Press release

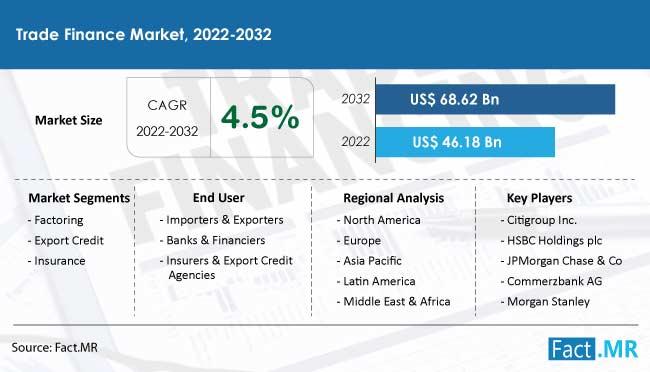

Trade Finance Market Is Anticipated To Rise At 4.5% CAGR Through 2032, Fact.MR

The global Trade Finance market is projected to reach $68.62 billion by 2032, growing at a CAGR of 4.5% from 2022 to 2032. The integration of blockchain technology is expected to drive continuous growth during this period. According to Fact.MR, the market is valued at $46.18 billion in 2022. Importers and exporters are anticipated to be the primary revenue contributors. Trade Finance plays a crucial role in mitigating fraudulent activities, thereby bolstering the market.The Asia-Pacific region dominates the trade finance market due to increasing awareness in emerging economies. North America and Europe, already mature markets, also hold significant shares. Currently, the top three countries in the global trade finance market collectively account for 42% of the market share.

For Critical Insights on this Market, Get A Sample Report!

https://www.factmr.com/connectus/sample?flag=S&rep_id=400

Key Takeaways:

• The Asia-Pacific is expected to hold more than 50% of the market share in the years to come due to propagation of SMEs herein.

• By trade activity, export credit is expected to go great guns in the next 10 years.

• Growing Preference for Trade Finance to Enhance Working Capital Efficiency in Businesses.

• Digitalization and utilization of new technologies such as Blockchain will improve efficiency and reduce the cost of players in the trade credit market.

Growth Drivers:

• Better exposure to the developing economies is expected to drive the trade finance market in the near future.

Increased demand for trade finance significantly impacts financial firms to invest in trade finance approaches that are less likely to spread, can collect and monitor multiple structured and unstructured data sets at the same time, and provide financial stability to importers and exporters in the form of payment risk and supply risk.

Technology is important in many businesses, including banking, financial services, and insurance (BFSI). Technological breakthroughs, automation, and a degree of standardization have all been developed in trade financing in recent years. Increasing advancements in data collection technology are driving the demand for AI and automation in banking.

Competitive Landscape:

The key participants in trade finance market are proactively engaging in new product launches as well as joint ventures to make a mark in the trade finance market.

For instance -

Citigroup Inc. does allow access to the advanced and specialized products as well as availability of finance while looking through financial statement's efficiency targets due to advancement in the technology.

Key Companies Profiled by Fact.MR

• Asian Development Bank

• Bank of America Corporation

• BNP Paribas S.A.

• Citigroup Inc.

• Euler Hermes Group

• HSBC Holdings PLC

• JP Morgan Chase & Co

• Mitsubishi UFJ Financial Inc.

• The Royal Bank of Scotland Group plc

• Standard Chartered Plc

More Valuable Insights on Trade Finance Market

Fact.MR in its latest study offers a comprehensive analysis on the global Trade Finance market. It also provides key information such as latest trends, drivers, and challenges that are expected to influence sales of Trade Finance during the forecast period of 2022 to 2032. It also uncovers critical forecast data for the

Trade Finance market through detailed segmentation as follows:

By Trade Activity:

• Factoring

• Export Credit

• Insurance

• Other Activities

By Transaction

• Domestic only

• International Only

By End-user:

• Importers & Exporters

• Banks & Financers

• Insurers & Export Credit Agencies

• Other Service Providers

By Region:

• North America

• Latin America

• Europe

• East Asia

• South Asia & Oceania

• MEA

Read More: https://www.factmr.com/report/400/trade-finance-market

About Fact.MR

We are a trusted research partner of 80% of fortune 1000 companies across the globe. We are consistently growing in the field of market research with more than 1000 reports published every year. The dedicated team of 400-plus analysts and consultants is committed to achieving the utmost level of our client's satisfaction.

Contact:

US Sales Office :

11140 Rockville Pike

Suite 400

Rockville, MD 20852

United States

Tel: +1 (628) 251-1583

E-Mail: sales@factmr.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Trade Finance Market Is Anticipated To Rise At 4.5% CAGR Through 2032, Fact.MR here

News-ID: 3547648 • Views: …

More Releases from Fact.MR

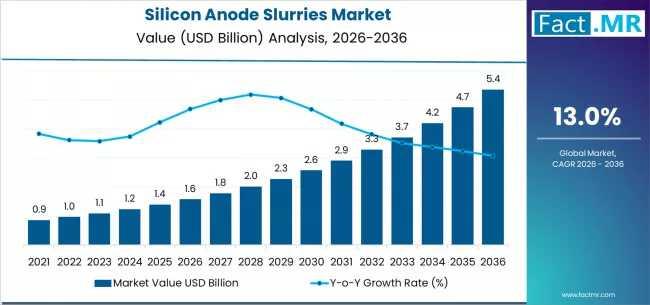

Silicon Anode Slurries Market Forecast 2026-2036: Market Size, Share, Competitiv …

The global silicon anode slurries market is set for significant expansion between 2026 and 2036, fueled by the rising adoption of high-energy-density lithium-ion batteries across electric vehicles (EVs), consumer electronics, and grid-scale energy storage. As battery manufacturers increasingly transition from graphite to silicon-enhanced anodes, the demand for high-performance, scalable silicon anode slurries is projected to grow sharply.

To access the complete data tables and in-depth insights, request a Discount On The…

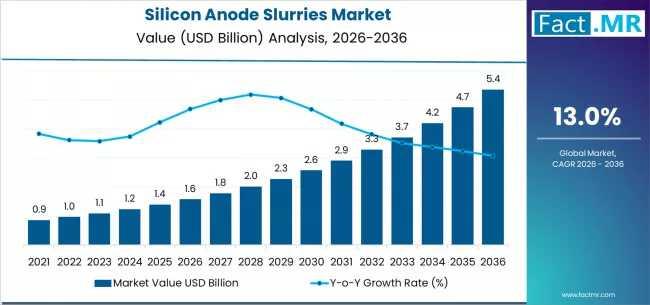

Silicon Anode Slurries Market Forecast 2026-2036: Market Size, Share, Competitiv …

The global silicon anode slurries market is set for significant expansion between 2026 and 2036, fueled by the rising adoption of high-energy-density lithium-ion batteries across electric vehicles (EVs), consumer electronics, and grid-scale energy storage. As battery manufacturers increasingly transition from graphite to silicon-enhanced anodes, the demand for high-performance, scalable silicon anode slurries is projected to grow sharply.

To access the complete data tables and in-depth insights, request a Discount On The…

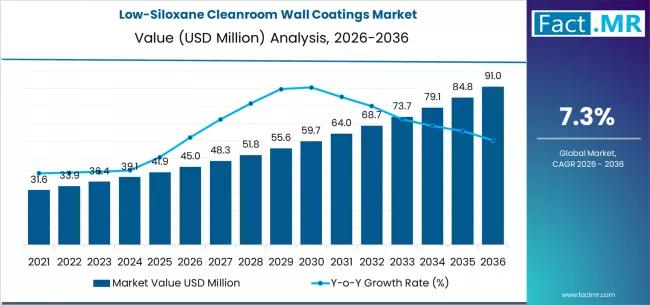

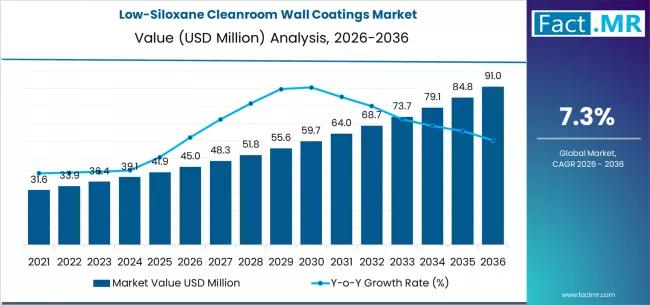

Low-Siloxane Cleanroom Wall Coatings Market Deep-Dive 2026-2036: Strategic Forec …

The low-siloxane cleanroom wall coatings market is poised for steady growth over the next decade, driven by rising contamination-control requirements across semiconductor, pharmaceutical, biotechnology, and precision manufacturing industries. These coatings are specifically engineered to minimize siloxane outgassing and volatile organic compound emissions, helping maintain ultra-clean environments where even trace contamination can disrupt production quality.

By 2036, the market for low-siloxane cleanroom wall coatings is expected to grow to USD 91.04 million.…

Low-Siloxane Cleanroom Wall Coatings Market Deep-Dive 2026-2036: Strategic Forec …

The low-siloxane cleanroom wall coatings market is poised for steady growth over the next decade, driven by rising contamination-control requirements across semiconductor, pharmaceutical, biotechnology, and precision manufacturing industries. These coatings are specifically engineered to minimize siloxane outgassing and volatile organic compound emissions, helping maintain ultra-clean environments where even trace contamination can disrupt production quality.

By 2036, the market for low-siloxane cleanroom wall coatings is expected to grow to USD 91.04 million.…

More Releases for Trade

Trade Intelligence for Global Trade: Benchmarking Competitors with Verified Trad …

In the modern supply chain battlefield, knowledge is not just power-it's leverage. Understanding how your competitors move in the global trade space can make the difference between a strategic win and a costly misstep. Yet, many companies still rely on fragmented or outdated information, missing out on key shifts that trade intelligence platforms can now uncover easily.

The Blind Spot in Traditional Competitive Research

Traditional competitor analysis typically relies on market reports,…

Decoding Chongqing's Cross-Border Trade through the Yumaotong Smart Trade Platfo …

Since its launch on May 13, the New Western International Land - Sea Corridor - Yumaotong Smart Trade Platform (hereinafter referred to as the 'Yumaotong Smart Trade Platform') has welcomed 420 enterprises, including over 100 foreign companies. At the 7th Western China International Fair held in Chongqing on May 22, Deng Ai, head of the platform, said that it offered global businesses a one-stop, full-chain, professional service from capturing trade…

Trade Show Displays: Maximizing Your Trade Show Booth Design

Trade shows are a critical aspect of any business that wants to showcase its products, services, and brand to potential customers, partners, and investors. Trade show displays are one of the most crucial elements in trade show marketing, and they play a significant role in determining the success of a company's presence at a trade show. In this article, we'll explore the different types of displays for trade shows and…

The future of international trade and worldwide network: Global Trade Plaza

The future of international trade and worldwide network: Global Trade Plaza

A radical change to support continuous growth in supply traffic.

Connecting all manufacturers, suppliers, traders, exporters, and importers.

Open the door to the future of safe international trade.

B2B marketplace Global Trade Plaza wants to redefine the supply chain. The growth due to digitalization has touched multiple fields, but couldn't do much for the intercountry supply. We are here with…

US-China trade war shifting cement seaborne trade flows

In 2018, the total number of active cement carriers surpassed 360 units, with the total dead weight tonnage topping 2.7 million, the highest figure recorded since 2010.

According to CW Research’s 2019 update of the World Cement, Clinker & Slag Sea-Based Trade Report, the upward trend was underpinned by a growing demand for cement carriers in key domestic trade markets.

Specialized cement carriers move about 25 million tons of cement per…

Suisse Trade – Holding Trade Seminar in Tokyo in December 2016

Suisse Trade is a full-fledged Forex trading firm that is renowned worldwide for rendering clients with the best assistance in commodity and Forex based trading. The company has been consistently successful in presenting clients with the most formidable instruments to trade in currency and commodities markets. The tasks undertaken by the company also involve spot and cash trades, limited risk options on futures as well as contracts. It has always…