Press release

Microinsurance Market

Microinsurance refers to insurance products designed to be affordable and accessible to low-income individuals or those who are typically underserved by traditional insurance markets. It offers coverage for various risks, such as health, life, property, and agriculture, but with smaller premiums and lower coverage limits. Microinsurance is especially important in developing countries, where people face significant risks but lack the financial means to access conventional insurance products. The primary aim is to provide a safety net to individuals who may not otherwise have access to formal financial services.Microinsurance plays a key role in improving financial inclusion. It helps low-income households manage risks and recover from financial shocks. These products are often tailored to the needs and challenges of specific populations, ensuring they remain affordable while offering meaningful protection. With advancements in digital technology, the microinsurance sector has expanded rapidly. Through mobile phones and online platforms, insurers can now reach a broader audience, particularly in rural or remote areas.

Market Size

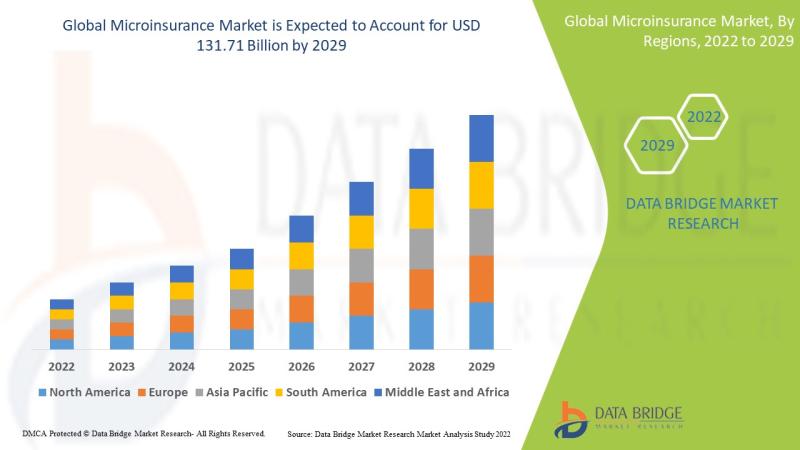

The global microinsurance market has grown considerably in recent years. This expansion is attributed to increasing awareness about the importance of insurance in mitigating risks for vulnerable populations. As of 2023, the market size is estimated to be worth approximately USD 80 billion. The market continues to expand as more people become aware of the benefits of microinsurance. It is expected to grow at a compound annual growth rate (CAGR) of about 8.5% from 2024 to 2030.

For More Information-https://www.databridgemarketresearch.com/reports/global-microinsurance-market

This growth has been driven by several factors, including rising demand from low-income groups and growing partnerships between insurance companies and financial institutions. In addition, governments in developing countries have played an instrumental role in supporting the development of microinsurance markets by introducing favorable regulations and initiatives. Emerging markets in Africa, Asia, and Latin America represent a significant portion of this growth, with many insurance providers tailoring their products to local needs.

The market size varies significantly across different regions. For example, Asia, particularly India, China, and Southeast Asian countries, holds the largest share of the microinsurance market. Africa is the second-largest region in terms of market size, thanks to the efforts of non-governmental organizations (NGOs) and microfinance institutions working in collaboration with insurance providers to promote microinsurance.

Market Share

Several key players dominate the microinsurance market, each offering a range of products that cater to the diverse needs of low-income groups. These players include Allianz SE, AXA Group, MetLife Inc., Zurich Insurance Group, and Tata AIG, among others. However, there is also a strong presence of local insurance companies and regional organizations working to promote microinsurance in specific markets.

These companies, along with microfinance institutions and NGOs, hold a significant share of the market. The growing involvement of digital platforms and mobile network operators has further helped expand the microinsurance market, with some companies focusing exclusively on digital insurance solutions. Insurtech companies, for example, are gaining ground by offering innovative products through mobile applications, making insurance more accessible and efficient.

The market share is fragmented due to the wide range of microinsurance products available. Life and health microinsurance products are the most commonly offered, followed by property and agricultural insurance. Each type of product holds a different share of the market based on the unique risks faced by low-income populations in different regions.

Health insurance has gained significant traction, accounting for approximately 35% of the overall market share. This is because health risks pose a substantial financial burden for low-income households. Life insurance products come in second, followed by agricultural and property insurance. The rise in digital platforms that support microinsurance has contributed to the diversity of products available, helping to increase market penetration.

The Evolution

Microinsurance has come a long way since its early days. Initially, it was primarily provided by mutual and community-based organizations. Over time, however, the market evolved, with larger insurance companies recognizing the potential of serving low-income groups. The introduction of digital technology further accelerated the evolution of the microinsurance market.

In the 1990s and early 2000s, microinsurance was seen as a social initiative aimed at poverty alleviation. However, as insurance providers realized the potential for profitability in this market, they began to introduce more commercially viable products. The evolution was marked by the introduction of health and life insurance, which proved to be essential in many low-income communities.

The integration of technology into the microinsurance market represents one of the most significant shifts. Mobile phones, digital platforms, and online payment systems have allowed insurers to reduce administrative costs and reach a wider audience. This shift has also enabled insurers to collect data more efficiently, helping them create better risk profiles and offer more tailored products.

Market Trends

Several trends are shaping the future of the microinsurance market. The rise of insurtech is among the most significant. Insurtech refers to the use of technology to streamline insurance processes, from product distribution to claims management. Companies are leveraging digital platforms to reach more clients, particularly in remote or underserved areas. These platforms not only increase access but also enhance the efficiency and speed of insurance services.

Another trend is the increasing collaboration between insurance companies and non-traditional partners, such as mobile network operators and microfinance institutions. These partnerships are helping to bridge the gap between insurers and low-income clients. By leveraging the existing infrastructure of these partners, insurance companies can reduce distribution costs and offer more affordable products.

The expansion of parametric insurance is also a growing trend. This type of insurance offers payouts based on predefined triggers, such as weather events, rather than traditional claims processes. Parametric insurance is particularly useful in agriculture, where farmers can receive compensation based on rainfall levels or other climatic conditions. This trend is gaining popularity in regions where agricultural risks are significant, such as Africa and parts of Asia.

Increasing regulatory support for microinsurance is another key trend. Governments in developing countries are recognizing the importance of microinsurance in promoting financial inclusion. They are introducing regulations that encourage insurance providers to offer products specifically designed for low-income groups. These regulations often include incentives, such as tax breaks or subsidies, that make it easier for insurers to operate in this market.

Factors Driving Growth

Several factors are contributing to the growth of the microinsurance market. One of the primary drivers is the increasing awareness of the benefits of insurance among low-income populations. As more people recognize the importance of financial protection, demand for microinsurance products continues to rise.

Another key factor is the rise of digital platforms. The integration of mobile phones and other digital technologies into the insurance industry has made it easier for low-income individuals to access insurance products. This is particularly true in developing countries, where mobile phone penetration is high, even in rural areas.

Additionally, growing support from governments and NGOs has played a crucial role in expanding the microinsurance market. Many governments are introducing policies that promote financial inclusion, including regulations that support the development of microinsurance products. NGOs and international organizations are also providing technical assistance and funding to help insurers develop and distribute microinsurance products.

Finally, partnerships between insurance companies and microfinance institutions have facilitated the distribution of microinsurance products. Microfinance institutions often have established relationships with low-income clients, making them ideal partners for insurers. These partnerships allow insurers to reach a broader audience and offer more affordable products.

Browse Trending Reports:

https://rutujabhosaleblogs.blogspot.com/2024/09/asthma-device-market-size-share-demand.html

https://rutujabhosaleblogs.blogspot.com/2024/09/automotive-sun-visor-market-size-share_20.html

https://rutujabhosaleblogs.blogspot.com/2024/09/high-performance-ceramic-coatings_20.html

https://rutujabhosaleblogs.blogspot.com/2024/09/on-premise-content-intelligence-market_20.html

In conclusion, the microinsurance market is expanding rapidly, driven by technological advancements, increased awareness, and supportive regulatory environments. As more people gain access to affordable insurance products, the market will continue to grow, playing a vital role in enhancing financial inclusion globally.

About Data Bridge Market Research:

Data Bridge set forth itself as an unconventional and neoteric Market research and consulting firm with unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email: corporatesales@databridgemarketresearch.com"

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Microinsurance Market here

News-ID: 3662181 • Views: …

More Releases from Data Bridge Market Research

Scented Candle Market Shows Strong Growth Driven by Wellness and Home Décor Tr …

The global scented candle market is on track for significant expansion, increasing from an estimated USD 3.60 billion in 2024 to USD 6.00 billion by 2032, registering a strong CAGR of 6.60%. Rising consumer interest in home ambiance, wellness, and premium lifestyle products continues to drive market demand.

Get More Detail: https://www.databridgemarketresearch.com/reports/global-scented-candle-market

Market Growth Drivers

The scented candle market has evolved beyond being just a decorative item. Key growth factors include:

Home Fragrance &…

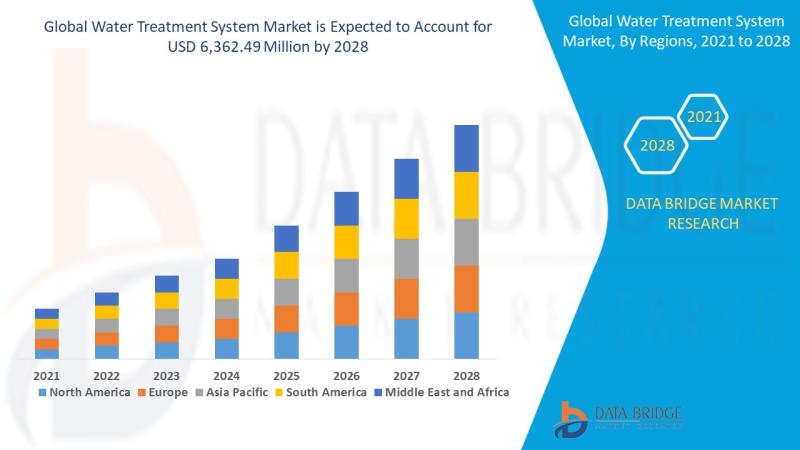

Water Treatment System Market: Sustaining the Future of Clean Water

Introduction

Understanding Water Treatment Systems

Water treatment systems are designed to purify and disinfect water for various uses-drinking, industrial processes, irrigation, and wastewater reuse. These systems eliminate contaminants such as bacteria, viruses, heavy metals, chemicals, and particulates, making water safe and sustainable for consumption and use.

Importance in Global Sustainability

Clean water is essential to life and industrial progress. With growing water demand and pollution, water treatment systems are now critical infrastructure across the…

Veterinary X-Ray Market Size, Analysis, Scope, Demand, Opportunities, Statistics

According to Data Bridge Market Research The global Veterinary X-Ray market size was valued at USD 915.19 million in 2024 and is projected to reach USD 1576.00 million by 2032, with a CAGR of 7.03 % during the forecast period of 2025 to 2032.

With increasing globalization and digital disruption, the Equine X-Ray Solutions Market is expanding across multiple industries, . Market research data indicates that businesses in the Companion Animal…

Veterinary X-Ray Market Size, Analysis, Scope, Demand, Opportunities, Statistics

According to Data Bridge Market Research The global Veterinary X-Ray market size was valued at USD 915.19 million in 2024 and is projected to reach USD 1576.00 million by 2032, with a CAGR of 7.03 % during the forecast period of 2025 to 2032.

With increasing globalization and digital disruption, the Equine X-Ray Solutions Market is expanding across multiple industries, . Market research data indicates that businesses in the Companion Animal…

More Releases for Microinsurance

Microinsurance for Vulnerable Communities Market Is Booming Worldwide | Major Gi …

The latest analysis of the worldwide Microinsurance for Vulnerable Communities market by HTF MI Research evaluates the market's size, trends, and forecasts through 2033. Microinsurance for Vulnerable Communities market study includes extensive research data and proofs to give managers, analysts, industry experts, and other key personnel a ready-to-access, self-analyzed study to help understand market trends, growth drivers, opportunities, and upcoming challenges as well as about competitors.

Key Players in This Report…

Digital Microinsurance Market Hits New High | Major Giants BIMA, MicroEnsure, AX …

HTF MI just released the Global Digital Microinsurance Market Study, a comprehensive analysis of the market that spans more than 143+ pages and describes the product and industry scope as well as the market prognosis and status for 2024-2033. The marketization process is being accelerated by the market study's segmentation by important regions. The market is currently expanding its reach.

Major companies profiled in Digital Microinsurance Market are: BIMA, MicroEnsure, AXA…

Microinsurance Market Size & Share | Growth Report - 2034

According to the report by Expert Market Research (EMR), the global microinsurance market reached a value of USD 82.87 billion in 2024. Aided by the growing demand for accessible and affordable insurance solutions among low-income populations, the market is projected to grow at a CAGR of 6.50% between 2025 and 2034, reaching USD 155.56 billion by 2034.

Microinsurance, a subset of insurance tailored for low-income individuals, provides financial protection against specific…

Government Initiatives Fueling Growth In The Microinsurance Market: Powering Inn …

Use code ONLINE30 to get 30% off on global market reports and stay ahead of tariff changes, macro trends, and global economic shifts

What Is the Expected CAGR for the Microinsurance Market Through 2025?

In the past few years, we have observed significant expansion in the size of the microinsurance market. The market's growth is projected to rise from $95.69 billion in 2024 to $101.82 billion in 2025, experiencing a compound annual…

Government Initiatives Fueling Growth In The Microinsurance Market: A Significan …

The Microinsurance Market Report by The Business Research Company delivers a detailed market assessment, covering size projections from 2025 to 2034. This report explores crucial market trends, major drivers and market segmentation by [key segment categories].

What Is the Microinsurance Market Size and Projected Growth Rate?

In recent times, the microinsurance market has seen impressive growth. The market is projected to expand from $95.69 billion in 2024 to $101.82 billion in 2025,…

Government Initiatives Fueling Growth In The Microinsurance Market Driver: A Maj …

What industry-specific factors are fueling the growth of the microinsurance market?

The microinsurance market is projected to see substantial growth due to increasing government-initiated programs for microinsurance. Government initiatives often consist of projects, policies, or actions instituted by governmental bodies, with the purpose of addressing societal issues, promoting specific interests, or achieving particular outcomes within a specific sector or within society at large. These initiatives often prove beneficial for small business…