Press release

Asset-Based Lending Market Growing Lending revenue is expected to grow at a CAGR of 11.32 Percentage from 2024 to 2030, reaching nearly USD 1324.75 Billion

Anticipated Growth in Revenue:Global Asset-Based Lending Market size was valued at USD 625.35 Billion in 2023 and the total Asset-Based Lending revenue is expected to grow at a CAGR of 11.32% from 2024 to 2030, reaching nearly USD 1324.75 Billion.

Asset-Based Lending Market Overview:

The asset-based lending market is experiencing robust growth as businesses increasingly seek flexible financing solutions to meet their working capital needs. This type of lending, which involves securing loans with company assets such as inventory, accounts receivable, and equipment, provides an attractive alternative to traditional bank loans, especially for companies with valuable assets but limited credit history. The market is driven by rising demand from small to medium-sized enterprises (SMEs) looking to optimize cash flow and finance expansion activities. Additionally, the economic uncertainty and tightening credit conditions have made asset-based lending a more viable and appealing option. Financial institutions are also leveraging advanced technologies and data analytics to streamline the lending process, enhance risk assessment, and provide more tailored financing solutions to businesses across various sectors.

𝐔𝐧𝐥𝐨𝐜𝐤 𝐈𝐧𝐬𝐢𝐠𝐡𝐭𝐬: 𝐑𝐞𝐪𝐮𝐞𝐬𝐭 𝐚 𝐅𝐫𝐞𝐞 𝐒𝐚𝐦𝐩𝐥𝐞 𝐨𝐟 𝐎𝐮𝐫 𝐋𝐚𝐭𝐞𝐬𝐭 𝐑𝐞𝐩𝐨𝐫𝐭 𝐍𝐨𝐰: https://www.maximizemarketresearch.com/request-sample/189641/

What are Asset-Based Lending Market Dynamics?

The dynamics of the asset-based lending market are influenced by several key factors. Economic conditions play a significant role, with businesses increasingly turning to asset-based lending during periods of tightening credit and economic uncertainty, seeking flexible financing options to maintain cash flow. The growing needs of small and medium-sized enterprises (SMEs) for accessible capital drive demand, as these companies often face challenges securing traditional loans. Advancements in technology and data analytics are enhancing lenders' ability to assess risk and streamline the loan approval process, making asset-based lending more efficient and appealing. Additionally, the competitive landscape is intensifying as more financial institutions and alternative lenders enter the market, offering customized lending solutions. Regulatory developments and interest rate fluctuations also impact market dynamics, influencing the cost and availability of asset-based loans.

Asset-Based Lending Market Trends:

The Asset-Based Lending (ABL) market is experiencing notable growth, driven by increasing demand from businesses seeking flexible financing solutions. ABL offers companies the ability to leverage their assets, such as inventory, accounts receivable, and equipment, to secure loans. This type of financing is particularly attractive in volatile economic conditions, as it provides a reliable source of capital without the need for traditional creditworthiness. Advances in technology and data analytics are also enhancing the efficiency and attractiveness of ABL, enabling lenders to better assess asset values and manage risks. As businesses continue to prioritize liquidity and operational agility, the ABL market is poised for sustained expansion.

𝐍𝐞𝐞𝐝 𝐌𝐨𝐫𝐞 𝐈𝐧𝐟𝐨𝐫𝐦𝐚𝐭𝐢𝐨𝐧? 𝐈𝐧𝐪𝐮𝐢𝐫𝐞 𝐀𝐛𝐨𝐮𝐭 𝐒𝐚𝐦𝐩𝐥𝐞 + 𝐆𝐫𝐚𝐩𝐡𝐬 𝐇𝐞𝐫𝐞: https://www.maximizemarketresearch.com/request-sample/189641/

What is Asset-Based Lending Market Regional Insight?

The Asset-Based Lending (ABL) market exhibits varied regional dynamics, reflecting differences in economic environments and financial practices. North America, particularly the United States, leads the market due to its well-established financial infrastructure and high demand for flexible funding options among SMEs. Europe follows, with significant growth in the UK and Germany, where businesses increasingly favor ABL to navigate economic uncertainties. In the Asia-Pacific region, rising industrialization and expanding SMEs are driving demand, particularly in China and India. Meanwhile, Latin America and the Middle East are emerging markets for ABL, with growing awareness and adoption of asset-backed financing solutions as businesses seek more robust capital management strategies.

𝐅𝐑𝐄𝐄 𝐆𝐞𝐭 𝐚 𝐂𝐨𝐩𝐲 𝐨𝐟 𝐒𝐚𝐦𝐩𝐥𝐞 𝐑𝐞𝐩𝐨𝐫𝐭 𝐍𝐨𝐰! @ https://www.maximizemarketresearch.com/request-sample/189641/

What is Asset-Based Lending Market Segmentation?

by Type

Inventory Financing

Receivables Financing

Equipment Financing

Others

by Interest Rate

Fixed Rate

Floating Rate

by End User Large

Enterprises

Small and Medium-sized Enterprises

Some of the current players in the Asset-Based Lending Market are:

1.Lloyds Bank

2.Barclays Bank PLC

3. Hilton-Baird Group

4. JPMorgan Chase & Co

5. Berkshire Bank

6.White Oak Financial, LLC

7.Wells Fargo

8. Porter Capital

9.Capital Funding Solutions Inc.

10.SLR Credit Solutions

11.Fifth Third Bank

12.HSBC Holdings plc

12. SunTrust Banks, Inc. (now part of Truist Financial Corporation)

13. Santander Bank, N.A.

14.KeyCorp

15.BB&T Corporation (now part of Truist Financial Corporation)

16. Goldman Sachs Group, Inc.

𝐅𝐨𝐫 𝐌𝐨𝐫𝐞 𝐈𝐧𝐟𝐨𝐫𝐦𝐚𝐭𝐢𝐨𝐧 𝐀𝐛𝐨𝐮𝐭 𝐓𝐡𝐢𝐬 𝐑𝐞𝐬𝐞𝐚𝐫𝐜𝐡 𝐏𝐥𝐞𝐚𝐬𝐞 𝐕𝐢𝐬𝐢𝐭: https://www.maximizemarketresearch.com/market-report/asset-based-lending-market/189641/

Key Offerings:

• Past Market Size and Competitive Landscape

• Asset-Based Lending MarketSize, Share, Size & Forecast by different segment

• Market Dynamics - Growth Drivers, Restraints, Opportunities, and Key Trends by region

• Asset-Based Lending MarketSegmentation - A detailed analysis by Product

• Competitive Landscape - Profiles of selected key players by region from a strategic perspective

• Competitive landscape - Market Leaders, Market Followers, Regional player

• Competitive benchmarking of key players by region

• PESTLE Analysis

• PORTER's analysis

• Value chain and supply chain analysis

• Legal Aspects of business by region

• Lucrative business opportunities with SWOT analysis

• Recommendations

Explore our top-performing reports on the latest trends:

♦ Action Camera Market https://www.maximizemarketresearch.com/market-report/global-action-camera-market/100070/

♦ Global Physical Identity and Access Management Market https://www.maximizemarketresearch.com/market-report/global-physical-identity-access-management-market/7876/

♦ Procurement Software Market https://www.maximizemarketresearch.com/market-report/global-procurement-software-market/26731/

♦ Global Assessment Services Market https://www.maximizemarketresearch.com/market-report/global-assessment-services-market/54365/

♦ Global 4K Set-Top Box Market https://www.maximizemarketresearch.com/market-report/global-4k-set-top-box-market/102764/

♦ Global Digital Badges Market https://www.maximizemarketresearch.com/market-report/digital-badges-market/12943/

♦ Business Software and Services Market https://www.maximizemarketresearch.com/market-report/global-business-software-and-services-market/102539/

MAXIMIZE MARKET RESEARCH PVT. LTD.

⮝ 3rd Floor, Navale IT park Phase 2,

Pune Banglore Highway, Narhe

Pune, Maharashtra 411041, India.

✆ +91 9607365656

🖂 sales@maximizemarketresearch.com

🌐 www.maximizemarketresearch.com

Maximize Market Research is one of the fastest-growing market research and business consulting firms serving clients globally. Our revenue impact and focused growth-driven research initiatives make us a proud partner of majority of the Fortune 500 companies. We have a diversified portfolio and serve a variety of industries such as IT & telecom, chemical, food & beverage, aerospace & defense, healthcare and others.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Asset-Based Lending Market Growing Lending revenue is expected to grow at a CAGR of 11.32 Percentage from 2024 to 2030, reaching nearly USD 1324.75 Billion here

News-ID: 3587296 • Views: …

More Releases from MAXIMIZE MARKET RESEARCH PVT. LTD.

Headwear Market to Reach US$ 34.97 Billion by 2032

Headwear Market was valued at US$ 22.84 billion in 2024 and is expected to reach US$ 34.97 billion by 2032, expanding at a compound annual growth rate (CAGR) of 5.47% during the forecast period.

The market growth is driven by increasing fashion consciousness, rising sports participation, growing demand for branded and designer headwear, and expanding e-commerce penetration worldwide. Additionally, changing lifestyle trends and the growing influence of social media and celebrity…

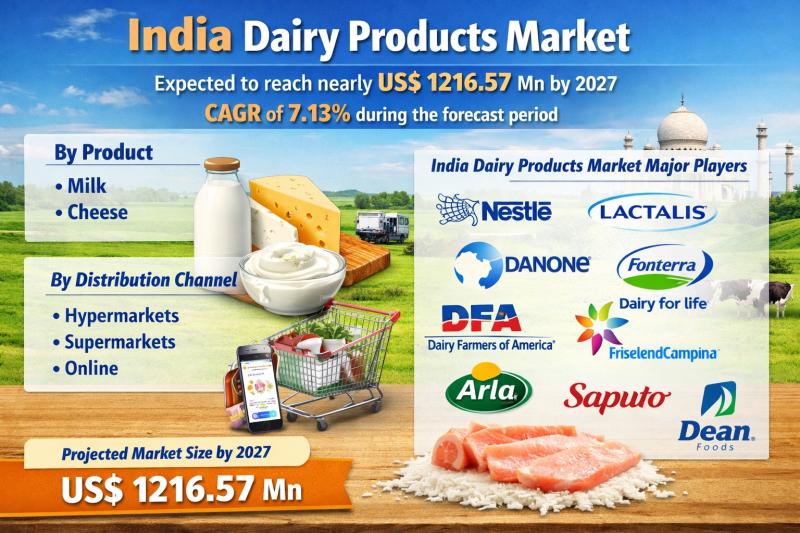

India Dairy Products Market to Reach US$ 1216.57 Mn by 2027, Expanding at a CAGR …

India Dairy Products Market size is expected to reach nearly US$ 1216.57 Mn by 2027, expanding at a CAGR of 7.13% during the forecast period. The market growth is driven by increasing dairy consumption, rising health awareness, expansion of organized retail, and growing demand for value-added dairy products across urban and semi-urban regions.

Request To Free Sample of This Strategic Report ➤https://www.maximizemarketresearch.com/market-report/india-dairy-products-market/92594/

Key Market Highlights

Market Size & CAGR:

The India Dairy Products…

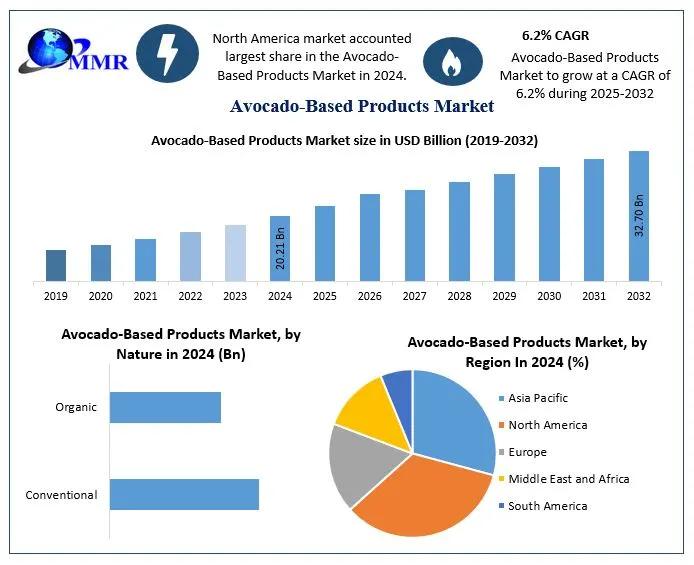

Avocado-Based Products Market Set for Strong Growth Through 2032 Driven by Healt …

The global Avocado-Based Products Market is projected to reach a market value of USD 32.70 Billion by 2032, expanding at a compound annual growth rate (CAGR) of 6.2% from 2025 to 2032, according to a new research report.

Avocado-Based Products Market Overview:

The global Avocado-Based Products Market is experiencing significant traction as consumers increasingly embrace nutrient-rich and plant-based options. With avocados recognized for their natural healthy fats, vitamins, and fiber, demand across…

Waste Paper Recycling Market to Reach USD 63.32 Billion by 2030, Growing at a CA …

Waste Paper Recycling Market reached a value of USD 45.60 Bn. in 2023. The global market is expected to grow at a CAGR of 4.8% during the forecast period, reaching nearly USD 63.32 Bn. by 2030. The market growth is driven by increasing environmental awareness, rising demand for sustainable packaging solutions, and stringent government regulations promoting recycling and waste reduction practices.

Request To Free Sample of This Strategic Report ➤https://www.maximizemarketresearch.com/market-report/global-waste-paper-recycling-market/84320/

Key…

More Releases for Lending

Mortgage Lending Market : Increased focus toward digitalizing lending process

According to the report published by Allied Market Research, the global mortgage lending market generated $11.48 billion in 2021, and is estimated to reach $27.50 billion by 2031, witnessing a CAGR of 9.5% from 2022 to 2031. The report offers a detailed analysis of changing market trends, top segments, value chain, key investment pockets, competitive scenario, and regional landscape. The report is a vital for leading market players, investors, new…

P2p Lending Market | Industry Overview 2021 | Worldwide Companies- CircleBack Le …

P2p Lending Market report will provide one with overall market analysis, statistics, various trends, drivers, opportunities, restraints, and every minute data relating to the Synthetic Fibers market necessary for forecasting its revenue, factors propelling & growth. The P2p Lending market study provides unique guidance in thoughtful details regarding the development factors and has used a top-down and bottom-up approach to keep it error-free and accurate. Our expert analysts have used…

Peer-to-peer Lending – Growing Popularity and Emerging Trends in the Market | …

Global Peer-to-peer Lending Market Size, Status and Forecast 2018-2025 is latest research study released by HTF MI evaluating the market, highlighting opportunities, risk side analysis, and leveraged with strategic and tactical decision-making support. The study provides information on market trends and development, drivers, capacities, technologies, and on the changing investment structure of the Global Peer-to-peer Lending Market. Some of the key players profiled in the study are CircleBack Lending, Lending…

Alternative Lending Market Is Booming Worldwide | Lending Club, Prosper, Upstart …

The ‘ Alternative Lending market’ research report added by Report Ocean, is an in-depth analysis of the latest developments, market size, status, upcoming technologies, industry drivers, challenges, regulatory policies, with key company profiles and strategies of players. The research study provides market overview, Alternative Lending market definition, regional market opportunity, sales and revenue by region, manufacturing cost analysis, Industrial Chain, market effect factors analysis, Alternative Lending market size forecast, market…

P2P Lending Market is Thriving Worldwide | CircleBack Lending, Lending Club, Pee …

Global P2P Lending Market Size, Status and Forecast 2025 is latest research study released by HTF MI evaluating the market, highlighting opportunities, risk side analysis, and leveraged with strategic and tactical decision-making support. The study provides information on market trends and development, drivers, capacities, technologies, and on the changing investment structure of the Global P2P Lending Market. Some of the key players profiled in the study are CircleBack Lending, Lending…

Canada Peer-to-peer Lending Market 2018-2022 Overview by CircleBack Lending, Len …

with the slowdown in world economic growth, the Peer-to-peer Lending industry has also suffered a certain impact, but still maintained a relatively optimistic growth, the past four years, Peer-to-peer Lending market size to maintain the average annual growth rate of 2.94% from 22 million $ in 2014 to 24 million $ in 2017, Research analysts believe that in the next few years, Peer-to-peer Lending market size will be further expanded,…