Press release

Mobile Payments Market Soars: Expected to Hit US$ 590 Billion by 2032 with 30% CAGR

The mobile payments market is predicted to reach US$ 42 billion in 2022 and grow at an astounding double-digit compound annual growth rate (CAGR) of 30% to reach US$ 590 billion by the assessment period of 2022-2032.The reliance on mobile payments is being driven by the expansion of the m-commerce sector and the global growth in smartphone usage. The need for mobile payments is also being boosted by businesses accepting mobile payments and by consumers purchasing a wider range of items online.

Download a Sample Copy Of Report: https://www.factmr.com/connectus/sample?flag=S&rep_id=7150

The Fact.MR analysis states that at the conclusion of the specified historical era, the demand for mobile payments reached US$ 36 billion between 2015 and 2021. Market research and competitive intelligence supplier Fact.MR claims that the demand for mobile payments increased at a CAGR of 27%. Mobile payments have become more common in recent years due to an increase in smartphone ownership and growing levels of digital literacy.

Due to the COVID-19 epidemic, governments over the world imposed stringent social distance laws that made traditional face-to-face financial transactions impossible. As a result, the number of money transactions made through mobile payments increased dramatically. The quantity of mobile-friendly online payment gateways surged to an astonishing degree, as more and more people turned to e-commerce websites to make purchases of products and services.

Key Companies Profiled

• Google (Alphabet Inc.)

• Samsung Electronics Co. Ltd.

• Visa Inc.

• Alibaba Group Holdings Limited

• PayPal Holdings Inc.

• WeChat (Tencent Holdings Limited)

• American Express Company

• M Pesa

• Money Gram International

• Amazon.com Inc.

• Apple Inc.

Simple Design Boosting Mobile Payments' Growth?

In addition to being quick, mobile payment methods are also practical. The widespread use of smartphones and tablets, in conjunction with reliable network connections, is a major factor in the adoption of mobile payments. Furthermore, both conventional and e-commerce companies are adjusting to the evolving consumer's behavior, which includes mobile device-based cashless payment options.

Furthermore, because making purchases using mobile payments doesn't involve additional verification processes, their simplicity is a major factor in their rising popularity. Additionally, banks provide their customers easy-to-use facilities and rapid payment capabilities.

When compared to PIN and chip technologies, mobile payment technology facilitates quick and simple transactions. Customers do not need to physically touch the POS devices in order to transfer information using mobile payment technology, which leverages NFC in mobile devices; instead, the customers' mobile devices simply need to be close to the terminal. As a result, mobile payments are being quickly adopted by companies and consumers.

Additionally, during the COVID-19 outbreak, customers preferred using mobile payments owing to the restrictions on movement. The use of mobile payments is being driven by their convenience and transaction detail availability. Furthermore, mobile payments are being accepted by e-commerce companies. Consequently, this has expedited the expansion of mobile payments.

Due of travel restrictions, the COVID-19 pandemic had a favorable effect for the remote payment market. Additionally, a number of businesses are releasing apps that let users make payments from a distance.

Additionally, it is anticipated that the growing use of virtual terminals for remote billing would propel market expansion. Therefore, it is anticipated that through 2032, remote payment would account for more than 60% of the mobile payment industry.

Read More: https://www.factmr.com/report/mobile-payment-market

Competitive Landscape

Leading mobile payment service providers are always working to improve the environment for digital financial transactions by launching wallets and payment gateways that are extremely safe and responsive. In addition, there are reports of partnerships with governments to ease the shift to a digital economy. Here are a few notable developments:

•For simpler and quicker payments, Samsung Electronics Co. Ltd. introduced a scan QR function with a camera and rapid panel in October 2021 in India. For smartphones that support Samsung Pay, the feature is presently available.

•Visa Inc. introduced the "Bring India Home" campaign in August 2021. The company's goal with this project is to help 50 million small businesses in India go digital. This will enable companies to profit from mobile payments.

Key Segments Covered

By Technology :

Direct Mobile Billing

Interactive Voice Response System based Mobile Payment

Mobile App based Payments

Mobile Payments via Near Field Communication

Mobile Web Payment

Mobile Payment via SMS

Other Mobile Payment Technologies

By Type :

B2B

B2C

B2G

Other Payment Types

By Location :

Remote

Proximity

By End Use :

Media & Entertainment

Healthcare

IT & Telecom

Retail & E-commerce

Transportation

BFSI

Other End Uses

By Region :

North America

Latin America

Europe

Asia Pacific

Middle East & Africa

As consumers and businesses alike embrace the shift towards cashless transactions, mobile payment technologies are revolutionizing the financial landscape, offering enhanced user experiences and greater efficiency. The projected growth underscores the critical role of mobile payments in driving digital transformation across various industries, from retail to banking and beyond. As the market evolves, continued innovation and strategic collaborations will be essential in addressing security concerns and ensuring the widespread adoption of mobile payment solutions, cementing their place as a cornerstone of the global economy.

Contact:

US Sales Office

11140 Rockville Pike

Suite 400

Rockville, MD 20852

United States

Tel: +1 (628) 251-1583, +353-1-4434-232

Email: sales@factmr.com

About Fact.MR

We are a trusted research partner of 80% of fortune 1000 companies across the globe. We are consistently growing in the field of market research with more than 1000 reports published every year. The dedicated team of 400-plus analysts and consultants is committed to achieving the utmost level of our client's satisfaction.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Mobile Payments Market Soars: Expected to Hit US$ 590 Billion by 2032 with 30% CAGR here

News-ID: 3582466 • Views: …

More Releases from Fact.MR

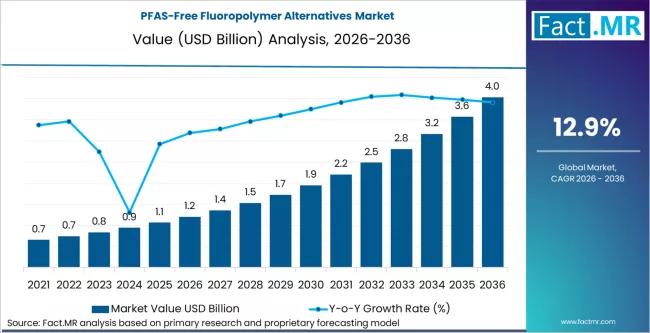

PFAS-Free Fluoropolymer Alternatives Market projects a CAGR of 12.9% by 2036

The global PFAS-free fluoropolymer alternatives market is projected to grow from USD 1.25 billion in 2026 to approximately USD 3.12 billion by 2036. This reflects a rapid compound annual growth rate (CAGR) of 9.6% over the ten-year forecast period.

The market is being aggressively driven by a global regulatory crackdown on "forever chemicals" (PFAS), forcing major industries to find non-fluorinated substitutes for coatings, membranes, and high-performance plastics.

Get Access of Report…

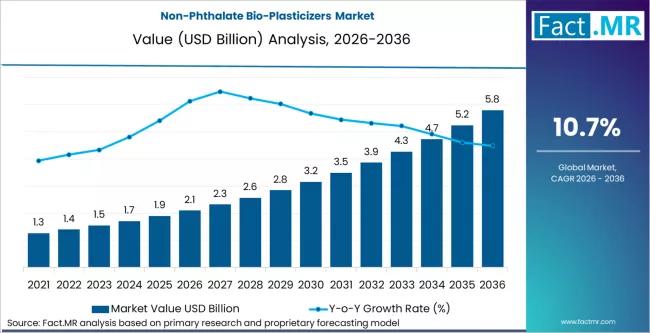

Non-Phthalate Bio-Plasticizers Market is Expected to Reach USD 5.8 billion by 20 …

The global HFO (Hydrofluoroolefin) Blowing Agent Market is forecast to grow substantially over the coming decade, driven by stringent environmental regulations, rising demand for energy-efficient insulation materials, and accelerated adoption of low-global-warming-potential (GWP) technologies across construction, refrigeration, and automotive sectors.

Industry analysts estimate that the market, valued at approximately USD 1.9 billion in 2025, is expected to exceed USD 3.6 billion by 2035, registering a compound annual growth rate (CAGR)…

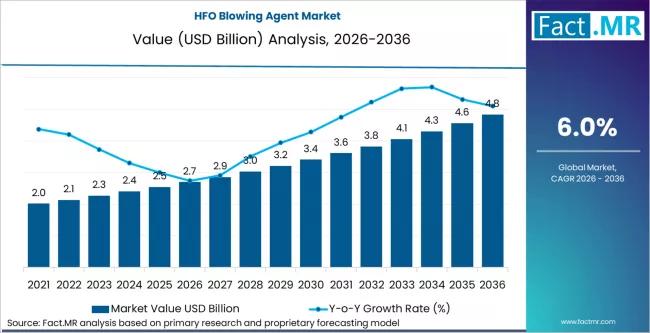

HFO Blowing Agent Market is Estimated to Grow to USD 2.7 billion in 2026

The global HFO (Hydrofluoroolefin) Blowing Agent Market is forecast to grow substantially over the coming decade, driven by stringent environmental regulations, rising demand for energy-efficient insulation materials, and accelerated adoption of low-global-warming-potential (GWP) technologies across construction, refrigeration, and automotive sectors. Industry analysts estimate that the market, valued at approximately USD 1.9 billion in 2025, is expected to exceed USD 3.6 billion by 2035, registering a compound annual growth rate (CAGR)…

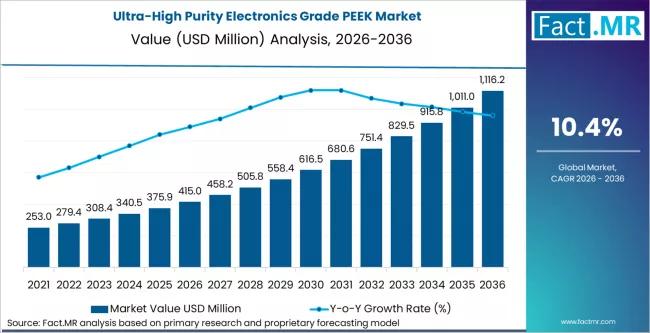

Ultra-High Purity Electronics Grade PEEK Market FOrecasted CAGR is 10.4% 2036

The global ultra-high purity (UHP) electronics-grade Polyether Ether Kitone (PEEK) market is projected to grow from USD 215.4 million in 2026 to approximately USD 458.6 million by 2036. This represents a strong compound annual growth rate (CAGR) of 7.8% over the ten-year forecast period.

The market is being driven by the relentless miniaturization of semiconductors and the shift toward 2nm and 3nm process nodes, where even microscopic material impurities can…

More Releases for Pay

Digital Wallets Market to See Thriving Worldwide | PayPal • Apple Pay • Goog …

The latest study by Coherent Market Insights, titled "Digital Wallets Market Size, Share & Trends Forecast 2026-2033," offers an in-depth analysis of the global and regional dynamics shaping this rapidly evolving industry. This comprehensive report highlights the competitive landscape, key market segments, value chain analysis, and emerging technological and regulatory trends expected between 2026 and 2033. The report provides actionable insights for business leaders, policymakers, investors, and new market entrants…

Mobile Payment Market to See Thriving Worldwide| Apple Pay • Google Pay • Sa …

Latest Report, titled Mobile Payment Market 2025-2032 Trends, Share, Size, Growth, Opportunity and Forecast 2025-2032, by Coherent Market Insights offers a comprehensive analysis of the industry, which comprises insights on the market analysis. As part of our Black Friday Limited-Time Discount, this premium research report is now available at up to 60% off, offering an exceptional opportunity for businesses, analysts, and stakeholders to access high-value insights at a significantly reduced…

Proximity Payment Market is Going to Boom | Major Giants Apple Pay, Google Pay, …

HTF MI just released the Global Proximity Payment Market Study, a comprehensive analysis of the market that spans more than 143+ pages and describes the product and industry scope as well as the market prognosis and status for 2025-2032. The marketization process is being accelerated by the market study's segmentation by important regions. The market is currently expanding its reach.

𝐌𝐚𝐣𝐨𝐫 Giants in Proximity Payment Market are:

Apple Pay, Google Pay, Samsung…

Unified Payments Interface (UPI) Market Is Booming Worldwide | Google Pay, Amazo …

The latest study released on the Global Unified Payments Interface (UPI) Market by AMA Research evaluates market size, trend, and forecast to 2028. The Unified Payments Interface (UPI) market study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about…

Unified Payments Interface (UPI) Market May See a Big Move | Major Giants Samsun …

The latest study released on the Global Unified Payments Interface (UPI) Market by AMA Research evaluates market size, trend, and forecast to 2027. The Unified Payments Interface (UPI) market study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about…

Samsung Pay Market is Booming Worldwide with Samsung Pay, Apple Pay, Google Pay

HTF Market Intelligence released a new research report of 23 pages on title 'Samsung Pay - Competitor Profile' with detailed analysis, forecast and strategies. The study covers key regions that includes North America, LATAM, United States, GCC, Southeast Asia, Europe, APAC, United Kingdom, India or China etc and important players such as Samsung Pay, Apple Pay, Google Pay, Alipay, Tenpay, Samsung Electronics, Visa, Mastercard.

Request a sample report @ https://www.htfmarketreport.com/sample-report/3587660-samsung-pay-competitor-profile

Summary

Samsung…