Press release

Pet Insurance Market Size to Hit USD 20.8 Billion by 2032 | Grow CAGR by 10.9%

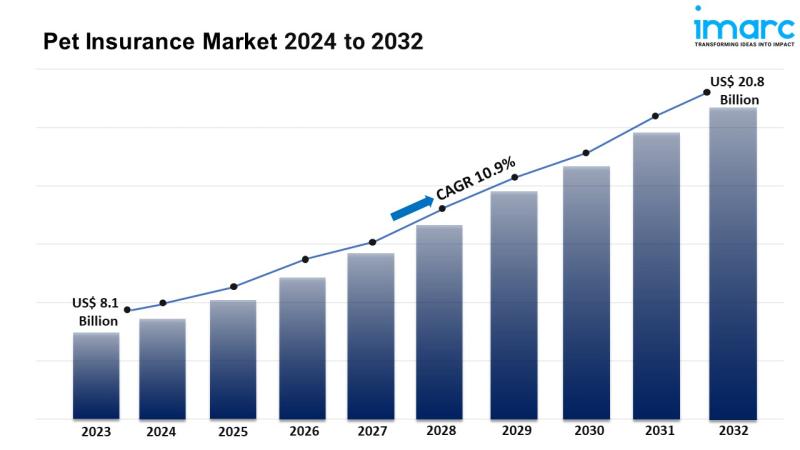

Summary:• The global pet insurance market size reached USD 8.1 Billion in 2023.

• The market is expected to reach USD 20.8 Billion by 2032, exhibiting a growth rate (CAGR) of 10.9% during 2024-2032.

• North America leads the market, accounting for the largest pet insurance market share.

• Illnesses and accidents accounts for the majority of the market share in the policy segment due to the strong demand for coverage of unexpected medical conditions and injuries.

• Dog holds the largest share in the pet insurance industry.

• Public providers remain a dominant segment in the market as they provide more comprehensive and widely accessible insurance plans to a broad customer base.

• The increasing pet ownership and humanization of pets is a primary driver of the pet insurance market.

• The increasing awareness about the benefits of pet insurance is propelling the pet insurance market.

Request Sample For PDF Report: https://www.imarcgroup.com/pet-insurance-market/requestsample

Industry Trends and Drivers:

• Rising Pet Ownership and Humanization of Pets:

The increasing trend of pet ownership, coupled with the growing humanization of pets, is driving significant growth in the pet insurance market. Pets are now viewed as integral family members, leading owners to invest more in their pets' health and well-being. This shift has resulted in a rising demand for comprehensive healthcare services, including pet insurance, which provides financial protection against unexpected veterinary expenses. With the rising costs of veterinary care, many pet owners are recognizing the importance of insurance to cover procedures, medications, and routine check-ups. As a result, pet insurance is becoming a popular option for mitigating the financial risks associated with pet healthcare. Additionally, pet owners are increasingly seeking policies that cover accidents and illnesses and preventative care, dental treatments, and wellness plans, reflecting their desire to ensure the long-term health and quality of life for their pets. This trend is expected to continue, as pet owners increasingly prioritize their pets' health and seek financial solutions to manage veterinary expenses.

• Growing Awareness about the Benefits of Pet Insurance:

A key trend in the pet insurance market is the increasing awareness of the benefits pet insurance offers, particularly among new and younger pet owners. With social media and online platforms playing a pivotal role, educational campaigns from insurers and pet organizations have been instrumental in informing pet owners about the importance of insuring their pets. As more pet owners learn about the potential financial burden of veterinary care, especially for serious conditions like cancer or chronic diseases, the appeal of pet insurance grows. This trend is particularly prevalent among millennials and Generation Z, who are more likely to research and adopt pet insurance as part of responsible pet ownership. Insurance companies are responding by offering tailored, flexible plans that cater to various pet types, breeds, and specific needs. The growing transparency and accessibility of policy details, along with digital platforms simplifying the claims process, are further fueling this trend, encouraging more pet owners to opt for coverage and contribute to the market's growth.

• Technological Advancements in Pet Insurance:

Technological advancements are transforming the pet insurance market, making policies more accessible and efficient for pet owners. Digital platforms and mobile applications are now enabling seamless policy management, from purchasing plans to filing claims. These innovations allow pet owners to easily compare policies, access veterinary networks, and receive real-time updates on claims processing. Some insurers are integrating telemedicine services, allowing pet owners to consult veterinarians virtually, which is especially beneficial for routine consultations or minor health issues. Moreover, advancements in data analytics are helping insurers design more personalized and predictive insurance products based on specific pet health data and behavior patterns. This allows for more accurate pricing models, ensuring that pet owners pay premiums that reflect their pet's individual risk factors. As technology continues to evolve, the pet insurance market is expected to become even more customer-centric, with digital tools streamlining the entire insurance process, from policy selection to claims reimbursement, enhancing the overall experience for pet owners.

Browse Full Report: https://www.imarcgroup.com/pet-insurance-market

Report Segmentation:

The report has segmented the market into the following categories:

Breakup by Policy:

• Illnesses and Accidents

• Chronic Conditions

• Others

Illnesses and accidents account for the majority of shares due to the high demand for coverage against unforeseen medical issues and injuries.

Breakup by Animal:

• Dog

• Cat

• Others

Dog dominates the market as dogs are the most commonly insured pets, with higher medical costs and care requirements compared to other animals.

Breakup by Provider:

• Public

• Private

Public providers represent the majority of shares as they offer more comprehensive and widely available insurance plans for a broad customer base.

Market Breakup by Region:

• North America (United States, Canada)

• Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

• Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

• Latin America (Brazil, Mexico, Others)

• Middle East and Africa

North America holds the leading position owing to a large market for pet insurance driven by the widespread pet ownership and higher awareness about pet insurance benefits, along with rising veterinary care costs.

Top Pet Insurance Market Leaders:

• Agria Pet Insurance Ltd.

• Anicom Holdings Inc.

• Direct Line Insurance Group plc

• dotsure.co.za

• Embrace Pet Insurance Agency LLC

• Figo Pet Insurance LLC

• PTZ Insurance Agency, Ltd.

• Healthy Paws Pet Insurance, LLC,

• Medibank Private Limited

• MetLife Services and Solutions, LLC

• Nationwide Mutual Insurance Company

• Pethealth Inc.

• Petplan (Allianz Insurance plc)

• The Oriental Insurance Company Ltd.

• Trupanion

Note: If you need specific information that is not currently within the scope of the report, we will provide it to you as a part of the customization.

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Pet Insurance Market Size to Hit USD 20.8 Billion by 2032 | Grow CAGR by 10.9% here

News-ID: 3695660 • Views: …

More Releases from IMARC Group

Australia Financial Services Market 2025 | Worth USD 317.7 Billion to 2025-2033

Market Overview

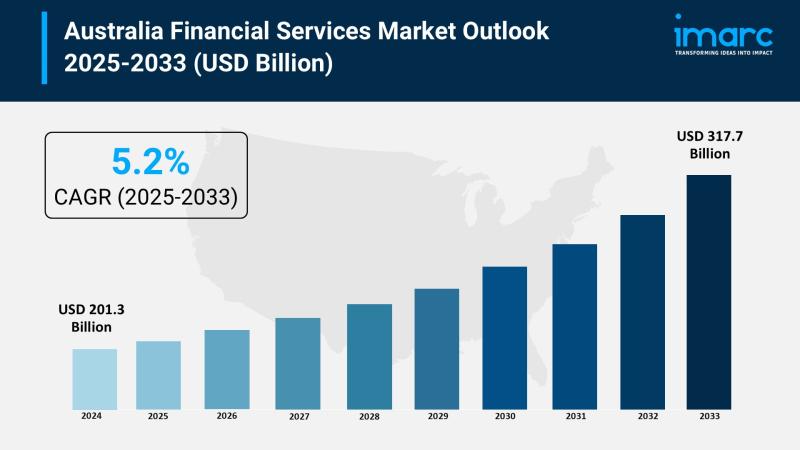

The Australia financial services market size reached USD 201.3 Billion in 2024 and is projected to grow to USD 317.7 Billion by 2033. The market is expected to expand steadily with a compound annual growth rate of 5.2% during the forecast period from 2025 to 2033. Key factors driving this growth include the rising demand for digital banking, regulatory advancements, strong economic performance, increasing fintech investments, and enhanced consumer…

Australia Advanced Carbon Dioxide Sensors Market | Worth USD 103.89 Million 2026 …

Market Overview

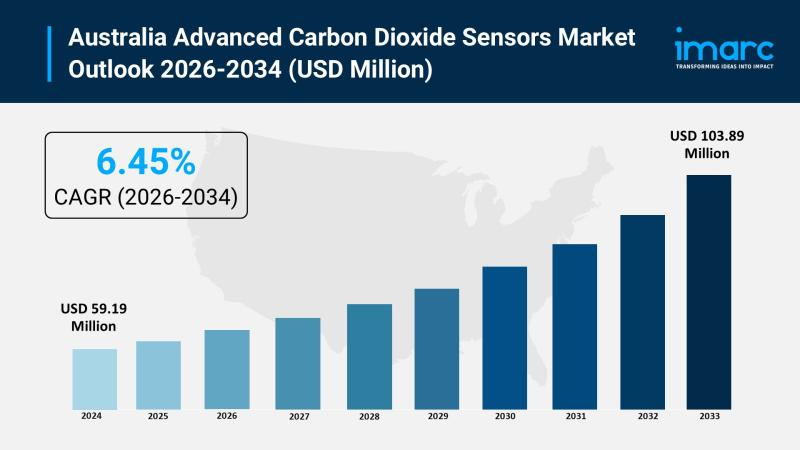

The Australia advanced carbon dioxide sensors market size was USD 59.19 Million in 2025 and is expected to grow to USD 103.89 Million by 2034. The market growth is driven by strong government-led emissions reduction policies, enhanced building standards for CO2 monitoring, and the integration of IoT-enabled sensor technologies in smart buildings. These trends are supported by increased focus on indoor air quality and workplace health, fueling innovation in…

Australia Used Car Market Projected to Reach USD 197 Billion by 2033

Market Overview

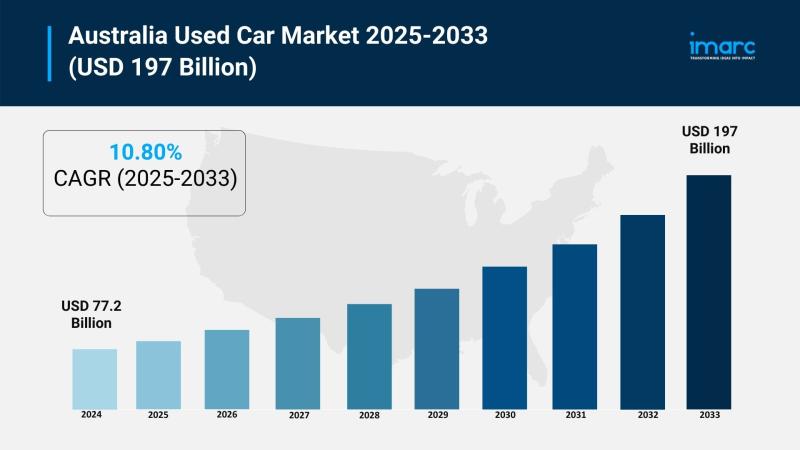

The Australia used car market was valued at USD 77.2 Billion in 2024 and is projected to reach USD 197 Billion by 2033. The market is experiencing strong growth driven by affordability concerns, rising demand for reliable pre-owned vehicles, and the increasing role of digital platforms that simplify transactions. Economic pressures and the shift toward cost-effective vehicle options are further accelerating expansion, making the used car market a vital…

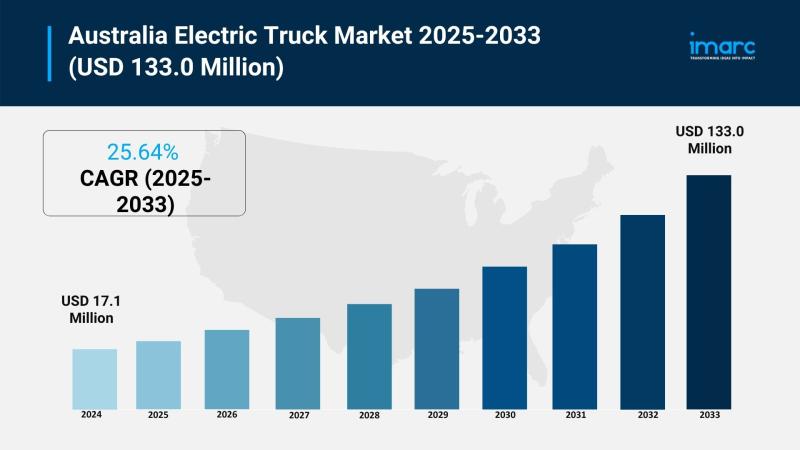

Australia Electric Truck Market Projected to Reach USD 133.0 Million by 2033

Market Overview

The Australia electric truck market reached USD 17.1 Million in 2024 and is projected to expand to USD 133.0 Million by 2033. With a forecast period spanning 2025 to 2033, the market is growing significantly due to stringent government emissions regulations, rising fuel costs, and advancements in battery and charging infrastructure technologies. Investments in fleet electrification and sustainable transport solutions are further driving market share growth. For further details,…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…