Press release

Tax Management Market Forecast: Predicted 10.52% CAGR to Elevate Sector to USD 61.59 Billion By 2032

Tax Management Market size was valued at USD 22.69 billion in 2022. The tax management industry is projected to grow to USD 61.59 billion by 2032, exhibiting a compound annual growth rate (CAGR) of 10.52% during the forecast period (2023 - 2032).Compliance with income tax laws and regulations is known as tax management. Penalties, prosecution, appeals, tax revision, and problem-solving are all included in tax management. Tax management's goals include keeping tax expenses to a minimum and making sure deadlines for complying with tax laws are met. Every industry is impacted by digitalization, and corporate practices are evolving swiftly. Financial transactions are shifting from cash to cashless transactions as a result of digitization.

𝐑𝐞𝐪𝐮𝐞𝐬𝐭 𝐅𝐨𝐫 𝐚 𝐒𝐚𝐦𝐩𝐥𝐞 𝐰𝐢𝐭𝐡 𝐀𝐧 𝐄𝐱𝐜𝐥𝐮𝐬𝐢𝐯𝐞 𝐋𝐨𝐨𝐤 𝐚𝐭 𝐭𝐡𝐞 𝐋𝐚𝐭𝐞𝐬𝐭 𝐓𝐫𝐞𝐧𝐝𝐬 𝐚𝐧𝐝 𝐔𝐩𝐜𝐨𝐦𝐢𝐧𝐠 𝐀𝐝𝐯𝐚𝐧𝐜𝐞𝐦𝐞𝐧𝐭𝐬: https://www.polarismarketresearch.com/industry-analysis/tax-management-market/request-for-sample

𝐆𝐫𝐨𝐰𝐭𝐡 𝐃𝐫𝐢𝐯𝐞𝐫𝐬 𝐚𝐧𝐝 𝐎𝐩𝐩𝐨𝐫𝐭𝐮𝐧𝐢𝐭𝐢𝐞𝐬:

● Corporate globalization has led to an increase in demand for tax administration software capable of handling complex cross-border tax compliance needs.

● Cloud-based tax administration software is becoming increasingly popular because of its greater flexibility, scalability, and cost. Increased corporate investment in technology is driving the growth of the tax management software industry, which helps businesses improve their tax administration practices.

𝐊𝐞𝐲 𝐏𝐥𝐚𝐲𝐞𝐫𝐬:

In this extremely competitive industry, major rivals constantly innovate and differentiate their products in an effort to take the lead in the market. Here is the list of the leading companies operating in the tax management market:

• Thomson Reuters

• Intuit H&R Block

• Avalara

• Wolters Kluwer NV

• Sovos Compliance

• LLC

• HRB Digital LLC

• Blucora Inc.

• Automatic Data Processing

• Taxback International

• Vertex Inc.

• Sailotech

• TaxSlayer LLC

• SAP SE

• Defmacro Software

• Xero

• Drake Enterprises

• TaxJar

• Webgility

• SafeSend

• EXEMPTAX

• Shoeboxed and SAXTAX

𝐏𝐮𝐫𝐜𝐡𝐚𝐬𝐞 𝐓𝐡𝐢𝐬 𝐏𝐫𝐞𝐦𝐢𝐮𝐦 𝐑𝐞𝐬𝐞𝐚𝐫𝐜𝐡 𝐑𝐞𝐩𝐨𝐫𝐭 𝐚𝐭: https://www.polarismarketresearch.com/buy/1157/2

𝐓𝐚𝐱 𝐌𝐚𝐧𝐚𝐠𝐞𝐦𝐞𝐧𝐭 𝐌𝐚𝐫𝐤𝐞𝐭 𝐑𝐞𝐩𝐨𝐫𝐭 𝐇𝐢𝐠𝐡𝐥𝐢𝐠𝐡𝐭𝐬

• Software segment garnered the largest share, owing the trend of shifting towards digital tax processes & the automation solutions provided by the software.

• Direct Tax segment is expected to grow at a high CAGR during the forecast period. These software help file multiple types of return and thereby streamline the compliances.

• Cloud segment accounted for the largest market share in 2022 due to their benefits such as recording every transaction. A special dedicated IT staff is not required for cloud deployment.

• North America is the largest market due to the presence of many small and large players in the region. Moreover, most of the companies in the region outsource tax related services to third party entities to focus on its core businesses

𝐀𝐩𝐩𝐥𝐢𝐜𝐚𝐭𝐢𝐨𝐧𝐬

• Tax Compliance: Ensuring that all tax filings are accurate and submitted on time, adhering to all relevant regulations and standards.

• Tax Planning and Strategy: Helping businesses plan their tax strategies to minimize liabilities and take advantage of available deductions and credits.

• Tax Reporting: Generating accurate and comprehensive tax reports for internal use and regulatory compliance.

𝐁𝐫𝐨𝐰𝐬𝐞 𝐅𝐮𝐥𝐥 𝐑𝐞𝐩𝐨𝐫𝐭: https://www.polarismarketresearch.com/industry-analysis/tax-management-market

𝐒𝐞𝐠𝐦𝐞𝐧𝐭𝐚𝐭𝐢𝐨𝐧 𝐎𝐯𝐞𝐫𝐯𝐢𝐞𝐰:

The tax management market is mainly segmented based on component, tax type, deployment, organization size, vertical, and region. Based on the component research, the software segment led the market in 2022 and is likely to maintain its dominance throughout the forecast period. Tax administration software enables businesses to generate and manage audit reports and payments, file tax returns, and handle large volumes of financial transaction data.

Furthermore, according to tax type, the direct tax category is predicted to increase at the fastest CAGR over the forecast period. Direct tax is paid directly to the entity that imposes the tax, which is the government.

𝐌𝐨𝐫𝐞 𝐓𝐫𝐞𝐧𝐝𝐢𝐧𝐠 𝐑𝐞𝐩𝐨𝐫𝐭𝐬 𝐛𝐲 𝐏𝐨𝐥𝐚𝐫𝐢𝐬 𝐌𝐚𝐫𝐤𝐞𝐭 𝐑𝐞𝐬𝐞𝐚𝐫𝐜𝐡:

NLP in Finance Market: https://www.polarismarketresearch.com/industry-analysis/nlp-in-finance-market

Mobile Threat Defense Market: https://www.polarismarketresearch.com/industry-analysis/mobile-threat-defense-market

Microprocessor Market: https://www.polarismarketresearch.com/industry-analysis/microprocessor-market

Game-Based Learning Market: https://www.polarismarketresearch.com/industry-analysis/game-based-learning-market

𝐂𝐨𝐧𝐭𝐚𝐜𝐭 𝐈𝐧𝐟𝐨:

Polaris Market Research

Phone: +1-929-297-9727

Email: sales@polarismarketresearch.com

𝐀𝐛𝐨𝐮𝐭 𝐔𝐬:

Polaris Market Research is a worldwide market research and consulting organization. We give unmatched nature of offering to our customers present all around the globe across industry verticals. Polaris Market Research has expertise in giving deep-dive market insight along with market intelligence to our customers spread crosswise over various undertakings. We at Polaris are obliged to serve our different client base present over the enterprises of medicinal services, healthcare, innovation, next-gen technologies, semi-conductors, chemicals, automotive, and aerospace & defence, among different ventures present globally.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Tax Management Market Forecast: Predicted 10.52% CAGR to Elevate Sector to USD 61.59 Billion By 2032 here

News-ID: 3599760 • Views: …

More Releases from Polaris Market Research & Consulting

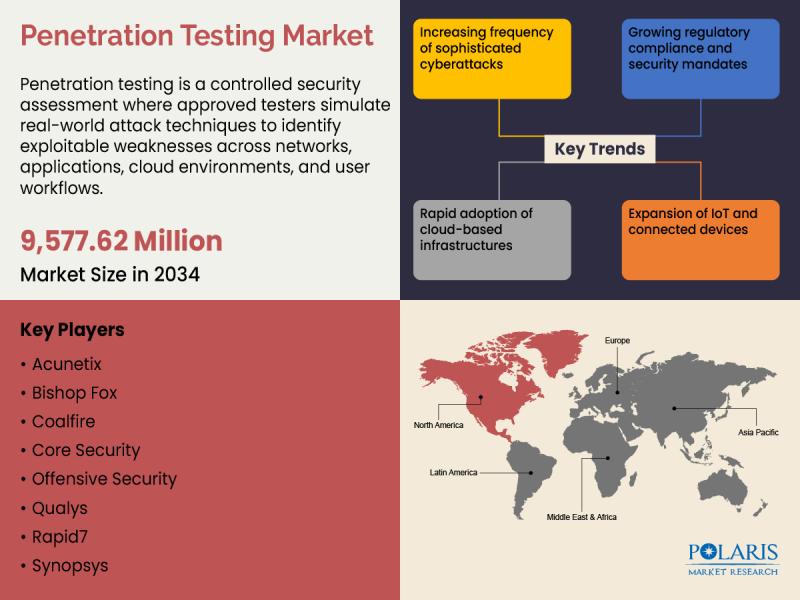

Global Penetration Testing Market Projected to Hit USD 9,577.62 Million by 2034 …

Polaris Market Research recently introduced the latest update on Penetration Testing Market that provides an extensive outlook of the market, analyzing key growth opportunities, challenges, risk factors, and emerging trends across diverse geographic regions. The report offers a definitive and meticulous analysis of the Penetration Testing Market size, share, demand, key growth factors, segmentation, country-level overview, and forecast.

The report helps businesses get a thorough understanding of the industry landscape…

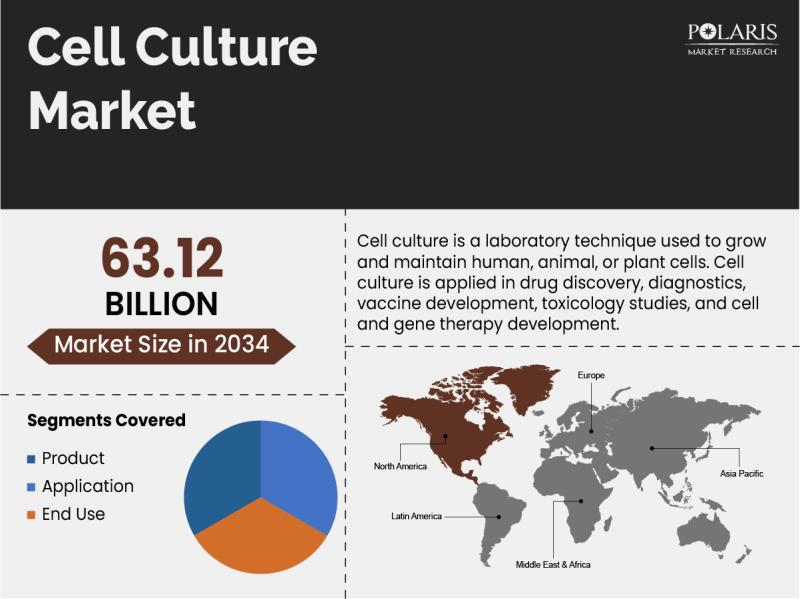

Cell Culture Market to Reach USD 63.12 Billion by 2034, Expanding at a CAGR of 1 …

Polaris Market Research recently introduced the latest update on Cell Culture Market that provides an extensive outlook of the market, analyzing key growth opportunities, challenges, risk factors, and emerging trends across diverse geographic regions. The report offers a definitive and meticulous analysis of the Cell Culture Market size, share, demand, key growth factors, segmentation, country-level overview, and forecast.

The report helps businesses get a thorough understanding of the industry landscape…

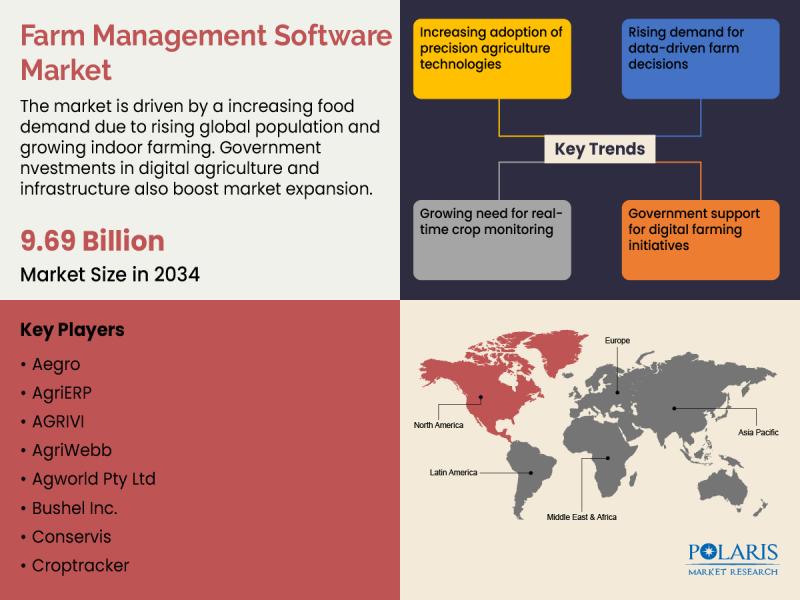

Farm Management Software Market Forecast 2026-2034: Growth Dynamics and Competit …

The quantitative market research report published by Polaris Market Research on Farm Management Software Market aims to educate users with an in-depth understanding of a rapidly growing market. The study details important facts and figures, expert opinions, and major developments across the globe. The research study serves as a vital source of information with the historical data, Farm Management Software market size, financial data, and projected future growth. All the…

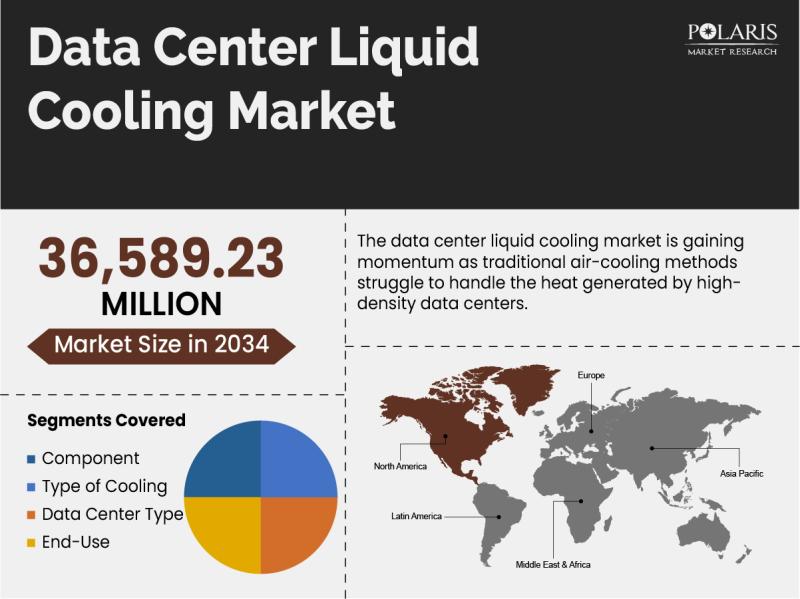

Future of the Data Center Liquid Cooling Market: Emerging Opportunities, Market …

The quantitative market research report published by Polaris Market Research on Data Center Liquid Cooling Market aims to educate users with an in-depth understanding of a rapidly growing market. The study details important facts and figures, expert opinions, and major developments across the globe. The research study serves as a vital source of information with the historical data, Data Center Liquid Cooling market size, financial data, and projected future growth.…

More Releases for Tax

Tax Accountant Launches Expert Tax Advisory Services for Complex UK Tax Issues

Birmingham, UK - Tax Accountant, a premier provider of tailored tax solutions, is proud to announce the introduction of its new Specialist Tax Advice service. Aimed at tackling the multifaceted tax challenges faced by individuals and businesses in the UK, this service is set to revolutionize how tax compliance and optimization are approached.

As tax laws become increasingly complex and the implications of non-compliance more severe, the need for specialized tax…

Legal Tax Defense Offers Tax Relief Services to Successfully Settle IRS Tax Debt …

Legal Tax Defense provides expert guidance and strategies to navigate IRS negotiations and reduce tax liabilities.

Legal Tax Defense, Inc., a premier provider of tax resolution services, is now providing strategic assistance and professional help for those who find IRS tax debt to be stressful and intimidating. The firm assists taxpayers in understanding their alternatives for efficiently managing and lowering tax liabilities by offering a range of specialist services.

"Handling IRS tax…

Legal Tax Defense Providing Strategic Assistance to Settle Tax Debts for Tax Pay …

Fulfill Tax Obligations and Prevent Legal Issues.

Legal Tax Defense, a premier firm specializing in tax resolution, proudly announces its updated services aimed at helping clients effectively settle their tax debts. With a focus on alleviating the financial and legal pressures associated with unpaid taxes, Legal Tax Defense offers a lifeline to individuals and businesses struggling with tax liabilities.

Understanding the options available for settling tax debts [https://www.legaltaxdefense.com/settling-tax-debts/] is crucial in taking…

Bidding At The Tax Sale - Tax Sale Success Masterclass with The Tax Lien Lady

Joanne Musa, founder of TaxLienLady.com is holding a Tax Sale Success Masterclass on Bidding at the Tax Sale on Thursday, November 10 at 7:00 pm Eastern Time.

Tax lien and tax deed investing can be very profitable. Tax Lien investors can earn interest rates that are much higher than current bank rates without the risk of the stock market. Joanne Musa, known online as the tax lien lady, has been helping…

Tax Software Market – Major Technology Giants in Buzz Again | TurboTax, Tax Sl …

The Latest Released Tax Software market study has evaluated the future growth potential of Global Tax Software market and provides information and useful stats on market structure and size. The report is intended to provide market intelligence and strategic insights to help decision makers take sound investment decisions and identify potential gaps and growth opportunities. Additionally, the report also identifies and analyses changing dynamics, emerging trends along with essential drivers,…

Tax Software Market to Eyewitness Massive Growth by 2026 | Tax Act, Tax Slayer, …

The latest independent research document on Global Tax Software examine investment in Market. It describes how companies deploying these technologies across various industry verticals aim to explore its potential to become a major business disrupter. The Tax Software study eludes very useful reviews & strategic assessment including the generic market trends, emerging technologies, industry drivers, challenges, regulatory policies that propel the market growth, along with major players profile and strategies.…