Press release

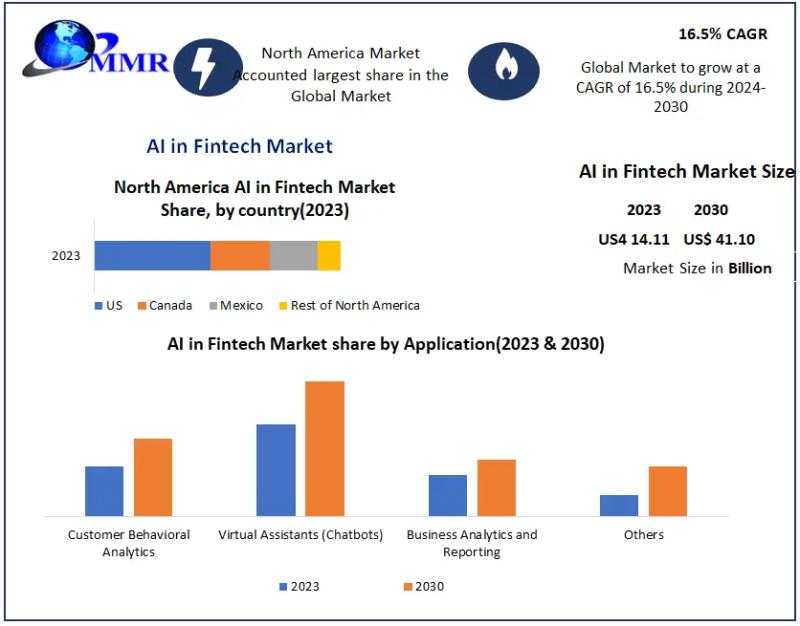

AI in Fintech Market Updates : Projected to Surpass USD 41.10 Billion by 2030

Forecast Increase in Revenue:AI in Fintech Market was valued at USD 14.11 Bn in 2023 and is expected to reach USD 41.10 Bn by 2030, at a CAGR of 16.5 percent during the forecast period.

AI in Fintech Market Overview:

The AI in Fintech market, valued at USD 14.11 billion in 2023, is projected to surge to USD 41.10 billion by 2030, reflecting a robust compound annual growth rate (CAGR) of 16.5%. This market encompasses the integration of advanced technologies such as machine learning and data analytics into financial services to enhance and automate processes. By leveraging AI, fintech solutions improve various financial operations, from fraud detection and compliance to customer service and personalized offerings. The sector's growth is driven by the increasing need for automation, advanced analytics, and enhanced customer experiences. Financial institutions and fintech companies alike are adopting AI to streamline operations and provide more tailored financial services, which is leading to a significant market expansion.

𝐘𝐨𝐮𝐫 𝐒𝐚𝐦𝐩𝐥𝐞 𝐑𝐞𝐩𝐨𝐫𝐭 𝐈𝐬 𝐉𝐮𝐬𝐭 𝐚 𝐂𝐥𝐢𝐜𝐤 𝐀𝐰𝐚𝐲! 𝐡𝐭𝐭𝐩𝐬 https://www.maximizemarketresearch.com/request-sample/30669/

Drivers in the AI in Fintech Market:

The AI in Fintech market is propelled by several key factors. One major driver is the push towards automation for operational efficiency. AI technologies, including machine learning and robotic process automation (RPA), streamline routine tasks such as transaction processing and customer service inquiries. This automation reduces costs and speeds up processes, allowing financial institutions to concentrate on more strategic areas. Additionally, the vast amounts of data generated daily in the financial sector are efficiently analyzed by AI, providing actionable insights for risk management, fraud detection, and customer engagement. The demand for personalized financial services also fuels market growth, as AI algorithms tailor financial products and advice to individual preferences and behaviors. Furthermore, AI helps in regulatory compliance by automating adherence processes, and enhances cybersecurity by detecting and preventing fraud through advanced algorithms.

AI in Fintech Market Trends:

Current trends in the AI in Fintech market highlight a shift towards more sophisticated and integrated solutions. The adoption of virtual assistants and chatbots is on the rise, as they enhance customer interactions and operational efficiency by automating routine tasks. Additionally, the use of AI in behavioral biometrics and fraud detection is becoming more prevalent, with advancements in machine learning improving the accuracy and speed of fraud detection systems. Another trend is the integration of AI with blockchain technology, aimed at enhancing transaction security and efficiency. As fintech companies increasingly leverage AI to provide personalized financial services, there is a growing emphasis on creating user-centric solutions that cater to individual financial needs and preferences.

𝐍𝐞𝐞𝐝 𝐌𝐨𝐫𝐞 𝐈𝐧𝐟𝐨𝐫𝐦𝐚𝐭𝐢𝐨𝐧? 𝐈𝐧𝐪𝐮𝐢𝐫𝐞 𝐀𝐛𝐨𝐮𝐭 𝐒𝐚𝐦𝐩𝐥𝐞 + 𝐆𝐫𝐚𝐩𝐡𝐬 𝐇𝐞𝐫𝐞:https://www.maximizemarketresearch.com/inquiry-before-buying/30669/

AI in Fintech Market Opportunities:

The AI in Fintech market presents numerous opportunities for growth. One significant opportunity lies in the continued development of AI-driven personalized financial services, which offer tailored advice and solutions based on individual user data. This can enhance customer satisfaction and loyalty. Additionally, the expanding use of AI in regulatory technology (Regtech) offers opportunities to streamline compliance processes and reduce the risk of regulatory penalties. The integration of AI with emerging technologies such as blockchain also presents new avenues for innovation, particularly in enhancing security and transaction efficiency. The market also benefits from the increasing investment and funding in fintech startups, which drives further innovation and adoption of AI solutions in the financial sector.

What is AI in Fintech Market Regional Insight?

North America holds a dominant position in the AI in Fintech market, largely due to its advanced technological infrastructure and significant investment in fintech innovations. The region's financial sector benefits from substantial venture capital and institutional funding, which supports the development and deployment of AI solutions. High-performance computing capabilities in the U.S. and Canada enable financial institutions to process and analyze large datasets in real time, improving decision-making and risk management. Additionally, North America's financial industry is leveraging AI to enhance customer interactions through personalized services and robust fraud detection systems. The emphasis on regulatory compliance and cybersecurity further drives the adoption of AI technologies in this region, solidifying its leading role in the global AI in Fintech market.

𝐂𝐮𝐫𝐢𝐨𝐮𝐬 𝐭𝐨 𝐩𝐞𝐞𝐤 𝐢𝐧𝐬𝐢𝐝𝐞? 𝐆𝐫𝐚𝐛 𝐲𝐨𝐮𝐫 𝐬𝐚𝐦𝐩𝐥𝐞 𝐜𝐨𝐩𝐲 𝐨𝐟 𝐭𝐡𝐢𝐬 𝐫𝐞𝐩𝐨𝐫𝐭 𝐧𝐨𝐰:https://www.maximizemarketresearch.com/request-sample/30669/

Segmentation Analysis of the AI in Fintech Market

by Component

Solutions

Software Tools

Platforms

Services

Managed

Professional

by Deployment Mode

Cloud

On-premises

by Application

Virtual Assistant (Chatbots)

Business Analytics and Reporting

Customer Behavioral Analytics

Others

Who is the largest manufacturers of AI in Fintech Market worldwide?

Global

1. IBM Corporation (New York, USA)

2. Microsoft Corporation (Washington, USA)

3. Google LLC (California, USA)

4. Amazon Web Services (AWS) (Washington, USA)

5. Palantir Technologies (Colorado, USA)

6. NVIDIA Corporation (California, USA)

North America:

1. JPMorgan Chase & Co. (New York, USA)

2. Goldman Sachs (New York, USA)

3. Wells Fargo & Co. (California, USA)

Asia Pacific:

1. Ant Group (Zhejiang, China)

2. Tencent Holdings Limited (Guangdong, China)

3. SoftBank Group Corp.( Tokyo, Japan)

Europe:

1. HSBC Holdings plc (London, United Kingdom)

2. BNP Paribas (Paris, France)

3. Santander Group(Madrid, Spain)

South America:

1. Itaú Unibanco (São Paulo, Brazil)

2. Banco Santander Brasil(São Paulo, Brazil)

Middle East & Africa (MEA):

1. Standard Bank Group (Johannesburg, South Africa)

2. First Abu Dhabi Bank (Abu Dhabi, United Arab Emirates)

𝐆𝐞𝐭 𝐃𝐢𝐬𝐜𝐨𝐮𝐧𝐭 𝐎𝐧 𝐓𝐡𝐞 𝐏𝐮𝐫𝐜𝐡𝐚𝐬𝐞 𝐎𝐟 𝐓𝐡𝐢𝐬 𝐑𝐞𝐩𝐨𝐫𝐭 @https://www.maximizemarketresearch.com/market-report/global-ai-in-fintech-market/30669/

Key Offerings:

Past Market Size and Competitive Landscape

AI in Fintech Market Size, Share, Size & Forecast by different segment

Market Dynamics - Growth Drivers, Restraints, Opportunities, and Key Trends by region

AI in Fintech Market Segmentation - A detailed analysis by Product

Competitive Landscape - Profiles of selected key players by region from a strategic perspective

Competitive landscape - Market Leaders, Market Followers, Regional player

Competitive benchmarking of key players by region

PESTLE Analysis

PORTER's analysis

Value chain and supply chain analysis

Legal Aspects of business by region

Lucrative business opportunities with SWOT analysis

Recommendations

Explore our top-performing reports on the latest trends:

♦ Voice Banking Market :https://www.linkedin.com/pulse/voice-banking-revolution-unveiling-usd-304-billion-market-jadhav-6veuf?trackingId=Rt2VMPJXToqu8RlGw4iRvQ%3D%3D&lipi=urn%3Ali%3Apage%3Ad_flagship3_profile_view_base_recent_activity_content_view%3BbdzwI860Rf6xmf05JXU3WA%3D%3D

♦ Education Apps Market https://www.maximizemarketresearch.com/market-report/global-education-apps-market/24428/

♦ Software as a Service (SaaS) Market https://www.maximizemarketresearch.com/market-report/software-as-a-service-saas-market/45115/

♦ Lawful Interception Market https://www.maximizemarketresearch.com/market-report/lawful-interception-market/187746/

♦ Address Verification Software Market https://www.maximizemarketresearch.com/market-report/address-verification-software-market/187921/

♦ Augmented Industrial Reality Market https://www.maximizemarketresearch.com/market-report/augmented-industrial-reality-market/189583/

♦ Text-to-Video AI Market https://www.maximizemarketresearch.com/market-report/text-to-video-ai-market/190642/

♦ High Density Interconnect Market https://www.maximizemarketresearch.com/market-report/global-high-density-interconnect-market/26294/

Contact Maximize Market Research:

MAXIMIZE MARKET RESEARCH PVT. LTD.

⮝ 3rd Floor, Navale IT park Phase 2,

Pune Banglore Highway, Narhe

Pune, Maharashtra 411041, India.

✆ +91 9607365656

🖂 sales@maximizemarketresearch.com

🌐 www.maximizemarketresearch.com

About Maximize Market Research:

Maximize Market Research is one of the fastest-growing market research and business consulting firms serving clients globally. Our revenue impact and focused growth-driven research initiatives make us a proud partner of majority of the Fortune 500 companies. We have a diversified portfolio and serve a variety of industries such as IT & telecom, chemical, food & beverage, aerospace & defense, healthcare and others.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release AI in Fintech Market Updates : Projected to Surpass USD 41.10 Billion by 2030 here

News-ID: 3599691 • Views: …

More Releases from MAXIMIZE MARKET RESEARCH PVT. LTD

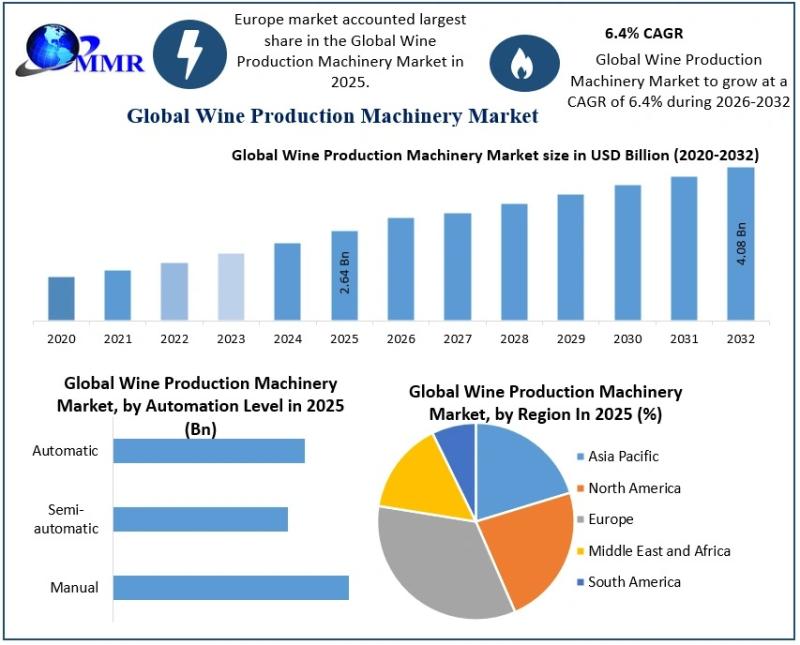

Wine Production Machinery Market Growing at a Robust CAGR of 6.4% Driven by Auto …

The Wine Production Machinery Market size was valued at USD 2.64 Billion in 2025 and the total Wine Production Machinery revenue is expected to grow at a CAGR of 6.4% from 2026 to 2032, reaching nearly USD 4.08 Billion by 2032.

Wine Production Machinery Market Overview:

The Wine Production Machinery Market is witnessing steady transformation as wineries across the globe increasingly adopt modern equipment to enhance efficiency, consistency, and product quality. From…

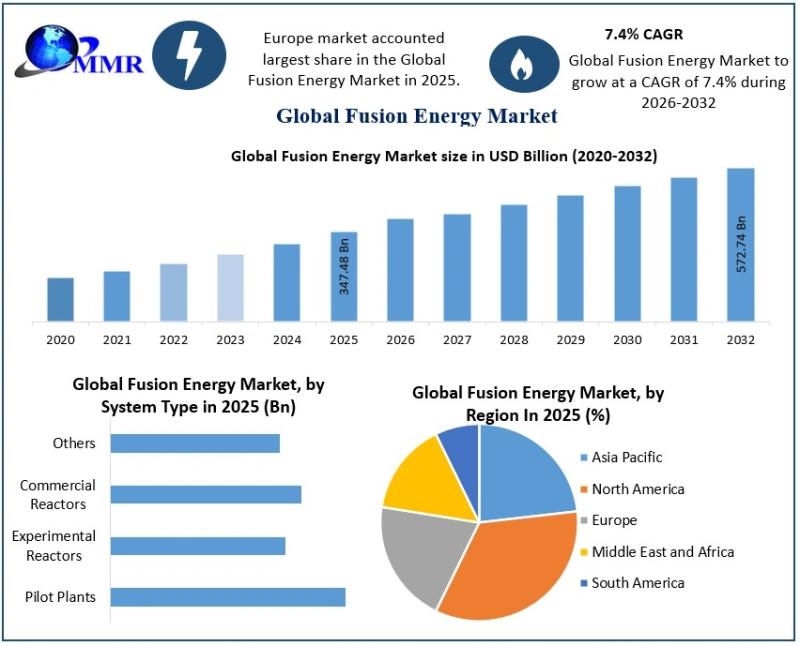

Fusion Energy Market Outlook Highlights Strong Growth at 7.4% CAGR

The Fusion Energy Market size was valued at USD 347.48 Billion in 2025 and the total Fusion Energy revenue is expected to grow at a CAGR of 7.4% from 2026 to 2032, reaching nearly USD 572.74 Billion by 2032.

Fusion Energy Market Overview:

The Fusion Energy Market is gaining global attention as nations, industries, and researchers intensify efforts to develop cleaner and more sustainable power alternatives for the future. Fusion energy is…

India Gold Loan Market Shows Strong Momentum Driven by Trust, Technology, and Fi …

The India Gold Loan Market size was valued at USD 67.40 Billion in 2024 and the total India Gold Loan Market is expected to grow at a CAGR of 12.30 % from 2025 to 2032, reaching nearly USD 170.49 Billion.

India Gold Loan Market Overview:

The India Gold Loan Market has steadily evolved into a trusted financial solution for individuals and small businesses seeking quick access to funds without liquidating their long-term…

Coffee Beans Market Trends Highlight Rising Demand for Specialty, Sustainable, a …

The Coffee Beans Market size was valued at USD 36.41 Billion in 2024 and the total Coffee Beans revenue is expected to grow at a CAGR of 6.8% from 2025 to 2032, reaching nearly USD 61.64 Billion.

Coffee Beans Market Overview:

The Coffee Beans Market reflects a complex ecosystem that begins at farms and extends to global distribution networks. Coffee beans are cultivated across diverse climatic regions, each contributing unique taste profiles…

More Releases for Fintech

EMBank Reinforces Fintech Leadership at Baltic Fintech Days 2025

As fintech innovation accelerates across Europe, Vilnius once again positioned itself as a central hub for forward-thinking financial dialogue during Baltic Fintech Days 2025. Held over two impactful days, the conference attracted over 1,000 stakeholders, bringing together startup leaders, financial institutions, regulators, and technology innovators from across the Baltics and beyond.

The event's agenda was shaped by more than 60 expert speakers who addressed emerging topics such as AI-powered banking, embedded…

Seoul Fintech Lab Accelerates Global Expansion with Participation in Singapore F …

Image: https://www.getnews.info/uploads/5b520c858c856e54cadb7d57558b7209.jpg

Seoul Fintech Lab successfully participated in the Singapore Fintech Festival from November 6 to 8, 2024. The event was organized to promote overseas investment and market entry for its resident, membership, and graduate companies, with a particular focus on Seoul-based fintech companies established within the last seven years.

A total of 10 companies participated in the event. The five resident companies were Antok, Whatssub, Ipxhop, MerakiPlace, and Korea Securities Lending,…

Seoul Fintech Lab and 2nd Seoul Fintech Lab Successfully Participate in Korea Fi …

Seoul Fintech Lab and 2nd Seoul Fintech Lab achieved great success by showcasing innovative solutions from 22 resident companies, attracting approximately 1,000 visitors to their booth during Korea Fintech Week 2024.

Image: https://www.getnews.info/uploads/e73eea3a5c8a6a46e5b43375b2a156be.jpg

Seoul Fintech Lab and the 2nd Seoul Fintech Lab jointly participated in the 'Korea Fintech Week 2024,' held at Dongdaemun Design Plaza (DDP) in Seoul, South Korea, from August 27 to 29. The event was a huge success, with…

FinTech in Insurance

The market for "FinTech in Insurance Market" is examined in this report, along with the factors that are expected to drive and restrain demand over the projected period.

Introduction to FinTech in Insurance Market Insights

The futuristic approach to gathering insights in the FinTech in Insurance sector integrates advanced technologies such as artificial intelligence, big data analytics, and blockchain. These tools enhance data collection from diverse sources, enabling insurers to gain deeper,…

BW Festival Of Fintech: A Comprehensive Fintech Colloquy

Business World’s Festival of Fintech is a two-day informative summit that will inform, illustrate and recognize the changes in the dynamic Fintech industry.

Business World brings forth Festival of Fintech, an exclusive conclave on Fintech innovation and growth on the 12th and 13th of February, 2021. The event will include expert panels and an industry award ceremony that recognizes excellence in all the ambits of the Fintech field.

The…

Bouchard Fintech

Information provided by Bouchard Fintech

The US, at least this current administration, has mystified its European Union business and political partners. The EU represents one of the very largest economies on the planet. The EU is also very much a trusted ally of the US. The EU market continues to be a fertile ground for US exports. So, it was quite a surprise that the US seemed to be picking a…