Press release

Atlanta Estate Planning Attorney Trace Brooks Highlights Estate Tax Exemption Sunset 2026

As the estate tax exemption thresholds under the Tax Cuts and Jobs Act (TCJA) are set to sunset in 2026, Atlanta estate planning attorney Trace Brooks (https://www.tracebrookslaw.com/estate-tax-exemption-sunset-2026/) from Trace Brooks Law is urging Atlanta residents to revisit their estate plans. This significant change, which will revert the current exemption levels to pre-2018 amounts adjusted for inflation, poses considerable implications for estate planning across the United States, especially for those in high-net-worth brackets. With the threshold for federal estate taxes expected to drop substantially, those with substantial estates are advised to act now to mitigate future tax liabilities.Atlanta estate planning attorney Trace Brooks emphasizes that understanding the impact of these changes is critical for effective planning. As the 2026 estate tax exemption sunset approaches, the ability of Atlanta residents to bequeath assets without incurring federal estate taxes will be diminished. Brooks highlights that the current exemption levels, which allow individuals to pass on up to $11.18 million tax-free ($22.36 million for married couples), will likely decrease significantly, increasing the exposure of estates to federal taxes. This shift underscores the importance of reviewing and updating estate plans to accommodate these upcoming tax changes.

Trace Brooks, an Atlanta estate planning attorney, encourages residents to explore their estate planning options ahead of this sunset. Brooks emphasizes that a proactive approach will allow families to secure their financial future by ensuring that their estate plans reflect the new tax landscape. Failing to adjust estate plans before the 2026 deadline could result in higher estate taxes, potentially reducing the amount of wealth that can be passed on to future generations.

At Trace Brooks Law, Brooks and his team work closely with clients to craft tailored estate plans that maximize the assets passed on to beneficiaries while minimizing tax burdens. Brooks states, "As we approach the 2026 sunset, it is essential that individuals take stock of their estate plans. By reviewing and updating these plans now, families can protect their wealth from unnecessary taxation and ensure that their loved ones benefit from the most favorable outcomes."

The potential reduction in estate tax exemptions could prompt a larger number of estates to fall within the taxable range, which previously avoided federal taxes. Brooks underscores the importance of being well-prepared for these changes, especially for Atlanta residents, by crafting strategic solutions that align with both federal and state laws. Given that Georgia does not impose a state inheritance tax, Atlanta residents are uniquely positioned to benefit from careful planning that mitigates exposure to federal taxes.

Trusts and gifting strategies are highlighted as potential methods for mitigating the impact of reduced estate tax exemptions. Trace Brooks explains that gifting assets to heirs during one's lifetime can lower the overall value of an estate and reduce the eventual estate tax burden. Trusts can also play a crucial role in structuring how assets are distributed, helping to preserve family wealth while managing tax liabilities.

In anticipation of the changes coming in 2026, Trace Brooks Law offers services that help clients navigate the challenging legal and financial implications of the sunset provision. Brooks emphasizes the importance of early planning, stating, "There is a limited window of time to take advantage of the current higher exemption levels. By acting now, families can protect a larger portion of their estates from taxation, ensuring that their wealth is preserved for the next generation."

The TCJA of 2017 brought about significant temporary relief for high-net-worth individuals and families by doubling the estate tax exemption amounts. However, as these provisions are scheduled to sunset, the threshold will likely revert to pre-2018 levels unless new legislation is enacted. For Atlanta residents, this shift means that revisiting estate plans is not just advisable, but necessary.

Atlanta estate planning attorney Trace Brooks offers guidance on several strategies that may benefit those anticipating increased tax exposure. Among these are establishing trusts, leveraging the annual gift tax exclusion, and utilizing life insurance policies to provide liquidity for covering future tax liabilities. These tools can help ensure that estates are distributed according to a person's wishes, without the burden of hefty tax penalties.

Trace Brooks Law advocates for a comprehensive approach to estate planning, one that takes into account current laws as well as potential legislative changes on the horizon. As families begin to prepare for the estate tax exemption sunset, Brooks and his team provide invaluable assistance in crafting estate plans that remain robust in the face of shifting tax laws. Estate planning, Brooks stresses, is not a one-time event but an ongoing process that must evolve alongside changes in legislation and family circumstances.

For individuals seeking to preserve their estates and minimize their tax liabilities, the upcoming 2026 sunset offers both challenges and opportunities. Now is the time to act to avoid the potential pitfalls of reduced exemptions and higher tax exposure. Trace Brooks encourages all Atlanta residents to schedule a consultation with Trace Brooks Law to review their estate plans and develop strategies that will protect their assets for future generations.

Those interested in safeguarding their wealth should contact Trace Brooks Law to schedule a consultation with an Atlanta estate planning attorney. By taking proactive steps today, families can ensure that their estates remain intact, shielding their heirs from unnecessary tax burdens in the years to come.

About Trace Brooks Law:

Trace Brooks Law is a full-service estate planning law firm based in Atlanta, Georgia, focused on providing personalized legal solutions for individuals and families seeking to preserve their wealth and protect their legacies. Led by Trace Brooks, the firm offers comprehensive estate planning services that align with federal and state laws, ensuring that clients' wishes are honored and their financial futures secured. The firm is dedicated to helping clients navigate the challenges of estate taxes, trusts, and wills with clarity and confidence.

Embeds:

Youtube Video: https://www.youtube.com/watch?v=Ifh-A89xF6Y

GMB: https://www.google.com/maps?cid=16944830140697754407

Email and website

Email: trace@tracebrookslaw.com

Website: https://www.tracebrookslaw.com/

Media Contact

Company Name: Trace Brooks Law

Contact Person: Trace Brooks

Email:Send Email [https://www.abnewswire.com/email_contact_us.php?pr=atlanta-estate-planning-attorney-trace-brooks-highlights-estate-tax-exemption-sunset-2026]

Phone: (404) 492-9559

Address:1275 Peachtree St NE #525

City: Atlanta

State: Georgia 30309

Country: United States

Website: https://www.tracebrookslaw.com/

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Atlanta Estate Planning Attorney Trace Brooks Highlights Estate Tax Exemption Sunset 2026 here

News-ID: 3687338 • Views: …

More Releases from ABNewswire

Self Employed Tax Software UK: Why Freelancers and Sole Traders Are Switching to …

With Many individuals are seeking software that simplifies tax filing while ensuring full compliance with HMRC requirements. Manual spreadsheets and paper-based calculations are being replaced by real-time, automated systems that give users visibility over their tax position throughout the year. Among the platforms gaining traction is Pie, a UK-based digital tax app built specifically to support self-employed individuals with modern income needs.

LONDON, United Kingdom - February 19, 2026 - Demand…

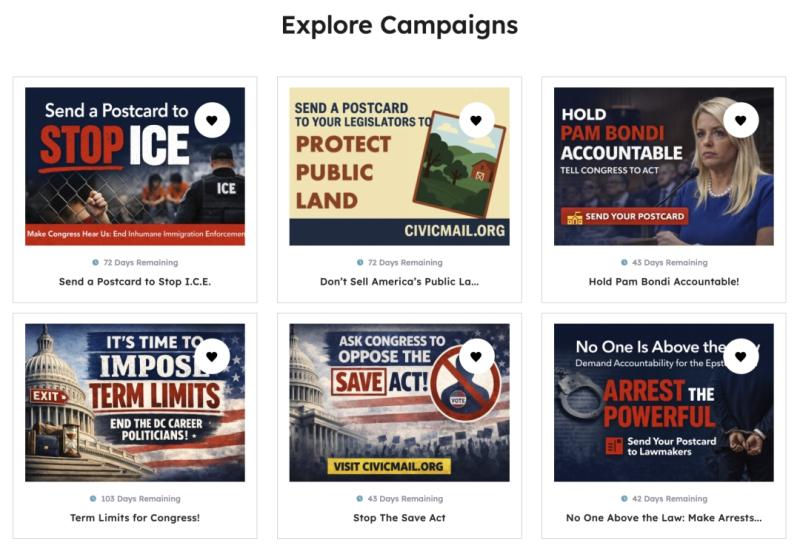

CivicMail.org Reinvents Postcard Campaigns for Grassroots Advocacy

CivicMail.org aims to bring civic engagement back to basics through the power of pen, paper, and postage.

Image: https://www.abnewswire.com/upload/2026/02/2addd1e9e0381d7e2262e1edbb064123.jpg

CivicMail.org [https://civicmail.org/] has announced its launch to help Americans send real, physical postcards to their elected officials with just a few clicks, delivering personalized messages directly to the desks of decision-makers at the local, state, and federal levels.

Research shows [https://www.concordia.ca/news/stories/2021/09/24/personalized-messages-are-more-likely-to-get-a-response-from-politicians-new-research-finds.html] that physical mail carries more weight with elected officials than petitions, emails, or…

New Children's Story: The Story of Sharin' Bear

A Heartfelt Message Of Courage, Kindness, And The True Meaning Of Giving

A pleasant new story for children, The Story of Sharin' Bear by Sharon Woods , introduces families to a lovable little cub whose journey of bravery and compassion changes him into a representation of sharing for children globally.

Entrenched in adventure, innocence, and emotional growth, this uplifting tale offers an unforgettable reminder that even the smallest acts of kindness can…

Fast-Growing Newman's Brew Combines Organic Coffee Excellence with Abandoned Ani …

Newman's Brew is experiencing rapid expansion by delivering on dual commitments that resonate with today's conscious consumers: exceptional fresh-roasted organic coffee and meaningful support for abandoned animals. The company's growing inventory and ethical business practices demonstrate that quality and social responsibility can drive sustainable business success in the competitive specialty coffee market.

Newman's Brew is riding a wave of growth that reflects fundamental shifts in how consumers approach coffee purchasing decisions.…

More Releases for Brooks

Brooks & Baez: Richmond's Leading Auto Accident Lawyer Team

Traffic incidents can happen in a split second, leaving lasting impacts on health, finances, and overall well-being. When collisions occur, having a trusted auto accident lawyer in Richmond, VA, becomes crucial for fair representation and proper claim recovery. The experienced team at Brooks & Baez provides the knowledge and guidance necessary to handle complex cases.

Traffic incidents can happen in a split second, leaving lasting impacts on health, finances, and overall…

Brooks & Baez: Trusted Advocates for Justice in Criminal Defense

Facing criminal charges can be one of the most stressful and life-altering experiences a person may encounter. In such moments, having an experienced criminal defense lawyer by your side can make all the difference. For Virginia residents searching for a criminal defense lawyer near me, Brooks & Baez has established itself as a leading law firm committed to protecting clients' rights and providing top-tier legal representation.

Facing criminal charges can be…

Soft Running Shoes Market | ASICS, Adidas, Altra, Brooks

The global soft running shoes market report is a comprehensive report that provides a detailed analysis of the current status and future trends of the soft running shoes market worldwide. This report provides valuable information to industry stakeholders by offering an in-depth perspective on market dynamics, competitive landscape, growth opportunities, and key challenges faced by industry participants.

From the perspective of market dynamics, this report explores the factors driving the growth…

Comedy legend Mel Brooks attends NYC premiere of son Nicholas Brooks' first feat …

October 26th 2016, NYC - Last night executive producer Mel Brooks attended the NYC premiere of "Sam," his first film together with his son Nicholas Brooks. On working with his father on his feature debut, Nicholas Brooks says: “Writing, producing and directing “Sam” has been an incredible experience thanks to an amazing cast and crew. I am excited to finally be sharing her with the world. Working with my dad…

Temporal Void featuring Mayumi Hamanka + Brooks Salzwedel

Johansson Projects presents Temporal Void, a two person show featuring new works by Mayumi Hamanaka and Brooks Salzwedel, in which the vulnerability of our environments, histories and memories is brought to the forefront.

By slightly distorting recognizable images from twentieth century wars and layering hand cut prints and paper, Mayumi Hamanaka investigates perceptions of history and the contexts in which histories are written. In Hamanaka’s latest project, Invisible Lands, her process…

Wormald acquire BROOKS service division

Fire protection specialist Wormald is expanding its service business with the acquisition of the service and maintenance division of BROOKS in Australia. BROOKS’s service division was predominantly operating in NSW.

BROOKS is a manufacturer and supplier of fire protection products across Australia, also providing training and after-sales service and support. The sale of its service division allows BROOKS to focus on its core area of manufacture, supply and technical support…