Press release

Tax Management Market Estimated Size by 2030 to Reach USD 50.31 Billion

Forecast Increase in Revenue:Tax Management Market Size in 2023 was worth USD 23.78 Bn. at a CAGR 11.3 % and it is expected to reach USD 50.31 Bn in 2030.

Tax Management Market Overview:

The Tax Management Market was valued at approximately $21.36 billion in 2022, reflecting the increasing reliance on tax management software among individuals and businesses. This software aids users in monitoring their expenditures, transactions, and income while simplifying the complex processes involved in tax compliance. By providing essential tools for managing various tax obligations-including income tax, corporate tax, VAT, and sales tax-this software aims to streamline tax filings and minimize errors. With the growing necessity for compliance and efficiency in tax management, the market is positioned for significant growth as more users adopt these digital solutions.

𝐆𝐞𝐭 𝐘𝐨𝐮𝐫 𝐅𝐫𝐞𝐞 𝐒𝐚𝐦𝐩𝐥𝐞 𝐄𝐱𝐩𝐥𝐨𝐫𝐞 𝐭𝐡𝐞 𝐋𝐚𝐭𝐞𝐬𝐭 𝐌𝐚𝐫𝐤𝐞𝐭 𝐈𝐧𝐬𝐢𝐠𝐡𝐭𝐬: https://www.maximizemarketresearch.com/request-sample/116778/

Drivers in the Tax Management Market:

The demand for tax management software is being propelled by the growing need for efficiency in tax filing and compliance processes across multiple industries. Organizations are increasingly recognizing the benefits of automating tax functions, which can significantly enhance accuracy and reduce the time spent on tax-related tasks. Additionally, the rising complexity of tax regulations is driving businesses to seek advanced software solutions that can handle large volumes of data and ensure compliance with various tax requirements. The banking, financial services, and insurance (BFSI) sector, in particular, is embracing tax software to manage its substantial transaction volumes, further contributing to market growth.

Tax Management Market Trends:

One of the key trends shaping the Tax Management Market is the transition towards cloud-based solutions, which offer improved accessibility and scalability for businesses. Cloud tax management software allows for real-time updates and collaboration across teams, facilitating better data management and compliance. Moreover, advancements in automation and artificial intelligence are enhancing the capabilities of tax management solutions, enabling more accurate calculations and streamlined processes. Companies are also prioritizing integrated tax solutions that not only manage compliance but also provide strategic insights to inform financial decision-making.

𝐈𝐧𝐪𝐮𝐢𝐫𝐞 𝐓𝐨𝐝𝐚𝐲 𝐟𝐨𝐫 𝐂𝐮𝐬𝐭𝐨𝐦 𝐌𝐚𝐫𝐤𝐞𝐭 𝐀𝐧𝐚𝐥𝐲𝐬𝐢𝐬: https://www.maximizemarketresearch.com/inquiry-before-buying/116778/

Tax Management Market Opportunities:

The Tax Management Market presents numerous opportunities for growth, particularly in the area of service-oriented solutions. As businesses increasingly seek expert guidance in implementing and maintaining tax management software, there is a rising demand for consulting and support services. Furthermore, emerging markets are showing significant potential as more businesses recognize the importance of tax compliance in driving operational efficiency. Companies that can offer customized solutions tailored to specific industries or regional regulations will likely gain a competitive edge in this expanding market.

What is Tax Management Market Regional Insight?

North America currently dominates the Tax Management Market, largely due to its advanced technology infrastructure and high adoption rates of tax management software among businesses. The region benefits from a complex taxation system that necessitates sophisticated software solutions, with the United States and Canada leading in revenue generation. As tax compliance becomes increasingly crucial, organizations in North America are leveraging software solutions to streamline operations, reduce errors, and enhance overall efficiency. This trend is expected to continue, driven by ongoing digital transformation initiatives across various sectors, particularly within the BFSI industry.

𝐂𝐮𝐫𝐢𝐨𝐮𝐬 𝐀𝐛𝐨𝐮𝐭 𝐌𝐚𝐫𝐤𝐞𝐭 𝐓𝐫𝐞𝐧𝐝𝐬? 𝐆𝐫𝐚𝐛 𝐘𝐨𝐮𝐫 𝐒𝐚𝐦𝐩𝐥𝐞 𝐑𝐞𝐩𝐨𝐫𝐭 𝐓𝐨𝐝𝐚𝐲: https://www.maximizemarketresearch.com/request-sample/116778/

Segmentation Analysis of the Tax Management Market:

by Component

Software

Services

by Tax Type

Indirect Tax

Direct Tax

by Deployment

Cloud

On-premises

by End-User

BFSI

IT and Telecom

Manufacturing

Energy and Utilities

Retail

Healthcare and Life Sciences

Media and Entertainment

Others

Who is the largest manufacturers of Tax Management Market worldwide?

1. Avalara

2. ADP

3. Automatic Data Processing

4. Wolters Kluwer N.V

5. Thomson Reuters

6. Intuit

7. H&R Block

8. SAP SE

9. Blucora

10. Sovos Compliance

11. Vertex

12. Sailotech

13. Defmacro Software

14. DAVO Technologies

15. Xero

16. TaxSlayer

17. Taxback International

18. TaxCloud

19. Drake Enterprises

20. Canopy Tax

21. TaxJar

𝐊𝐧𝐨𝐰 𝐌𝐨𝐫𝐞 𝐀𝐛𝐨𝐮𝐭 𝐓𝐡𝐞 𝐑𝐞𝐩𝐨𝐫𝐭: https://www.maximizemarketresearch.com/market-report/global-tax-management-market/116778/

Key Offerings:

Past Market Size and Competitive Landscape

Tax Management Market Size, Share, Size & Forecast by different segment

Market Dynamics - Growth Drivers, Restraints, Opportunities, and Key Trends by region

Tax Management Market Segmentation - A detailed analysis by Product

Competitive Landscape - Profiles of selected key players by region from a strategic perspective

Competitive landscape - Market Leaders, Market Followers, Regional player

Competitive benchmarking of key players by region

PESTLE Analysis

PORTER's analysis

Value chain and supply chain analysis

Legal Aspects of business by region

Lucrative business opportunities with SWOT analysis

Recommendations

Explore More: Visit Our Website for Additional Reports:

♦ Global Control Valve Market https://www.maximizemarketresearch.com/market-report/global-control-valve-market/17135/

♦ Global Smart Office Market https://www.maximizemarketresearch.com/market-report/global-smart-office-market/24179/

♦ Customer Data Platform Market https://www.maximizemarketresearch.com/market-report/customer-data-platform-market/14397/

♦ silicon wafer market https://www.maximizemarketresearch.com/market-report/global-silicon-wafer-market/35534/

♦ Electric Vehicle Battery Market https://www.maximizemarketresearch.com/market-report/electric-vehicle-battery-market/12071/

♦ Knowledge Process Outsourcing Market https://www.maximizemarketresearch.com/market-report/knowledge-process-outsourcing-market/187554/

♦ Renewable Energy Policy Market https://www.maximizemarketresearch.com/market-report/renewable-energy-policy-market/200155/

Contact Maximize Market Research:

MAXIMIZE MARKET RESEARCH PVT. LTD.

⮝ 3rd Floor, Navale IT park Phase 2,

Pune Banglore Highway, Narhe

Pune, Maharashtra 411041, India.

✆ +91 9607365656

🖂 sales@maximizemarketresearch.com

🌐 www.maximizemarketresearch.com

About Maximize Market Research:

Maximize Market Research is one of the fastest-growing market research and business consulting firms serving clients globally. Our revenue impact and focused growth-driven research initiatives make us a proud partner of majority of the Fortune 500 companies. We have a diversified portfolio and serve a variety of industries such as IT & telecom, chemical, food & beverage, aerospace & defense, healthcare and others.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Tax Management Market Estimated Size by 2030 to Reach USD 50.31 Billion here

News-ID: 3692941 • Views: …

More Releases from MAXIMIZE MARKET RESEARCH PVT. LTD

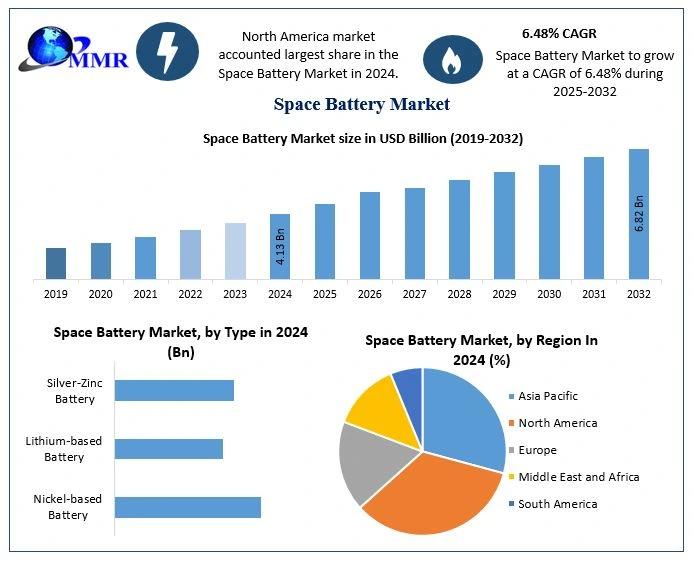

Space Battery Market to Surge to USD 6.82 Billion by 2032 | Size, Key Drivers, C …

The Global Space Battery Market was valued at approximately USD 4.13 Billion in 2024 and is projected to reach USD 6.82 Billion by 2032, expanding at a CAGR of 6.48% during 2025-2032.

Market Overview

The Global Space Battery Market is experiencing robust growth driven by the escalating number of space missions, increased satellite deployments, and rapid commercialization of space technologies. Batteries play a mission-critical role in powering satellites, spacecraft, launch vehicles, and…

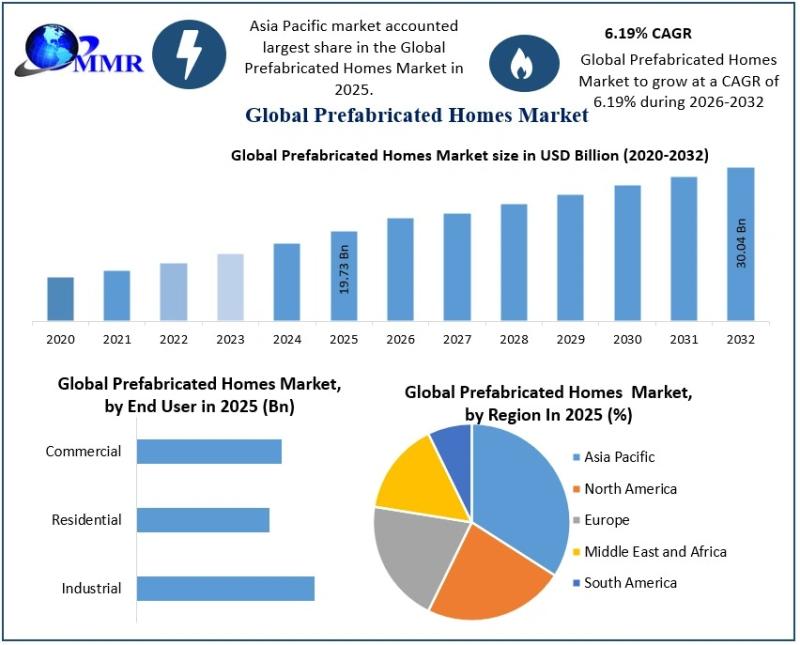

Prefabricated Homes Market Size, Outlook 2032: Rising Demand for Cost-Effective …

The Prefabricated Homes Market size was valued at USD 19.73 Billion in 2025 and the total Prefabricated Homes revenue is expected to grow at a CAGR of 6.19% from 2025 to 2032, reaching nearly USD 30.04 Billion by 2032.

Prefabricated Homes Market Poised for Accelerated Growth with Rising Demand for Affordable and Sustainable Housing

The Prefabricated Homes Market is expected to witness strong expansion during the forecast period, driven by increasing demand…

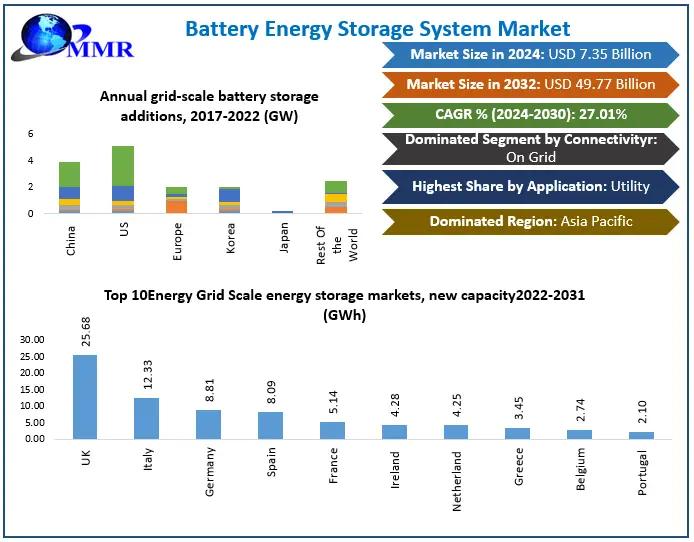

Battery Energy Storage System Market Set to Surge to USD 49.77 Billion by 2032 - …

The Battery Energy Storage System Market was valued at USD 7.35 Billion in 2024 and is projected to expand to USD 49.77 Billion by 2032, growing at a CAGR of 27.01% between 2025 and 2032.

Market Overview

The Battery Energy Storage System Market is experiencing exponential growth as global energy strategies increasingly focus on renewable integration, grid modernization, and decarbonization. BESS solutions enable utilities, industries, and residential consumers to store intermittent renewable…

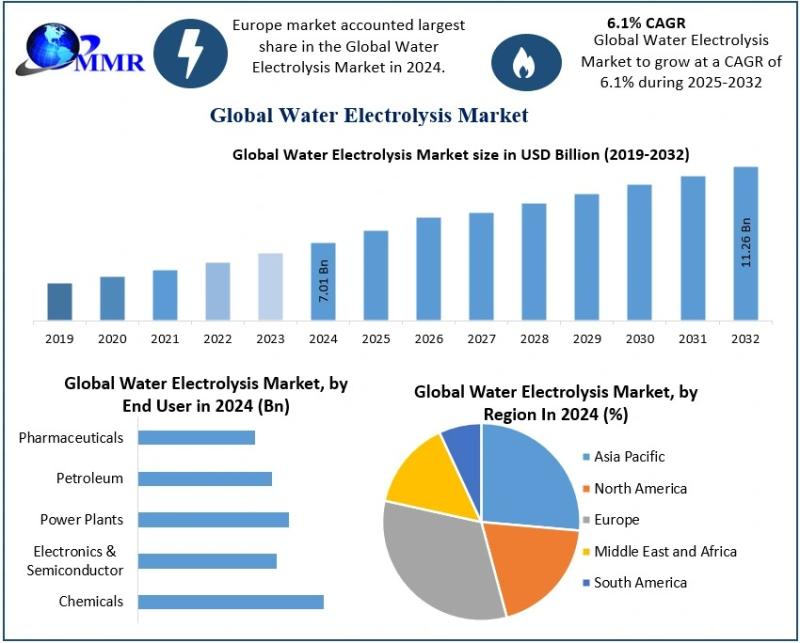

Water Electrolysis Market Size, Trends, and Growth Drivers Shaping the Hydrogen …

The Water Electrolysis Market size was valued at USD 7.01 Billion in 2024 and the total Water Electrolysis revenue is expected to grow at a CAGR of 6.1% from 2025 to 2032, reaching nearly USD 11.26 Billion. Market Outlook 2032 Rising Green Hydrogen Demand Accelerates Market Expansion

Want deeper insights? Download a sample copy now: https://www.maximizemarketresearch.com/request-sample/221915/

The Water Electrolysis Market is gaining strong momentum as global decarbonization goals and green hydrogen…

More Releases for Tax

Tax Accountant Launches Expert Tax Advisory Services for Complex UK Tax Issues

Birmingham, UK - Tax Accountant, a premier provider of tailored tax solutions, is proud to announce the introduction of its new Specialist Tax Advice service. Aimed at tackling the multifaceted tax challenges faced by individuals and businesses in the UK, this service is set to revolutionize how tax compliance and optimization are approached.

As tax laws become increasingly complex and the implications of non-compliance more severe, the need for specialized tax…

Legal Tax Defense Offers Tax Relief Services to Successfully Settle IRS Tax Debt …

Legal Tax Defense provides expert guidance and strategies to navigate IRS negotiations and reduce tax liabilities.

Legal Tax Defense, Inc., a premier provider of tax resolution services, is now providing strategic assistance and professional help for those who find IRS tax debt to be stressful and intimidating. The firm assists taxpayers in understanding their alternatives for efficiently managing and lowering tax liabilities by offering a range of specialist services.

"Handling IRS tax…

Legal Tax Defense Providing Strategic Assistance to Settle Tax Debts for Tax Pay …

Fulfill Tax Obligations and Prevent Legal Issues.

Legal Tax Defense, a premier firm specializing in tax resolution, proudly announces its updated services aimed at helping clients effectively settle their tax debts. With a focus on alleviating the financial and legal pressures associated with unpaid taxes, Legal Tax Defense offers a lifeline to individuals and businesses struggling with tax liabilities.

Understanding the options available for settling tax debts [https://www.legaltaxdefense.com/settling-tax-debts/] is crucial in taking…

Bidding At The Tax Sale - Tax Sale Success Masterclass with The Tax Lien Lady

Joanne Musa, founder of TaxLienLady.com is holding a Tax Sale Success Masterclass on Bidding at the Tax Sale on Thursday, November 10 at 7:00 pm Eastern Time.

Tax lien and tax deed investing can be very profitable. Tax Lien investors can earn interest rates that are much higher than current bank rates without the risk of the stock market. Joanne Musa, known online as the tax lien lady, has been helping…

Tax Software Market – Major Technology Giants in Buzz Again | TurboTax, Tax Sl …

The Latest Released Tax Software market study has evaluated the future growth potential of Global Tax Software market and provides information and useful stats on market structure and size. The report is intended to provide market intelligence and strategic insights to help decision makers take sound investment decisions and identify potential gaps and growth opportunities. Additionally, the report also identifies and analyses changing dynamics, emerging trends along with essential drivers,…

Tax Software Market to Eyewitness Massive Growth by 2026 | Tax Act, Tax Slayer, …

The latest independent research document on Global Tax Software examine investment in Market. It describes how companies deploying these technologies across various industry verticals aim to explore its potential to become a major business disrupter. The Tax Software study eludes very useful reviews & strategic assessment including the generic market trends, emerging technologies, industry drivers, challenges, regulatory policies that propel the market growth, along with major players profile and strategies.…