Press release

Sales Tax Software Market Overview & Growth Rate Forecast for the Next 5 Years: Avalara, Vertex, TaxJar

The latest research study released by HTF MI on Sales Tax Software Market with 123+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, sales, drivers, opportunities, market viewpoint and status. The market Study is segmented by key a region that is accelerating the marketization. Sales Tax Software study is a perfect mix of qualitative and quantitative Market data collected and validated majorly through primary data and secondary sources.Key Players in This Report Include:

Avalara (United States), Vertex Inc. (United States), Sovos (United States), TaxJar (United States), CCH SureTax (United States), Thomson Reuters (Canada), TaxCloud (United States), Taxify by Sovos (United States), TaxJar API (United States), Vertex Cloud (United States)

Download Sample Report PDF (Including Full TOC, Table & Figures) @ https://www.htfmarketintelligence.com/sample-report/global-sales-tax-software-market?utm_source=Akash_OpenPR&utm_id=Akash

"According to HTF Market Intelligence, the Sales Tax Software market size is estimated to reach by USD 17.8 Billion at a CAGR of 12.4% by 2030. The report includes historic market data from 2019 to 2023. The Current market value is pegged at USD 11.73 Billion."

Definition:

The Sales Tax Software Market encompasses software solutions designed to assist businesses in automating and managing their sales tax compliance processes. These solutions typically include features such as real-time tax rate calculation, jurisdiction determination, tax reporting, and filing assistance. They help businesses navigate complex and ever-changing tax laws and regulations, ensuring accurate calculation and collection of sales taxes across various jurisdictions. The market includes a variety of vendors offering both standalone sales tax software and integrated solutions within broader accounting or enterprise resource planning (ERP) systems.

Market Trends:

• Increasing adoption of sales tax software solutions that automate tax calculations, filing, and compliance processes, integrating seamlessly with accounting and ERP systems to streamline operations.

• Growing preference for cloud-based sales tax software, offering scalability, flexibility, and accessibility from anywhere, anytime, enabling businesses to adapt to changing tax regulations and business needs.

Market Drivers:

• Regulatory mandates and tax law changes driving the adoption of sales tax software solutions to ensure accurate tax calculations, reporting, and compliance with local, state/provincial, and federal tax requirements.

• Business expansion, mergers, acquisitions, and globalization initiatives creating demand for sales tax software solutions that can scale with growing transaction volumes, geographic reach, and regulatory complexity.

Market Opportunities:

• Expanding market opportunities driven by increasing adoption of sales tax software solutions among businesses of all sizes, industries, and geographic regions, due to growing complexity and scrutiny of tax regulations.

• Opportunities to develop sales tax software solutions that automate compliance tasks, such as tax rate updates, filing, remittance, and audit management, reducing the burden of manual tax processes on businesses.

Market Challenges:

• Complexity and frequent changes in tax laws, regulations, and jurisdictional requirements posing challenges for sales tax software vendors to keep pace with updates and ensure accurate tax calculations and compliance.

• Risks associated with data accuracy, integrity, and security, particularly when handling sensitive financial and customer information in sales tax software systems, necessitating robust data governance and security measures.

Market Restraints:

• Budget limitations and cost considerations hindering investment in sales tax software solutions, particularly for small businesses and startups with limited financial resources.

• Resistance from businesses to adopt new sales tax software solutions due to concerns about disruption to existing workflows, training requirements, and perceived complexity of implementation.

Major Highlights of the Sales Tax Software Market report released by HTF MI

Global Sales Tax Software Market Breakdown by Application (Small and Medium-sized Enterprises (SMEs), Large Enterprises) by Type (On-Premises, Cloud-based) by Industry Vertical (BFSI, Healthcare, Retail, Telecom & IT, Others) by Functionality (Tax Calculation, Reporting and Filing, Compliance Monitoring, Others) and by Geography (North America, South America, Europe, Asia Pacific, MEA)

Global Sales Tax Software market report highlights information regarding the current and future industry trends, growth patterns, as well as it offers business strategies to help the stakeholders in making sound decisions that may help to ensure the profit trajectory over the forecast years.

Get Discount (10-30%) on immediate purchase 👉 https://www.htfmarketintelligence.com/request-discount/global-sales-tax-software-market?utm_source=Akash_OpenPR&utm_id=Akash

Geographically, the detailed analysis of consumption, revenue, market share, and growth rate of the following regions:

• The Middle East and Africa (South Africa, Saudi Arabia, UAE, Israel, Egypt, etc.)

• North America (United States, Mexico & Canada)

• South America (Brazil, Venezuela, Argentina, Ecuador, Peru, Colombia, etc.)

• Europe (Turkey, Spain, Turkey, Netherlands Denmark, Belgium, Switzerland, Germany, Russia UK, Italy, France, etc.)

• Asia-Pacific (Taiwan, Hong Kong, Singapore, Vietnam, China, Malaysia, Japan, Philippines, Korea, Thailand, India, Indonesia, and Australia).

Objectives of the Report

• To carefully analyse and forecast the size of the Sales Tax Software market by value and volume.

• To estimate the market shares of major segments of the Sales Tax Software

• To showcase the development of the Sales Tax Software market in different parts of the world.

• To analyse and study micro-markets in terms of their contributions to the Sales Tax Software market, their prospects, and individual growth trends.

• To offer precise and useful details about factors affecting the growth of the Sales Tax Software

• To provide a meticulous assessment of crucial business strategies used by leading companies operating in the Sales Tax Software market, which include research and development, collaborations, agreements, partnerships, acquisitions, mergers, new developments, and product launches.

Have a query? Market an enquiry before purchase @ https://www.htfmarketintelligence.com/enquiry-before-buy/global-sales-tax-software-market?utm_source=Akash_OpenPR&utm_id=Akash

Points Covered in Table of Content of Global Sales Tax Software Market:

Sales Tax Software Market Study Coverage:

• It includes major manufacturers, emerging player's growth story, and major business segments of Sales Tax Software market, years considered, and research objectives. Additionally, segmentation on the basis of the type of product, application, and technology.

• Sales Tax Software Market Executive Summary: It gives a summary of overall studies, growth rate, available market, competitive landscape, market drivers, trends, and issues, and macroscopic indicators.

• Sales Tax Software Market Production by Region Sales Tax Software Market Profile of Manufacturers-players are studied on the basis of SWOT, their products, production, value, financials, and other vital factors.

• Key Points Covered in Sales Tax Software Market Report:

• Sales Tax Software Overview, Definition and Classification Market drivers and barriers

• Sales Tax Software Market Competition by Manufacturers

• Sales Tax Software Capacity, Production, Revenue (Value) by Region (2024-2030)

• Sales Tax Software Supply (Production), Consumption, Export, Import by Region (2024-2030)

• Sales Tax Software Production, Revenue (Value), Price Trend by Type {Review Management, Identity Monitoring, Search Engine Suppression, Internet Removal}

• Sales Tax Software Market Analysis by Application {SMEs, Large Enterprises}

• Sales Tax Software Manufacturers Profiles/Analysis Sales Tax Software Manufacturing Cost Analysis, Industrial/Supply Chain Analysis, Sourcing Strategy and Downstream Buyers, Marketing

• Strategy by Key Manufacturers/Players, Connected Distributors/Traders Standardization, Regulatory and collaborative initiatives, Industry road map and value chain Market Effect Factors Analysis.

Buy Complete Assessment of Sales Tax Software market now @ https://www.htfmarketintelligence.com/buy-now?format=3&report=4450?utm_source=Akash_OpenPR&utm_id=Akash

Key questions answered

• How feasible is Sales Tax Software market for long-term investment?

• What are influencing factors driving the demand for Sales Tax Software near future?

• What is the impact analysis of various factors in the Global Sales Tax Software market growth?

• What are the recent trends in the regional market and how successful they are?

Thanks for reading this article; you can also get individual chapter-wise sections or region-wise report versions like North America, MINT, BRICS, G7, Western / Eastern Europe, or Southeast Asia. Also, we can serve you with customized research services as HTF MI holds a database repository that includes public organizations and Millions of Privately held companies with expertise across various Industry domains.

Nidhi Bhawsar (PR & Marketing Manager)

HTF Market Intelligence Consulting Private Limited

Phone: +15075562445

sales@htfmarketintelligence.com

About Author:

HTF Market Intelligence Consulting is uniquely positioned to empower and inspire with research and consulting services to empower businesses with growth strategies, by offering services with extraordinary depth and breadth of thought leadership, research, tools, events, and experience that assist in decision-making.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Sales Tax Software Market Overview & Growth Rate Forecast for the Next 5 Years: Avalara, Vertex, TaxJar here

News-ID: 3593309 • Views: …

More Releases from HTF Market Intelligence Consulting Private Limited

Online Travel Booking Platform Market: Growth Factors, Emerging Trends & Key Pla …

The Online Travel Booking Platform Market is entering a transformative phase as digitalization, AI-driven personalization, and mobile-first travel planning redefine the global tourism landscape. Today's travelers demand speed, transparency, and seamless booking experiences, pushing travel-tech companies to innovate with automation, virtual assistance, smart itinerary planning, and multi-service integration. As global tourism recovers strongly and digital adoption accelerates, online travel booking solutions are witnessing exponential growth across leisure, corporate, and last-minute…

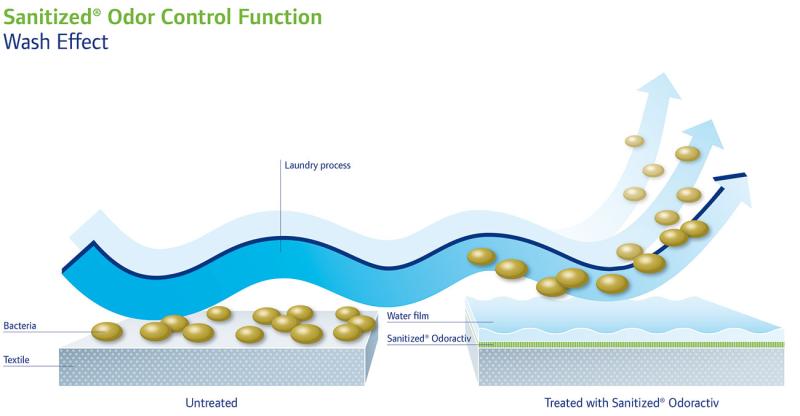

Odour Control Textiles Market Growth Outlook: Trends, Opportunities & Competitiv …

The Odour Control Textiles Market is entering a high-growth phase as global consumer and industrial sectors increasingly demand freshness-enhancing, hygiene-focused, and performance-driven textile solutions. From sportswear and athleisure to healthcare fabrics, military gear, and home furnishings, odour-neutralizing technologies are transforming product design and functionality. As brands move toward sustainability, antimicrobial performance, and premium comfort, odour control textiles have become a core component in next-generation material engineering.

Get a Sample Copy of…

Pet Shampoo Market Overview & Growth Rate Forecast for the Next 5 Years

The latest study released on the Global Pet Shampoo Market by HTF MI Research evaluates market size, trend, and forecast to 2033. The Pet Shampoo study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about the competitors.

Consider how these…

E-Passport and E-Visa Market: Pioneering Secure, Digital Travel Authentication

The E-Passport and E-Visa Market is at the intersection of travel security, digital identity management, and global mobility. As international travel continues to rebound and migrate toward contactless experiences, governments and border authorities are embracing electronic solutions that streamline entry processes, enhance security, and reduce fraud. E-passports and e-visas have emerged as cornerstones of modern travel infrastructure, enabling faster processing, greater convenience, and stronger identity assurance for travelers and authorities…

More Releases for Tax

Tax Accountant Launches Expert Tax Advisory Services for Complex UK Tax Issues

Birmingham, UK - Tax Accountant, a premier provider of tailored tax solutions, is proud to announce the introduction of its new Specialist Tax Advice service. Aimed at tackling the multifaceted tax challenges faced by individuals and businesses in the UK, this service is set to revolutionize how tax compliance and optimization are approached.

As tax laws become increasingly complex and the implications of non-compliance more severe, the need for specialized tax…

Legal Tax Defense Offers Tax Relief Services to Successfully Settle IRS Tax Debt …

Legal Tax Defense provides expert guidance and strategies to navigate IRS negotiations and reduce tax liabilities.

Legal Tax Defense, Inc., a premier provider of tax resolution services, is now providing strategic assistance and professional help for those who find IRS tax debt to be stressful and intimidating. The firm assists taxpayers in understanding their alternatives for efficiently managing and lowering tax liabilities by offering a range of specialist services.

"Handling IRS tax…

Legal Tax Defense Providing Strategic Assistance to Settle Tax Debts for Tax Pay …

Fulfill Tax Obligations and Prevent Legal Issues.

Legal Tax Defense, a premier firm specializing in tax resolution, proudly announces its updated services aimed at helping clients effectively settle their tax debts. With a focus on alleviating the financial and legal pressures associated with unpaid taxes, Legal Tax Defense offers a lifeline to individuals and businesses struggling with tax liabilities.

Understanding the options available for settling tax debts [https://www.legaltaxdefense.com/settling-tax-debts/] is crucial in taking…

Bidding At The Tax Sale - Tax Sale Success Masterclass with The Tax Lien Lady

Joanne Musa, founder of TaxLienLady.com is holding a Tax Sale Success Masterclass on Bidding at the Tax Sale on Thursday, November 10 at 7:00 pm Eastern Time.

Tax lien and tax deed investing can be very profitable. Tax Lien investors can earn interest rates that are much higher than current bank rates without the risk of the stock market. Joanne Musa, known online as the tax lien lady, has been helping…

Tax Software Market – Major Technology Giants in Buzz Again | TurboTax, Tax Sl …

The Latest Released Tax Software market study has evaluated the future growth potential of Global Tax Software market and provides information and useful stats on market structure and size. The report is intended to provide market intelligence and strategic insights to help decision makers take sound investment decisions and identify potential gaps and growth opportunities. Additionally, the report also identifies and analyses changing dynamics, emerging trends along with essential drivers,…

Tax Software Market to Eyewitness Massive Growth by 2026 | Tax Act, Tax Slayer, …

The latest independent research document on Global Tax Software examine investment in Market. It describes how companies deploying these technologies across various industry verticals aim to explore its potential to become a major business disrupter. The Tax Software study eludes very useful reviews & strategic assessment including the generic market trends, emerging technologies, industry drivers, challenges, regulatory policies that propel the market growth, along with major players profile and strategies.…