Press release

Business Insurance Market Set for Significant Growth: Projected to Reach USD 1387.2 Billion by 2032

The Business Insurance Market plays a crucial role in helping companies mitigate various operational risks, including those associated with liability, property, and employee-related issues. In 2022, the global business insurance market was valued at USD 648.9 billion, and it is projected to grow to USD 678.7 billion in 2023. Looking further ahead, the market is anticipated to reach USD 1,387.2 billion by 2032, at a compound annual growth rate (CAGR) of 9.3% during the forecast period from 2024 to 2032.Key Companies in the Business Insurance Market Include:

Generali, AIG, Berkshire Hathaway, Liberty Mutual, Lloyd's of London, AXA, Allianz, Chubb, Travelers, Munich Re, Zurich Insurance Group, The Hartford

Get a FREE Sample Report PDF Here:

https://www.marketresearchfuture.com/sample_request/22853

Key Drivers of Market Growth

Increased Awareness of Risk Management

Businesses are increasingly aware of the potential financial impact of risks such as cyber threats, natural disasters, and employee safety issues. This heightened awareness is prompting more companies, particularly small and medium-sized enterprises (SMEs), to invest in comprehensive insurance coverage.

Growth in Cybersecurity Insurance Demand

With the rise in cyberattacks, the demand for cybersecurity insurance has surged. Companies of all sizes are facing increased threats from data breaches, ransomware, and other digital security risks, making cybersecurity coverage a vital component of business insurance offerings.

Expansion of Small and Medium-Sized Enterprises (SMEs)

SMEs represent a significant portion of business insurance clients, especially as they continue to grow globally. As new businesses emerge and expand, their need for property, liability, and other specialized insurance coverage grows, driving market demand.

Stricter Regulatory Requirements

Governments worldwide are implementing stricter regulatory requirements that mandate insurance for specific industries and activities, such as environmental protection, employee safety, and data privacy. Compliance with these regulations often requires businesses to purchase appropriate insurance policies, further fueling market growth.

Emergence of Tailored Insurance Solutions

Insurers are increasingly offering customized policies that meet the unique needs of different industries. For example, insurers are developing specific products for sectors like technology, healthcare, and manufacturing, which face distinctive risks that require specialized coverage.

Business Insurance Market Segmentation

The business insurance market can be segmented by type of insurance, enterprise size, industry vertical, and geographic region.

By Type of Insurance:

Key types include property and casualty insurance, liability insurance, workers' compensation, cybersecurity insurance, and professional liability insurance. Among these, cybersecurity insurance is expected to experience the fastest growth due to the rising number of cyber threats.

By Enterprise Size:

The market serves both large enterprises and small and medium-sized enterprises (SMEs). SMEs are expected to drive significant growth in the market, as they increasingly recognize the importance of protecting against business risks.

By Industry Vertical:

Major sectors utilizing business insurance include healthcare, retail, construction, manufacturing, IT and technology, and financial services. Each sector requires tailored insurance products to address specific risks, such as data protection in the IT sector or liability in healthcare.

By Region:

The market is divided into North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa. North America currently leads in market share due to high insurance adoption rates and strong regulatory support, but the Asia-Pacific region is expected to exhibit the fastest growth due to expanding business activity and rising awareness about risk management.

Know More about the Business Insurance Market Report:

https://www.marketresearchfuture.com/reports/business-insurance-market-22853

Key Trends Shaping the Market

Digital Transformation in Insurance Distribution

Insurers are increasingly leveraging digital platforms to improve customer engagement, streamline the application process, and offer flexible, real-time services. The use of digital tools and AI-powered analytics helps insurers better assess risk, price policies more accurately, and deliver faster claim processing.

Rise of Insurtech and AI in Risk Assessment

The integration of artificial intelligence (AI) and machine learning in the insurance sector is revolutionizing risk assessment. Insurtech solutions help insurance providers optimize their underwriting processes, improve customer experiences, and enhance fraud detection capabilities.

Increasing Focus on ESG (Environmental, Social, and Governance) Standards

Companies are placing greater emphasis on environmental, social, and governance (ESG) factors, which has led insurers to develop products supporting sustainable business practices. Insurance policies that reward companies for adopting eco-friendly practices or improving employee welfare are becoming more popular.

Growth of Cybersecurity Insurance

As businesses increasingly rely on digital infrastructure, the demand for cybersecurity insurance is growing rapidly. Insurers are expanding their cybersecurity products to cover data breaches, ransomware attacks, and business interruptions resulting from cyber incidents. This segment is expected to be one of the fastest-growing areas in business insurance.

Demand for Pandemic and Supply Chain Insurance

The COVID-19 pandemic highlighted the importance of coverage for unforeseen disruptions. Insurance providers are now developing products to cover pandemic-related losses and supply chain interruptions, helping businesses safeguard their operations from global uncertainties.

Business Insurance Market Competitive Landscape

The business insurance market is highly competitive, with major players including Allianz SE, AXA SA, American International Group, Inc. (AIG), Zurich Insurance Group Ltd., Chubb Ltd., Liberty Mutual Insurance, and The Hartford Financial Services Group, Inc.. These companies are expanding their digital capabilities and focusing on innovative insurance solutions to meet the evolving needs of modern businesses.

Many insurers are also collaborating with technology firms to enhance their digital capabilities and create more efficient platforms for policy management and claims processing. Insurtech companies are disrupting traditional insurance models, especially in areas like cyber insurance and digital policy distribution, by prioritizing ease of use and personalized offerings.

Business Insurance Market Future Outlook

With a projected CAGR of 9.3% from 2024 to 2032, the business insurance market is set for substantial growth. The expansion will be fueled by an increasing focus on cybersecurity, tailored risk management solutions, digital transformation, and evolving regulatory requirements. The growth of SMEs, especially in emerging markets, presents additional opportunities for insurers, as does the rising interest in specialized insurance products.

Top Trending Research Report:

Trade Credit Insurance Market - https://www.marketresearchfuture.com/reports/trade-credit-insurance-market-24106

Fintech As A Service Market - https://www.marketresearchfuture.com/reports/fintech-as-a-service-market-24170

Network Tokenisation Market - https://www.marketresearchfuture.com/reports/network-tokenisation-market-24137

Gold Derivatives And Futures Market - https://www.marketresearchfuture.com/reports/gold-derivatives-and-futures-market-24346

Alternative Finance Market - https://www.marketresearchfuture.com/reports/alternative-finance-market-24302

Aviation Leasing Market - https://www.marketresearchfuture.com/reports/aviation-leasing-market-24313

Corporate Lending Market - https://www.marketresearchfuture.com/reports/corporate-lending-market-24324

Debt Collection Services Market - https://www.marketresearchfuture.com/reports/debt-collection-services-market-24376

Enterprise Asset Leasing Market - https://www.marketresearchfuture.com/reports/enterprise-asset-leasing-market-24423

P&C Insurance Software Market - https://www.marketresearchfuture.com/reports/pc-insurance-software-market-24435

About Market Research Future:

Market Research Future (MRFR) is a global market research company that takes pride in its services, offering a complete and accurate analysis regarding diverse markets and consumers worldwide. Market Research Future has the distinguished objective of providing the optimal quality research and granular research to clients. Our market research studies by products, services, technologies, applications, end users, and market players for global, regional, and country level market segments, enable our clients to see more, know more, and do more, which help answer your most important questions.

Contact US:

Market Research Future (Part of Wantstats Research and Media Private Limited)

99 Hudson Street, 5Th Floor

New York, NY 10013

United States of America

+1 628 258 0071 (US)

+44 2035 002 764 (UK)

Email: sales@marketresearchfuture.com

Website: https://www.marketresearchfuture.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Business Insurance Market Set for Significant Growth: Projected to Reach USD 1387.2 Billion by 2032 here

News-ID: 3721402 • Views: …

More Releases from MRFR ( Market Research Future Reports)

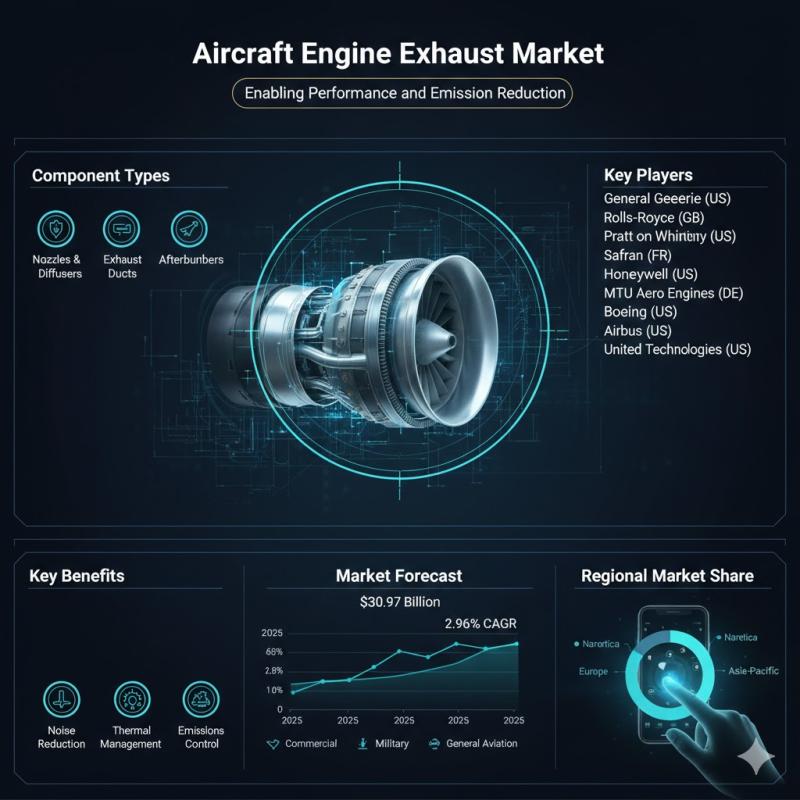

Aircraft Engine Exhaust Market Size to Reach USD 41.47 Billion by 2035, Growing …

The Aircraft Engine Exhaust Market plays a vital role in modern aviation by managing the discharge of combustion gases from aircraft engines - a key factor in performance, fuel efficiency, emissions control, and noise reduction. As airlines expand fleets and regulatory pressures increase to reduce environmental impact, the demand for advanced aircraft engine exhaust systems continues to grow globally. According to reliable industry research, tThe Aircraft Engine Exhaust industry is…

Marine Auxiliary Engine Market Size to Reach USD 3.71 Billion by 2035, Growing a …

Marine Auxiliary Engine Market: Powering Shipboard Operations with Efficiency and Innovation

The Marine Auxiliary Engine Market is poised for measured growth as maritime industries emphasize energy efficiency, stricter emissions standards, and reliable onboard power solutions. Auxiliary engines - essential for powering electrical systems, pumps, ballast operations, emergency power, and other non-propulsion functions - are fundamental to vessel performance, safety, and operational continuity. According to Market Research Future (MRFR) analysis, the marine…

Counter IED Market Size USD 1.612 Billion in 2025, Projected to Reach USD 2.089 …

The Counter IED (Improvised Explosive Device) Market is poised for sustained growth as defense and security agencies globally prioritize the detection and neutralization of explosive threats used in asymmetric warfare, terrorism, and urban insurgency environments. IEDs - an unpredictable and cost-effective threat - have become a major concern for military forces, homeland security organizations, and critical infrastructure protection programs. According to Market Research Future (MRFR), the Counter IED Market Overview…

Electronic Flight Bag Market Size USD 1.79 Billion in 2025, Projected to Reach U …

The global Electronic Flight Bag (EFB) Market is moving into a period of sustained growth as airlines, business jets, and military operators increasingly adopt digital solutions designed to replace paper-based charts, manuals, and flight documents. EFBs - digital systems that streamline flight planning, navigation, weather updates, and aircraft performance calculations - are becoming essential tools in modern aviation, enabling improved operational efficiency, reduced pilot workload, and enhanced flight safety. According…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…