Press release

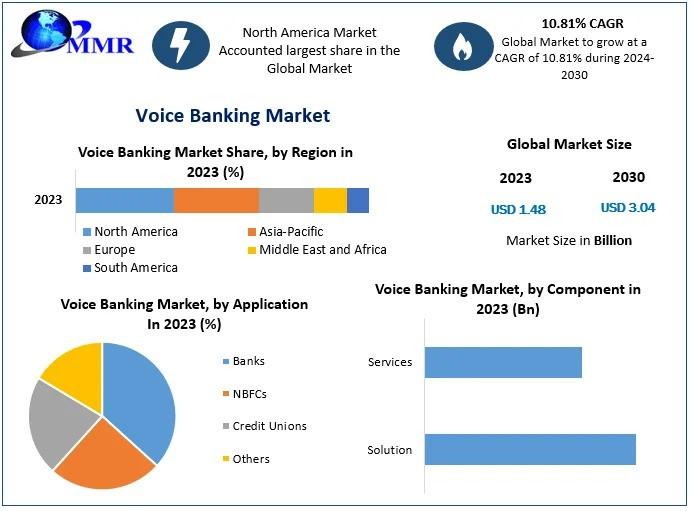

Voice Banking Market Drivers Shaping Future Growth, Revenue CAGR 10.81 % At USD 3.04 Billion by 2030

Anticipated Growth in Revenue:Voice Banking Market was valued at USD 1.48 Billion in 2024 globally and is expected to reach USD 3.04 Billion by 2030, exhibiting a CAGR of 10.81 % during the forecast period (2024-2030)

Voice Banking Market Overview:

The Voice Banking Market, valued at USD 1.48 billion in 2024, is projected to expand to USD 3.04 billion by 2030, with a robust CAGR of 10.81% during the forecast period. This growth reflects the rising adoption of voice-powered technology in banking, driven by increased demand for convenient, secure, and accessible banking services. As fintech companies, startups, and traditional banks vie for clients within this evolving ecosystem, voice banking is transforming the financial landscape by enhancing operational efficiency and customer experience through advanced voice management systems.

𝐃𝐢𝐯𝐞 𝐢𝐧𝐭𝐨 𝐭𝐡𝐞 𝐋𝐚𝐭𝐞𝐬𝐭 𝐓𝐫𝐞𝐧𝐝𝐬: 𝐅𝐫𝐞𝐞 𝐒𝐚𝐦𝐩𝐥𝐞 𝐑𝐞𝐩𝐨𝐫𝐭 𝐀𝐯𝐚𝐢𝐥𝐚𝐛𝐥𝐞 𝐟𝐨𝐫 𝐑𝐞𝐪𝐮𝐞𝐬𝐭: https://www.maximizemarketresearch.com/request-sample/169729/

What are Voice Banking Market Dynamics?

Key drivers of the Voice Banking Market include the rapid advancement of AI technology and the increasing integration of voice-activated systems in banking. AI-driven voice technology enhances security through biometric authentication, improves accessibility by enabling 24/7 banking services, and streamlines financial transactions. The growing emphasis on seamless and contactless banking solutions, coupled with the need to reduce operational costs and improve service efficiency, propels the adoption of voice banking solutions across the industry.

Voice Banking Market Trends:

Current trends in the Voice Banking Market highlight the surge in consumer adoption of voice-activated banking services, driven by the widespread use of digital assistants like Siri and Alexa. There is a noticeable shift towards integrating natural language processing and text-to-speech technologies to create more intuitive and responsive voice interfaces. The rise of voice-based payment systems and the increasing focus on personalized customer interactions are shaping the market dynamics, with a growing emphasis on enhancing user experience and operational efficiency.

𝐍𝐞𝐞𝐝 𝐃𝐞𝐭𝐚𝐢𝐥𝐞𝐝 𝐌𝐚𝐫𝐤𝐞𝐭 𝐈𝐧𝐬𝐢𝐠𝐡𝐭𝐬? 𝐆𝐞𝐭 𝐢𝐧 𝐓𝐨𝐮𝐜𝐡 𝐚𝐧𝐝 𝐋𝐞𝐭'𝐬 𝐄𝐱𝐩𝐥𝐨𝐫𝐞 𝐓𝐨𝐠𝐞𝐭𝐡𝐞𝐫: https://www.maximizemarketresearch.com/inquiry-before-buying/169729/

Voice Banking Market Opportunities:

The Voice Banking Market presents significant opportunities through the expansion of voice authentication for visually impaired customers and the removal of language barriers via live translation. These innovations enable banks to cater to a broader customer base and enhance financial accessibility. Additionally, the adoption of voice banking can help financial institutions overcome limitations of outdated core banking technologies and gain a competitive edge by leveraging advanced voice features to attract and retain clients.

What is Voice Banking Market Regional Insight?

North America currently holds the largest share of the Voice Banking Market, driven by high consumer adoption of voice technology and contactless payment solutions. The region's strong market presence is bolstered by significant investments in voice-based banking technologies. Meanwhile, the APAC region is anticipated to experience substantial growth, fueled by increasing awareness of voice-based payments and active initiatives to promote their adoption in countries like China, India, and Japan.

𝐒𝐭𝐚𝐲 𝐔𝐩𝐝𝐚𝐭𝐞𝐝: 𝐑𝐞𝐪𝐮𝐞𝐬𝐭 𝐘𝐨𝐮𝐫 𝐂𝐨𝐦𝐩𝐥𝐢𝐦𝐞𝐧𝐭𝐚𝐫𝐲 𝐒𝐚𝐦𝐩𝐥𝐞 𝐑𝐞𝐩𝐨𝐫𝐭 𝐍𝐨𝐰: https://www.maximizemarketresearch.com/request-sample/169729/

What is Voice Banking Market Segmentation?

by Component

Solution

Services

by Deployment Mode

On-Premise

Cloud

by Technology

Large Enterprises

Small and Medium-sized Enterprises

by Application

Banks

NBFCs

Credit Unions

Others

by Technology

Machine Learning

Deep Learning

Natural Language Processing

Others

Some of the current players in the Voice Banking Market are:

1. U.S. Bank (US)

2. Citigroup (US)

3. Axis Bank(India)

4. HSBC (UK)

5. NatWest Group (UK)

6. IndusInd Bank (India)

7. BankBuddy (India)

8. Central 1 Credit Union (Canada)

9. ICICI bank (India)

10. United Bank of India (India)

11. DBS Bank (Singapore)

12. Acapela Group. (Belgium)

13. Emirates NBD Bank (UAE)

𝐀𝐜𝐜𝐞𝐬𝐬 𝐈𝐧-𝐃𝐞𝐩𝐭𝐡 𝐀𝐧𝐚𝐥𝐲𝐬𝐢𝐬 𝐟𝐫𝐨𝐦 𝐎𝐮𝐫 𝐋𝐚𝐭𝐞𝐬𝐭 𝐑𝐞𝐩𝐨𝐫𝐭: https://www.maximizemarketresearch.com/market-report/voice-banking-market/169729/

Key Offerings:

Past Market Size and Competitive Landscape

Voice Banking Market Size, Share, Size & Forecast by different segment

Market Dynamics - Growth Drivers, Restraints, Opportunities, and Key Trends by region

Voice Banking Market Segmentation - A detailed analysis by Product

Competitive Landscape - Profiles of selected key players by region from a strategic perspective

Competitive landscape - Market Leaders, Market Followers, Regional player

Competitive benchmarking of key players by region

PESTLE Analysis

PORTER's analysis

Value chain and supply chain analysis

Legal Aspects of business by region

Lucrative business opportunities with SWOT analysis

Recommendations

Explore our top-performing reports on the latest trends:

♦Food Waste Disposers Market https://www.maximizemarketresearch.com/market-report/global-food-waste-disposers-market/84654/

♦Global Golf Cart Unit Production Market https://www.maximizemarketresearch.com/market-report/global-golf-cart-unit-production-market/54595/

♦Traction Battery Market https://www.maximizemarketresearch.com/market-report/traction-battery-market/145881/

♦Solid Sulfur Market https://www.maximizemarketresearch.com/market-report/solid-sulfur-market/168618/

♦Non-fused Switch Disconnectors Market https://www.maximizemarketresearch.com/market-report/global-non-fused-switch-disconnectors-market/29014/

♦Global Advanced Cinema Projector Market https://www.maximizemarketresearch.com/market-report/global-advanced-cinema-projector-market/33986/

♦Global Proximity and Displacement Sensors Market https://www.maximizemarketresearch.com/market-report/global-proximity-displacement-sensors-market/2998/

♦Global Automotive Hydrostatic Fan Drive System Market https://www.maximizemarketresearch.com/market-report/automotive-hydrostatic-fan-drive-system-market/11203/

♦Global Marine Gensets Market https://www.maximizemarketresearch.com/market-report/global-marine-gensets-market/34861/

♦Global Hybrid Solar Wind Market https://www.maximizemarketresearch.com/market-report/global-hybrid-solar-wind-market/11722/

Contact Maximize Market Research:

MAXIMIZE MARKET RESEARCH PVT. LTD.

⮝ 444 West Lake Street, Floor 17,

Chicago, IL, 60606, USA.

✆ +1 800 507 4489

✆ +91 9607365656

🖂 mailto:sales@maximizemarketresearch.com

🌐 https://www.maximizemarketresearch.com

About Maximize Market Research:

Maximize Market Research is one of the fastest-growing market research and business consulting firms serving clients globally. Our revenue impact and focused growth-driven research initiatives make us a proud partner of majority of the Fortune 500 companies. We have a diversified portfolio and serve a variety of industries such as IT & telecom, chemical, food & beverage, aerospace & defense, healthcare and others.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Voice Banking Market Drivers Shaping Future Growth, Revenue CAGR 10.81 % At USD 3.04 Billion by 2030 here

News-ID: 3624083 • Views: …

More Releases from Maximize Market Research Pvt. Ltd.

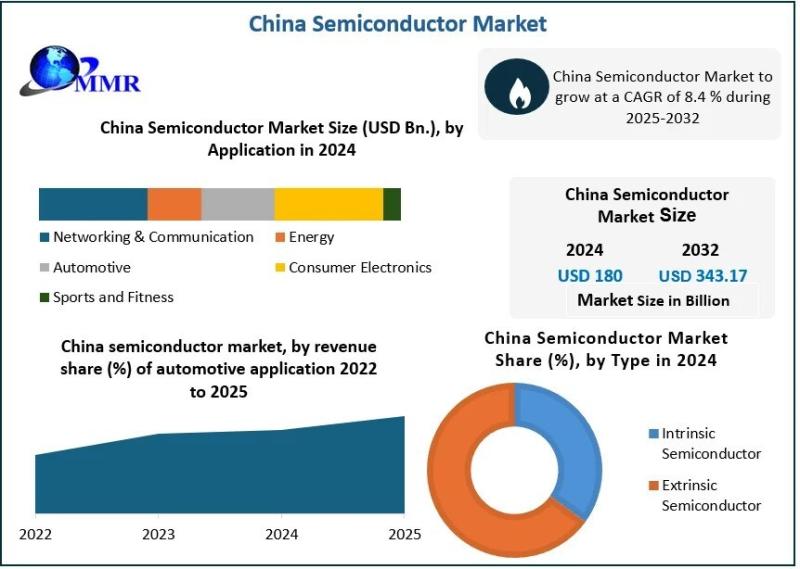

China Semiconductor Market Analysis: Projected to Grow from USD 180 Billion in 2 …

China Semiconductor Market size was valued at USD 180 Bn. in 2024, and the total China Semiconductor revenue is expected to grow by 8.4 % from 2025 to 2032, reaching nearly USD 343.17 Bn.

china-semiconductor-market Overview:

The China semiconductor market is one of the largest and most dynamic in the world, driving significant growth in the global tech industry. As China continues to expand its influence in high-tech manufacturing, the semiconductor market…

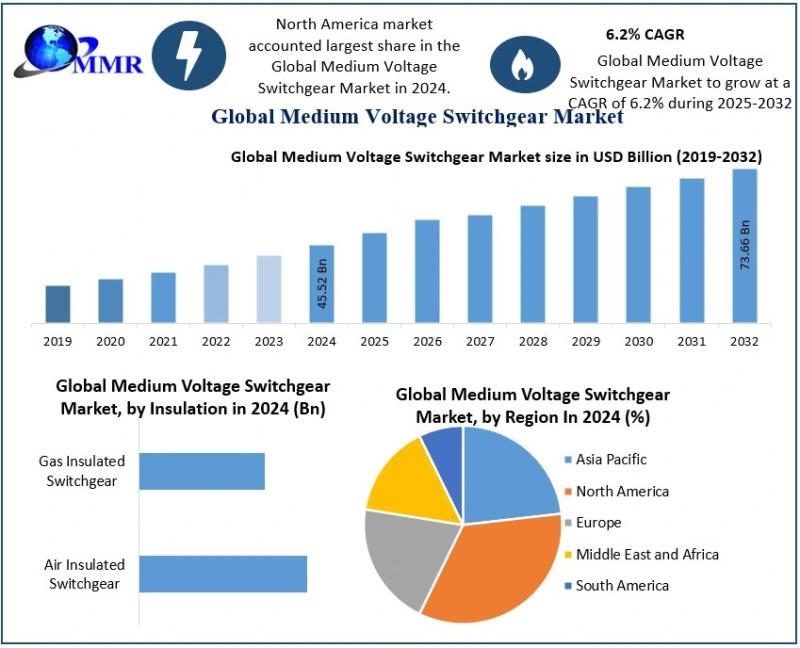

Medium Voltage Switchgear Market Analysis: 6.2% CAGR Driving Growth from USD 48. …

Medium Voltage Switchgear Market size was valued at USD 48.34 Billion in 2025 and the total Medium Voltage Switchgear revenue is expected to grow at a CAGR of 6.2% from 2025 to 2032, reaching nearly USD 73.65 Billion by 2032.

Medium-voltage Switchgear Market Overview:

The medium-voltage switchgear market plays a pivotal role in the global energy distribution landscape. These switchgear devices, typically operating between 1 kV and 72.5 kV, are critical for…

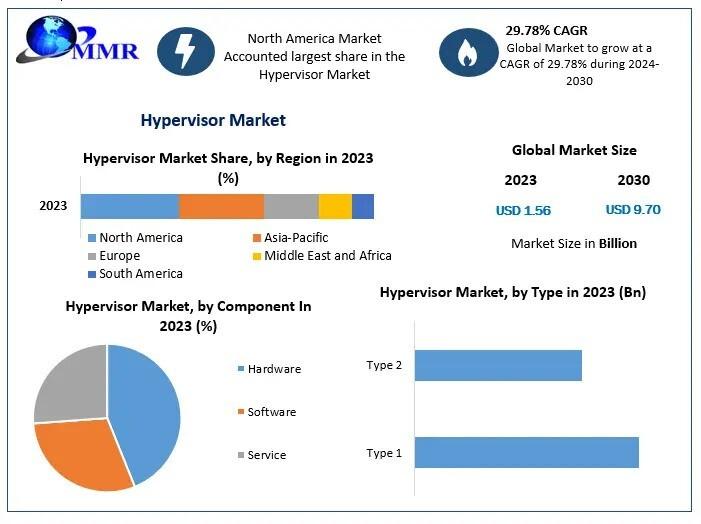

Hypervisor Market Analysis 2025-2030: Growth Rate of 29.78% and Market Value of …

Hypervisor Market size is estimated to grow at a CAGR of 29.78%. The market is expected to reach a value of US $ 9.70 Bn. in 2030.

Hypervisor Market Overview:

The hypervisor market, a critical component of virtualization technology, plays an essential role in the expansion of cloud computing, data centers, and IT infrastructure. By enabling multiple operating systems to run concurrently on a single physical machine, hypervisors streamline resource allocation and…

Cider Market Poised for Steady Growth, Expected to Reach USD 26.90 Billion by 20 …

The global Cider Market is witnessing a significant transformation driven by evolving consumer preferences, premiumization trends, and innovation in flavors and formats. Valued at USD 17.42 Billion in 2025, the market is projected to grow at a compound annual growth rate (CAGR) of 6.4% from 2025 to 2032, reaching nearly USD 26.90 Billion by 2032. This growth reflects cider's rising appeal as a refreshing, gluten-free, and lower-calorie alcoholic beverage alternative…

More Releases for Bank

Mortgage-Backed Security Market 2022: Industry Manufacturers Forecasts- Construc …

The Mortgage-Backed Security research report is the professional report with the premium insights which includes the size of the business, the ongoing patterns, drivers, dangers, conceivable outcomes and primary segments. The Market Report predicts the future progress of the Mortgage-Backed Security market based on accurate estimations. Furthermore, the report offers actionable insights into the future growth of the market based on inputs from industry experts to help readers formulate effective…

Doorstep Banking Services Market Challenges and Opportunities in Banking Service …

Doorstep banking is a facility provided so that user don't have to visit bank branches for routine banking activities like cash deposit, cash withdrawal, cheque deposit, or making a demand draft. The bank extends these facilities at user work place by appointing a service provider on your behalf.

This service was earlier available only to senior citizens but it is available to everyone with nominal fee charges, depending on the type…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank of …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance,…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank o …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance, regulatory, and other…