Press release

How Much is the Usage Insurance Market Worth

According to a recent Fact.MR analysis, the global Usage Insurance market is expected to develop at a CAGR of 17% between 2021 and 2031. The market is predicted to reach $150 billion by the end of 2031.Demand for Usage Insurance is estimated to increase throughout the projection period, with a global market size of $30 billion by the end of 2020.

According to industry history, use insurance uptake has grown at an amazing 10% CAGR and is expected to reach US$ 30 billion by 2020. Prospects took a temporary hit in the early half of 2020, when the COVID-19 epidemic interrupted car manufacturing and distribution activities. Fortunately, the growing popularity of electric vehicles has kept demand high.

For Critical Insights on This Market, Request a Sample Report

https://www.factmr.com/connectus/sample?flag=S&rep_id=5352

In the long run, usage insurance providers hope to use telematics as an effective technology to deliver their services. Telematics-based insurance is extremely precise since driving data can be captured quickly, allowing insurers to provide feedback on on-road driver and vehicle performance. Several advancements are occurring, including the recent acquisition of TrueMotion by Cambridge Mobile Telematics in June 2021. After joining, Cambridge Mobile will supply telematics services to 21 of the top 25 vehicle insurers in the United States.

Key players in the Usage Insurance Market

Insure the Box Limited

Allstate Insurance Company

State Farm

Uniqa Insurance Group AG

Groupama

Generali Group

UnipolSai Assicurazioni S.p.A

Key Takeaways from the Market Study

Global use insurance market could grow 5x by 2031 compared to 2021.

Pay-as-you-drive (PAYD) will account for 55% of global market revenue, while smartphone-based usage insurance is expected to grow at a 9% CAGR until 2031.

Commercial usage insurance for vehicles is expected to expand at a 7% CAGR, with the United States accounting for half of worldwide demand over the next decade.

Europe is expected to expand at a 10% value CAGR until 2031.

Asia would account for a remarkable 15% growth rate between 2021 and 2031.

How are Good Driving Practices Paving Way for Usage Insurance?

Incentives for better driving behaviors will boost drivers' motivation to improve their driving skills. It leads to fewer traffic offenses and accidents, which means fewer claims for insurance companies. This might prevent most drivers from paying higher rates, saving them money.

Implementation of methods for tracking drivers' driving behavior via telematics is gaining pace. The widespread adoption of numerous technology, such as odometers, cellphones, and OBD dongles, has had a significant impact on consumer driving behavior.

Usage-based insurance coverage can provide current and continuous information about driving behaviors, allowing for quick and accurate premium and discount calculations. The maximum discount granted is 25%, however most drivers receive a 5% to 10% reduction after documenting their driving.

𝐑𝐞𝐚𝐝 𝐌𝐨𝐫𝐞: https://www.factmr.com/report/5352/usage-insurance-market

Competitive Landscape

Strategic agreements help insurance companies boost revenue and market share. New products and technologies will allow for the expansion of usage-based insurance in the insurance business.

Bolttech, an insurance technology firm, has acquired i-surance, a next-generation B2B2C digital insurance platform, to speed its expansion across Europe. With the acquisition of i-surance, Boltech now serves 26 countries in North America, Asia, and Europe, including Switzerland, Belgium, Germany, France, Liechtenstein, Monaco, Luxembourg, the Netherlands, Portugal, Poland, Spain, and the United Kingdom.

Bolttech plans to expand its insurance exchange services across Europe, giving both partners and customers more options.

Key Segments Covered in the Usage Insurance Industry Survey

Policy Type

Pay-how-you-drive(PHYD)

Pay-as-you-drive(PAYD)

Manage-how-you-drive(MHYD)

Product

Black Box

OBD Dongle

Smartphone

Others

Vehicle

Passenger Vehicle

Commercial Vehicle

Get Customization on this Report for Specific Research Solutions

https://www.factmr.com/connectus/sample?flag=RC&rep_id=5352

𝐂𝐨𝐧𝐭𝐚𝐜𝐭:

US Sales Office

11140 Rockville Pike

Suite 400

Rockville, MD 20852

United States

Tel: +1 (628) 251-1583, +353-1-4434-232

Email: sales@factmr.com

𝐀𝐛𝐨𝐮𝐭 𝐅𝐚𝐜𝐭.𝐌𝐑

We are a trusted research partner of 80% of fortune 1000 companies across the globe. We are consistently growing in the field of market research with more than 1000 reports published every year. The dedicated team of 400-plus analysts and consultants is committed to achieving the utmost level of our client's satisfaction.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release How Much is the Usage Insurance Market Worth here

News-ID: 3533411 • Views: …

More Releases from Fact.MR

Snacks Market is Growing at USD 569.2 billion in 2025 | Fact.MR Report

The global snacks market is projected to grow from USD 545.2 billion in 2026 to approximately USD 835.4 billion by 2036. This growth reflects a steady compound annual growth rate (CAGR) of 4.3% over the ten-year forecast period. The market is being fundamentally reshaped by the "snackification" of meals, where busy consumers are increasingly replacing traditional breakfast, lunch, and dinner with portable, nutrient-dense snacking options.

Get Access of Report Sample: https://www.factmr.com/connectus/sample?flag=S&rep_id=50

Quick…

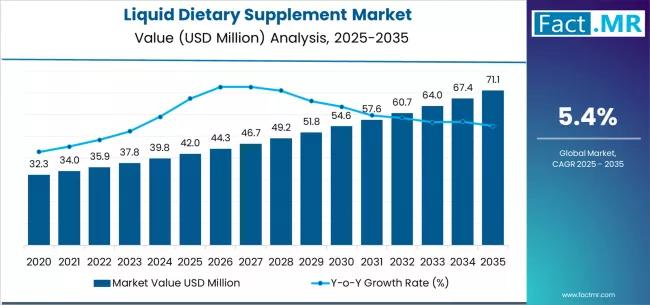

Liquid Nutritional Supplement Market Growing from USD 42.0 billion in 2025 to US …

The global liquid Nutritional supplements market is projected to grow from USD 33.25 billion in 2026 to approximately USD 45.10 billion by 2036. This growth represents a compound annual growth rate (CAGR) of 6.1% to 10.2% depending on the specific product segment (e.g., high-growth Ready-to-Drink formulations vs. traditional tonics).

The market is being primarily driven by a "pill fatigue" trend among consumers and an aging global population that increasingly prefers…

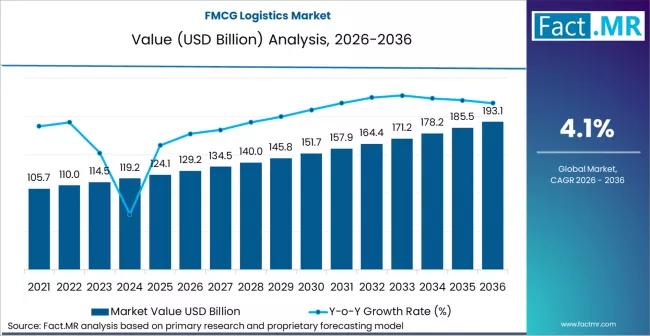

FMCG Logistics Market is Expected to Hit USD 190.5 billion by 2036 | Fact.MR Ins …

The global FMCG logistics market is projected to grow from USD 126.9 billion in 2026 to approximately USD 189.5 billion by 2036. This growth reflects a steady compound annual growth rate (CAGR) of 4.1% over the ten-year forecast period.

The market is entering a decade of transformation, shifting from a focus on cost-driven efficiency to automation-led resilience as retailers and brands navigate the complexities of quick-commerce and global supply chain…

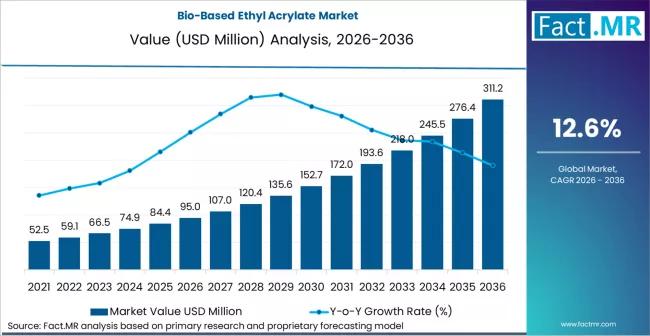

Bio-Based Ethyl Acrylate Market Forecasted CAGR of 12.6% by 2036 | Fact.MR Repor …

The global Bio-Based Ethyl Acrylate Market is projected to expand significantly over the next decade as demand for sustainable, performance-oriented monomers rises across coatings, adhesives, textiles, and specialty chemical applications. Industry analysts estimate that the market, valued at approximately USD 450 million in 2025, is expected to reach around USD 940 million by 2035, representing a compound annual growth rate (CAGR) of about 7.9% over the forecast period.

Get Access of…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…