Press release

Tax Management Market Demand Will Reach a Value of US $ 45.21 Billion by the Year 2029, At a CAGR of 11.3 percentage

Anticipated Growth in Revenue:Tax Management Market Size in 2022 was worth US $ 21.36 Bn. at a CAGR 11.3 % and it is expected to reach US $ 45.21 Bn in 2029.

Tax Management Market Overview:

The Tax Management Market is experiencing robust growth, driven by the increasing complexity of tax regulations and the need for efficient tax planning and compliance. Businesses are increasingly adopting advanced tax management solutions to streamline their tax processes, reduce errors, and ensure compliance with evolving tax laws. These solutions leverage technologies such as artificial intelligence and machine learning to automate tax calculations, reporting, and filing, providing real-time insights and enhancing decision-making capabilities. The market is further propelled by the rising demand for cloud-based tax management systems, which offer scalability, flexibility, and cost-effectiveness, catering to the needs of both large enterprises and small to medium-sized businesses.

𝐔𝐧𝐥𝐨𝐜𝐤 𝐈𝐧𝐬𝐢𝐠𝐡𝐭𝐬: 𝐑𝐞𝐪𝐮𝐞𝐬𝐭 𝐚 𝐅𝐫𝐞𝐞 𝐒𝐚𝐦𝐩𝐥𝐞 𝐨𝐟 𝐎𝐮𝐫 𝐋𝐚𝐭𝐞𝐬𝐭 𝐑𝐞𝐩𝐨𝐫𝐭 𝐍𝐨𝐰:https://www.maximizemarketresearch.com/request-sample/116778/

Tax Management Market Trends:

The Tax Management Market is witnessing several key trends, including the growing adoption of cloud-based solutions that offer enhanced flexibility and real-time updates. Automation and AI are increasingly being integrated to streamline tax processes, improve accuracy, and reduce manual intervention. Additionally, there is a heightened focus on compliance management due to constantly changing tax regulations globally, driving demand for advanced tax management software. The market is also seeing a rise in the use of blockchain technology for secure and transparent tax transactions. Furthermore, the increasing need for data analytics in tax planning and strategy is shaping the future landscape of tax management solutions.

What are Tax Management Market Dynamics?

The dynamics of the Tax Management Market are shaped by several factors, including the increasing complexity of global tax regulations and the consequent need for businesses to ensure compliance. Technological advancements, particularly in automation and artificial intelligence, are driving the adoption of sophisticated tax management solutions that enhance efficiency and accuracy. Additionally, the shift towards cloud-based platforms is providing businesses with scalable and cost-effective options. Economic fluctuations and regulatory changes also play a significant role, as companies seek to optimize their tax strategies in response to evolving fiscal environments. Moreover, the growing emphasis on data security and transparency is pushing the integration of blockchain technology in tax management practices.

𝐍𝐞𝐞𝐝 𝐌𝐨𝐫𝐞 𝐈𝐧𝐟𝐨𝐫𝐦𝐚𝐭𝐢𝐨𝐧? 𝐈𝐧𝐪𝐮𝐢𝐫𝐞 𝐀𝐛𝐨𝐮𝐭 𝐒𝐚𝐦𝐩𝐥𝐞 + 𝐆𝐫𝐚𝐩𝐡𝐬 𝐇𝐞𝐫𝐞: https://www.maximizemarketresearch.com/inquiry-before-buying/116778/

Tax Management Market Opportunities:

The Tax Management Market presents numerous opportunities, primarily driven by the increasing digital transformation across industries. The growing adoption of cloud-based tax solutions offers significant potential, providing scalable and flexible options for businesses of all sizes. The integration of AI and machine learning in tax management systems opens up opportunities for enhanced automation, predictive analytics, and improved decision-making. Additionally, the rising focus on data security and compliance amidst evolving tax regulations creates a demand for robust and innovative tax management solutions. Emerging markets also offer substantial growth potential as businesses in these regions seek to modernize their tax processes and systems.

What is Tax Management Market Regional Insight?

The Tax Management Market exhibits varied regional dynamics, with North America leading due to its advanced technological infrastructure and stringent regulatory landscape. Europe follows closely, driven by complex tax structures and the need for compliance across multiple jurisdictions. The Asia-Pacific region is experiencing rapid growth, fueled by increasing digitalization and the adoption of cloud-based tax solutions by emerging economies. Latin America and the Middle East & Africa are also witnessing steady growth, driven by regulatory reforms and the modernization of tax systems. Each region's unique regulatory environment and economic conditions significantly influence the adoption and implementation of tax management solutions.

𝐅𝐑𝐄𝐄 𝐆𝐞𝐭 𝐚 𝐂𝐨𝐩𝐲 𝐨𝐟 𝐒𝐚𝐦𝐩𝐥𝐞 𝐑𝐞𝐩𝐨𝐫𝐭 𝐍𝐨𝐰! @https://www.maximizemarketresearch.com/request-sample/116778/

What is Tax Management Market Segmentation?

by Component

Software

Services

by Tax Type

Indirect Tax

Direct Tax

by Deployment

Cloud

On-premises

by End-User

BFSI

IT and Telecom

Manufacturing

Energy and Utilities

Retail

Healthcare and Life Sciences

Media and Entertainment

Others

Some of the current players in the Tax Management Market are:

1. Avalara

2. ADP

3. Automatic Data Processing

4. Wolters Kluwer N.V

5. Thomson Reuters

6. Intuit

7. H&R Block

8. SAP SE

9. Blucora

10. Sovos Compliance

11. Vertex

12. Sailotech

13. Defmacro Software

14. DAVO Technologies

15. Xero

16. TaxSlayer

17. Taxback International

18. TaxCloud

19. Drake Enterprises

20. Canopy Tax

21. TaxJar

𝐅𝐨𝐫 𝐌𝐨𝐫𝐞 𝐈𝐧𝐟𝐨𝐫𝐦𝐚𝐭𝐢𝐨𝐧 𝐀𝐛𝐨𝐮𝐭 𝐓𝐡𝐢𝐬 𝐑𝐞𝐬𝐞𝐚𝐫𝐜𝐡 𝐏𝐥𝐞𝐚𝐬𝐞 𝐕𝐢𝐬𝐢𝐭:https://www.maximizemarketresearch.com/market-report/global-tax-management-market/116778/

Key Offerings:

Past Market Size and Competitive Landscape

Tax Management Market Size, Share, Size & Forecast by different segment

Market Dynamics - Growth Drivers, Restraints, Opportunities, and Key Trends by region

Tax Management Market Segmentation - A detailed analysis by Product

Competitive Landscape - Profiles of selected key players by region from a strategic perspective

Competitive landscape - Market Leaders, Market Followers, Regional player

Competitive benchmarking of key players by region

PESTLE Analysis

PORTER's analysis

Value chain and supply chain analysis

Legal Aspects of business by region

Lucrative business opportunities with SWOT analysis

Recommendations

Explore our top-performing reports on the latest trends:

♦ IoT Platform Market https://www.maximizemarketresearch.com/market-report/global-iot-platform-market/10330/

♦ Mobile Gaming Market https://www.maximizemarketresearch.com/market-report/global-mobile-gaming-market/63745/

♦ Medical Education Market https://www.maximizemarketresearch.com/market-report/global-medical-education-market/32035/

♦ Global Small Cell Networks Market https://www.maximizemarketresearch.com/market-report/global-small-cell-networks-market/8042/

♦ Software as a Service (SaaS) Market https://www.maximizemarketresearch.com/market-report/software-as-a-service-saas-market/45115/

♦ Global White Box Server Market https://www.maximizemarketresearch.com/market-report/global-white-box-server-market/65959/

Contact Maximize Market Research:

MAXIMIZE MARKET RESEARCH PVT. LTD.

⮝ 3rd Floor, Navale IT park Phase 2,

Pune Banglore Highway, Narhe

Pune, Maharashtra 411041, India.

✆ +91 9607365656

🖂 sales@maximizemarketresearch.com

🌐 www.maximizemarketresearch.com

About Maximize Market Research:

Maximize Market Research is one of the fastest-growing market research and business consulting firms serving clients globally. Our revenue impact and focused growth-driven research initiatives make us a proud partner of majority of the Fortune 500 companies. We have a diversified portfolio and serve a variety of industries such as IT & telecom, chemical, food & beverage, aerospace & defense, healthcare and others.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Tax Management Market Demand Will Reach a Value of US $ 45.21 Billion by the Year 2029, At a CAGR of 11.3 percentage here

News-ID: 3559791 • Views: …

More Releases from MAXIMIZE MARKET RESEARCH PVT. LTD

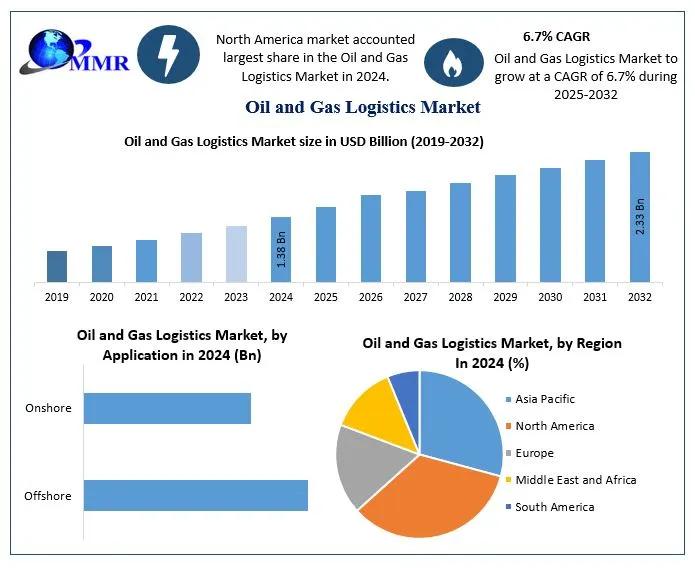

Oil and Gas Logistics Market to Reach USD 2.33 Billion by 2032 | Growth, Trends, …

The Oil and Gas Logistics Market was valued at USD 1.38 Billion in 2024 and is forecasted to grow to USD 2.33 Billion by 2032, exhibiting a CAGR of 6.7% during 2025 to 2032, driven by rising global energy demand, technological innovation, and expanding upstream and downstream supply chain activities.

Market Overview

The oil and gas logistics market encompasses the transportation, storage, handling, and distribution of crude oil, refined products, natural gas,…

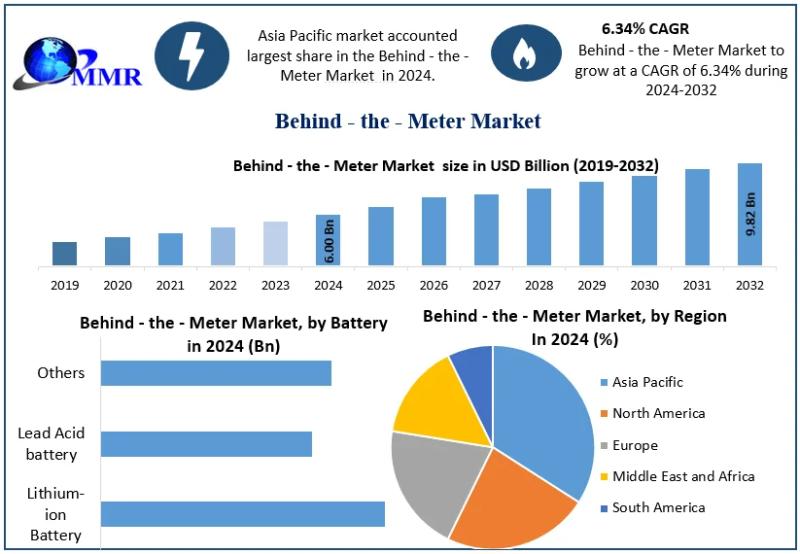

Behind the Meter Market to Surge to USD 9.82 Billion by 2032 - Unmatched Growth …

According to Maximize Market Research, the Global Behind the Meter Market was valued at USD 6.00 Billion in 2024 and is projected to reach USD 9.82 Billion by 2032 at a 6.34 % CAGR, driven by growth in residential, commercial, and industrial energy storage adoption.

Market Overview

The Behind the Meter Market consists of energy storage systems installed on the consumer side of the utility meter. These systems store electricity generated from…

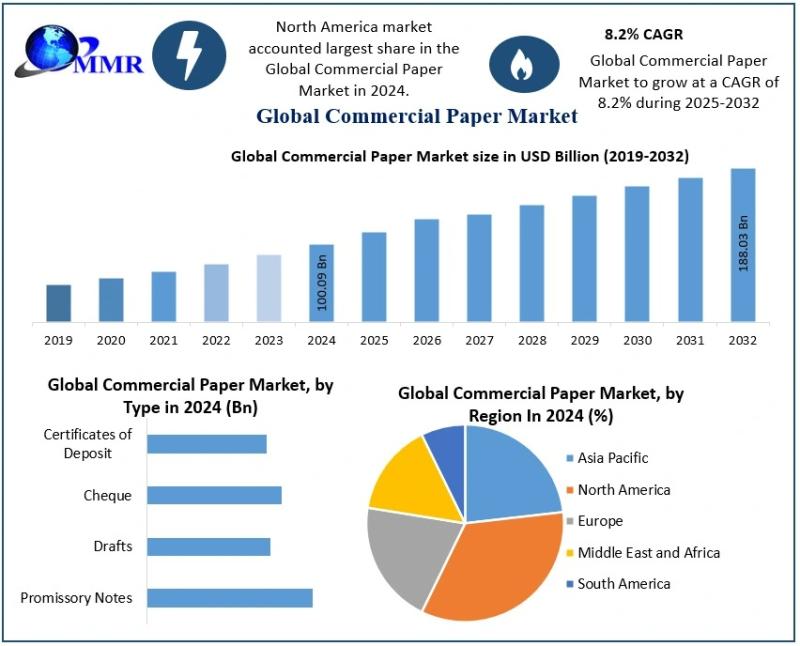

Commercial Paper Market Expected to Witness Steady Growth Driven by Short-Term C …

The Commercial Paper Market size was valued at USD 100.09 Billion in 2024 and the total Commercial Paper revenue is expected to grow at a CAGR of 8.2% from 2025 to 2032, reaching nearly USD 188.03 Billion.

Curious to peek inside? Grab your sample copy of this report now: https://www.maximizemarketresearch.com/request-sample/199690/

The Commercial Paper Market is gaining strong momentum as corporations, financial institutions, and large enterprises increasingly rely on short-term unsecured debt instruments…

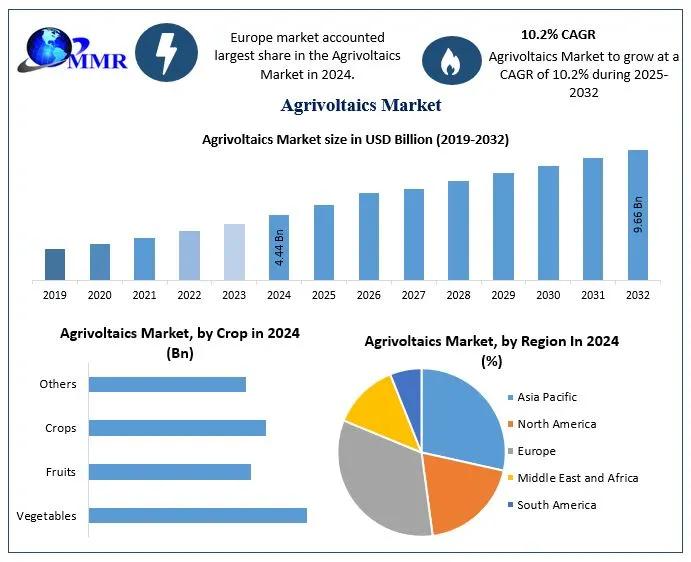

Agrivoltaics Market to Reach USD 9.66 Billion by 2032: Unlocking Dual-Use Land f …

The Global Agrivoltaics Market size was valued at USD 4.44 Billion in 2024 and is anticipated to reach nearly USD 9.66 Billion by 2032, growing at a CAGR of 10.2 % from 2025 to 2032, driven by rising demand for renewable energy solutions and sustainable agriculture practices.

Market Overview

Agrivoltaics - also called "dual-use farming" - integrates photovoltaic (PV) solar power systems with agricultural land, enabling simultaneous cultivation and energy generation on…

More Releases for Tax

Tax Accountant Launches Expert Tax Advisory Services for Complex UK Tax Issues

Birmingham, UK - Tax Accountant, a premier provider of tailored tax solutions, is proud to announce the introduction of its new Specialist Tax Advice service. Aimed at tackling the multifaceted tax challenges faced by individuals and businesses in the UK, this service is set to revolutionize how tax compliance and optimization are approached.

As tax laws become increasingly complex and the implications of non-compliance more severe, the need for specialized tax…

Legal Tax Defense Offers Tax Relief Services to Successfully Settle IRS Tax Debt …

Legal Tax Defense provides expert guidance and strategies to navigate IRS negotiations and reduce tax liabilities.

Legal Tax Defense, Inc., a premier provider of tax resolution services, is now providing strategic assistance and professional help for those who find IRS tax debt to be stressful and intimidating. The firm assists taxpayers in understanding their alternatives for efficiently managing and lowering tax liabilities by offering a range of specialist services.

"Handling IRS tax…

Legal Tax Defense Providing Strategic Assistance to Settle Tax Debts for Tax Pay …

Fulfill Tax Obligations and Prevent Legal Issues.

Legal Tax Defense, a premier firm specializing in tax resolution, proudly announces its updated services aimed at helping clients effectively settle their tax debts. With a focus on alleviating the financial and legal pressures associated with unpaid taxes, Legal Tax Defense offers a lifeline to individuals and businesses struggling with tax liabilities.

Understanding the options available for settling tax debts [https://www.legaltaxdefense.com/settling-tax-debts/] is crucial in taking…

Bidding At The Tax Sale - Tax Sale Success Masterclass with The Tax Lien Lady

Joanne Musa, founder of TaxLienLady.com is holding a Tax Sale Success Masterclass on Bidding at the Tax Sale on Thursday, November 10 at 7:00 pm Eastern Time.

Tax lien and tax deed investing can be very profitable. Tax Lien investors can earn interest rates that are much higher than current bank rates without the risk of the stock market. Joanne Musa, known online as the tax lien lady, has been helping…

Tax Software Market – Major Technology Giants in Buzz Again | TurboTax, Tax Sl …

The Latest Released Tax Software market study has evaluated the future growth potential of Global Tax Software market and provides information and useful stats on market structure and size. The report is intended to provide market intelligence and strategic insights to help decision makers take sound investment decisions and identify potential gaps and growth opportunities. Additionally, the report also identifies and analyses changing dynamics, emerging trends along with essential drivers,…

Tax Software Market to Eyewitness Massive Growth by 2026 | Tax Act, Tax Slayer, …

The latest independent research document on Global Tax Software examine investment in Market. It describes how companies deploying these technologies across various industry verticals aim to explore its potential to become a major business disrupter. The Tax Software study eludes very useful reviews & strategic assessment including the generic market trends, emerging technologies, industry drivers, challenges, regulatory policies that propel the market growth, along with major players profile and strategies.…