Press release

Insolvency Software Market Growth Outlook Beyond 2024 | Thomson Reuters Corporation, CaseWare International

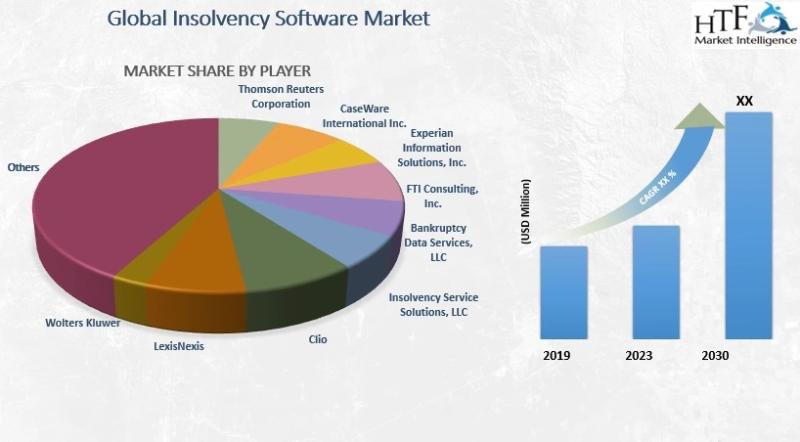

According to HTF Market Intelligence, the Insolvency Software market to witness a CAGR of 10.4% during the forecast period (2024-2030).The Latest published a market study on Global Insolvency Software Market provides an overview of the current market dynamics in the Global Insolvency Software space, as well as what our survey respondents- all outsourcing decision-makers- predict the market will look like in 2030. The study breaks the market by revenue and volume (wherever applicable) and price history to estimate the size and trend analysis and identify gaps and opportunities.Some of the players that are in coverage of the study are Thomson Reuters Corporation (Canada), CaseWare International Inc. (Canada), Experian Information Solutions, Inc. (United States), FTI Consulting, Inc. (United States), Bankruptcy Data Services, LLC (United States), Insolvency Service Solutions, LLC (United States), Clio (Canada), LexisNexis (United States), Wolters Kluwer (Netherlands), SAP SE (Germany).

The global Insolvency Software market size is expanding at robust growth of 10.4%, sizing up market trajectory from USD Billion in 2024 to USD Billion by 2030.

Get ready to identify the pros and cons of the regulatory framework, local reforms, and its impact on the Industry. Know how Leaders in Global Insolvency Software are keeping themselves one step forward with our latest survey analysis

Click to get Global Insolvency Software Market Research Sample PDF Copy Here @: https://www.htfmarketintelligence.com/sample-report/global-insolvency-software-market?utm_source=Sweety_OpenPR&utm_id=Sweety

Definition

Insolvency software refers to specialized software designed to assist professionals in managing insolvency and bankruptcy cases. It includes features for case management, document preparation, financial analysis, compliance tracking, and reporting. The software is used by insolvency practitioners, lawyers, and accountants to streamline the process of handling insolvency cases and ensuring legal and regulatory compliance.

Basic Segmentation Details

Global Insolvency Software Market Breakdown by Application (Compliance, Creditor management, Document management, Financial transaction management, Reporting, Others) by Component (Software, Service) by Deployment Mode (On-premises, Cloud) by Organization Size (Large organization, SMEs) by End-User (IT & telecom, BFSI, Government, Retail, Manufacturing, Energy and Utilities, Others) and by Geography (North America, LATAM, West Europe, Central & Eastern Europe, Northern Europe, Southern Europe, East Asia, Southeast Asia, South Asia, Central Asia, Oceania, MEA)

Insolvency Software Market Driver

• The growth of the insolvency software market is mainly fueled by growing financial regulations complexity and rising global insolvency cases. With the maturation of regulatory structures, companies need sophisticated software to guarantee adherence and efficiently handle extensive paperwork. The increasing need for automation in financial procedures drives market expansion, as companies aim to minimize manual mistakes and enhance effectiveness. Moreover, the growth of financial services and the rise in corporate bankruptcies caused by economic changes fuel the demand for advanced insolvency management instruments. The increasing focus on digital transformation in the legal and financial industries is driving up demand, with companies giving importance to technology for improving case management and ensuring accurate data. Growing awareness of data security and the importance of handling sensitive information securely also fuel the increase, as businesses look for software solutions that provide strong protection and adherence to data privacy rules.

•

Insolvency Software Market Opportunity

• Technological advancements like artificial intelligence and machine learning provide chances to create advanced tools that boost data analysis, streamline workflows, and enhance decision-making. With the increasing complexity of financial regulations, there is a rising need for software solutions that guarantee adherence and simplify bankruptcy procedures. Moreover, the rising utilization of cloud-based platforms enables more versatility and ease of access, meeting the requirements of companies working in various geographical areas. The growth of insolvency services in emerging markets offers expansion opportunities, with businesses in these areas looking to update their financial management processes. Moreover, when insolvency software is integrated with other financial and legal systems, it can offer holistic solutions that benefit users and broaden market opportunities.

Insolvency Software Market Restraints

Major Highlights of the Insolvency Software Market report released by HTF MI

Global Insolvency Software Market Breakdown by Application (Compliance, Creditor management, Document management, Financial transaction management, Reporting, Others) by Component (Software, Service) by Deployment Mode (On-premises, Cloud) by Organization Size (Large organization, SMEs) by End-User (IT & telecom, BFSI, Government, Retail, Manufacturing, Energy and Utilities, Others) and by Geography (North America, LATAM, West Europe, Central & Eastern Europe, Northern Europe, Southern Europe, East Asia, Southeast Asia, South Asia, Central Asia, Oceania, MEA)

Global Insolvency Software market report highlights information regarding the current and future industry trends, growth patterns, as well as it offers business strategies to helps the stakeholders in making sound decisions that may help to ensure the profit trajectory over the forecast years.

Buy Complete Assessment of Insolvency Software market Now @ https://www.htfmarketintelligence.com/buy-now?format=1&report=12099?utm_source=Sweety_OpenPR&utm_id=Sweety

Geographically, the detailed analysis of consumption, revenue, market share, and growth rate of the following regions:

• The Middle East and Africa (South Africa, Saudi Arabia, UAE, Israel, Egypt, etc.)

• North America (United States, Mexico & Canada)

• South America (Brazil, Venezuela, Argentina, Ecuador, Peru, Colombia, etc.)

• Europe (Turkey, Spain, Turkey, Netherlands Denmark, Belgium, Switzerland, Germany, Russia UK, Italy, France, etc.)

• Asia-Pacific (Taiwan, Hong Kong, Singapore, Vietnam, China, Malaysia, Japan, Philippines, Korea, Thailand, India, Indonesia, and Australia).

Objectives of the Report

• To carefully analyze and forecast the size of the Insolvency Software market by value and volume.

• To estimate the market shares of major segments of the Insolvency Software

• To showcase the development of the Insolvency Software market in different parts of the world.

• To analyze and study micro-markets in terms of their contributions to the Insolvency Software market, their prospects, and individual growth trends.

• To offer precise and useful details about factors affecting the growth of the Insolvency Software

• To provide a meticulous assessment of crucial business strategies used by leading companies operating in the Insolvency Software market, which include research and development, collaborations, agreements, partnerships, acquisitions, mergers, new developments, and product launches.

Have a query? Market an enquiry before purchase @ https://www.htfmarketintelligence.com/enquiry-before-buy/global-insolvency-software-market?utm_source=Sweety_OpenPR&utm_id=Sweety

Major highlights from Table of Contents:

Insolvency Software Market Study Coverage:

• It includes major manufacturers, emerging player's growth story, and major business segments of Insolvency Software market, years considered, and research objectives. Additionally, segmentation on the basis of the type of product, application, and technology.

• Insolvency Software Market Executive Summary: It gives a summary of overall studies, growth rate, available market, competitive landscape, market drivers, trends, and issues, and macroscopic indicators.

• Insolvency Software Market Production by Region Insolvency Software Market Profile of Manufacturers-players are studied on the basis of SWOT, their products, production, value, financials, and other vital factors.

• Key Points Covered in Insolvency Software Market Report:

• Insolvency Software Overview, Definition and Classification Market drivers and barriers

• Insolvency Software Market Competition by Manufacturers

• Insolvency Software Capacity, Production, Revenue (Value) by Region (2024-2030)

• Insolvency Software Supply (Production), Consumption, Export, Import by Region (2024-2030)

• Insolvency Software Production, Revenue (Value), Price Trend by Type {}

• Insolvency Software Market Analysis by Application {Compliance, Creditor management, Document management, Financial transaction management, Reporting, Others}

• Insolvency Software Manufacturers Profiles/Analysis Insolvency Software Manufacturing Cost Analysis, Industrial/Supply Chain Analysis, Sourcing Strategy and Downstream Buyers, Marketing

• Strategy by Key Manufacturers/Players, Connected Distributors/Traders Standardization, Regulatory and collaborative initiatives, Industry road map and value chain Market Effect Factors Analysis.

Browse Complete Summary and Table of Content @ https://www.htfmarketintelligence.com/report/global-insolvency-software-market?utm_source=Sweety_OpenPR&utm_id=Sweety

Key questions answered

• How feasible is Insolvency Software market for long-term investment?

• What are influencing factors driving the demand for Insolvency Software near future?

• What is the impact analysis of various factors in the Global Insolvency Software market growth?

• What are the recent trends in the regional market and how successful they are?

Thanks for reading this article; you can also get individual chapter-wise sections or region-wise report versions like North America, LATAM, Europe, or Southeast Asia.

Nidhi Bhawsar (PR & Marketing Manager)

HTF Market Intelligence Consulting Private Limited

Phone: +15075562445

sales@htfmarketreport.com

About Author:

HTF Market Intelligence Consulting is uniquely positioned to empower and inspire with research and consulting services to empower businesses with growth strategies, by offering services with extraordinary depth and breadth of thought leadership, research, tools, events, and experience that assist in decision-making.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Insolvency Software Market Growth Outlook Beyond 2024 | Thomson Reuters Corporation, CaseWare International here

News-ID: 3635865 • Views: …

More Releases from HTF Market Intelligence Consulting Pvt. Ltd.

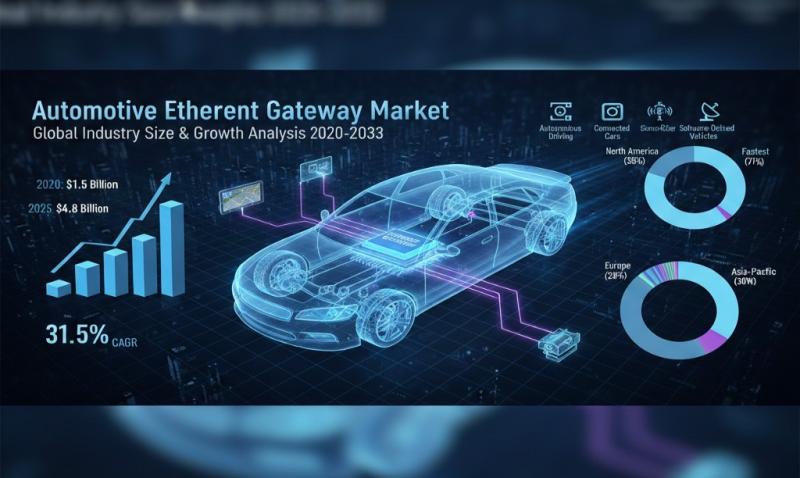

Automotive Ethernet Gateway Market - Global Industry Size & Growth Analysis 2020 …

The latest study released on the Global Automotive Ethernet Gateway Market by HTF MI Research evaluates market size, trend, and forecast to 2033. The Automotive Ethernet Gateway study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about the competitors.

Consider…

Aluminum Coils Market - Global Industry Size & Growth Analysis 2020-2033

The latest study released on the Global Aluminum Coils Market by HTF MI Research evaluates market size, trend, and forecast to 2033. The Aluminum Coils study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about the competitors.

Consider how these…

Hot Honey Drizzle Market Hits New High | Major Giants Nature Nate's, The Honey P …

The latest study released on the Global Hot Honey Drizzle Market by HTF MI Research evaluates market size, trend, and forecast to 2033. The Hot Honey Drizzle study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analysed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about the competitors.

Consider…

AI Document Generator Market May See a Big Move | Major Giants Google (USA), SAP …

The latest study released on the Global AI Document Generator Market by HTF MI Research evaluates market size, trend, and forecast to 2033. The AI Document Generator study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analysed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about the competitors.

Consider…

More Releases for Insolvency

Macmillan Lawyers and Advisors Launch Insolvency Support Services for Brisbane B …

Australia, 24th Oct 2025 - Macmillan Lawyers and Advisors, a respected Brisbane law firm, has introduced a dedicated insolvency support service designed to assist local businesses experiencing financial distress. The initiative enhances the firm's existing range of commercial and legal advisory services, ensuring that organisations receive professional guidance during financially challenging periods.

The new insolvency support services have been developed in response to growing demand for specialist legal assistance in navigating…

Corporate Insolvency Service Market: Major Trends Reshaping the Future of the In …

Use code ONLINE30 to get 30% off on global market reports and stay ahead of tariff changes, macro trends, and global economic shifts.

What Is the Expected CAGR for the Corporate Insolvency Service Market Through 2025?

The market size of the corporate insolvency service has seen significant growth in the past few years. The projected growth from $11.55 billion in 2024 to $12.45 billion in 2025, with a compound annual growth rate…

Insolvency Software Market Size, Future Opportunities, Emerging Trends, Top Comp …

Insolvency Software Market by Offering (Solutions, Services), Organization Size (Large Enterprises, & SMEs), Application (Document Management, Financial Transaction Management, Reporting, Compliance, Creditor Management), Vertical - Global Forecast to 2028.

The Insolvency Software market [https://www.marketsandmarkets.com/Market-Reports/insolvency-software-market-217636399.html?utm_campaign=insolvencysoftwaremarket&utm_source=abnewswire.com&utm_medium=paidpr] is expected to grow from USD 1.5 billion in 2023 to USD 2.4 billion by 2028, registering a compound annual growth rate (CAGR) of 10.4% during the forecast period. Government initiatives aimed at promoting digitalization across key…

Leading Growth Driver in the Insolvency Software Market in 2025: The Pivotal Rol …

What market dynamics are playing a key role in accelerating the growth of the insolvency software market?

The insolvency software market is projected to expand due to an increase in corporate bankruptcies. When a business encounters significant financial hardship and is unable to meet its monetary commitments, it often results in legal interventions for debt resolution, also known as corporate bankruptcies. Insolvency software is a tool that helps firms effectively manage…

McJu§tice buys insolvency claims with immediate effect

It is already annoying when you have claims against third parties. It is even worse when the debtor files for insolvency.

This raises the question: should you throw good money after bad?

Insolvency proceedings are complicated and often very lengthy.

Lawyers are expensive and it often takes a long time to process insolvencies due to the high workload. Creditors often only receive their quota after several years.

If you have legal expenses insurance, you…

McJustice - the voice of insolvency creditors

Insolvency law is a complex topic in Germany. Creditors in insolvency are often overwhelmed by the many unanswered questions and complex issues. For this reason, many creditors take their claims to a lawyer.

The lawyer incurs high costs, which are not economically worthwhile, especially for small claims.

Insolvency law in Germany has been modernized since July 2024. It is now possible to submit the claim to the insolvency administrator using an electronic…