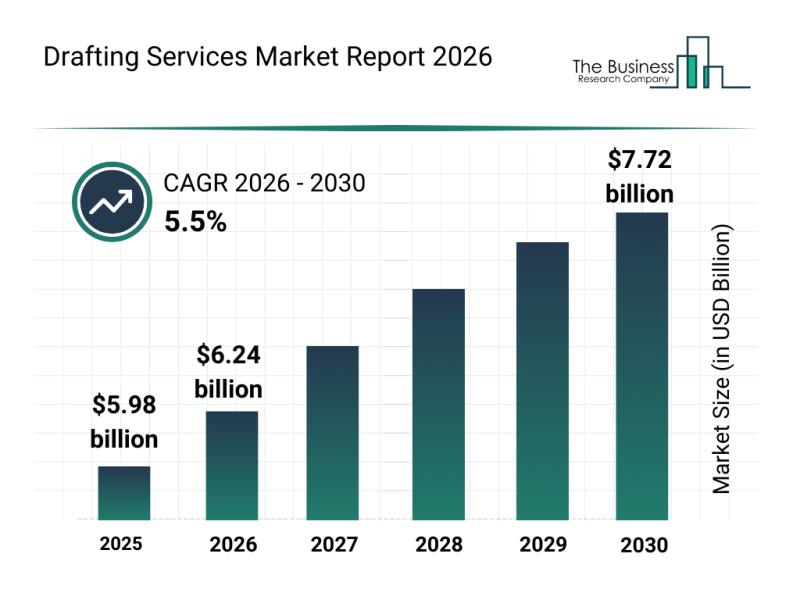

Future Perspective: Key Trends Shaping the Drafting Services Market Until 2030

The drafting services industry is poised for considerable expansion in the coming years as technological advancements and evolving construction needs drive demand. With a wide range of applications across sectors, this market is set to experience steady growth fueled by innovation and increasing adoption of digital tools. Let's explore the current market size, influential factors, key players, emerging trends, and segmentation in this dynamic field.

Projected Growth and Market Size of…

Emerging Sub-Segments Transforming the Digital Rights Management Market Landscap …

The digital rights management (DRM) market is positioned for remarkable expansion in the coming years, driven by technological advancements and increasing concerns over content security. As digital media consumption grows and new platforms emerge, DRM solutions are becoming essential to protect intellectual property and ensure the authorized use of digital assets. Let's explore the current market size, key players, prevailing trends, and the main segments shaping the future of this…

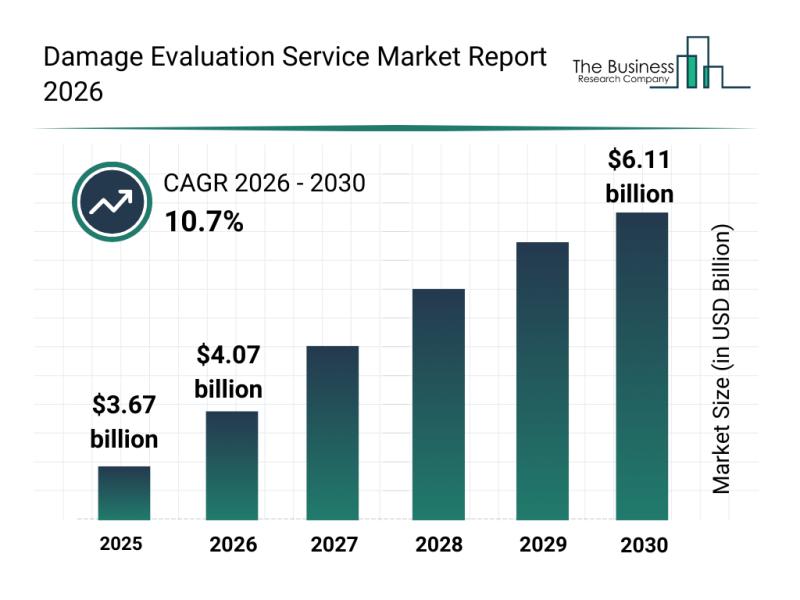

Market Trend Insights: The Impact of Recent Advances on the Damage Evaluation Se …

The damage evaluation service market is on the brink of substantial growth as advancements in technology and increasing demand for efficient damage assessment methods gain momentum. This sector is evolving rapidly with the integration of innovative tools and techniques that enhance accuracy and speed in evaluating damages across various industries.

Forecasted Market Size and Growth Trajectory of the Damage Evaluation Service Market

The damage evaluation service market is projected to…

Corporate Training Market: Segmentation Analysis, Market Trends, and Competitive …

The corporate training sector is on a path of significant growth as organizations increasingly recognize the importance of continuous employee development. With rapid technological advances and shifting workforce needs, this market is expected to expand steadily, driven by innovative solutions and evolving learning preferences. Below, we explore the market's size projections, key players, emerging trends, and segmentation insights to provide a comprehensive overview of the corporate training landscape.

Projected Growth and…

More Releases for Pay

Digital Wallets Market to See Thriving Worldwide | PayPal • Apple Pay • Goog …

The latest study by Coherent Market Insights, titled "Digital Wallets Market Size, Share & Trends Forecast 2026-2033," offers an in-depth analysis of the global and regional dynamics shaping this rapidly evolving industry. This comprehensive report highlights the competitive landscape, key market segments, value chain analysis, and emerging technological and regulatory trends expected between 2026 and 2033. The report provides actionable insights for business leaders, policymakers, investors, and new market entrants…

Mobile Payment Market to See Thriving Worldwide| Apple Pay • Google Pay • Sa …

Latest Report, titled Mobile Payment Market 2025-2032 Trends, Share, Size, Growth, Opportunity and Forecast 2025-2032, by Coherent Market Insights offers a comprehensive analysis of the industry, which comprises insights on the market analysis. As part of our Black Friday Limited-Time Discount, this premium research report is now available at up to 60% off, offering an exceptional opportunity for businesses, analysts, and stakeholders to access high-value insights at a significantly reduced…

Proximity Payment Market is Going to Boom | Major Giants Apple Pay, Google Pay, …

HTF MI just released the Global Proximity Payment Market Study, a comprehensive analysis of the market that spans more than 143+ pages and describes the product and industry scope as well as the market prognosis and status for 2025-2032. The marketization process is being accelerated by the market study's segmentation by important regions. The market is currently expanding its reach.

𝐌𝐚𝐣𝐨𝐫 Giants in Proximity Payment Market are:

Apple Pay, Google Pay, Samsung…

Unified Payments Interface (UPI) Market Is Booming Worldwide | Google Pay, Amazo …

The latest study released on the Global Unified Payments Interface (UPI) Market by AMA Research evaluates market size, trend, and forecast to 2028. The Unified Payments Interface (UPI) market study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about…

Unified Payments Interface (UPI) Market May See a Big Move | Major Giants Samsun …

The latest study released on the Global Unified Payments Interface (UPI) Market by AMA Research evaluates market size, trend, and forecast to 2027. The Unified Payments Interface (UPI) market study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about…

Samsung Pay Market is Booming Worldwide with Samsung Pay, Apple Pay, Google Pay

HTF Market Intelligence released a new research report of 23 pages on title 'Samsung Pay - Competitor Profile' with detailed analysis, forecast and strategies. The study covers key regions that includes North America, LATAM, United States, GCC, Southeast Asia, Europe, APAC, United Kingdom, India or China etc and important players such as Samsung Pay, Apple Pay, Google Pay, Alipay, Tenpay, Samsung Electronics, Visa, Mastercard.

Request a sample report @ https://www.htfmarketreport.com/sample-report/3587660-samsung-pay-competitor-profile

Summary

Samsung…