Press release

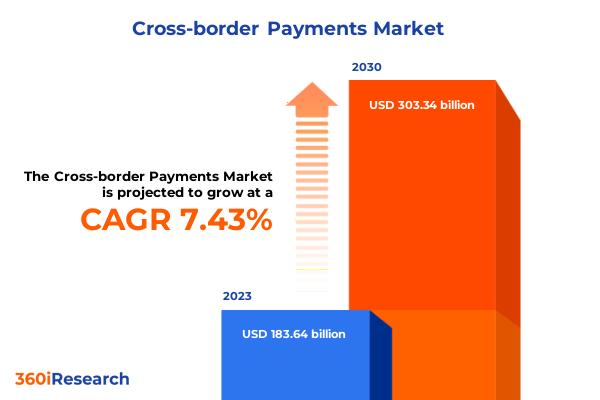

Cross-border Payments Market worth $303.34 billion by 2030, growing at a CAGR of 7.43% - Exclusive Report by 360iResearch

The "Cross-border Payments Market by Service (Banking Services, Cryptocurrency Transactions, Mobile Wallets), Transaction Type (Business-to-Business, Business-to-Consumer, Consumer-to-Business), Channel, End Users - Global Forecast 2024-2030" report has been added to 360iResearch.com's offering.Request a Free Sample Report @ https://www.360iresearch.com/library/intelligence/cross-border-payments?utm_source=openpr&utm_medium=referral&utm_campaign=sample

"Global Dynamics Fuel Robust Growth in Cross-Border Payments Market"

The cross-border payments market is experiencing significant growth driven by several key factors. The increasing global e-commerce activity necessitates efficient and secure multi-currency payment systems, while supportive regulatory frameworks are simplifying international transactions by standardizing protocols and enhancing security. Additionally, the rise in remittance flows underscores the need for fast, cost-effective solutions for foreign workers sending money home. Technological advancements, including blockchain and digital wallets, are streamlining payment processes and boosting security. Strategic partnerships among financial institutions, fintech companies, and technology providers are enhancing service reach and functionality. Further, the widespread adoption of mobile devices and internet access is making cross-border payments more accessible. These solutions also offer economic benefits over traditional banking methods, being faster, more cost-effective, and providing better exchange rates. Collectively, these factors are driving the dynamic growth of the cross-border payments market, catering to the global demand for quick, secure, and efficient payment solutions.

"Key Challenges Impacting the Growth of the Cross-Border Payments Market"

Despite its potential, the cross-border payments market faces several significant restraints. High transaction costs, driven by fees from intermediaries, currency conversion expenses, and other charges, make international payments expensive and deter small and medium-sized enterprises and individuals from participating. The absence of unified standards and varying regulatory requirements across countries further complicates the process, resulting in delays and higher compliance costs. Security remains a critical concern, with heightened risks of fraud and cyber-attacks making both consumers and businesses hesitant to engage in these transactions. Additionally, the slow processing times due to multiple intermediaries and checks frustrate users, leading them to seek faster alternatives. Compounding these issues is the limited access to advanced payment technologies in many regions, which hampers market growth and threatens the viability of traditional methods in the face of emerging payment solutions.

"Unlocking Opportunities in Cross-Border Payments: Technological Advancements, Emerging Markets, and Strategic Collaborations"

The cross-border payments market is poised for significant advancements, driven by a confluence of technological innovations, strategic expansions, and collaborative efforts. Emerging technologies such as blockchain and advanced cryptography are pivotal in enhancing the security, speed, and cost-efficiency of international transactions by reducing fraud risks and eliminating intermediaries. Expanding services into emerging markets presents vast growth potential, given the rapid digital adoption and economic activity in these regions despite their often limited financial infrastructures. Strategic collaborations among financial institutions, fintech startups, and technology providers are fostering the development of seamless, efficient, and user-friendly payment solutions. Moreover, supportive government policies and regulatory frameworks are accelerating the adoption of digital payment solutions by ensuring security and encouraging innovation. The burgeoning fintech startup ecosystem also offers a fertile ground for investment, promising groundbreaking solutions that address current market inefficiencies. Ensuring scalability and interoperability of payment platforms is crucial for broader adoption and efficiency, while public-private partnerships can significantly enhance infrastructure development, ensuring robust and secure payment ecosystems. These factors collectively chart a path for substantial advancements in the cross-border payments market, highlighting multiple avenues for innovation, expansion, and collaboration.

"Addressing Key Challenges in the Evolving Cross-Border Payments Market"

Navigating the complexities of the cross-border payments market unveils a myriad of challenges, from integration and deployment obstacles to counterfeit and fraud risks. Implementing these payment solutions demands seamless integration with diverse banking systems and regulatory frameworks across multiple countries, often leading to technical difficulties, extended deployment periods, and higher costs. The market's vulnerability to fraudulent activities, exacerbated by differences in regulatory environments and financial practices, further threatens revenue and user trust. Moreover, substantial energy consumption in payment infrastructures highlights environmental concerns, prompting the need for sustainable technology solutions. The industry also faces a skilled workforce shortage, as developing and maintaining these sophisticated systems requires expertise in software development, cybersecurity, and financial analysis-areas with notable personnel deficits. Finally, regulatory changes, such as updates to anti-money laundering laws and international compliance standards, impose long-term operational consequences and necessitate constant adaptation from service providers. Addressing these challenges is crucial for ensuring secure and efficient cross-border transactions.

Inquire Before Buying @ https://www.360iresearch.com/library/intelligence/cross-border-payments?utm_source=openpr&utm_medium=referral&utm_campaign=inquire

Market Segmentation & Coverage:

This research report categorizes the Cross-border Payments Market in order to forecast the revenues and analyze trends in each of following sub-markets:

Based on Service, market is studied across Banking Services, Cryptocurrency Transactions, Mobile Wallets, and Money Transfer Services.

Based on Transaction Type, market is studied across Business-to-Business, Business-to-Consumer, Consumer-to-Business, and Consumer-to-Consumer.

Based on Channel, market is studied across Bank Transfer, Card Payment, and Money Transfer Operator.

Based on End Users, market is studied across Businesses and Individuals.

Based on Region, market is studied across Americas, Asia-Pacific, and Europe, Middle East & Africa. The Americas is further studied across Argentina, Brazil, Canada, Mexico, and United States. The United States is further studied across California, Florida, Illinois, New York, Ohio, Pennsylvania, and Texas. The Asia-Pacific is further studied across Australia, China, India, Indonesia, Japan, Malaysia, Philippines, Singapore, South Korea, Taiwan, Thailand, and Vietnam. The Europe, Middle East & Africa is further studied across Denmark, Egypt, Finland, France, Germany, Israel, Italy, Netherlands, Nigeria, Norway, Poland, Qatar, Russia, Saudi Arabia, South Africa, Spain, Sweden, Switzerland, Turkey, United Arab Emirates, and United Kingdom.

Key Company Profiles:

The report delves into recent significant developments in the Cross-border Payments Market, highlighting leading vendors and their innovative profiles. These include 2Checkout.com, Inc. by VERIFONE SYSTEMS, INC., Airwallex, CurrencyFair Ltd., GoCardless Ltd., MoneyGram International, Inc., Nium Pte. Ltd., OzForex Limited, PayPal Holdings, Inc., PAYSEND PLC, Rapyd Financial Network Ltd., Remitly, Inc., Revolut Ltd, Ripple Labs Inc., Skrill by Paysafe Limited, Stripe, Inc., The Western Union Company, Touch 'n Go Sdn Bhd, TransferGo Ltd., Travelex International Limited, Wise PLC, and WorldRemit Ltd..

Introducing ThinkMi Query: Revolutionizing Market Intelligence with AI-Powered Insights for the Cross-border Payments Market

We proudly unveil ThinkMi Query, a cutting-edge AI product designed to transform how businesses interact with the Cross-border Payments Market. ThinkMi Query stands out as your premier market intelligence partner, delivering unparalleled insights with the power of artificial intelligence. Whether deciphering market trends or offering actionable intelligence, ThinkMi Query is engineered to provide precise, relevant answers to your most critical business questions. This revolutionary tool is more than just an information source; it's a strategic asset that empowers your decision-making with up-to-the-minute data, ensuring you stay ahead in the fiercely competitive Cross-border Payments Market. Embrace the future of market analysis with ThinkMi Query, where informed decisions lead to remarkable growth.

Ask Question to ThinkMi Query @ https://www.360iresearch.com/library/intelligence/cross-border-payments?utm_source=openpr&utm_medium=referral&utm_campaign=query

Key Topics Covered:

1. Preface

2. Research Methodology

3. Executive Summary

4. Market Overview

5. Market Insights

6. Cross-border Payments Market, by Service

7. Cross-border Payments Market, by Transaction Type

8. Cross-border Payments Market, by Channel

9. Cross-border Payments Market, by End Users

10. Americas Cross-border Payments Market

11. Asia-Pacific Cross-border Payments Market

12. Europe, Middle East & Africa Cross-border Payments Market

13. Competitive Landscape

14. Competitive Portfolio

Read More @ https://www.360iresearch.com/library/intelligence/cross-border-payments?utm_source=openpr&utm_medium=referral&utm_campaign=analyst

Contact 360iResearch

Mr. Ketan Rohom

Sales & Marketing,

Office No. 519, Nyati Empress,

Opposite Phoenix Market City,

Vimannagar, Pune, Maharashtra,

India - 411014.

sales@360iresearch.com

+1-530-264-8485

+91-922-607-7550

About 360iResearch

360iResearch is a market research and business consulting company headquartered in India, with clients and focus markets spanning the globe.

We are a dynamic, nimble company that believes in carving ambitious, purposeful goals and achieving them with the backing of our greatest asset - our people.

Quick on our feet, we have our ear to the ground when it comes to market intelligence and volatility. Our market intelligence is diligent, real-time and tailored to your needs, and arms you with all the insight that empowers strategic decision-making.

Our clientele encompasses about 80% of the Fortune Global 500, and leading consulting and research companies and academic institutions that rely on our expertise in compiling data in niche markets. Our meta-insights are intelligent, impactful and infinite, and translate into actionable data that support your quest for enhanced profitability, tapping into niche markets, and exploring new revenue opportunities.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Cross-border Payments Market worth $303.34 billion by 2030, growing at a CAGR of 7.43% - Exclusive Report by 360iResearch here

News-ID: 3526529 • Views: …

More Releases from 360iResearch

Rising Incidence of Human Metapneumovirus in Vulnerable Populations Boosts Globa …

In recent years, the silent ascent of human metapneumovirus (HMPV) infections has begun to capture significant attention within the realm of infectious diseases. As we advance in medical science, unraveling complexities of age-old pathogens like common influenza or emerging illnesses like COVID-19, a critical discourse has been emerging around HMPV. Particularly, there seems to be a burgeoning acknowledgment of its growing impact on vulnerable global populations, propelling an increased demand…

The Meat Alternatives Market size was estimated at USD 9.39 billion in 2023 and …

From Appetite to Advocacy: The Rising Demand for Meat Alternatives

In recent years, the global food industry has been undergoing a remarkable transformation, driven primarily by an increasing consumer demand for healthier, sustainable, and ethically sourced food products. This seismic shift has brought traditional meat alternatives and high-protein plant-based foods into the spotlight. As the world becomes more conscious of the implications of meat consumption on health and the environment, the…

The Mobility-as-a-Service Market size was estimated at USD 264.80 billion in 202 …

Unpacking the Surge in Investments and Collaborations to Bolster Mobility-as-a-Service

In recent years, as urban landscapes continually evolve, a transformative shift known as Mobility-as-a-Service (MaaS) has reshaped the way we perceive transportation. Marked by the integration of various forms of transport services into a single accessible on-demand mobility solution, MaaS is rapidly gaining traction across global cities. As an emerging paradigm, it's not just shaping the future of travel but also…

The Data Center Services Market size was estimated at USD 56.65 billion in 2023 …

Smart City Revolutions: Why Data Center Colocation is the Future Backbone

In the era of digital transformation, urban landscapes across the globe are undergoing a seismic shift toward becoming "smart cities." The concept of a smart city revolves around using digital technology, IoT (Internet of Things), AI, and data analytics at an unprecedented scale to improve urban infrastructure, manage resources efficiently, and enhance the quality of life for citizens. A vital…

More Releases for Payment

Evolving Market Trends In The Bitcoin Payment Ecosystem Industry: NFC-Enabled Cr …

The Bitcoin Payment Ecosystem Market Report by The Business Research Company delivers a detailed market assessment, covering size projections from 2025 to 2034. This report explores crucial market trends, major drivers and market segmentation by [key segment categories].

What Is the Expected Bitcoin Payment Ecosystem Market Size During the Forecast Period?

The market size of the Bitcoin payment ecosystem has seen swift acceleration in the past few years. Its growth is projected…

Payment Security Market : Increased Adoption of Digital Payment Modes Leading pl …

According to a recent report published by Allied Market Research, titled, "Payment Security Market by Component, Platform, Enterprise Size and Industry Vertical: Global Opportunity Analysis and Industry Forecast, 2021-2030," the global payment security market size was valued at $17.64 billion in 2020, and is projected to reach $60.56 billion by 2030, growing at a CAGR of 13.2% from 2021 to 2030.

Download Free PDF Report Sample :

https://www.alliedmarketresearch.com/request-sample/10390

Payment security software is used…

Hosted Payment Gateway Segment dominates Payment Gateway Market - TechSci Resear …

Government initiatives towards digitization and surging popularity of digital payment to drive global payment gateway market through 2024

According to TechSci Research report, “Global Payment Gateway Market By Type, By Enterprise Size, By End-User, By Region, Competition, Forecast & Opportunities, 2024”, global payment gateway market is projected to grow at a CAGR of over 8% during 2019-2024, on account of increasing internet penetration, which is aiding growing demand for online transactions.…

Digital Payment Market by Component (Solutions (Payment Processing, Payment Gate …

Magarpatta SEZ, Pune, “ReportsnReports”, one of the world’s prominent market research firms has released a new report on Global Digital Payment Market. The report contains crucial insights on the market which will support the clients to make the right business decisions. This research will help both existing and new aspirants for Digital Payment Market to figure out and study market needs, market size, and competition. The report talks about the…

Digital Payment Market by Payment Gateway Solutions, Payment Wallet Solutions, P …

Digital Payment Market 2019-2025: In 2018, the global Digital Payment market size was xx million US$ and it is projected to surpass xx million US$ by the end of 2025, growing at a CAGR of 18.1% during 2019-2025.

Things Covered in Sample Report

> Deep Dive Strategy & Competition

> Deep Dive Data & Forecasting

> Executive Summary & Core Findings

Get a Quick Sample report at https://decisionmarketreports.com/request-sample?productID=1008739

The key players covered in…

Online Payment Gateway Market Analysis By 2028 | Amazon.com, Avenues India Pvt. …

Future Market Insights (FMI) has recently published a new research report on the online payment gateway market titled “Online Payment Gateway Market: Global Industry Analysis (2013-2017) and Opportunity Assessment (2018-2028).” The report states that the growing prevalence of third party payment processes is expected to have a positive impact on the growth of the global market. Websites have always been a good source for channel merchants for generating revenue. Concentrating…