Press release

Insurtech Market Projected to Expand at 15% CAGR, Valued at US$ 34.7 Billion by 2033

By the end of 2033, the worldwide insurtech market is projected to have grown from a value of US$ 8.6 billion in 2023 to US$ 34.7 billion, growing at a 15% compound annual growth rate. Global insurance claim instances are increasing, which is one of the main drivers driving the insurtech market's growth.Insurance businesses are making significant investments in digital technology in order to reduce operating costs, boost operational efficiency, and improve the customer experience overall. Auto, life, and home insurance are the three categories of claims that individuals obtain the most frequently.

Download a Sample Copy Of Report: https://www.factmr.com/connectus/sample?flag=S&rep_id=6191

The term "insurtech," which refers to the use of technology to alter and optimize different areas of the insurance value chain, has given rise to a surge of innovation in the insurance technology business, which has long been recognized for its conventional and conservative nature. The insurance sector as a whole has been changing due to insurtech, which is upending long-standing conventions and changing the face of insurance.

In the next ten years, insurtech is predicted to grow in popularity for a number of reasons, chief among them being the development of new technologies like blockchain, artificial intelligence (AI), machine learning (ML), big data analytics, and the Internet of Things (IoT). These technologies have given insurers new ways to leverage data and digital capabilities to improve underwriting and risk assessment while also streamlining operations and improving customer experience. The insurtech industry is expanding because to the fact that younger generations, who are more tech-savvy and seek ease, transparency, and customized solutions, are driving these changes in customer expectations and behavior.

Key Companies Profiled

• Alan SA

• Shift Technology

• Cytora Ltd.

• simplesurance GmbH

• Haven Life Insurance Agency LLC

• Quantemplate Technologies Inc.

• Oscar Insurance Corp.

• Trov Insurance Solutions LLC

• ZhongAn Online P&C Insurance Co. Ltd.

• Damco Group

• Amodo

One of the key areas where the insurtech sector is seeing transformation is customer connection. Insurtech companies leverage digital platforms to deliver personalized and smooth customer experiences. This includes web-based and mobile interfaces for purchasing insurance, monitoring policies, handling claims, and offering customer support.

Customers may search for, assess, and purchase insurance policies on their terms more easily and transparently because to these digital solutions' increased simplicity of use, accessibility, and openness. Insurtech businesses may also offer tailored insurance services and solutions that are tailored to the needs and lifestyles of their customers thanks to data and analytics. Usage-based insurance, on-demand coverage, and parametric insurance are a few examples.

The Benefits of Insurtech for Data-driven Decision-making and Customer-centric Solutions: Insights, Innovation, and Convenience

Data accessibility allows a company to track client behavior and obtain insights to improve customer satisfaction and provide better services. As insurtech becomes more widely used, it makes it possible to make better decisions and carry out creative business plans in order to meet the expanding demands of the international insurance industry. Customers may now make micropayments more easily thanks to insurtech and the growing use of wearables and mobile phones.

Major insurtech companies are developing micropayment systems to service clients in areas with low insurance penetration rates. Insurtech enables the development of systems that offer customers a single point of contact for payments, purchases, service, and social media interaction.

Insurance businesses are developing self-directed client acquisition and customer service solutions in response to the growing need for online and mobile channels for communication. Customer-centric solutions are being used increasingly often to improve user experience, increase transaction efficiency, and increase transparency. Because customers are demanding more personalized and efficient services, usage-based insurance (UBI) models are gaining traction.

Genomic & Epigenetic Technologies: Redefining Life Policies for the Future of Healthcare Insurance

The cost and implementation of life policies are expected to be completely transformed by the increasing use of genomic and epigenetic technologies in the biological age determination sector. In this segment of the insurtech industry, companies like Good Doctor, Discovery Vitality, Babylon, and Wellthy Therapeutics, among others, are leading the way with innovative solutions that are redefining the landscape of health insurance.

Read More: https://www.factmr.com/report/insurtech-market

Competitive Landscape

Leading insurtech firms are focusing on strategies like partnerships to help them fortify their positions in the industry. Additionally, they are concentrating on developing insurtech tools to assist insurers in forming partnerships and streamlining the claims process in order to increase their clientele.

In November 2021, Heritage Insurance Holdings Inc., a property and casualty insurer, announced a partnership with Slide, an insurtech P&C carrier. Through this partnership, the former corporation would make better underwriting and rating decisions by utilizing Slide's expertise.

Key Segments of Insurtech Industry Research

• By Insurance Type :

o Health

o Life

o Travel

o Auto

o Business

o Home

• By Service :

o Consulting

o Support & Maintenance

o Managed Services

• By Technology :

o Blockchain

o Cloud Computing

o IoT

o Artificial Intelligence

o Machine Learning

o Robo Advisory

o Big Data & Business Analytics

• By End-use Industry :

o Automotive

o BFSI

o Healthcare

o Manufacturing

o Retail

o Transportation

• By Region :

o North America

o Latin America

o Europe

o East Asia

o South Asia & Oceania

o MEA

The market's growth trajectory signifies a new era of insurance, where technology-driven strategies will dominate, offering unprecedented opportunities for innovation and customer-centric services. As the InsurTech market continues to evolve, it is set to play a critical role in the future of the global insurance industry, delivering enhanced value to both providers and consumers.

Contact:

US Sales Office

11140 Rockville Pike

Suite 400

Rockville, MD 20852

United States

Tel: +1 (628) 251-1583, +353-1-4434-232

Email: sales@factmr.com

About Fact.MR

We are a trusted research partner of 80% of fortune 1000 companies across the globe. We are consistently growing in the field of market research with more than 1000 reports published every year. The dedicated team of 400-plus analysts and consultants is committed to achieving the utmost level of our client's satisfaction.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Insurtech Market Projected to Expand at 15% CAGR, Valued at US$ 34.7 Billion by 2033 here

News-ID: 3584638 • Views: …

More Releases from Fact.MR

Organic Rice Syrup Market is forecasted to increase at a CAGR of 5.1% and US$ 1. …

The global Organic Rice Syrup Market is projected to expand steadily over the coming decade, driven by rising consumer demand for natural, clean-label sweeteners and growing awareness of health and wellness trends. Industry analysts estimate that the organic rice syrup market, valued at approximately USD 450 million in 2025, is expected to reach nearly USD 880 million by 2035, registering a compound annual growth rate (CAGR) of about 7.1% during…

Compound Horse Feedstuff Market is Estimated to Grow at a CAGR of 4.6%, Reaching …

The global compound horse feedstuff market is galloping toward steady growth, projected to expand from a valuation of USD 3.8 billion in 2026 to approximately USD 5.4 billion by 2036. This represents a compound annual growth rate (CAGR) of 3.6% over the ten-year forecast period.

The market is being driven by the "humanization" of equine companions, the professionalization of equestrian sports, and a significant shift toward specialized performance nutrition that…

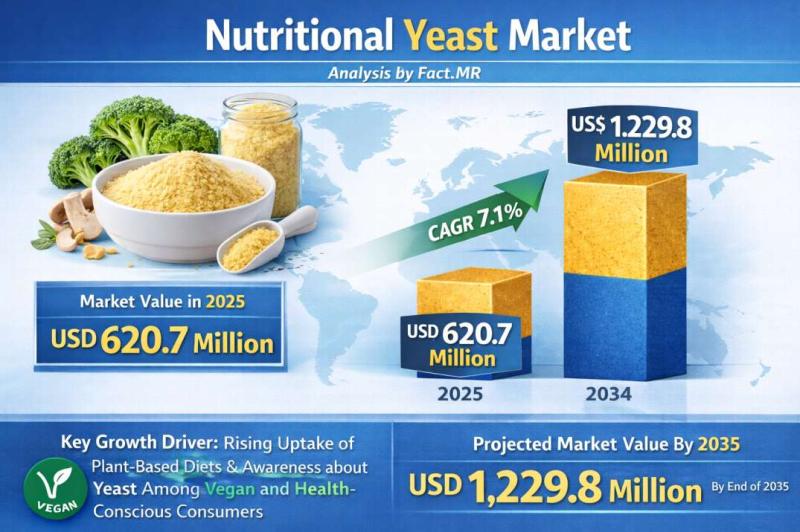

Nutritional Yeast Market Forecasted CAGR is 7.1% by 2035 | Fact.MR Report

The global nutritional yeast market is experiencing a significant surge in demand, projected to grow from a valuation of USD 515.2 million in 2026 to approximately USD 1.2 billion by 2036. This represents a robust compound annual growth rate (CAGR) of 8.8% over the ten-year forecast period.

The market is being propelled by the global explosion of plant-based diets and the "clean-label" movement, with nutritional yeast emerging as the primary…

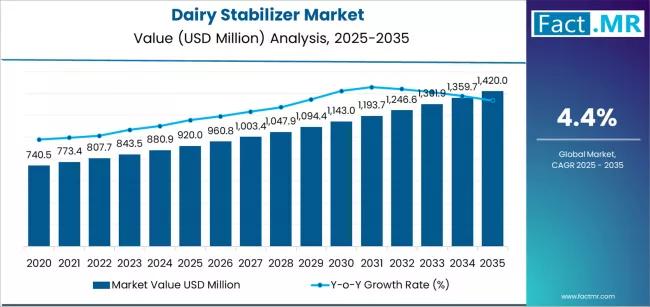

Dairy Stabilizer Market is Expected to Reach USD 1,420.0 million by 2035 | Resea …

The global Dairy Stabilizers Market is projected to sustain solid growth over the next decade as consumer demand for high-quality dairy and dairy-based products continues to expand across foodservice and retail sectors. Industry analysts estimate that the dairy stabilizers market, valued at approximately USD 2.4 billion in 2025, is expected to reach around USD 4.3 billion by 2035, registering a compound annual growth rate (CAGR) of about 6.5% during the…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…