Press release

Debt Collection Software Market Forecasted to Reach at 9.1% CAGR by 2032

The Debt Collection Software Market has been experiencing substantial growth over recent years, driven by an increasing need for efficient debt recovery processes and improved customer relationship management within the financial sector. As of 2022, the global debt collection software market size was estimated at USD 4.53 billion. Projections for 2023 suggest growth to USD 4.95 billion, and the market is anticipated to reach USD 10.76 billion by 2032, marking a compound annual growth rate (CAGR) of 9.1% over the forecast period from 2024 to 2032.Key Companies in the Debt Collection Software Market Include:

TransUnion, Wolters Kluwer, Equifax, Thomson Reuters, SAP, Moody's Analytics, Experian, Salesforce, CoreLogic, LexisNexis, Oracle, SAS Institute, FICO, Fair Isaac Corporation

Get a FREE Sample Report PDF Here:

https://www.marketresearchfuture.com/sample_request/22776

Key Drivers of Market Growth

Increasing Financial Debts and Rising Need for Efficient Collection Systems

The ongoing accumulation of financial debts, fueled by rising consumer credit and increasing adoption of "buy now, pay later" models, has created a demand for efficient and effective debt recovery solutions. Debt collection software automates many manual processes in collections, improving recovery rates and reducing operational costs.

Advances in Automation and Artificial Intelligence (AI)

The integration of AI and machine learning has revolutionized debt collection software, allowing systems to predict debtor behavior, prioritize collection activities, and personalize recovery approaches. AI-driven analytics can enhance decision-making processes, reduce default risks, and improve the overall efficiency of collection efforts.

Regulatory Compliance

In many regions, compliance with regulatory standards is a critical factor in the debt collection process. Debt collection software aids companies in staying compliant with complex and evolving regulations. The ability to automatically update compliance guidelines in software is a major advantage for organizations operating in highly regulated environments.

Adoption of Cloud-Based Solutions

Cloud technology enables debt collection agencies to implement software with lower upfront costs and increased scalability. Cloud-based solutions also offer greater flexibility, allowing agencies to access systems remotely and securely. This accessibility has been particularly beneficial for small- and medium-sized enterprises (SMEs), which are increasingly adopting cloud-based debt collection solutions.

Customer-Centric Collection Approaches

Modern debt collection is evolving to focus on maintaining customer relationships. Debt collection software includes tools for digital communication, automated reminders, and a more customer-friendly approach to collections. This approach helps companies retain customers while managing delinquencies effectively, thereby minimizing the risk of damaging long-term relationships.

Market Segmentation

The debt collection software market can be segmented by deployment type, end-user industry, and geographical regions.

By Deployment Type:

The market includes on-premises and cloud-based solutions. Cloud-based deployment is expected to witness higher growth due to its flexibility, scalability, and cost-effectiveness.

By End-User Industry:

Key industries include banking and financial services, telecommunications, healthcare, and utilities. The banking and financial services sector is a leading segment due to its high reliance on credit services and the necessity for debt recovery.

By Region:

The market is divided across North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa. North America is currently the largest market due to early adoption of debt collection technology and stringent regulatory environments. The Asia-Pacific region, however, is expected to see the fastest growth due to a rising consumer base and increased debt accumulation in emerging economies like India and China.

Know More about the Debt Collection Software Market Report:

https://www.marketresearchfuture.com/reports/debt-collection-software-market-22776

Key Trends Impacting Market Development

Integration with Customer Relationship Management (CRM) Systems

Many debt collection solutions are being integrated with CRM platforms to enhance customer insights and improve the communication process. These integrations help debt collectors manage accounts more effectively by providing a comprehensive view of customer data, interactions, and history.

Predictive Analytics for Improved Decision-Making

Predictive analytics tools within debt collection software help companies forecast delinquency trends, identify high-risk accounts, and determine optimal times for reaching out to debtors. These analytics allow debt collection agencies to prioritize accounts and allocate resources more efficiently.

Self-Service Payment Options

The shift towards digital self-service payment options is gaining traction, allowing customers to make payments online, set up payment plans, or negotiate debt settlements directly. Self-service options reduce the workload for collectors and provide a more positive experience for customers.

Enhanced Security Features

As cyber threats increase, debt collection software vendors are incorporating robust security measures, including multi-factor authentication, encryption, and compliance with data protection regulations such as GDPR and CCPA. Security is a crucial factor, especially given the sensitivity of financial data in debt collection processes.

Competitive Landscape

The debt collection software market includes a mix of established players and emerging companies focused on innovation and enhanced customer service. Key players in the industry include FICO, Experian, CGI Inc., TransUnion, Temenos AG, and Chetu Inc. These companies continually invest in product development, focusing on AI, cloud integration, and compliance with regulatory standards.

Future Outlook

The debt collection software market is positioned for sustained growth over the next decade, fueled by advancements in AI, the expansion of cloud-based solutions, and increasing regulatory requirements. As companies prioritize customer retention and look to streamline debt recovery processes, demand for innovative debt collection solutions is expected to rise, potentially expanding the market's size and profitability.

Top Trending Research Report:

Umbrella Insurance Market - https://www.marketresearchfuture.com/reports/umbrella-insurance-market-22580

Asset-Backed Securities Market - https://www.marketresearchfuture.com/reports/asset-backed-securities-market-23890

Banking BPS Market - https://www.marketresearchfuture.com/reports/banking-bps-market-23871

Final Expense Insurance Market - https://www.marketresearchfuture.com/reports/final-expense-insurance-market-23889

Investor Esg Software Market - https://www.marketresearchfuture.com/reports/investor-esg-software-market-23872

Commercial Payment Cards Market - https://www.marketresearchfuture.com/reports/commercial-payment-cards-market-23869

Emv Smart Cards Market - https://www.marketresearchfuture.com/reports/emv-smart-cards-market-23876

Aviation Insurance Market - https://www.marketresearchfuture.com/reports/aviation-insurance-market-23897

Accidental Death Insurance Market - https://www.marketresearchfuture.com/reports/accidental-death-insurance-market-23901

Home Loan Market - https://www.marketresearchfuture.com/reports/home-loan-market-24178

About Market Research Future:

Market Research Future (MRFR) is a global market research company that takes pride in its services, offering a complete and accurate analysis regarding diverse markets and consumers worldwide. Market Research Future has the distinguished objective of providing the optimal quality research and granular research to clients. Our market research studies by products, services, technologies, applications, end users, and market players for global, regional, and country level market segments, enable our clients to see more, know more, and do more, which help answer your most important questions.

Contact US:

Market Research Future (Part of Wantstats Research and Media Private Limited)

99 Hudson Street, 5Th Floor

New York, NY 10013

United States of America

+1 628 258 0071 (US)

+44 2035 002 764 (UK)

Email: sales@marketresearchfuture.com

Website: https://www.marketresearchfuture.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Debt Collection Software Market Forecasted to Reach at 9.1% CAGR by 2032 here

News-ID: 3721363 • Views: …

More Releases from MRFR ( Market Research Future Reports)

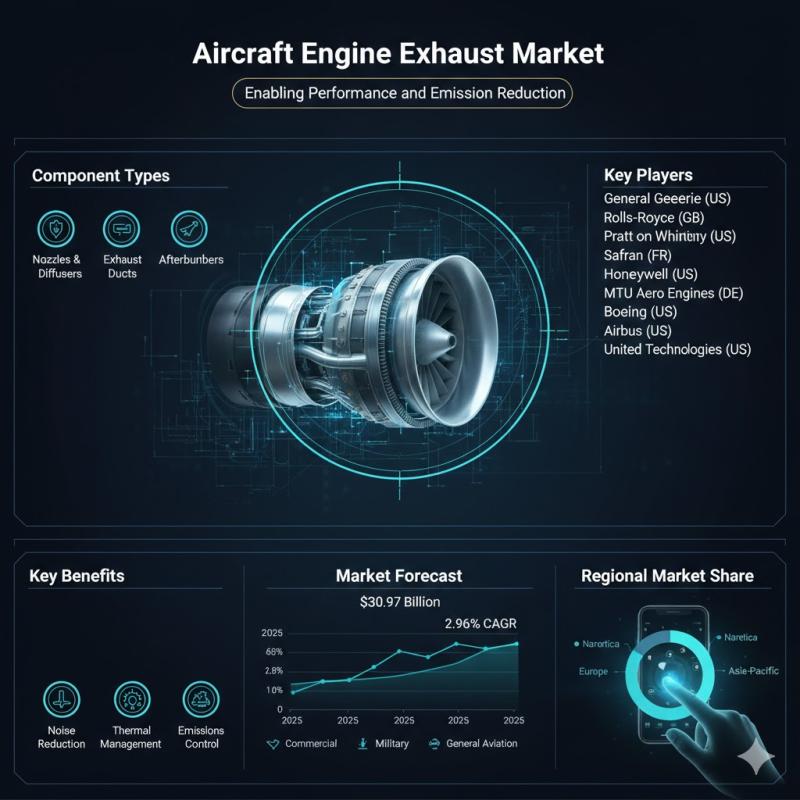

Aircraft Engine Exhaust Market Size to Reach USD 41.47 Billion by 2035, Growing …

The Aircraft Engine Exhaust Market plays a vital role in modern aviation by managing the discharge of combustion gases from aircraft engines - a key factor in performance, fuel efficiency, emissions control, and noise reduction. As airlines expand fleets and regulatory pressures increase to reduce environmental impact, the demand for advanced aircraft engine exhaust systems continues to grow globally. According to reliable industry research, tThe Aircraft Engine Exhaust industry is…

Marine Auxiliary Engine Market Size to Reach USD 3.71 Billion by 2035, Growing a …

Marine Auxiliary Engine Market: Powering Shipboard Operations with Efficiency and Innovation

The Marine Auxiliary Engine Market is poised for measured growth as maritime industries emphasize energy efficiency, stricter emissions standards, and reliable onboard power solutions. Auxiliary engines - essential for powering electrical systems, pumps, ballast operations, emergency power, and other non-propulsion functions - are fundamental to vessel performance, safety, and operational continuity. According to Market Research Future (MRFR) analysis, the marine…

Counter IED Market Size USD 1.612 Billion in 2025, Projected to Reach USD 2.089 …

The Counter IED (Improvised Explosive Device) Market is poised for sustained growth as defense and security agencies globally prioritize the detection and neutralization of explosive threats used in asymmetric warfare, terrorism, and urban insurgency environments. IEDs - an unpredictable and cost-effective threat - have become a major concern for military forces, homeland security organizations, and critical infrastructure protection programs. According to Market Research Future (MRFR), the Counter IED Market Overview…

Electronic Flight Bag Market Size USD 1.79 Billion in 2025, Projected to Reach U …

The global Electronic Flight Bag (EFB) Market is moving into a period of sustained growth as airlines, business jets, and military operators increasingly adopt digital solutions designed to replace paper-based charts, manuals, and flight documents. EFBs - digital systems that streamline flight planning, navigation, weather updates, and aircraft performance calculations - are becoming essential tools in modern aviation, enabling improved operational efficiency, reduced pilot workload, and enhanced flight safety. According…

More Releases for Debt

Debt Settlement Solution Market Impressive Growth 2021-2028 | National Debt Reli …

The Insight Partners announces the research on Global Debt Settlement Solution Market [Report Page Link as it covers the key boundaries Required for your Research Need. This Global Debt Settlement Solution Market Report covers worldwide, local, and nation level market size, pieces of the overall industry, ongoing pattern, the effect of covid19 on worldwide

Market Research Report Investigations Research Methodology review comprises of Secondary Research, Primary Research, Company Share Analysis,…

Debt Settlement Market Emerging Growth Analysis, Demand and Business Opportuniti …

Debt settlement is the process of negotiating with creditors to reduce overall debts in exchange for a lump sum payment. A successful settlement occurs when the creditor agrees to forgive a percentage of total account balance. Normally, only unsecured debts not secured by real assets like homes or autos can be settled. Debt Settlement Market report studies the Debt Settlement market. Debt settlement is an approach to debt reduction in…

Debt Settlement Market Emerging Growth Analysis, Demand and Business Opportuniti …

Debt settlement is the process of negotiating with creditors to reduce overall debts in exchange for a lump sum payment. A successful settlement occurs when the creditor agrees to forgive a percentage of total account balance. Normally, only unsecured debts not secured by real assets like homes or autos can be settled. Debt Settlement Market report studies the Debt Settlement market. Debt settlement is an approach to debt reduction in…

Debt Settlement Market 2019 By Freedom Debt Relief National Debt Relief Rescue O …

This report studies the Debt Settlement market. Debt settlement is an approach to debt reduction in which the debtor and creditor agree on a reduced balance that will be regarded as payment in full.

Request a Sample of this Report @ https://www.orbisresearch.com/contacts/request-sample/2575396 …

Debt Settlement Market 2018-National Debt Relief, Freedom Debt Relief, New Era D …

The report on Debt Settlement, documents a detailed study of different aspects of the ‘Debt Settlement’ market. It shows the steady growth in market in spite of the fluctuations and changing market trends. In the past four years the ‘Debt Settlement’ market has grown to a booming value of $xxx million and is expected to grow more.

Request a Sample of this Report@ http://www.orbisresearch.com/contacts/request-sample/2335800

Every market intelligence report is based on certain…

Debt Settlement Market 2018 | Global Demand, Top Companies Analysis- National De …

Global Debt Settlement Market Research Report 2018 is a professional and in-depth study on the current state of the global Debt Settlement industry with a focus on the regional market, analysis of industry share, growth factors, development trends, size, majors manufacturers and 2025 forecast. The report also analyze innovative business strategies, value added factors and business opportunities. The Debt Settlement report introduces market revenue, product & services, latest developments and…