Press release

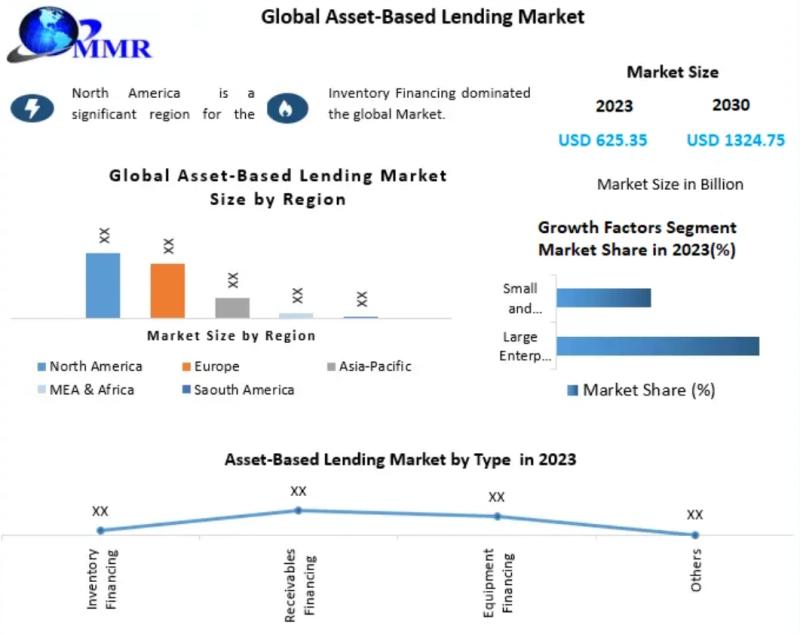

Asset-Based Lending Market Poised to be Valued at USD 1324.75 Billion. by 2030, Growing at a 9.62 % CAGR

Forecast Increase in Revenue:size was valued at USD 625.35 Billion in 2023 and the total Asset-Based Lending revenue is expected to grow at a CAGR of 11.32% from 2024 to 2030, reaching nearly USD 1324.75 Billion.

Asset-Based Lending Market Overview:

The asset-based lending (ABL) market is growing as businesses increasingly rely on this financing option to secure loans using collateral such as inventory, accounts receivable, and equipment. ABL provides companies with flexible funding solutions, especially those facing liquidity challenges or seeking working capital. It is particularly popular among mid-sized and large companies across industries like manufacturing, retail, and distribution. As economic uncertainty and credit risks rise, businesses turn to asset-based lending as a stable financing option, driving the market's expansion.

𝐘𝐨𝐮𝐫 𝐒𝐚𝐦𝐩𝐥𝐞 𝐑𝐞𝐩𝐨𝐫𝐭 𝐈𝐬 𝐉𝐮𝐬𝐭 𝐚 𝐂𝐥𝐢𝐜𝐤 𝐀𝐰𝐚𝐲! https://www.maximizemarketresearch.com/request-sample/189641/

Drivers in the Asset-Based Lending Market:

Key drivers of the asset-based lending market include increased demand for working capital in industries with fluctuating cash flows and the tightening of traditional bank lending standards. Companies facing liquidity issues or needing to finance growth rely on ABL due to its flexibility and asset-backed security. Additionally, businesses with strong asset bases but lower credit scores find ABL a viable alternative. The growing complexity of supply chains and rising operational costs also fuel demand for asset-based lending as companies seek more efficient capital management.

Asset-Based Lending Market Trends:

Major trends in the asset-based lending market include the increasing use of technology and automation to streamline loan approval processes and improve risk assessment. The rise of alternative lenders offering digital platforms is expanding access to ABL for small and mid-sized enterprises. Additionally, there is a growing focus on non-traditional collateral such as intellectual property and trademarks, broadening the scope of ABL offerings. The market is also seeing greater interest in asset-based financing for mergers and acquisitions as businesses look to restructure or expand.

𝐍𝐞𝐞𝐝 𝐌𝐨𝐫𝐞 𝐈𝐧𝐟𝐨𝐫𝐦𝐚𝐭𝐢𝐨𝐧? 𝐈𝐧𝐪𝐮𝐢𝐫𝐞 𝐀𝐛𝐨𝐮𝐭 𝐒𝐚𝐦𝐩𝐥𝐞 + 𝐆𝐫𝐚𝐩𝐡𝐬 𝐇𝐞𝐫𝐞: https://www.maximizemarketresearch.com/request-sample/189641/

Asset-Based Lending Market Opportunities:

Opportunities in the asset-based lending market are emerging due to the increasing number of businesses seeking alternative financing amid economic uncertainty. The rise of digital lending platforms presents significant potential for lenders to reach small and mid-sized businesses more efficiently. Moreover, emerging markets in Asia-Pacific and Latin America offer growth potential as companies in these regions seek more flexible financing solutions. As more industries explore the benefits of ABL, lenders can expand their portfolios by incorporating diverse asset types, including intangible assets.

What is Asset-Based Lending Market Regional Insight?

North America leads the asset-based lending market, driven by the strong presence of established ABL providers and demand from sectors such as manufacturing, retail, and healthcare. Europe is also a significant market, with ABL gaining traction in response to tighter bank lending regulations and the need for flexible financing. The Asia-Pacific region is witnessing rapid growth in ABL, fueled by expanding industrial sectors and increased access to credit for small and medium-sized enterprises. Latin America and the Middle East & Africa are seeing rising adoption as businesses look for alternatives to traditional bank financing, creating new opportunities for market expansion.

𝐂𝐮𝐫𝐢𝐨𝐮𝐬 𝐭𝐨 𝐩𝐞𝐞𝐤 𝐢𝐧𝐬𝐢𝐝𝐞? 𝐆𝐫𝐚𝐛 𝐲𝐨𝐮𝐫 𝐬𝐚𝐦𝐩𝐥𝐞 𝐜𝐨𝐩𝐲 𝐨𝐟 𝐭𝐡𝐢𝐬 𝐫𝐞𝐩𝐨𝐫𝐭 𝐧𝐨𝐰: https://www.maximizemarketresearch.com/request-sample/189641/

Segmentation Analysis of the Asset-Based Lending Market

by Type

Inventory Financing

Receivables Financing

Equipment Financing

Others

by Interest Rate

Fixed Rate

Floating Rate

by End User

Large Enterprises

Small and Medium-sized Enterprises

Who is the largest manufacturers of Asset-Based Lending Market worldwide?

1.Lloyds Bank

2.Barclays Bank PLC

3. Hilton-Baird Group

4. JPMorgan Chase & Co

5. Berkshire Bank

6.White Oak Financial, LLC

7.Wells Fargo

8. Porter Capital

9.Capital Funding Solutions Inc.

10.SLR Credit Solutions

11.Fifth Third Bank

12.HSBC Holdings plc

12. SunTrust Banks, Inc. (now part of Truist Financial Corporation)

13. Santander Bank, N.A.

14.KeyCorp

15.BB&T Corporation (now part of Truist Financial Corporation)

16. Goldman Sachs Group, Inc.

𝐆𝐞𝐭 𝐃𝐢𝐬𝐜𝐨𝐮𝐧𝐭 𝐎𝐧 𝐓𝐡𝐞 𝐏𝐮𝐫𝐜𝐡𝐚𝐬𝐞 𝐎𝐟 𝐓𝐡𝐢𝐬 𝐑𝐞𝐩𝐨𝐫𝐭 @ https://www.maximizemarketresearch.com/market-report/asset-based-lending-market/189641/

Key Offerings:

Asset-Based Lending Market Size and Competitive Landscape

Asset-Based Lending Market Size, Share, Size & Forecast by different segment

Market Dynamics - Growth Drivers, Restraints, Opportunities, and Key Trends by region

Asset-Based Lending Market Segmentation - A detailed analysis by Product

Competitive Landscape - Profiles of selected key players by region from a strategic perspective

Competitive landscape - Market Leaders, Market Followers, Regional player

Competitive benchmarking of key players by region

PESTLE Analysis

PORTER's analysis

Value chain and supply chain analysis

Legal Aspects of business by region

Lucrative business opportunities with SWOT analysis

Recommendations

Explore our top-performing reports on the latest trends:

Solar Trash Compactors Market https://www.maximizemarketresearch.com/market-report/global-solar-trash-compactors-market/90079/

Industrial Laminating Machines Market https://www.maximizemarketresearch.com/market-report/industrial-laminating-machines-market/123549/

Drum Handling Equipment Market https://www.maximizemarketresearch.com/market-report/drum-handling-equipment-market/146889/

Water Bath Heater Market https://www.maximizemarketresearch.com/market-report/water-bath-heater-market/148668/

Paper drying systems market https://www.maximizemarketresearch.com/market-report/paper-drying-systems-market/148689/

MAXIMIZE MARKET RESEARCH PVT. LTD.

⮝ 3rd Floor, Navale IT park Phase 2,

Pune Banglore Highway, Narhe

Pune, Maharashtra 411041, India.

✆ +91 9607365656

About Us

Maximize Market Research is one of the fastest-growing market research and business consulting firms serving clients globally. Our revenue impact and focused growth-driven research initiatives make us a proud partner of majority of the Fortune 500 companies. We have a diversified portfolio and serve a variety of industries such as IT & telecom, chemical, food & beverage, aerospace & defense, healthcare and others.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Asset-Based Lending Market Poised to be Valued at USD 1324.75 Billion. by 2030, Growing at a 9.62 % CAGR here

News-ID: 3698546 • Views: …

More Releases from MAXIMIZE MARKET RESEARCH PVT. LTD

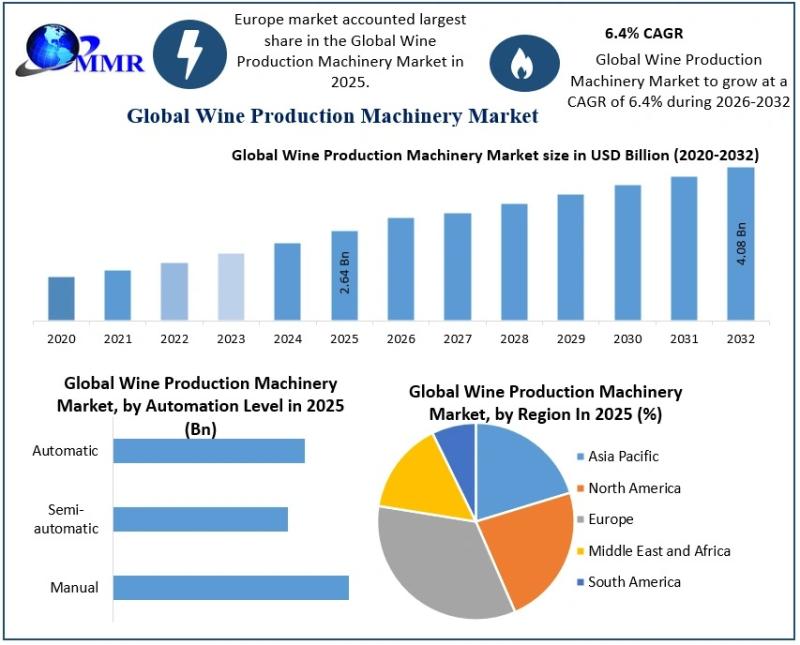

Wine Production Machinery Market Growing at a Robust CAGR of 6.4% Driven by Auto …

The Wine Production Machinery Market size was valued at USD 2.64 Billion in 2025 and the total Wine Production Machinery revenue is expected to grow at a CAGR of 6.4% from 2026 to 2032, reaching nearly USD 4.08 Billion by 2032.

Wine Production Machinery Market Overview:

The Wine Production Machinery Market is witnessing steady transformation as wineries across the globe increasingly adopt modern equipment to enhance efficiency, consistency, and product quality. From…

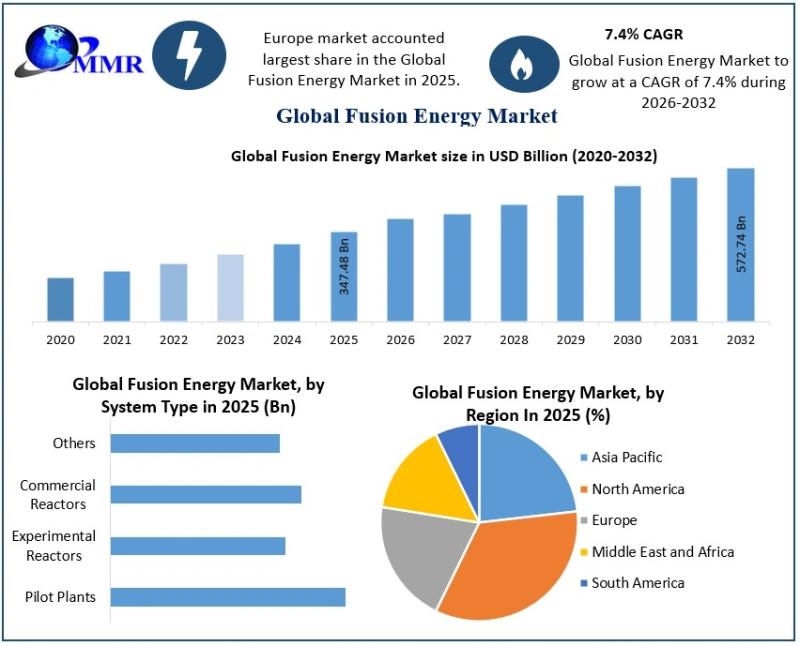

Fusion Energy Market Outlook Highlights Strong Growth at 7.4% CAGR

The Fusion Energy Market size was valued at USD 347.48 Billion in 2025 and the total Fusion Energy revenue is expected to grow at a CAGR of 7.4% from 2026 to 2032, reaching nearly USD 572.74 Billion by 2032.

Fusion Energy Market Overview:

The Fusion Energy Market is gaining global attention as nations, industries, and researchers intensify efforts to develop cleaner and more sustainable power alternatives for the future. Fusion energy is…

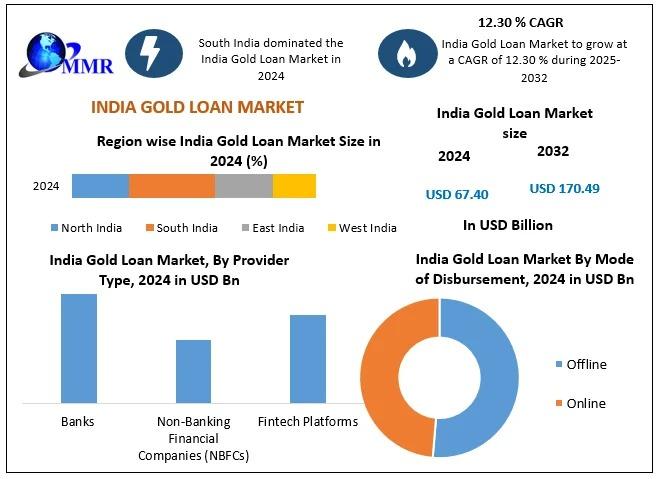

India Gold Loan Market Shows Strong Momentum Driven by Trust, Technology, and Fi …

The India Gold Loan Market size was valued at USD 67.40 Billion in 2024 and the total India Gold Loan Market is expected to grow at a CAGR of 12.30 % from 2025 to 2032, reaching nearly USD 170.49 Billion.

India Gold Loan Market Overview:

The India Gold Loan Market has steadily evolved into a trusted financial solution for individuals and small businesses seeking quick access to funds without liquidating their long-term…

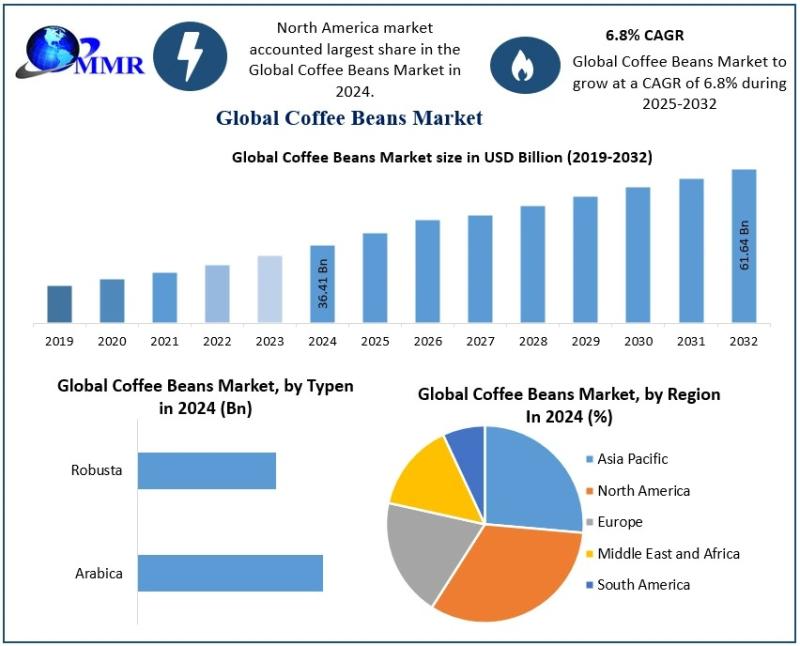

Coffee Beans Market Trends Highlight Rising Demand for Specialty, Sustainable, a …

The Coffee Beans Market size was valued at USD 36.41 Billion in 2024 and the total Coffee Beans revenue is expected to grow at a CAGR of 6.8% from 2025 to 2032, reaching nearly USD 61.64 Billion.

Coffee Beans Market Overview:

The Coffee Beans Market reflects a complex ecosystem that begins at farms and extends to global distribution networks. Coffee beans are cultivated across diverse climatic regions, each contributing unique taste profiles…

More Releases for Lending

Mortgage Lending Market : Increased focus toward digitalizing lending process

According to the report published by Allied Market Research, the global mortgage lending market generated $11.48 billion in 2021, and is estimated to reach $27.50 billion by 2031, witnessing a CAGR of 9.5% from 2022 to 2031. The report offers a detailed analysis of changing market trends, top segments, value chain, key investment pockets, competitive scenario, and regional landscape. The report is a vital for leading market players, investors, new…

P2p Lending Market | Industry Overview 2021 | Worldwide Companies- CircleBack Le …

P2p Lending Market report will provide one with overall market analysis, statistics, various trends, drivers, opportunities, restraints, and every minute data relating to the Synthetic Fibers market necessary for forecasting its revenue, factors propelling & growth. The P2p Lending market study provides unique guidance in thoughtful details regarding the development factors and has used a top-down and bottom-up approach to keep it error-free and accurate. Our expert analysts have used…

Peer-to-peer Lending – Growing Popularity and Emerging Trends in the Market | …

Global Peer-to-peer Lending Market Size, Status and Forecast 2018-2025 is latest research study released by HTF MI evaluating the market, highlighting opportunities, risk side analysis, and leveraged with strategic and tactical decision-making support. The study provides information on market trends and development, drivers, capacities, technologies, and on the changing investment structure of the Global Peer-to-peer Lending Market. Some of the key players profiled in the study are CircleBack Lending, Lending…

Alternative Lending Market Is Booming Worldwide | Lending Club, Prosper, Upstart …

The ‘ Alternative Lending market’ research report added by Report Ocean, is an in-depth analysis of the latest developments, market size, status, upcoming technologies, industry drivers, challenges, regulatory policies, with key company profiles and strategies of players. The research study provides market overview, Alternative Lending market definition, regional market opportunity, sales and revenue by region, manufacturing cost analysis, Industrial Chain, market effect factors analysis, Alternative Lending market size forecast, market…

P2P Lending Market is Thriving Worldwide | CircleBack Lending, Lending Club, Pee …

Global P2P Lending Market Size, Status and Forecast 2025 is latest research study released by HTF MI evaluating the market, highlighting opportunities, risk side analysis, and leveraged with strategic and tactical decision-making support. The study provides information on market trends and development, drivers, capacities, technologies, and on the changing investment structure of the Global P2P Lending Market. Some of the key players profiled in the study are CircleBack Lending, Lending…

Canada Peer-to-peer Lending Market 2018-2022 Overview by CircleBack Lending, Len …

with the slowdown in world economic growth, the Peer-to-peer Lending industry has also suffered a certain impact, but still maintained a relatively optimistic growth, the past four years, Peer-to-peer Lending market size to maintain the average annual growth rate of 2.94% from 22 million $ in 2014 to 24 million $ in 2017, Research analysts believe that in the next few years, Peer-to-peer Lending market size will be further expanded,…