Press release

Consumer Mobile Payment Market to Experience Unprecedented Growth, Surpassing $850 Billion by 2034

By 2024, the size of the worldwide consumer mobile payment market is projected to reach US$ 76,501.3 million. It is anticipated that the market would grow at a notable rate of 27.2% over the course of the projected period, reaching a valuation of US$ 8,50,251.2 million by 2034.Due to customer demand for contactless transactions, the consumer mobile payment sector has expanded. Customers value the quick and safe contactless payment options provided by mobile devices. The number of people using smartphones is increasing due to easy access to the Internet for mobile payments. The growth of the mobile payment sector is directly impacted by the rise in smartphone use.

Download a Sample Copy Of Report: https://www.factmr.com/connectus/sample?flag=S&rep_id=9441

The adoption of mobile payments by consumers can be positively impacted by government initiatives and regulatory regimes that are favorable. Businesses and customers are urged to use mobile payment solutions by clear regulations and standards.

Mobile payments serve as a means of extending banking and financial services to those who may not have easy access to traditional banking infrastructure. This may promote the use of consumer mobile payments in emerging nations.

Key Companies Profiled

• ACI Worldwide

• Alphabet

• Samsung Electronics

• DH

• Fidelity National Information Services

• Fiserv

• Jack Henry & Associates

• MasterCard

• PayPal Holdings

• Square

• Visa

• Apple

Constraints Affecting Consumer Mobile Payments Adoption

Customers are reluctant to use mobile payment options because they are worried about the security of their financial information. The fear of identity theft, data breaches, or unauthorized access prevents widespread consumer acceptance of mobile payments. Weak internet and telecommunications infrastructure limits the use and trustworthiness of mobile payment systems, which prevents their widespread adoption.

Many consumers are unaware of all the benefits and functionality associated with mobile payment solutions. Lower adoption rates can be linked to a lack of understanding of the features and advantages of these systems. Certain mobile payment systems' transaction fees may deter certain consumers. The notion that more conventional payment methods are more cost-effective may be the root of reluctance to accept mobile payments.

The surge in e-commerce propels the growth of the mobile payment market

The use of QR codes for customer mobile payments has grown in China as more shops use this useful and efficient method. They are contributing to the country's shift to a cashless society. Because of the country's technologically savvy population and government support of new advancements in the industry, China's mobile payment business is constantly growing and evolving. China's share in the consumer mobile payment market is predicted to reach 67.9% by 2024.

Japan's consumer mobile payment environment is characterized by a wide range of services that cater to different consumer preferences, providing a dynamic ecosystem where customers may choose from a choice of solutions based on their needs and interests. Japan's hybrid strategy, which permits the coexistence of traditional and mobile payment systems, sets it apart from other Asia-Pacific nations in terms of market dynamics. This demonstrates how Japanese payment customs are influenced by culture. Japan's consumer mobile payment market is anticipated to hold a 24.1% share in 2024.

Read More: https://www.factmr.com/report/consumer-mobile-payment-market

Competitive Analysis

Significant consumer mobile payment providers are engaged in intense rivalry with one another for market share, which defines the market. The market is dominated by large technology businesses, fintech startups, and well-established financial institutions. These companies are always coming up with new ideas to enhance the security, convenience, and user experience of mobile payment systems, which encourages consumers to embrace them widely.

Tech startups and traditional financial institutions collaborate to create alliances and collaborations that alter the competitive landscape. With the entry of new consumer mobile payment suppliers, the industry is dynamic and evolving. For these providers, flexibility and agility are essential as the competitive environment gets more complicated as a result of shifting consumer preferences and legal frameworks.

Notable Progress

In April 2023, Visa revealed plans to work with PayPal and Venmo on a pilot program called Visa+. The goal of this innovative service is to make it easier for users to send money quickly and safely between different person-to-person (P2P) digital payment apps. Because of this cooperation, Visa+ will be able to serve more use cases, such gig, creator, and marketplace payouts. Visa+ is set to facilitate interoperability for digital wallets, neo-banks, and other payment applications that are accessible to millions of users in the United States.

In March 2023, PayPal launched Secure Payments, providing passkeys for Apple iOS as a new, easy, and secure way for approved PayPal users to log in, and passkeys for approved Google Android users to do the same, starting on the Android mobile web.

In May 2023, Visa introduced free online Cardholder Verification Value (CVV) transactions for nation-specific tokenized credentials in India. Because tokens are becoming more and more popular, businesses that tokenize Visa card transactions are excluded from collecting the CVV2 for domestic online transactions made using tokenized credentials.

In October 2022, PayPal announced that passkeys, a quick and safe way to log in, will be added to accounts. Passkeys, a new industry standard developed by the FIDO Alliance and the World Wide Web Consortium, replace passwords with cryptographic key pairs to provide users with a quick and secure way to access PayPal. Passkeys are equipped with phishing-resistant technology that prevents passkey information from being shared between platforms.

Segmentation of Consumer Mobile Payment Market Research:

• By Mode of Payment :

o Remote

o Proximity

• By End Use :

o Retail

o Hospitality and Tourism

o IT and Telecommunication

o BFSI

o Media and Entertainment

o Others

• By Region :

o North America

o East Asia

o East Asia

o South Asia and Pacific

o Western Europe

o Eastern Europe

o The Middle East and Africa

As technological advancements continue to enhance the security and convenience of mobile payments, the market is set to evolve rapidly. Key players are expected to innovate and expand their offerings to meet the growing demand for seamless, efficient, and secure payment solutions. The future of consumer mobile payments looks promising, with vast opportunities for growth and transformation in the financial and retail sectors.

Contact:

US Sales Office

11140 Rockville Pike

Suite 400

Rockville, MD 20852

United States

Tel: +1 (628) 251-1583, +353-1-4434-232

Email: sales@factmr.com

About Fact.MR

We are a trusted research partner of 80% of fortune 1000 companies across the globe. We are consistently growing in the field of market research with more than 1000 reports published every year. The dedicated team of 400-plus analysts and consultants is committed to achieving the utmost level of our client's satisfaction.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Consumer Mobile Payment Market to Experience Unprecedented Growth, Surpassing $850 Billion by 2034 here

News-ID: 3569244 • Views: …

More Releases from Fact.MR

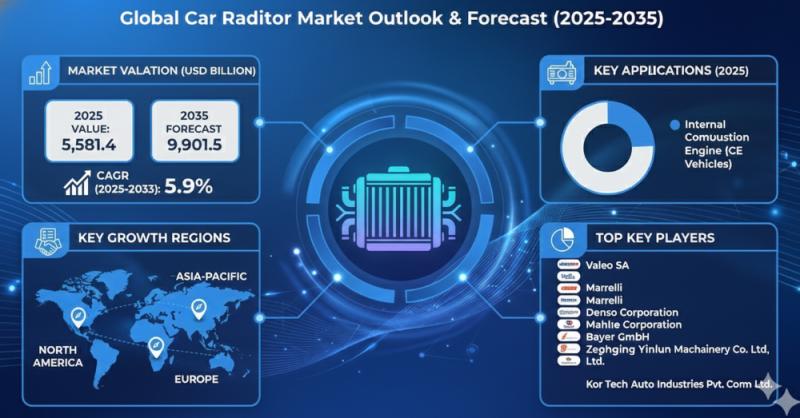

Car Radiator Market Forecast 2025-2035: Market to Reach USD 9,901.5 Billion by 2 …

The global Car Radiator Market is projected to grow from a valuation of US$ 5,581.4 billion in 2025 to US$ 9,901.5 billion by 2035. This expansion, representing a compound annual growth rate (CAGR) of 5.9%, is primarily driven by the rising demand for efficient engine cooling systems and the increasing production of passenger and commercial vehicles worldwide.

Request for Sample Report | Customize Report | Purchase Full Report - https://www.factmr.com/connectus/sample?flag=S&rep_id=325

Market…

Sports Flooring Market Forecast 2025-2035: Market to Reach USD 4,161 Million by …

The global sports flooring market is projected to grow from a valuation of US$ 2,867 million in 2025 to US$ 4,161 million by 2035. This expansion, representing a compound annual growth rate (CAGR) of 3.5%, is primarily driven by rising health awareness and significant global investments in athletic infrastructure to support peak performance and safety.

Request for Sample Report | Customize Report | Purchase Full Report - https://www.factmr.com/connectus/sample?flag=S&rep_id=324

Market snapshot: global…

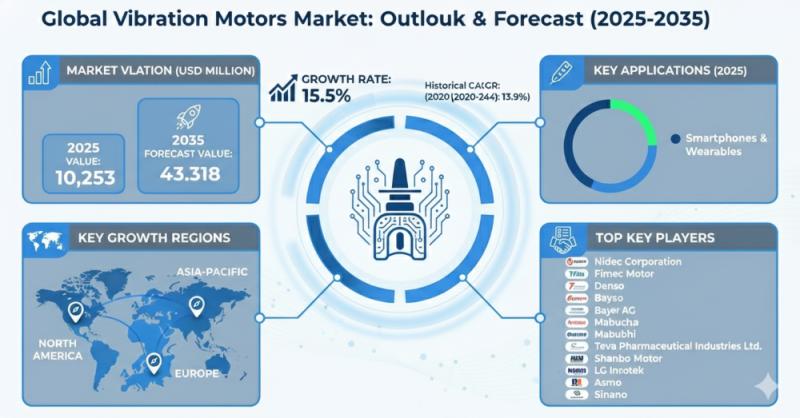

Vibration Motors Market Forecast 2025-2035: Market to Reach USD 43,318 Million b …

The global vibration motors market is projected to grow from a valuation of US$ 10,253 million in 2025 to US$ 43,318 million by 2035. This expansion, representing a compound annual growth rate (CAGR) of 13.9%, is driven by the increasing integration of haptic feedback technology in consumer electronics and the expanding demand for precision tactile alerts across various industrial applications.

Request for Sample Report | Customize Report | Purchase Full Report…

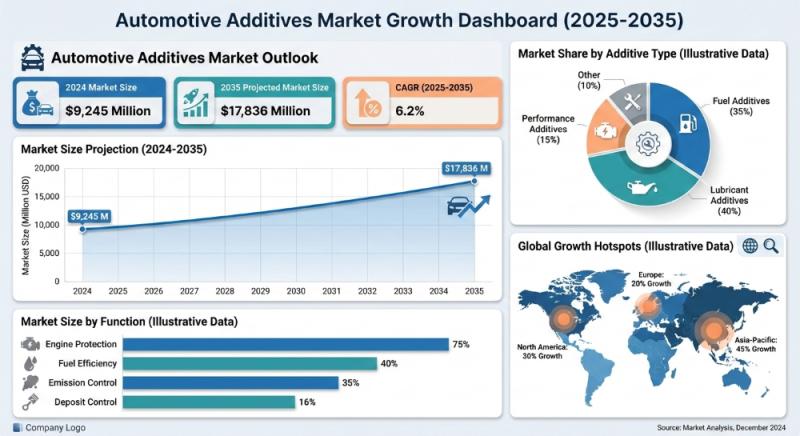

Automotive Additives Market Forecast 2025-2035: Market to Reach USD 17,836 Milli …

The global automotive additives market is projected to grow from a valuation of US$ 9,245 million in 2025 to US$ 17,836 million by 2035. This expansion, representing a compound annual growth rate (CAGR) of 6.2%, is primarily driven by the rising demand for fuel-efficient vehicles and the increasing focus on engine longevity across the global automotive sector.

Request for Sample Report | Customize Report | Purchase Full Report - https://www.factmr.com/connectus/sample?flag=S&rep_id=308

Market…

More Releases for Visa

E-Visa Market May Set New Growth Story | Semlex, Egypt E-Visa, Qatar E-Visa

HTF MI recently introduced Global E-Visa Market study with 143+ pages in-depth overview, describing about the Product / Industry Scope and elaborates market outlook and status (2025-2032). The market Study is segmented by key regions which is accelerating the marketization. At present, the market is developing its presence.

𝐌𝐚𝐣𝐨𝐫 𝐜𝐨𝐦𝐩𝐚𝐧𝐢𝐞𝐬 in E-Visa Market are:

Thales (Gemalto), IDEMIA (France), CGI Group Inc. (Canada), Cox & Kings (India), BLS International (India), TLS Contact (Paris),…

Crypto Credit Card Market Key Players Analysis - Nexo Mastercard, BlockFi Visa C …

InsightAce Analytic Pvt. Ltd. announces the release of a market assessment report on the "Global Crypto Credit Card Market - (By Type (Regular Crypto Credit Cards, Rewards Crypto Credit Cards, Others), By Application (BFSI, Personal Consumption, Business, Others)), Trends, Industry Competition Analysis, Revenue and Forecast To 2031."

According to the latest research by InsightAce Analytic, the Global Crypto Credit Card Market is valued at US$ 10.1 billion in 2023, and it…

Visa Center Streamlining Visa Applications Without Consulate Visits

Visa Center is a premier Canadian company specializing in helping clients obtain visas and stay informed about the latest visa regulations.

Image: https://www.getnews.info/uploads/06c09176a81087a4c0d1db13f69be7a9.jpg

The Chinese government has simplified the visa application process, eliminating the need for Canadians to attend consulate appointments for mandatory fingerprinting if they apply for a short-term visa. Previously, all applicants had to visit the Chinese consulate in person, which made the process cumbersome, especially for those living far…

Business Visa Service Market Size in 2023 To 2029 | TLScontact, VFS Global, Frag …

The Business Visa Service research report gives complete information about the trade evolving markets and studies vision across the well-known segments of the markets. The Business Visa Service research report highlights a bunch of constantly changing market situations as well as future evaluations of various factors that totally affect the market. The Business Visa Service research report gives complete data regarding the profitable developing markets and examines insight across the…

Business Visa Service Market Size in 2023 To 2029 | TLScontact, VFS Global, Frag …

The comprehensive report on the Business Visa Service market provides a thorough examination of the various factors that influence industry demand, growth, opportunities, challenges, and limitations. The report analyzes both the global and regional markets, offering insights into their composition and potential. Additionally, it includes information on research and development, new product launches, and feedback from major players in the global and regional markets. Using a systematic approach, the report…

Obtain a visa within quickest possible time with Visa Snap.

United States 25-05-2019. An emergency situation never comes with a warning. In case you are caught in trouble where you have to move to some other country as soon as possible, you would be requiring an emergency visa. Not all agencies issuing are ready to produce a visa under those situations since it is a complicated process. Visa Snap, a One Source Process Company is a reliable and trustworthy rush…