Press release

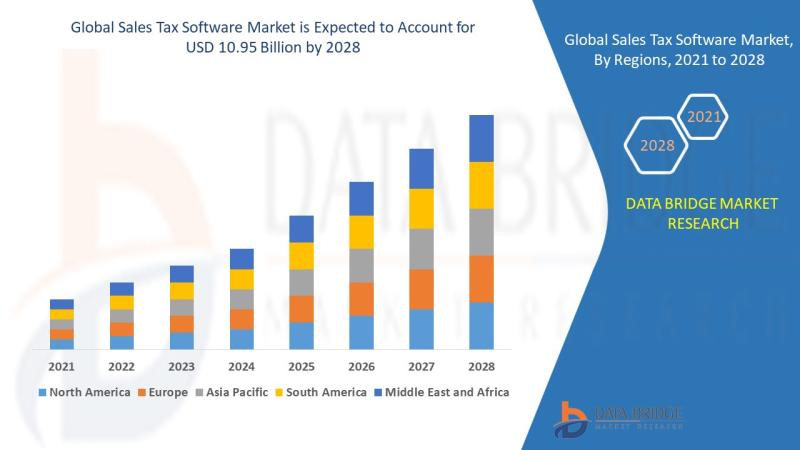

Sales Tax Software Market will reach at an estimated value of USD 10.95 billion and grow at a CAGR of 8.05%

Sales Tax Software Market will reach at an estimated value of USD 10.95 billion and grow at a CAGR of 8.05%

Global Sales Tax Software Market, By Solution (Consumer Use Tax Management, Automatic Tax Filings, Exemption Certificate Management, Others), Deployment Model (On-Premises, Cloud-Based, SaaS), Platform Type (Web, Mobile), Industrial Vertical (BFSI, Transportation, Retail, Telecommunication & IT, Healthcare, Manufacturing, Food Services, Energy & Utilities, Others), Application (Small Business, Midsize Enterprise, Large Enterprise), End-Users (Individuals, Commercial Enterprises), Country (U.S., Canada, Mexico, Brazil, Argentina, Rest of South America, Germany, Italy, U.K., France, Spain, Netherlands, Belgium, Switzerland, Turkey, Russia, Rest of Europe, Japan, China, India, South Korea, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific, Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa) Industry Trends and Forecast to 2028

Sales Tax Software Market CAGR Etimation

The sales tax software market will reach at an estimated value of USD 10.95 billion and grow at a CAGR of 8.05% in the forecast period of 2021 to 2028.

Explore Further Details about This Research Sales Tax Software Market Report https://www.databridgemarketresearch.com/reports/global-sales-tax-software-market

Sales Tax Software Market Growth or Demand Increase or Decrease for What Contains:

**Market Analysis of Sales Tax Software Market in 2020:**

- In 2020, the sales tax software market experienced steady growth due to the increasing complexity of tax laws and regulations around the world. With the rise of e-commerce and digital businesses, there was a growing demand for automated tax solutions to ensure compliance and accuracy in sales tax calculations. The market was driven by the need for businesses to streamline their tax processes and reduce the risk of audits and penalties.

**Market Analysis of Sales Tax Software Market in 2028:**

- Looking ahead to 2028, the sales tax software market is expected to witness significant growth as organizations continue to prioritize tax compliance and efficiency. The market is projected to expand further as more countries implement digital tax systems and regulations, increasing the demand for sophisticated tax software solutions. The adoption of cloud-based tax software is also expected to rise, enabling businesses to access real-time tax data and insights.

**Market Segments:**

- Cloud-Based Sales Tax Software

- On-Premises Sales Tax Software

- Integrated Sales Tax Software

- Standalone Sales Tax Software

- Small and Medium Enterprises (SMEs)

- Large Enterprises

**Market Players:**

- Avalara

- Vertex Inc.

- Sovos

- AccurateTax.com

- CFS Tax Software, Inc.

- Xero

- Intuit Inc.

- Thomson Reuters

- TaxCloud

- TaxJar

The sales tax software market is competitive and fragmented, with key players constantly innovating to offer advanced features and integrations to meet the evolving needs of businesses. As the regulatory environment becomes more complex, businesses are increasingly turning to sales tax software to ensure compliance and reduce the burden of manual tax calculations. Overall, the sales tax software market is poised for significant growth in the coming years, driven by the increasing adoption of digital tax solutions and the need for streamlined tax processes.

The sales tax software market has been witnessing a paradigm shift in recent years due to the escalating complexities in tax laws and regulations across the globe. Businesses are grappling with the challenges posed by the digital economy and e-commerce platforms, resulting in a heightened demand for automated tax solutions that can ensure accuracy, compliance, and efficiency in sales tax calculations. This growing awareness among organizations regarding the importance of tax compliance has been a key driver for the market. As businesses strive to streamline their tax processes and mitigate the risks associated with audits and penalties, the adoption of sales tax software has become imperative.

Looking towards the future, the sales tax software market is poised for substantial growth driven by the evolving regulatory landscape and the increasing digitization of tax systems worldwide. The year 2028 is expected to witness a surge in demand for sophisticated tax software solutions as countries continue to implement stringent tax regulations and digital tax mechanisms. The adoption of cloud-based sales tax software is projected to soar, providing businesses with real-time access to tax data and insights to make informed decisions. This shift towards cloud-based solutions will enhance scalability, flexibility, and cost-effectiveness for organizations of all sizes, from SMEs to large enterprises.

Market segmentation plays a pivotal role in catering to the diverse needs of businesses seeking sales tax software solutions. Cloud-based sales tax software offers the advantage of remote accessibility, seamless updates, and reduced maintenance costs. On-premises solutions, on the other hand, provide greater control and security for organizations with specific compliance requirements. Integrated sales tax software, which can seamlessly integrate with existing ERP systems, and standalone solutions, which focus solely on tax calculations, offer tailored options for different business models.

The key market players in the sales tax software industry such as Avalara, Vertex Inc., and Sovos are constantly innovating to stay ahead in the competitive landscape. These companies are focusing on enhancing their software capabilities, expanding their global presence, and forging strategic partnerships to offer comprehensive solutions to their clients. As businesses continue to grapple with the complexities**Market Players:**

- **APEX Analytix, LLC**

- **Avalara Inc.**

- **CCH**

- **Intuit Inc.**

- **LumaTax, Inc.**

- **Ryan, LLC**

- **Sage Intacct, Inc.**

- **Sales Tax DataLINK**

- **Sovos Compliance, LLC**

- **Thomson Reuters**

- **Vertex, Inc.**

- **Zoho Corporation Pvt. Ltd.**

- **Xero Limited**

- **The Federal Tax Authority, LLC d/b/a TaxCloud**

- **Wolters Kluwer**

- **CFS Tax Software Inc.**

- **Service Objects, Inc.**

- **TaxJar**

- **Chetu Inc.**

- **HRB Digital LLC**

The sales tax software market is witnessing a paradigm shift driven by the escalating complexities in tax laws globally. Businesses are increasingly facing challenges from the digital economy and e-commerce domains, creating a heightened demand for automated tax solutions that guarantee accuracy, compliance, and efficiency in sales tax calculations. The growing emphasis on tax compliance has emerged as a significant market driver, pushing organizations to adopt sales tax software to streamline tax processes and minimize risks associated with audits and penalties. As businesses seek to navigate the evolving regulatory landscape, the market is positioned for significant growth in the years to come.

Looking ahead to 2028, the sales tax software market is poised for substantial expansion fueled by the dynamic regulatory environment

Browse More Reports:

https://dbmr2blog.blogspot.com/2024/09/radar-level-transmitter-market.html

https://dbmr2blog.blogspot.com/2024/09/submarine-cable-system-market-industry.html

https://dbmr2blog.blogspot.com/2024/09/plant-based-beverages-market-trends.html

https://dbmr2blog.blogspot.com/2024/09/fish-sauce-market-revenue-analysis.html

Data Bridge Market Research:

Today's trends are a great way to predict future events!

Office Number 402, Amanora Chambers, Magarpatta Road,

Hadapsar Pune - 411028 Maharashtra, India

Data Bridge Market Research is a market research and consulting company that educates its clients about the market and encourages growth and expansion. We offer customized reports, syndicated research, consulting services, cloud-connected intelligence, and a holistic suite of offerings including competitive intelligence, epidemiology analyses, trade analytics, country analysis, and pharma insights. We deliver objective and actionable insights, crafted to meet the unique needs of our clients. Our database features thousands of statistics and in-depth analyses on 200 plus industries and more than 5000 markets in 75 major countries globally. Additionally, DBMR has served for more than 40% of Fortune 500 firms internationally and has a more than 3000 client's network.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Sales Tax Software Market will reach at an estimated value of USD 10.95 billion and grow at a CAGR of 8.05% here

News-ID: 3648271 • Views: …

More Releases from Data Bridge Market Research Private Ltd .

Gloves Market Expands with Increasing Focus on Hygiene and Safety

"Global Gloves Market, By Product Type (Nitrile Gloves, Latex Gloves, Vinyl Glove, Polyethylene Gloves, Cotton Fabric Gloves, Puncture Resistant Gloves, Butyl Gloves, Aluminized Gloves, Neoprene Gloves, Kevlar Gloves, Leather Gloves and Others), Type (Disposable and Reusable), Application (Biological, Chemical, Mechanical, Thermal, Anti-Static and Others), End User (Medical & Healthcare, Food & Beverage, Fire Protection, Construction, Manufacturing Industries, Metal Fabrication, Electronics and Others), Distribution Channel (Online, Offline and Others) -Industry Trends…

Precision Agriculture Market Flourishes as Demand for Sustainable Farming Soluti …

"Precision Agriculture Market Size And Forecast by 2031

Precision agriculture market is expected to gain market growth in the forecast period of 2021 to 2028.

Precision Agriculture Market research report provides a comprehensive analysis of the market. The report aims to provide insights into Precision Agriculture Market trends, growth opportunities, key drivers and challenges, competitive landscape, and other crucial factors that may impact the market in the forecast period (2024-2031).

Get a Sample…

Data Warehouse as a Service Market Grows with Demand for Scalable Data Managemen …

"Data Warehouse as a Service Market Size And Forecast by 2031

The global data warehouse as a service market size was valued at USD 9.06 billion in 2023 and is projected to reach USD 55.96 billion by 2031, with a CAGR of 25.55% during the forecast period of 2024 to 2031.

Data Warehouse as a Service Market research report provides a comprehensive analysis of the market. The report aims to provide…

AWS Managed Services Market Expands as Cloud Adoption and Optimization Needs Inc …

"AWS Managed Services Market Size And Forecast by 2031

Data Bridge Market Research analyses that the Global Aws Managed Services Market which was USD 974.91 Billion in 2023 is expected to reach USD 3045.07 Million by 2031 and is expected to undergo a CAGR of 15.30% during the forecast period of 2023 to 2031

AWS Managed Services Market research report provides a comprehensive analysis of the market. The report aims to provide…

More Releases for Tax

Tax Accountant Launches Expert Tax Advisory Services for Complex UK Tax Issues

Birmingham, UK - Tax Accountant, a premier provider of tailored tax solutions, is proud to announce the introduction of its new Specialist Tax Advice service. Aimed at tackling the multifaceted tax challenges faced by individuals and businesses in the UK, this service is set to revolutionize how tax compliance and optimization are approached.

As tax laws become increasingly complex and the implications of non-compliance more severe, the need for specialized tax…

Legal Tax Defense Offers Tax Relief Services to Successfully Settle IRS Tax Debt …

Legal Tax Defense provides expert guidance and strategies to navigate IRS negotiations and reduce tax liabilities.

Legal Tax Defense, Inc., a premier provider of tax resolution services, is now providing strategic assistance and professional help for those who find IRS tax debt to be stressful and intimidating. The firm assists taxpayers in understanding their alternatives for efficiently managing and lowering tax liabilities by offering a range of specialist services.

"Handling IRS tax…

Legal Tax Defense Providing Strategic Assistance to Settle Tax Debts for Tax Pay …

Fulfill Tax Obligations and Prevent Legal Issues.

Legal Tax Defense, a premier firm specializing in tax resolution, proudly announces its updated services aimed at helping clients effectively settle their tax debts. With a focus on alleviating the financial and legal pressures associated with unpaid taxes, Legal Tax Defense offers a lifeline to individuals and businesses struggling with tax liabilities.

Understanding the options available for settling tax debts [https://www.legaltaxdefense.com/settling-tax-debts/] is crucial in taking…

Bidding At The Tax Sale - Tax Sale Success Masterclass with The Tax Lien Lady

Joanne Musa, founder of TaxLienLady.com is holding a Tax Sale Success Masterclass on Bidding at the Tax Sale on Thursday, November 10 at 7:00 pm Eastern Time.

Tax lien and tax deed investing can be very profitable. Tax Lien investors can earn interest rates that are much higher than current bank rates without the risk of the stock market. Joanne Musa, known online as the tax lien lady, has been helping…

Tax Software Market – Major Technology Giants in Buzz Again | TurboTax, Tax Sl …

The Latest Released Tax Software market study has evaluated the future growth potential of Global Tax Software market and provides information and useful stats on market structure and size. The report is intended to provide market intelligence and strategic insights to help decision makers take sound investment decisions and identify potential gaps and growth opportunities. Additionally, the report also identifies and analyses changing dynamics, emerging trends along with essential drivers,…

Tax Software Market to Eyewitness Massive Growth by 2026 | Tax Act, Tax Slayer, …

The latest independent research document on Global Tax Software examine investment in Market. It describes how companies deploying these technologies across various industry verticals aim to explore its potential to become a major business disrupter. The Tax Software study eludes very useful reviews & strategic assessment including the generic market trends, emerging technologies, industry drivers, challenges, regulatory policies that propel the market growth, along with major players profile and strategies.…