Press release

Whole Life Insurance Market Growth Factors, Opportunities, Upcoming Trends, Segmentation, Challenges

The new report published by The Business Research Company, titled ""Whole Life Insurance Global Market Report 2024 - Market Size, Trends, And Global Forecast 2024-2033"", delivers an in-depth analysis of the leading size and forecasts, investment opportunities, winning strategies, market drivers and trends, competitive landscape, and evolving market trends.As per the report, the whole life insurance market size has grown steadily in recent years. It will grow from $175.67 billion in 2023 to $180.58 billion in 2024 at a compound annual growth rate (CAGR) of 2.8%. The whole life insurance market size is expected to see steadily grown in the next few years. It will grow to $205.16 billion in 2028 at a compound annual growth rate (CAGR) of 3.2%.

Download Free Sample Report @ https://www.thebusinessresearchcompany.com/sample.aspx?id=2596&type=smp

The Rising Aging Population Is Anticipated To Fuel The Whole Life Insurance Market

The rising aging population is expected to propel the whole life insurance market. The aging population refers to a demographic shift characterized by a rising proportion or increase in the number of individuals within a society who are in the later stages of life, typically aged 65 and older. Whole life insurance serves as a financial planning tool for the aging population, offering lifetime coverage, cash value accumulation, and potential estate planning benefits. For instance, in October 2022, according to the World Health Organization, a Switzerland-based Intergovernmental organization, projected that by 2030, one out of every six individuals globally would be 60 years old or older. During this period, the proportion of the population aged 60 and over is expected to rise from 1 billion in 2020 to 1.4 billion. Furthermore, by the year 2050, the global population of individuals aged 60 and older is anticipated to double, reaching 2.1 billion. Therefore, the rising aging population is driving the growth of the whole life insurance market.

Technology Platform For The Whole Life Insurance Market

Major companies operating in whole life insurance are focusing on incorporating advanced technologies for simplified operations and strengthening their market position. For instance, in December 2022, Modern Life Insurance Group Inc., a US-based insurance group, announced the launch of its latest technology platform, where life insurance advisors can take advantage of a variety of cutting-edge tools and solutions from the new stack. These include the ability to manage all client and brokerage needs in one location, enhanced customer involvement, entirely digital applications, and comparison and pricing capabilities.

The whole life insurance market covered in this report is segmented -

1) By Type: Non-Participating Whole Life, Participating Whole Life

2) By Application: Agency, Brokers, Bancassurance, Digital And Direct Channels

Buy Now & Get Exclusive Discount on this Report, Checkout link @

https://www.thebusinessresearchcompany.com/Discount?id=2596&type=discount

Major companies operating in the whole life insurance market report are China Life Insurance Company Limited, MetLife Inc., Ping An Insurance Company of China Ltd., Allianz Life Insurance, Axa SA, Generali Group, Munich Re Group, Zurich Insurance Group Ltd., Nippon Life Insurance Company, Japan Post Holdings Company Ltd., Berkshire Hathaway Inc., Manulife Financial Corporation, China Pacific Insurance Co. Ltd., Chubb Corp., American International Group, Aviva Plc., Allstate Corporation, Swiss Reinsurance Company Ltd., Prudential Financial Inc., New York Life Insurance Company, Massachusetts Mutual Life Insurance Company, Guardian Life Insurance Company of America, Penn Mutual Life Insurance Company, Ohio National Life Insurance Company, State Farm Mutual Automobile Insurance Company, Pacific Life Insurance Company, John Hancock Financial Services, Principal Financial Group Inc., Nationwide Mutual Insurance Company, Thrivent Financial for Lutherans .

Contents of the report:

1. Executive Summary

2. Whole Life Insurance Market Report Structure

3. Whole Life Insurance Market Trends And Strategies

4. Whole Life Insurance Market - Macro Economic Scenario

5. Whole Life Insurance Market Size And Growth

…..

27. Whole Life Insurance Market Competitor Landscape And Company Profiles

28. Key Mergers And Acquisitions

29. Future Outlook and Potential Analysis

30. Appendix

Explore the report store to make a direct purchase of the report @ https://www.thebusinessresearchcompany.com/report/whole-life-insurance-global-market-report

Contact us:

The Business Research Company

Europe: +44 207 1930 708

Asia: +91 8897263534

Americas: +1 315 623 0293

Email: info@tbrc.info

Follow Us On:

LinkedIn: https://in.linkedin.com/company/the-business-research-company

Twitter: https://twitter.com/tbrc_info

Facebook: https://www.facebook.com/TheBusinessResearchCompany

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ

Blog: https://blog.tbrc.info/

Healthcare Blog: https://healthcareresearchreports.com/

Global Market Model: https://www.thebusinessresearchcompany.com/global-market-model

Latest Trending Press Releases: https://www.thebusinessresearchcompany.com/press-release.aspx

Learn More About The Business Research Company

The Business Research Company (www.thebusinessresearchcompany.com) is a leading market intelligence firm renowned for its expertise in company, market, and consumer research. With a global presence, TBRC's consultants specialize in diverse industries such as manufacturing, healthcare, financial services, chemicals, and technology, providing unparalleled insights and strategic guidance to clients worldwide.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Whole Life Insurance Market Growth Factors, Opportunities, Upcoming Trends, Segmentation, Challenges here

News-ID: 3593985 • Views: …

More Releases from The Business research company

Trends in Growth, Segment Analysis, and Competitive Strategies Influencing the M …

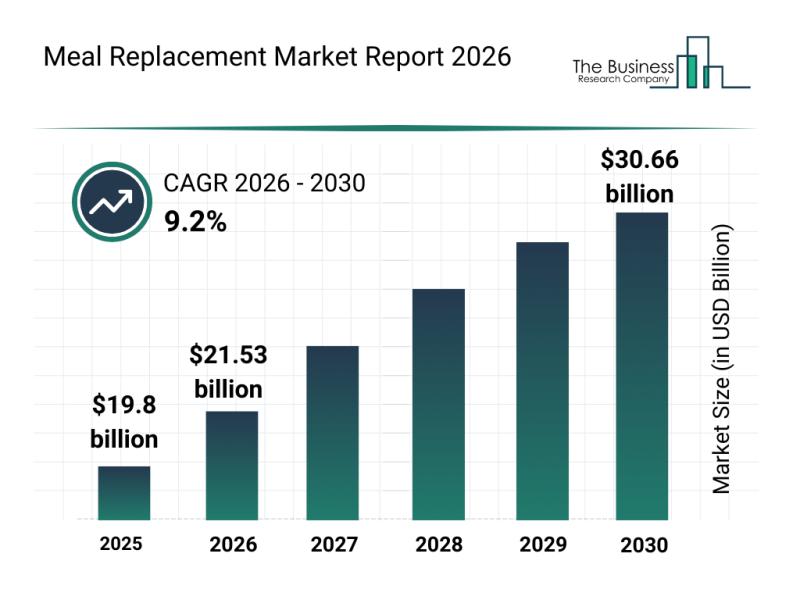

The meal replacement market is gaining significant momentum as consumer preferences shift toward convenient and health-focused nutrition solutions. With rising awareness about preventive healthcare and personalized diets, this sector is set for considerable expansion. Let's explore how the market size is expected to evolve, who the key players are, emerging trends, and the main segments driving this growth.

Projected Growth Trajectory of the Meal Replacement Market Size

The meal replacement…

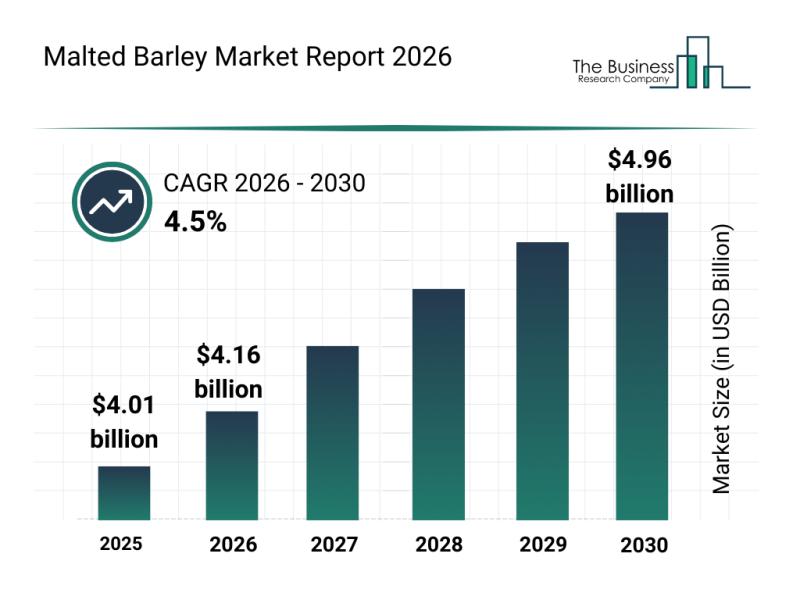

Leading Companies Reinforcing Their Presence in the Malted Barley Market

The malted barley industry is positioned for steady expansion as demand grows across various sectors. With increasing interest from craft brewers and functional food producers, this market is set to experience meaningful growth driven by innovation and sustainability efforts. Let's dive into the current market size, key players shaping the industry, trends influencing its trajectory, and detailed segment insights.

Projected Market Size and Growth Outlook of the Malted Barley Market …

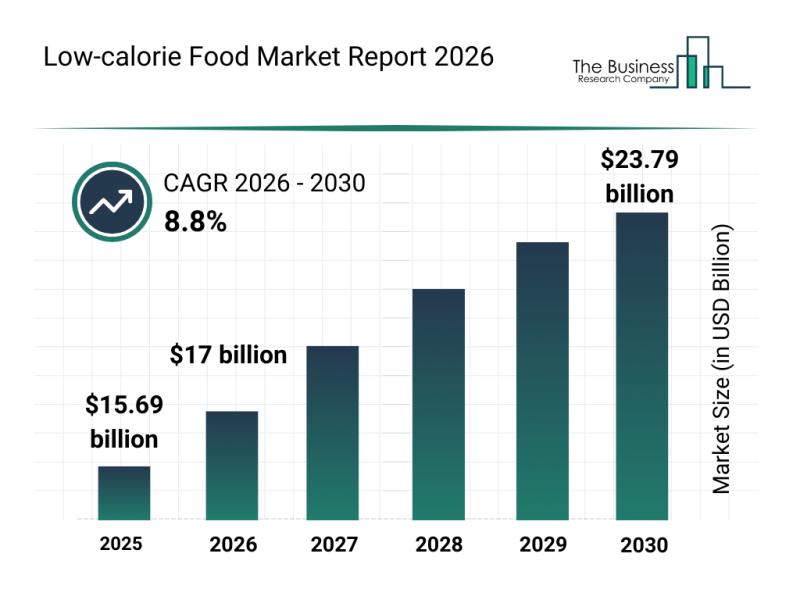

Future Perspective: Key Trends Shaping the Low-calorie Food Market up to 2030

The low-calorie food market is poised for significant expansion as consumer preferences shift toward healthier eating habits and more personalized nutrition options. Advances in product innovation and supportive regulatory frameworks are expected to drive rapid growth over the coming years. Here's an overview of the market size, key players, emerging trends, and segmentation shaping this evolving industry.

Projected Expansion of the Low-calorie Food Market Size Through 2030

The low-calorie food…

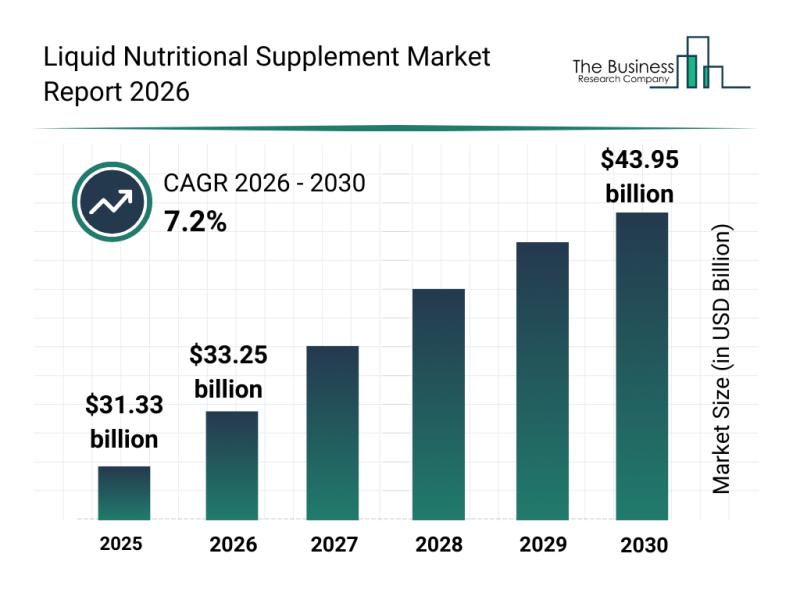

Competitive Landscape: Leading Companies and New Entrants in the Liquid Nutritio …

The liquid nutritional supplement sector is on the rise, driven by evolving consumer preferences and innovations in health and wellness. With growing awareness about personalized nutrition and preventive healthcare, this market is set to witness substantial growth over the coming years. Let's explore the market's projected size, major players, emerging trends, and key segments shaping this dynamic industry.

Projected Market Value and Growth Trajectory of the Liquid Nutritional Supplement Market …

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…