Press release

Tax Management Market Share To Rise At 10.52% CAGR, To Reach USD 61.59 Billion By 2032

The tax management market size was valued at USD 22.69 billion in 2022. The market is projected to grow to USD 61.59 billion by 2032, exhibiting a compound annual growth rate (CAGR) of 10.52% from 2023 to 2032.𝐌𝐚𝐫𝐤𝐞𝐭 𝐃𝐞𝐟𝐢𝐧𝐢𝐭𝐢𝐨𝐧:

Tax management refers to following the guidelines and laws related to income tax. The main objective of tax management is to lower taxes by making smart investments and utilizing deductions allowed under tax laws. It involves ensuring returns are filed on time, auditing accounts, deducting tax at the source, and other related tasks. Tax management helps prevent interest, penalties, and legal action.

𝐂𝐡𝐞𝐜𝐤 𝐒𝐚𝐦𝐩𝐥𝐞 𝐑𝐞𝐩𝐨𝐫𝐭 𝐟𝐨𝐫 𝐋𝐚𝐭𝐞𝐬𝐭 𝐈𝐧𝐝𝐮𝐬𝐭𝐫𝐲 𝐓𝐫𝐞𝐧𝐝𝐬: https://www.polarismarketresearch.com/industry-analysis/tax-management-market/request-for-sample

𝐆𝐫𝐨𝐰𝐭𝐡 𝐃𝐫𝐢𝐯𝐞𝐫𝐬 𝐚𝐧𝐝 𝐎𝐩𝐩𝐨𝐫𝐭𝐮𝐧𝐢𝐭𝐢𝐞𝐬:

● As companies become more knowledgeable about the benefits, they are using tax management software more often, leading to better accuracy and a decreased risk of facing penalties. It is fueling the demand in the market.

● During the projection period, the main factor driving revenue growth in the worldwide market is predicted to be the increasing need for uncomplicated tax record-keeping options. Maintaining records is crucial for many companies in preserving essential tax paperwork, and using tax software can make this task easier.

𝐊𝐞𝐲 𝐏𝐥𝐚𝐲𝐞𝐫𝐬:

The market is marked by fierce competition, and the leading companies rely on innovative technology, superior goods, and a strong brand identity to boost sales. Here is the list of the leading companies operating in the tax management market:

• Thomson Reuters

• Intuit H&R Block

• Avalara

• Wolters Kluwer NV

• Sovos Compliance LLC

• HRB Digital LLC

• Blucora Inc.

• Automatic Data Processing

• Taxback International

• Vertex Inc.

• Sailotech

• TaxSlayer LLC

• SAP SE

• Defmacro Software

• Xero

• Drake Enterprises

• TaxJar

• Webgility

• SafeSend

• EXEMPTAX

• Shoeboxed and SAXTAX

𝐌𝐚𝐤𝐞 𝐚𝐧 𝐈𝐧𝐪𝐮𝐢𝐫𝐲 𝐁𝐞𝐟𝐨𝐫𝐞 𝐁𝐮𝐲𝐢𝐧𝐠: https://www.polarismarketresearch.com/industry-analysis/tax-management-market/inquire-before-buying

𝐓𝐚𝐱 𝐌𝐚𝐧𝐚𝐠𝐞𝐦𝐞𝐧𝐭 𝐌𝐚𝐫𝐤𝐞𝐭 𝐑𝐞𝐩𝐨𝐫𝐭 𝐇𝐢𝐠𝐡𝐥𝐢𝐠𝐡𝐭𝐬:

• Software segment garnered the largest share, owing the trend of shifting towards digital tax processes & the automation solutions provided by the software.

• Direct Tax segment is expected to grow at a high CAGR during the forecast period. These software help file multiple types of return and thereby streamline the compliances.

• Cloud segment accounted for the largest market share in 2022 due to their benefits such as recording every transaction. A special dedicated IT staff is not required for cloud deployment.

• North America is the largest market due to the presence of many small and large players in the region. Moreover, most of the companies in the region outsource tax related services to third party entities to focus on its core businesses

𝐑𝐞𝐬𝐞𝐚𝐫𝐜𝐡 𝐌𝐞𝐭𝐡𝐨𝐝𝐨𝐥𝐨𝐠𝐲:

The Tax Management Market analysis has been done using advanced research techniques and methodologies to offer accurate and reliable market analysis. It uses the quantitative research that involves the collection and analysis of numerical data. Also, quantitative research in the form of focus groups, interviews, and observations has been included in the report to offer in-depth insights. After filtering, all the collected data and information are analyzed to derive meaningful insights and conclusions.

𝐄𝐱𝐩𝐥𝐨𝐫𝐞 𝐭𝐡𝐞 𝐂𝐨𝐦𝐩𝐥𝐞𝐭𝐞 𝐂𝐨𝐦𝐩𝐫𝐞𝐡𝐞𝐧𝐬𝐢𝐯𝐞 𝐑𝐞𝐩𝐨𝐫𝐭 𝐇𝐞𝐫𝐞: https://www.polarismarketresearch.com/industry-analysis/tax-management-market

𝐒𝐞𝐠𝐦𝐞𝐧𝐭𝐚𝐭𝐢𝐨𝐧 𝐎𝐯𝐞𝐫𝐯𝐢𝐞𝐰:

The tax management market is mainly segmented based on component, tax type, deployment, organization size, vertical, and region. Based on the component analysis, the software segment dominated the market in 2022 and is projected to continue its leadership in the upcoming period. Businesses can get ready and oversee audit reports and payments, submit tax returns, and manage the large quantities of financial transaction information generated by tax management software.

Furthermore, accounting to tax type analysis, the indirect tax segment held the highest market share in 2022. Indirect taxes such as Value Added Tax (VAT), Goods and Services Tax, and Excise Duty are encompassed within the tax system.

𝐌𝐨𝐫𝐞 𝐓𝐫𝐞𝐧𝐝𝐢𝐧𝐠 𝐑𝐞𝐩𝐨𝐫𝐭𝐬 𝐛𝐲 𝐏𝐨𝐥𝐚𝐫𝐢𝐬 𝐌𝐚𝐫𝐤𝐞𝐭 𝐑𝐞𝐬𝐞𝐚𝐫𝐜𝐡:

Smart Agriculture Market: https://www.polarismarketresearch.com/industry-analysis/smart-agriculture-market

Patient Engagement Solutions Market: https://www.polarismarketresearch.com/industry-analysis/patient-engagement-solutions-market

Smart Manufacturing Market: https://www.polarismarketresearch.com/industry-analysis/smart-manufacturing-market

Core Banking Software Market: https://www.polarismarketresearch.com/industry-analysis/core-banking-software-market

Cloud Managed Services Market: https://www.polarismarketresearch.com/industry-analysis/cloud-managed-service-market

𝐂𝐨𝐧𝐭𝐚𝐜𝐭:

Likhil G

8 The Green Ste 19824,

Dover, DE 19901,

United States

Phone: +1-929 297-9727

Email: sales@polarismarketresearch.com

Web: https://www.polarismarketresearch.com

Follow Us: LinkedIn | Twitter

𝐀𝐛𝐨𝐮𝐭 𝐏𝐨𝐥𝐚𝐫𝐢𝐬 𝐌𝐚𝐫𝐤𝐞𝐭 𝐑𝐞𝐬𝐞𝐚𝐫𝐜𝐡 & 𝐂𝐨𝐧𝐬𝐮𝐥𝐭𝐢𝐧𝐠, 𝐈𝐧𝐜:

Polaris Market Research is a global market research and consulting company. The company specializes in providing exceptional market intelligence and in-depth business research services for PMR's clientele spread across different enterprises. We at Polaris are obliged to serve PMR's diverse customer base present across the industries of healthcare, technology, semiconductors, and chemicals among various other industries present around the world. We strive to provide PMR's customers with updated information on innovative technologies, high-growth markets, emerging business environments, and the latest business-centric applications, thereby helping them always to make informed decisions and leverage new opportunities. Adept with a highly competent, experienced, and extremely qualified team of experts comprising SMEs, analysts, and consultants, we at Polaris endeavor to deliver value-added business solutions to PMR's customers.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Tax Management Market Share To Rise At 10.52% CAGR, To Reach USD 61.59 Billion By 2032 here

News-ID: 3675638 • Views: …

More Releases from Polaris Market Research & Consulting

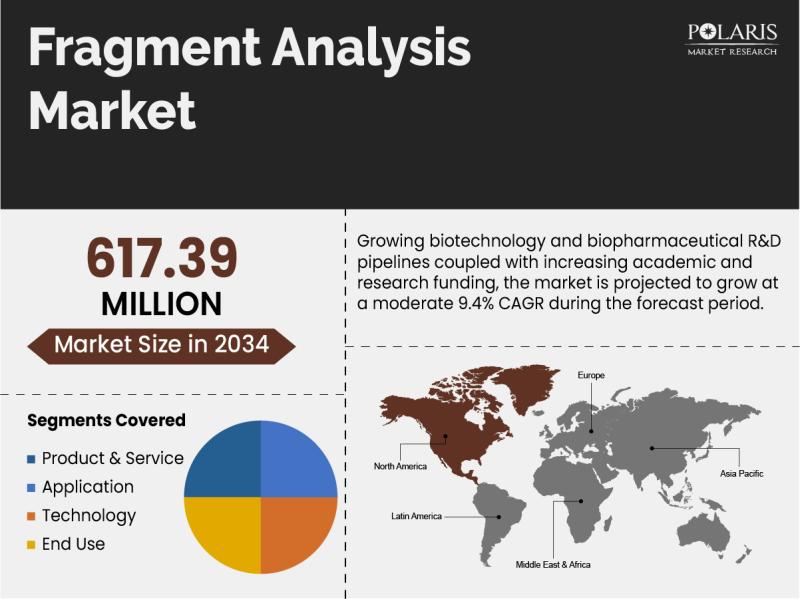

Fragment Analysis Market Size Projected to Reach USD 617.39 Million by 2034, Gro …

Global Fragment Analysis Market is currently valued at USD 275.72 Million in 2025 and is anticipated to generate an estimated revenue of USD 617.39 Million by 2034, according to the latest study by Polaris Market Research. Besides, the report notes that the market exhibits a robust 9.4% Compound Annual Growth Rate (CAGR) over the forecasted timeframe, 2026 - 2034.

Polaris Market Research recently introduced the latest update on Fragment Analysis Market…

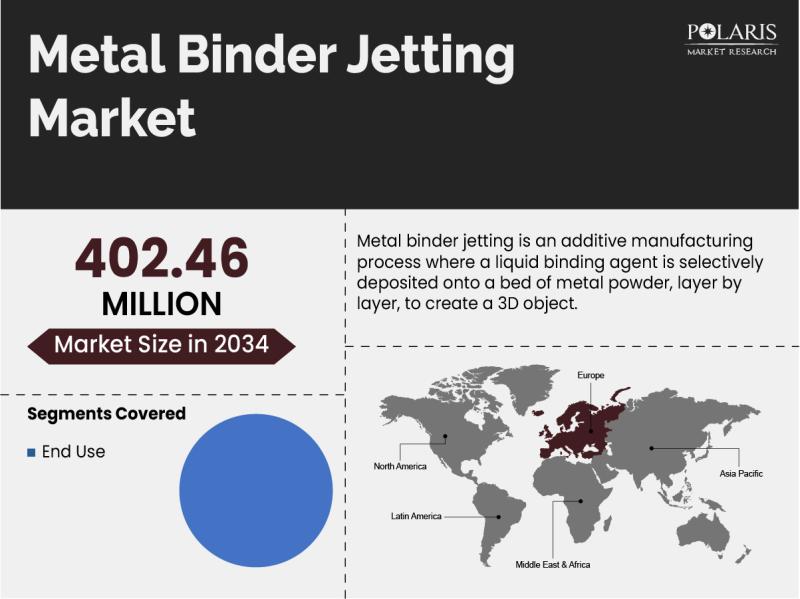

Metal Binder Jetting Market Growth Projected at 10.6% CAGR, Reaching USD 402.46 …

Global Metal Binder Jetting Market is currently valued at USD 147.51 Million in 2024 and is anticipated to generate an estimated revenue of USD 402.46 Million by 2034, according to the latest study by Polaris Market Research. Besides, the report notes that the market exhibits a robust 10.6% Compound Annual Growth Rate (CAGR) over the forecasted timeframe, 2025 - 2034.

Polaris Market Research recently introduced the latest update on Metal Binder…

Rigid Food Packaging Market to Reach USD 354.25 Billion by 2034, Growing at a CA …

The quantitative market research report published by Polaris Market Research on Rigid Food Packaging Market aims to educate users with an in-depth understanding of a rapidly growing market. The study details important facts and figures, expert opinions, and major developments across the globe. The research study serves as a vital source of information with the historical data, Rigid Food Packaging Market size, financial data, and projected future growth. All the…

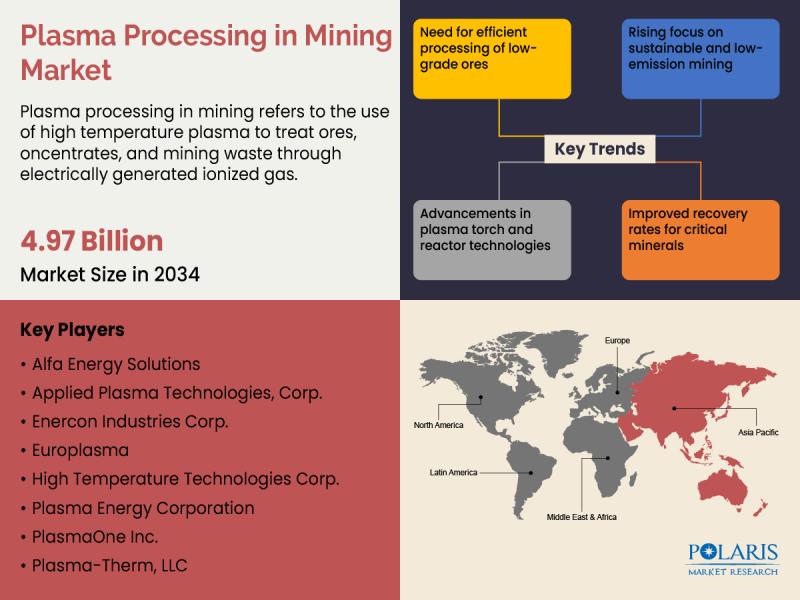

Global Plasma Processing in Mining Market to Reach USD 4.97 Billion by 2034, Reg …

Market Size and Share:

The global plasma processing in mining market is estimated to reach approximately USD 2.62 billion in 2025 and is expected to experience steady growth from 2026 to 2034, expanding at a projected CAGR of 7.4% during the forecast period.

Polaris Market Research has introduced the latest market research report titled Plasma Processing in Mining Market that highlights the major revenue stream for the forecast period. The report contains…

More Releases for Tax

Tax Accountant Launches Expert Tax Advisory Services for Complex UK Tax Issues

Birmingham, UK - Tax Accountant, a premier provider of tailored tax solutions, is proud to announce the introduction of its new Specialist Tax Advice service. Aimed at tackling the multifaceted tax challenges faced by individuals and businesses in the UK, this service is set to revolutionize how tax compliance and optimization are approached.

As tax laws become increasingly complex and the implications of non-compliance more severe, the need for specialized tax…

Legal Tax Defense Offers Tax Relief Services to Successfully Settle IRS Tax Debt …

Legal Tax Defense provides expert guidance and strategies to navigate IRS negotiations and reduce tax liabilities.

Legal Tax Defense, Inc., a premier provider of tax resolution services, is now providing strategic assistance and professional help for those who find IRS tax debt to be stressful and intimidating. The firm assists taxpayers in understanding their alternatives for efficiently managing and lowering tax liabilities by offering a range of specialist services.

"Handling IRS tax…

Legal Tax Defense Providing Strategic Assistance to Settle Tax Debts for Tax Pay …

Fulfill Tax Obligations and Prevent Legal Issues.

Legal Tax Defense, a premier firm specializing in tax resolution, proudly announces its updated services aimed at helping clients effectively settle their tax debts. With a focus on alleviating the financial and legal pressures associated with unpaid taxes, Legal Tax Defense offers a lifeline to individuals and businesses struggling with tax liabilities.

Understanding the options available for settling tax debts [https://www.legaltaxdefense.com/settling-tax-debts/] is crucial in taking…

Bidding At The Tax Sale - Tax Sale Success Masterclass with The Tax Lien Lady

Joanne Musa, founder of TaxLienLady.com is holding a Tax Sale Success Masterclass on Bidding at the Tax Sale on Thursday, November 10 at 7:00 pm Eastern Time.

Tax lien and tax deed investing can be very profitable. Tax Lien investors can earn interest rates that are much higher than current bank rates without the risk of the stock market. Joanne Musa, known online as the tax lien lady, has been helping…

Tax Software Market – Major Technology Giants in Buzz Again | TurboTax, Tax Sl …

The Latest Released Tax Software market study has evaluated the future growth potential of Global Tax Software market and provides information and useful stats on market structure and size. The report is intended to provide market intelligence and strategic insights to help decision makers take sound investment decisions and identify potential gaps and growth opportunities. Additionally, the report also identifies and analyses changing dynamics, emerging trends along with essential drivers,…

Tax Software Market to Eyewitness Massive Growth by 2026 | Tax Act, Tax Slayer, …

The latest independent research document on Global Tax Software examine investment in Market. It describes how companies deploying these technologies across various industry verticals aim to explore its potential to become a major business disrupter. The Tax Software study eludes very useful reviews & strategic assessment including the generic market trends, emerging technologies, industry drivers, challenges, regulatory policies that propel the market growth, along with major players profile and strategies.…