Press release

ESG Finance Market Outlook 2024: Shaping the Future of Sustainable Investments

"Gain a competitive edge with up to 30% off in-depth market reports-uncover key trends, growth drivers, and forecasts today!The new report published by The Business Research Company, titled ESG Finance Global Market Report 2024 - Market Size, Trends, And Global Forecast 2024-2033, delivers an in-depth analysis of the leading size and forecasts, investment opportunities, winning strategies, market drivers and trends, competitive landscape, and evolving market trends.

As per the report, the ESG finance market size has grown rapidly in recent years. It will grow from $5,716.79 billion in 2023 to $6,347.59 billion in 2024 at a compound annual growth rate (CAGR) of 11%. The ESG finance market size is expected to see rapid growth in the next few years. It will grow to $9690.94 billion in 2028 at a compound annual growth rate (CAGR) of 11.2%.

Download Free Sample Report: https://www.thebusinessresearchcompany.com/sample.aspx?id=18601&type=smp

What Is Driving The Growth Of The Global ESG Finance Market?

Green Bond Investments To Accelerate Growth In ESG Finance Market

The rising investment in green bonds is expected to propel the growth of the ESG finance market going forward. Green bonds are fixed-income securities issued to raise capital specifically for financing environmentally sustainable projects and initiatives. Rising investment in green bonds is driven by growing global awareness of climate change and a demand for socially responsible investments. Additionally, institutional investors, including pension funds and insurance companies, are increasingly seeking investments with environmental, social, and governance (ESG) criteria. ESG insurance provides coverage and risk mitigation for environmentally sustainable projects, thereby enhancing investor confidence and facilitating the financing of green initiatives. For instance, in May 2024, according to The International Finance Corporation, a US-based international financial institution, green bond issuance is expected to grow at a rate of 7.5 percent annually, reaching $156 billion by 2025, up from $135 billion in 2023. Therefore, rising investments in green bonds will drive the growth of the ESG finance market.

What Is The Key Trend In The Global ESG Finance Market?

Cutting-Edge AI Platform For Enhanced ESG Insights

Major companies operating in the ESG finance market are focusing on the integration of AI, such as AI-powered data analytics and research platforms, to drive informed investment decisions and meet the growing demand for transparency and accountability in sustainable finance. AI-powered data analytics and research platforms use artificial intelligence to analyze and interpret vast amounts of environmental, social, and governance data, providing investors and companies with actionable insights and enhanced decision-making capabilities in sustainable finance. For instance, in March 2022, ESG Data Services Inc. (ESG Analytics), a Canada-based provider of advanced data solutions and insights, launched ESG Analytics, an advanced AI-powered platform for ESG data, analytics, and research. This web-based solution and API leverage extensive alternative data sources and artificial intelligence to identify risks and opportunities in the ESG practices of countries, companies, and ETFs. ESG Analytics' dynamic big data platform provides researchers, analysts, funds, and corporations with real-time insights, facilitating the integration of ESG factors into investment management and corporate decision-making processes.

How Is The Global ESG Finance Market Segmented?

The ESG finance market covered in this report is segmented -

1) By Investment Type: Equity, Fixed Income, Mixed Allocation, Other Investment Types

2) By Investor Type: Institutional Investors, Retail Investors

3) By Transaction Type: Green Bond, Social Bond, Mixed Sustainability Bond, ESG Integrated Investment Funds, Other Transaction Types

4) By Industry Vertical: Utilities, Transport And Logistics, Chemicals, Food And Beverage, Government, Other Industry Verticals

You Can Pre-Book The Global Market Report Of Your Requirement For A Swift Delivery And Also Get An Exclusive Discount On This Report, Checkout Link:

https://www.thebusinessresearchcompany.com/purchaseoptions.aspx?id=18601

How Is The Competitive Landscape Of The Global ESG Finance Market?

Major companies operating in the ESG finance market are JPMorgan Chase & Co., HSBC Holdings plc, Morgan Stanley, BNP Paribas Asset Management S.A., The Goldman Sachs Group Inc., UBS Group AG, Deutsche Bank Aktiengesellschaft, Fidelity Investments Inc., The Bank of New York Mellon Corporation, BlackRock Inc., State Street Corporation, The Vanguard Group Inc., Franklin Templeton Holdings Ltd., Northern Trust Asset Management, T. Rowe Price Group Inc., Amundi Asset Management Inc., Invesco Ltd., Schroders plc, Pacific Investment Management Company LLC, Allianz Global Investors GmbH, Columbia Threadneedle Investments Inc., AXA Investment Managers S.A., Wellington Management Company LLP, Natixis Investment Managers International, Legal & General Investment Management Limited

Contents Of The Global ESG Finance Market

1. Executive Summary

2. ESG Finance Market Report Structure

3. ESG Finance Market Trends And Strategies

4. ESG Finance Market - Macro Economic Scenario

5. ESG Finance Market Size And Growth

…..

27. ESG Finance Market Competitor Landscape And Company Profiles

28. Key Mergers And Acquisitions

29. Future Outlook and Potential Analysis

30. Appendix

Explore The Report Store To Make A Direct Purchase Of The Report: https://www.thebusinessresearchcompany.com/report/esg-finance-global-market-report

Contact Us:

The Business Research Company

Europe: +44 207 1930 708

Asia: +91 88972 63534

Americas: +1 315 623 0293

Email: info@tbrc.info

Follow Us On:

LinkedIn: https://in.linkedin.com/company/the-business-research-company

Twitter: https://twitter.com/tbrc_info

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ

Learn More About The Business Research Company

The Business Research Company (www.thebusinessresearchcompany.com) is a leading market intelligence firm renowned for its expertise in company, market, and consumer research. With a global presence, TBRC's consultants specialize in diverse industries such as manufacturing, healthcare, financial services, chemicals, and technology, providing unparalleled insights and strategic guidance to clients worldwide.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release ESG Finance Market Outlook 2024: Shaping the Future of Sustainable Investments here

News-ID: 3688227 • Views: …

More Releases from The Business Research Company

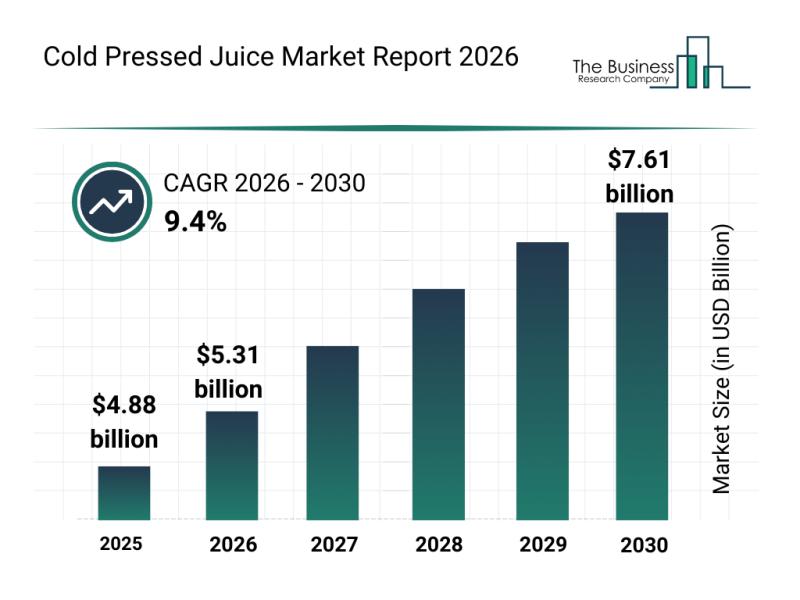

Emerging Sub-Segments Transforming the Cold Pressed Juice Market Landscape

The cold pressed juice market is on the verge of significant expansion as consumers increasingly seek healthier and more functional beverage options. Shifting preferences towards immunity-boosting drinks and sustainability are driving innovation and growth in this sector. Let's explore the current market size, influential players, emerging trends, and segment breakdowns shaping the future of cold pressed juices.

Cold Pressed Juice Market Size and Growth Expectations Through 2030

The market for…

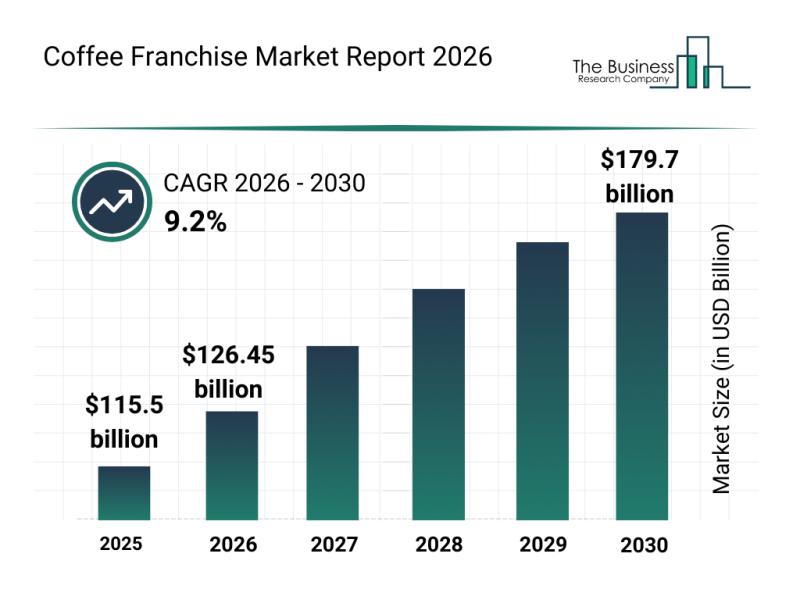

Top Companies and Industry Competition in the Coffee Franchise Market

The coffee franchise industry is positioned for significant expansion in the coming years, driven by evolving consumer preferences and strategic market initiatives. Increasing demand for high-quality coffee experiences and innovative business models is shaping the future landscape. Let's explore the current market size, leading companies, key trends, and major segments that define this dynamic sector.

Projected Growth and Market Size of the Coffee Franchise Market by 2030

The coffee franchise…

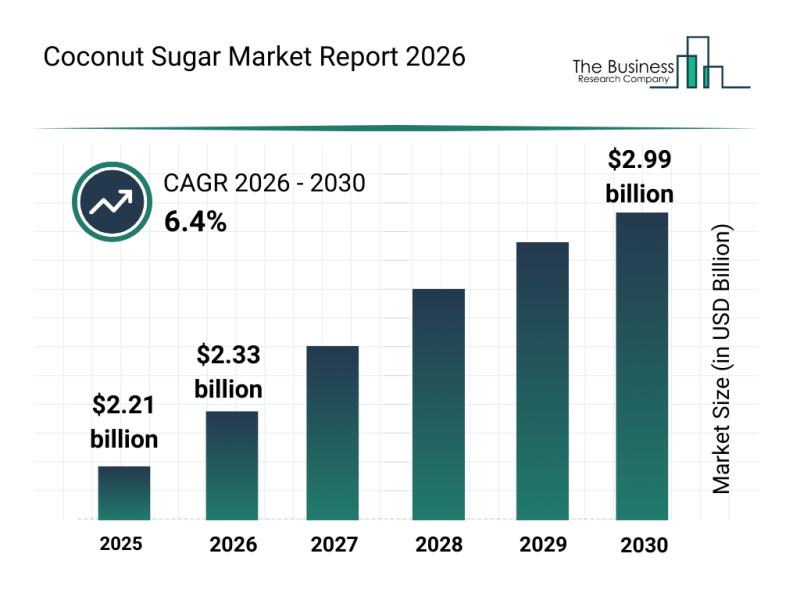

Coconut Sugar Market Overview: Major Segments, Strategic Developments, and Leadi …

The coconut sugar market is gaining significant momentum and is poised for notable expansion over the coming years. Driven by evolving consumer preferences and increasing interest in healthier and sustainable sweeteners, this market presents promising opportunities for businesses and consumers alike. Let's explore the market's size, key players, emerging trends, and segmentation in detail.

Projected Expansion of the Coconut Sugar Market Size Through 2030

The coconut sugar market is forecasted…

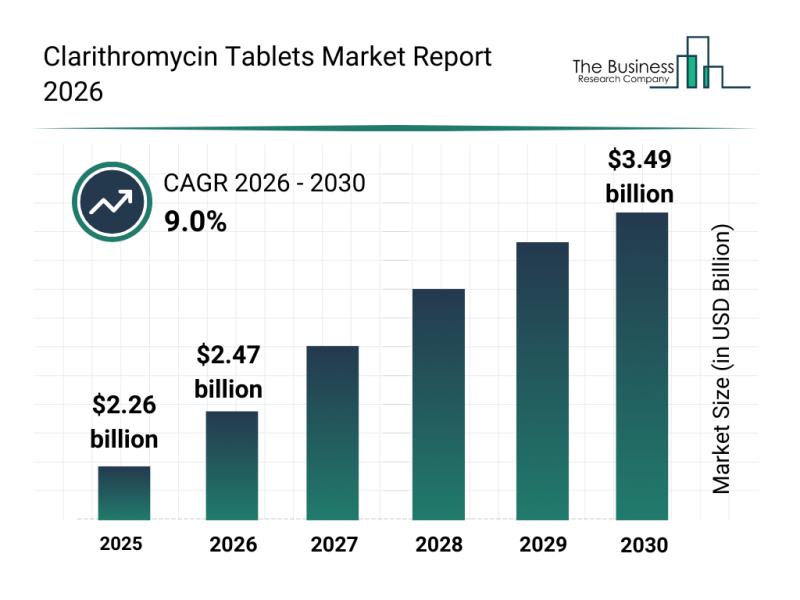

Emerging Sub-Segments Transforming the Clarithromycin Tablets Market Landscape

The clarithromycin tablets market is poised for notable expansion in the coming years, driven by several healthcare and pharmaceutical developments. As demand for effective antibiotic treatments rises globally, this sector is attracting considerable attention from manufacturers and healthcare providers alike. Let's explore the market's size, key players, prevailing trends, and segmentation to understand its current landscape and future potential.

Projected Market Valuation and Growth Trajectory for Clarithromycin Tablets

The clarithromycin…

More Releases for ESG

CARE ESG Awards 2025 highlights outstanding achievements in sustainability, clim …

Dubai, UAE, 29th November 2025, ZEX PR WIRE, The CARE ESG Awards by Trescon and ESG Mena recognised the region's most outstanding leaders, changemakers, and industry shapers driving sustainability, clean energy, climate resilience, and responsible growth. Held during the inaugural edition of climate action, renewable energy & sustainability forum, CARE 2025, the awards spotlighted high-impact contributions driving measurable progress across environmental stewardship, renewable energy deployment, resource efficiency, social value creation,…

APAC Investor ESG Software Market Rises at 16.5% CAGR Amid Regional Push for ESG …

The Asia Pacific (APAC) Investor ESG Software market is poised for a decade of robust expansion, projected to grow from US$ 214.91 million in 2024 to an estimated US$ 756.92 million by 2031. This represents a significant Compound Annual Growth Rate (CAGR) of 19.7% during the forecast period of 2024-2031, according to a new market research report published by The Insight Partners.

Download PDF Sample Copy @ https://www.theinsightpartners.com/sample/TIPRE00023473/?utm_source=OpenPR&utm_medium=10813

The report, titled "Asia-Pacific…

Global ESG Reporting Software Market Size by Application, Type, and Geography: F …

USA, New Jersey- According to Market Research Intellect, the global ESG Reporting Software market in the Internet, Communication and Technology category is projected to witness significant growth from 2025 to 2032. Market dynamics, technological advancements, and evolving consumer demand are expected to drive expansion during this period.

The growing need for clear and consistent sustainability disclosures is driving the market for ESG (Environmental, Social, and Governance) reporting software, which is expanding…

ZeeDimension Wins ESG Data Company Award at the 5th World ESG Summit in Riyadh

Riyadh, Saudi Arabia - February 12, 2025 - ZeeDimension, a leading provider of ESG, GRC, and data analytics solutions, has been honored with the prestigious ESG Data Company Award at the 5th World ESG Summit, held on February 10-11, 2025, in Riyadh, Saudi Arabia.

The World ESG Summit is one of the most influential global gatherings for sustainability leaders, investors, and policymakers, dedicated to advancing Environmental, Social, and Governance (ESG) initiatives.…

Transforming the Environmental, Social And Governance (ESG) Investment Analytics …

What Is the Expected Size and Growth Rate of the Environmental, Social And Governance (ESG) Investment Analytics Market?

The market size for investment analytics related to environmental, social, and governance (ESG) has been on a rapid surge over the recent years. The market estimation is to rise from $1.7 billion in 2024 to $2.01 billion in 2025 with a compound annual growth rate (CAGR) of 18.1%. Growth in the past can…

Inrate Unveils New ESG Data Platform for Transparent and Traceable ESG Data Insi …

Zurich, Oct 22, 2024 - Inrate, a leading impact rating and ESG data company, is thrilled to announce the release of CLIF, its new ESG data platform, designed to provide transparent and traceable ESG data to simply investment analysis. With expanded features and seamless functionality, CLIF allows investors to gain enhanced visibility into the sustainability performance of over 10,000 companies and 190 sovereigns worldwide.

Empowering Data-Driven ESG Decisions

The CLIF…