Press release

TBRC Report: Securities Brokerage and Stock Exchange Services Market to Reach $2807.24B by 2028 at 7.8% CAGR

The new report published by The Business Research Company, titled "Securities Brokerage And Stock Exchange Services Global Market Report 2024 - Market Size, Trends, And Global Forecast 2024-2033", delivers an in-depth analysis of the leading size and forecasts, investment opportunities, winning strategies, market drivers and trends, competitive landscape, and evolving market trends.As per the report, the securities brokerage and stock exchange services market size has grown strongly in recent years. It will grow from $1932.93 billion in 2023 to $2078.98 billion in 2024 at a compound annual growth rate (CAGR) of 7.6%. The securities brokerage and stock exchange services market size is expected to see strong growth in the next few years. It will grow to $2807.24 billion in 2028 at a compound annual growth rate (CAGR) of 7.8%.

Download Free Sample Report @ https://www.thebusinessresearchcompany.com/sample.aspx?id=3538&type=smp

Increasing Popularity Of Online Trading Platforms Is Anticipated To Fuel Security Brokerage And Stock Exchange Services Market

The increasing popularity of online trading platforms is expected to propel the security brokerage and stock exchange services markets going forward. An online trading platform refers to a digital interface, either a website or a software program, that facilitates the buying and selling of securities via the Internet. Security brokerage and stock exchange services offer a secure place for customers to purchase stocks, bonds, and other securities at reduced transaction fees, eliminating the need to go directly through a security broker or dealer. For instance, in January 2023, according to Business of Apps, a UK-based company that connects the app industry through B2B media services, the online stock trading apps or platforms were used by 130 million people in 2021, a 49% increase compared to 2020. Therefore, the increasing popularity of online trading platforms is driving the security brokerage and stock exchange services markets.

Brokerage Firms Diversify With Ad Hoc Peripheral Services For Global Clients

Brokerage firms are increasingly focusing on providing additional peripheral services to their customers around the world. Ad hoc peripheral services are unconventional trading solutions such as investment advice and planning services offered by brokerage firms to attract more customers. This is mainly to remain competitive in a price-sensitive market and capture a larger portion of the investor's assets. For instance, firms are offering loyalty programs, retirement products and services, analytical software, and social components to increase their share in the market. Brokerage firms are also waiving minimum activity charges, providing free access to premium industry publications, and offering discounted fees for existing traders.

The securities brokerage and stock exchange services market covered in this report is segmented -

1) By Type: Derivatives And Commodities Brokerage, Stock Exchanges, Bonds Brokerage, Equities Brokerage, Other Stock Brokerage

2) By Type of Establishment: Exclusive Brokers, Banks, Investment Firms, Other Type of Establishments

3) By Mode: Online, Offline

Subsegments Covered: Derivatives Brokerage, Commodities Brokerage, Clearing And Transaction Services, Listing Services, Market Data

Buy Now & Get Exclusive Discount on this Report, Checkout link @

https://www.thebusinessresearchcompany.com/Discount?id=3538&type=discount

Major companies operating in the securities brokerage and stock exchange services market report are Bank of America Corporation, Citigroup Global Markets Inc./Smith Barney, Northwestern Mutual Life Insurance Company, INVEST Financial Corporation, Ameriprise Financial Services Inc., Edward Jones & Co. L.P., Raymond James Financial Inc., Genworth Financial Inc., Wells Fargo Advisors LLC, H&R Block Financial Advisors Inc., H.D. Vest Financial Services Inc., Ameritas Investment Corp., Associated Securities Corporation, Commonwealth Financial Network Inc., Axa Advisors LLC, Aura Financial Services Inc., Cambridge Investment Research Inc., Lincoln Investment Planning Inc., Geneos Wealth Management Inc., GunnAllen Financial Inc., FSC Securities Corporation, Cadaret Grant & Co. Inc., Berthel Fisher & Company Financial Services Inc., First Allied Securities Inc., Capital Financial Group Inc., Investacorp Inc., InterSecurities Inc., Capital Analysts Incorporated, Investment Centers of America Inc., Investors Capital Corporation

Contents of the report:

1. Executive Summary

2. Securities Brokerage And Stock Exchange Services Market Report Structure

3. Securities Brokerage And Stock Exchange Services Market Trends And Strategies

4. Securities Brokerage And Stock Exchange Services Market - Macro Economic Scenario

5. Securities Brokerage And Stock Exchange Services Market Size And Growth

…..

27. Securities Brokerage And Stock Exchange Services Market Competitor Landscape And Company Profiles

28. Key Mergers And Acquisitions

29. Future Outlook and Potential Analysis

30. Appendix

Explore the report store to make a direct purchase of the report @ https://www.thebusinessresearchcompany.com/report/securities-brokerage-and-stock-exchange-services-global-market-report

Contact Us:

The Business Research Company

Europe: +44 207 1930 708

Asia: +91 88972 63534

Americas: +1 315 623 0293

Email: info@tbrc.info

Follow Us On:

LinkedIn: https://in.linkedin.com/company/the-business-research-company

Twitter: https://twitter.com/tbrc_info

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ

Learn More About The Business Research Company

The Business Research Company (www.thebusinessresearchcompany.com) is a leading market intelligence firm renowned for its expertise in company, market, and consumer research. With a global presence, TBRC's consultants specialize in diverse industries such as manufacturing, healthcare, financial services, chemicals, and technology, providing unparalleled insights and strategic guidance to clients worldwide.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release TBRC Report: Securities Brokerage and Stock Exchange Services Market to Reach $2807.24B by 2028 at 7.8% CAGR here

News-ID: 3581901 • Views: …

More Releases from The Business Research Company

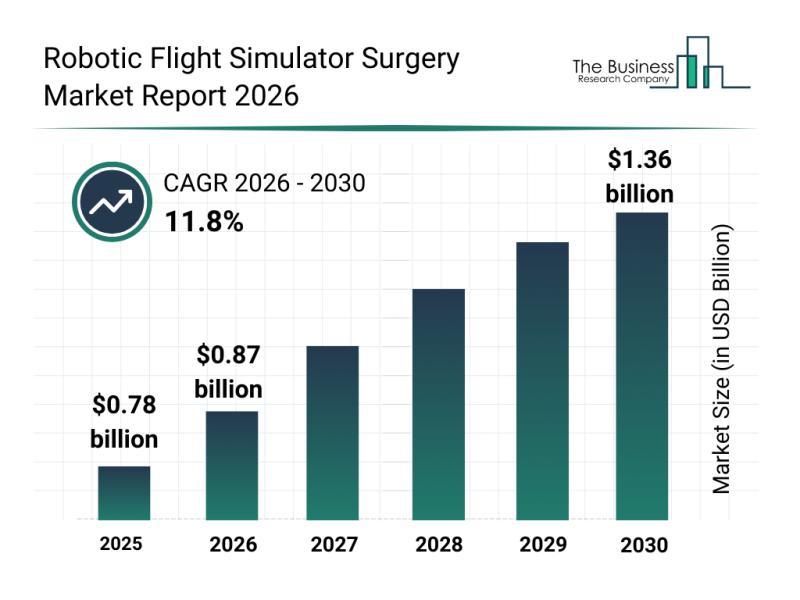

Global Factors Influencing the Rapid Evolution of the Robotic Flight Simulator S …

The robotic flight simulator surgery market is on the verge of significant expansion as advanced technologies continue to reshape surgical training and planning. Driven by increasing adoption of virtual reality and innovative simulation tools, this sector is set to experience considerable growth over the coming years. The following analysis explores the market's valuation, key contributors, evolving trends, and the segmentation landscape.

Projected Market Size and Growth Trajectory of the Robotic Flight…

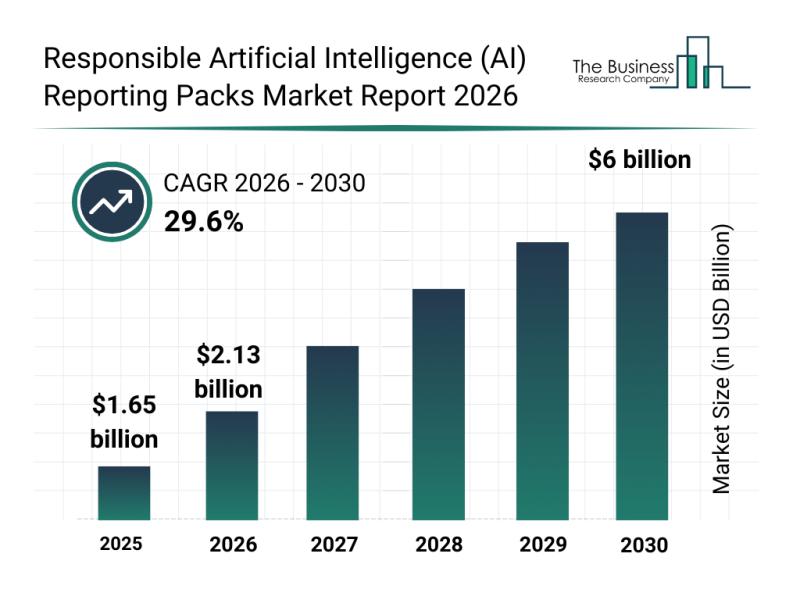

Leading Companies Consolidating Their Presence in the Responsible Artificial Int …

As artificial intelligence (AI) technologies continue to evolve and integrate deeply into business operations, the need for transparent and accountable AI practices has never been more critical. The responsible artificial intelligence (AI) reporting packs market is emerging as a vital sector dedicated to ensuring that AI systems are monitored, governed, and reported with rigor. Let's explore the expected growth, key players, industry trends, and market segments shaping this important field.

Projected…

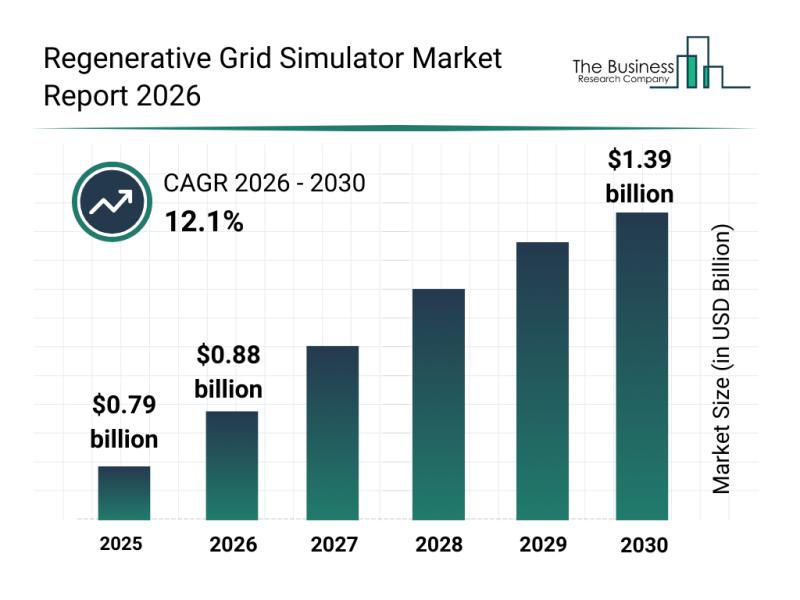

Future Perspective: Key Trends Shaping the Regenerative Grid Simulator Market Up …

The regenerative grid simulator market is on track for significant expansion as technological advancements and increasing energy demands drive innovation. With rising focus on smart grids and electric vehicle infrastructure, this market is poised to transform energy testing and validation processes in the coming years. Here's an in-depth look at the market's size, key players, emerging trends, and major segments shaping its future.

Forecast and Market Size Growth in the Regenerative…

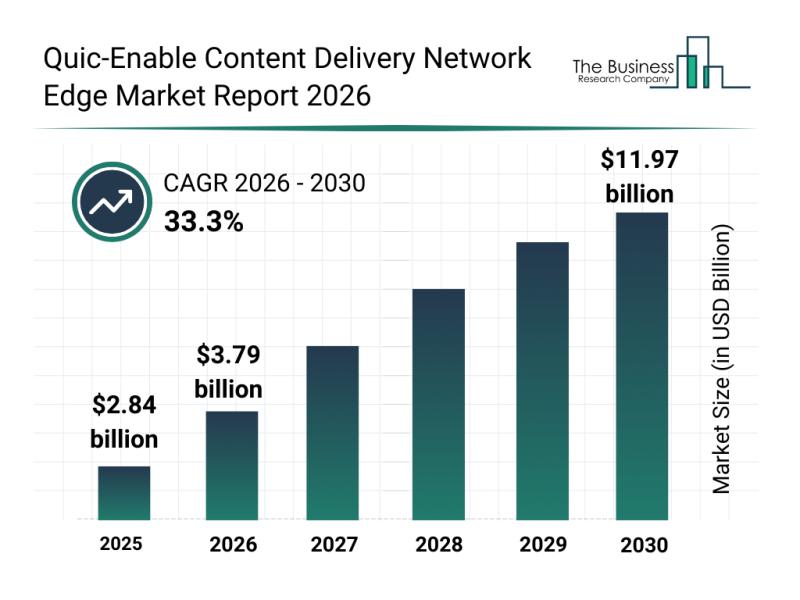

Analysis of Key Market Segments Driving the Quic-Enabled Content Delivery Networ …

The quic-enabled content delivery network edge industry is on track for remarkable expansion over the coming years. Driven by evolving digital needs and technological advancements, this market is set to transform how content is delivered and experienced globally. Let's explore its market size, key players, prevailing trends, and segment-specific forecasts to understand the future trajectory of this dynamic sector.

Projected Market Growth and Size of the Quic-Enable Content Delivery Network Edge…

More Releases for Brokerage

Prominent Mortgage Brokerage Services Market Trend for 2025: Technological Advan …

How Are the key drivers contributing to the expansion of the mortgage brokerage services market?

The increasing need for personalized financial guidance is likely to fuel the growth of the mortgage brokerage services market in the coming years. Personalized financial guidance involves creating financial strategies based on an individual's financial needs and goals. This demand is growing due to factors such as inflation, economic growth, interest rates, and technological progress. Mortgage…

Prediction market Kalshi launches brokerage integrations

Image: https://www.globalnewslines.com/uploads/2025/01/1738333447.jpg

New York, NY - Feb 3, 2025 - Kalshi, America's largest regulated prediction market, today announced the capability to integrate prediction markets with traditional financial brokerages.

The ability to integrate event contracts with brokerages significantly increases the number of Americans who will have access to prediction markets, signifying that further growth for the industry is imminent.

"A few years ago, prediction markets were a niche corner of the internet. We built…

Insurance Brokerage Market Size and Forecast

𝐔𝐒𝐀, 𝐍𝐞𝐰 𝐉𝐞𝐫𝐬𝐞𝐲- The global Insurance Brokerage Market is expected to record a CAGR of XX.X% from 2024 to 2031 In 2024, the market size is projected to reach a valuation of USD XX.X Billion. By 2031 the valuation is anticipated to reach USD XX.X Billion.

Insurance Brokerage Market Size and Scope

The insurance brokerage market is substantial and continues to expand, driven by the increasing demand for insurance solutions across various…

Online Financial Brokerage Market Next Big Thing | Major Giants- Financial Broke …

Advance Market Analytics published a new research publication on "Online Financial Brokerage Market Insights, to 2028" with 232 pages and enriched with self-explained Tables and charts in presentable format. In the Study you will find new evolving Trends, Drivers, Restraints, Opportunities generated by targeting market associated stakeholders. The growth of the Online Financial Brokerage market was mainly driven by the increasing R&D spending across the world.

Some of the key players…

Online Financial Brokerage Market, Online Discount Brokerage Market: Ken Researc …

Financial Brokerage Market –during the recent trend the financial market across the Philippines is one of the most fortunate financial markets in the South-Asia region with the very few financial products recommended for trading at recent but will enhance during a few years. In addition, the Trading activities across the Philippines region is exceedingly delimited owing to very low trading capacity and reasonably fewer trading accounts, most of the brokerage…

Cloud Services Brokerage Market Report 2018: Segmentation by Service Type (Catal …

Global Cloud Services Brokerage market research report provides company profile for Accenture (Ireland), DoubleHorn (US), Jamcracker (US), IBM (US), HPE (US), RightScale (US), Dell (US), Wipro (India), Arrow Electronics (US), ActivePlatform (Belarus), Cloudmore (Sweden) and Others.

This market study includes data about consumer perspective, comprehensive analysis, statistics, market share, company performances (Stocks), historical analysis 2012 to 2017, market forecast 2018 to 2025 in terms of volume, revenue, YOY growth rate,…