Press release

ESG Finance Market Trends 2024: Comprehensive Analysis of Share and Size

The Business Research Company recently released a comprehensive report on the Global ESG Finance Market Size and Trends Analysis with Forecast 2024-2033. This latest market research report offers a wealth of valuable insights and data, including global market size, regional shares, and competitor market share. Additionally, it covers current trends, future opportunities, and essential data for success in the industry.According to The Business Research Company's, the ESG finance market size has grown rapidly in recent years. It will grow from $5,716.79 billion in 2023 to $6,347.59 billion in 2024 at a compound annual growth rate (CAGR) of 11%. The growth in the historic period can be attributed to increased awareness of climate change, regulatory developments, the growth of green bonds, corporate sustainability initiatives, and growing consumer preferences.

The ESG finance market size is expected to see rapid growth in the next few years. It will grow to $9690.94 billion in 2028 at a compound annual growth rate (CAGR) of 11.2%. The growth in the forecast period can be attributed to strengthening regulatory frameworks, increased focus on climate risk management, rising corporate sustainability goals, growing institutional investment, and global climate initiatives. Major trends in the forecast period include enhanced ESG data and analytics, advancements in ESG technology, enhanced analytics tools, the integration of AI, and the and the integration of blockchain.

Get The Complete Scope Of The Report @

https://www.thebusinessresearchcompany.com/report/esg-finance-global-market-report

Market Drivers and Trends:

The rising investment in green bonds is expected to propel the growth of the ESG finance market going forward. Green bonds are fixed-income securities issued to raise capital specifically for financing environmentally sustainable projects and initiatives. Rising investment in green bonds is driven by growing global awareness of climate change and a demand for socially responsible investments. Additionally, institutional investors, including pension funds and insurance companies, are increasingly seeking investments with environmental, social, and governance (ESG) criteria. ESG insurance provides coverage and risk mitigation for environmentally sustainable projects, thereby enhancing investor confidence and facilitating the financing of green initiatives. For instance, in May 2024, according to The International Finance Corporation, a US-based international financial institution, green bond issuance is expected to grow at a rate of 7.5 percent annually, reaching $156 billion by 2025, up from $135 billion in 2023. Therefore, rising investments in green bonds will drive the growth of the ESG finance market.

Major companies operating in the ESG finance market are focusing on the integration of AI, such as AI-powered data analytics and research platforms, to drive informed investment decisions and meet the growing demand for transparency and accountability in sustainable finance. AI-powered data analytics and research platforms use artificial intelligence to analyze and interpret vast amounts of environmental, social, and governance data, providing investors and companies with actionable insights and enhanced decision-making capabilities in sustainable finance. For instance, in March 2022, ESG Data Services Inc. (ESG Analytics), a Canada-based provider of advanced data solutions and insights, launched ESG Analytics, an advanced AI-powered platform for ESG data, analytics, and research. This web-based solution and API leverage extensive alternative data sources and artificial intelligence to identify risks and opportunities in the ESG practices of countries, companies, and ETFs. ESG Analytics' dynamic big data platform provides researchers, analysts, funds, and corporations with real-time insights, facilitating the integration of ESG factors into investment management and corporate decision-making processes.

Key Benefits for Stakeholders:

• Comprehensive Market Insights: Stakeholders gain access to detailed market statistics, trends, and analyses that help them understand the current and future landscape of their industry.

• Informed Decision-Making: The reports provide crucial data that support strategic decisions, reducing risks and enhancing business planning.

• Competitive Advantage: With in-depth competitor analysis and market share information, stakeholders can identify opportunities to outperform their competition.

• Tailored Solutions: The Business Research Company offers customized reports that address specific needs, ensuring stakeholders receive relevant and actionable insights.

• Global Perspective: The reports cover various regions and markets, providing a broad view that helps stakeholders expand and operate successfully on a global scale.

Ready to Dive into Something Exciting? Get Your Free Exclusive Sample of Our Research Report @

https://www.thebusinessresearchcompany.com/sample.aspx?id=18601&type=smp

Major Key Players of the Market:

JPMorgan Chase & Co.; HSBC Holdings plc; Morgan Stanley; BNP Paribas Asset Management S.A.; The Goldman Sachs Group Inc.; UBS Group AG; Deutsche Bank AG; Fidelity Investments Inc.; The Bank of New York Mellon Corporation; BlackRock Inc.; State Street Corporation; The Vanguard Group Inc.; Franklin Templeton Holdings Ltd.; Northern Trust Asset Management; T. Rowe Price Group Inc.; Amundi Asset Management Inc.; Invesco Ltd.; Schroders plc; Pacific Investment Management Company LLC; Allianz Global Investors GmbH; Columbia Threadneedle Investments Inc.; AXA Investment Managers S.A.; Wellington Management Company LLP; Natixis Investment Managers International; Legal & General Investment Management Limited

ESG Finance Market 2024 Key Insights:

• The ESG finance market size is expected to grow to $9690.94 billion in 2028 at a compound annual growth rate (CAGR) of 11.2%.

• Green Bond Investments To Accelerate Growth In ESG Finance Market

• Cutting-Edge AI Platform For Enhanced ESG Insights

• Europe was the largest region in the ESG finance market in 2023

We Offer Customized Report, Click @

https://www.thebusinessresearchcompany.com/customise?id=18601&type=smp

Contact Us:

The Business Research Company

Europe: +44 207 1930 708

Asia: +91 88972 63534

Americas: +1 315 623 0293

Email: info@tbrc.info

Follow Us On:

LinkedIn: https://in.linkedin.com/company/the-business-research-company

Twitter: https://twitter.com/tbrc_info

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ

Learn More About The Business Research Company

The Business Research Company (www.thebusinessresearchcompany.com) is a leading market intelligence firm renowned for its expertise in company, market, and consumer research. With a global presence, TBRC's consultants specialize in diverse industries such as manufacturing, healthcare, financial services, chemicals, and technology, providing unparalleled insights and strategic guidance to clients worldwide.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release ESG Finance Market Trends 2024: Comprehensive Analysis of Share and Size here

News-ID: 3720810 • Views: …

More Releases from The Business research company

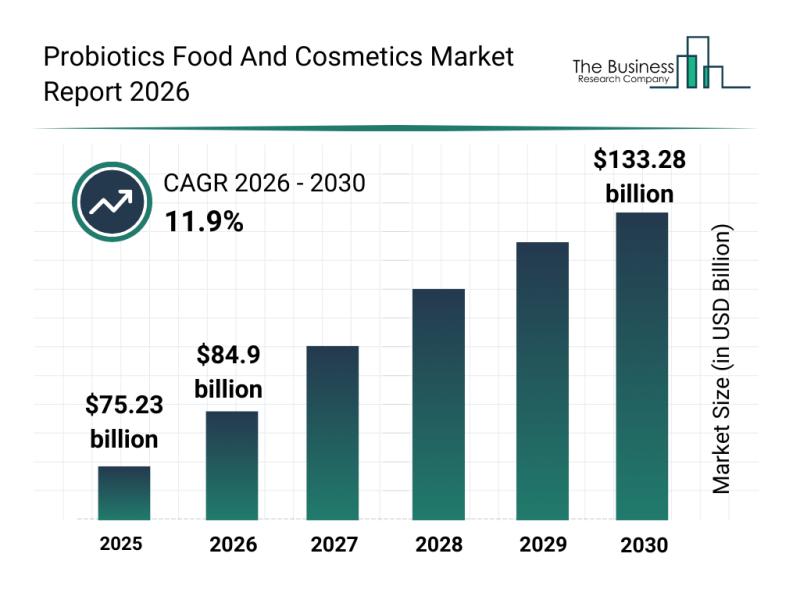

Outlook on the Probiotics Food and Cosmetics Market: Major Segments, Strategic D …

The probiotics food and cosmetics sector is on the brink of significant expansion, driven by increasing consumer awareness and innovative product developments. As wellness trends continue to evolve, this market is set to experience remarkable growth, presenting vast opportunities for manufacturers and retailers alike. Here, we explore the market's expected size, key players, emerging trends, and detailed segmentation.

Projected Market Size and Growth Trends in the Probiotics Food and Cosmetics Market…

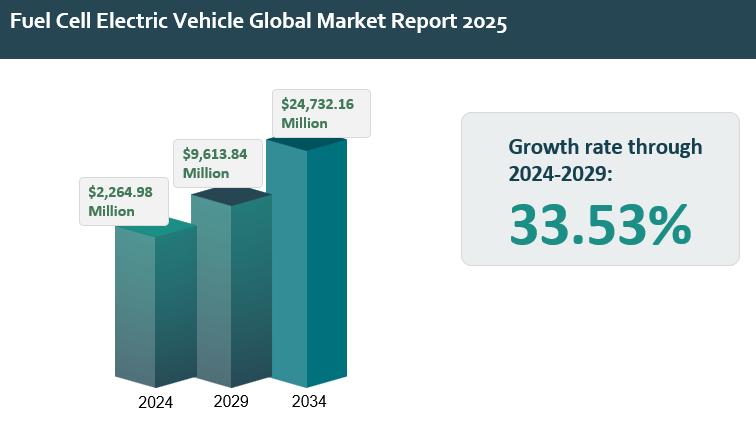

Global Fuel Cell Electric Vehicle Market Outlook 2025-2034: Growth Acceleration, …

The fuel cell electric vehicle report outlines and analyzes the fuel cell electric vehicle market, covering the historic period 2019-2024 and the forecast periods 2024-2029 and 2034F. The report assesses the market across regions and the major economies within each region.

The global fuel cell electric vehicle market was valued at $2.26498 billion in 2024, increasing at a CAGR of 6.88% since 2019. The market is projected to rise from $2.26498…

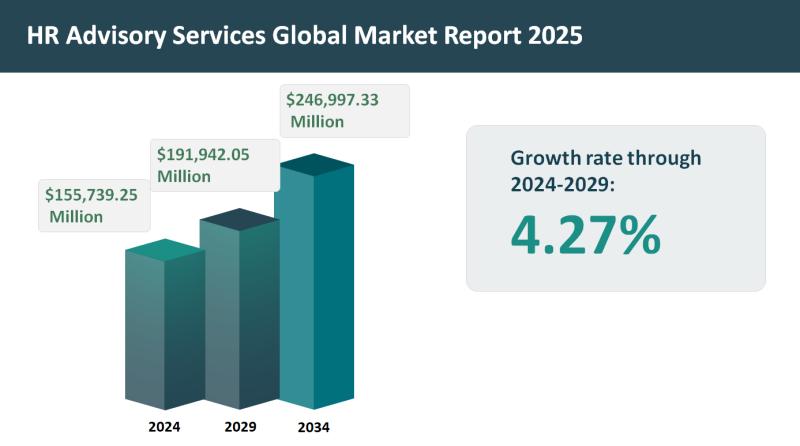

Global HR Advisory Services Market Set for 4.27% Growth, Projected to Reach $191 …

The HR advisory services report outlines and analyzes the HR advisory services market across 2019-2024 (historic period) and 2024-2029, 2034F (forecast period). It examines market performance across global regions and key economies.

The global HR advisory services market was valued at approximately $155.73925 billion in 2024, increasing at a CAGR of 4.22% since 2019. The market is anticipated to rise from $155.73925 billion in 2024 to $191.94205 billion in 2029, reflecting…

Evolving Market Trends In The Integrated Geophysical Services Industry: Enhancin …

The Integrated Geophysical Services Market Report by The Business Research Company delivers a detailed market assessment, covering size projections from 2025 to 2034. This report explores crucial market trends, major drivers and market segmentation by [key segment categories].

What Is the Expected Integrated Geophysical Services Market Size During the Forecast Period?

The integrated geophysical services market has experienced consistent growth in recent years, expected to rise from $2.35 billion in 2024 to…

More Releases for ESG

CARE ESG Awards 2025 highlights outstanding achievements in sustainability, clim …

Dubai, UAE, 29th November 2025, ZEX PR WIRE, The CARE ESG Awards by Trescon and ESG Mena recognised the region's most outstanding leaders, changemakers, and industry shapers driving sustainability, clean energy, climate resilience, and responsible growth. Held during the inaugural edition of climate action, renewable energy & sustainability forum, CARE 2025, the awards spotlighted high-impact contributions driving measurable progress across environmental stewardship, renewable energy deployment, resource efficiency, social value creation,…

APAC Investor ESG Software Market Rises at 16.5% CAGR Amid Regional Push for ESG …

The Asia Pacific (APAC) Investor ESG Software market is poised for a decade of robust expansion, projected to grow from US$ 214.91 million in 2024 to an estimated US$ 756.92 million by 2031. This represents a significant Compound Annual Growth Rate (CAGR) of 19.7% during the forecast period of 2024-2031, according to a new market research report published by The Insight Partners.

Download PDF Sample Copy @ https://www.theinsightpartners.com/sample/TIPRE00023473/?utm_source=OpenPR&utm_medium=10813

The report, titled "Asia-Pacific…

Global ESG Reporting Software Market Size by Application, Type, and Geography: F …

USA, New Jersey- According to Market Research Intellect, the global ESG Reporting Software market in the Internet, Communication and Technology category is projected to witness significant growth from 2025 to 2032. Market dynamics, technological advancements, and evolving consumer demand are expected to drive expansion during this period.

The growing need for clear and consistent sustainability disclosures is driving the market for ESG (Environmental, Social, and Governance) reporting software, which is expanding…

ZeeDimension Wins ESG Data Company Award at the 5th World ESG Summit in Riyadh

Riyadh, Saudi Arabia - February 12, 2025 - ZeeDimension, a leading provider of ESG, GRC, and data analytics solutions, has been honored with the prestigious ESG Data Company Award at the 5th World ESG Summit, held on February 10-11, 2025, in Riyadh, Saudi Arabia.

The World ESG Summit is one of the most influential global gatherings for sustainability leaders, investors, and policymakers, dedicated to advancing Environmental, Social, and Governance (ESG) initiatives.…

Transforming the Environmental, Social And Governance (ESG) Investment Analytics …

What Is the Expected Size and Growth Rate of the Environmental, Social And Governance (ESG) Investment Analytics Market?

The market size for investment analytics related to environmental, social, and governance (ESG) has been on a rapid surge over the recent years. The market estimation is to rise from $1.7 billion in 2024 to $2.01 billion in 2025 with a compound annual growth rate (CAGR) of 18.1%. Growth in the past can…

Inrate Unveils New ESG Data Platform for Transparent and Traceable ESG Data Insi …

Zurich, Oct 22, 2024 - Inrate, a leading impact rating and ESG data company, is thrilled to announce the release of CLIF, its new ESG data platform, designed to provide transparent and traceable ESG data to simply investment analysis. With expanded features and seamless functionality, CLIF allows investors to gain enhanced visibility into the sustainability performance of over 10,000 companies and 190 sovereigns worldwide.

Empowering Data-Driven ESG Decisions

The CLIF…