Press release

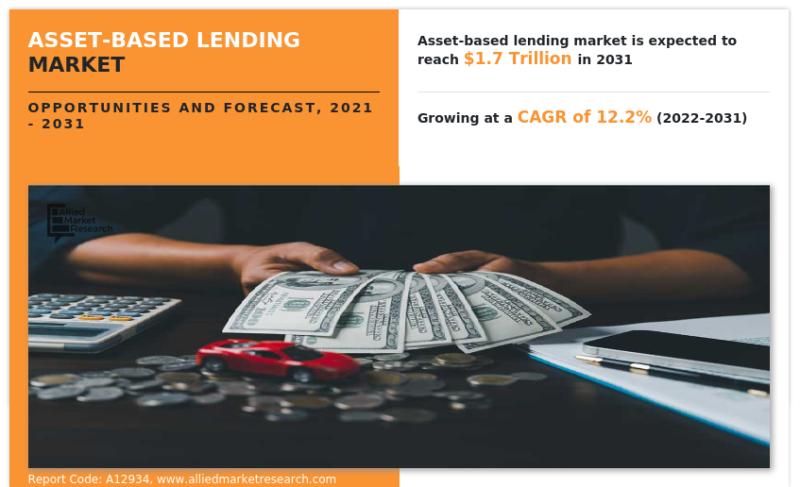

Asset-Based Lending Market Projected to Hit $1,721.38 Billion by 2031, Says Allied Market Research

Asset-based lending is gaining massive traction among businesses, as low costs of asset-based loans and easy loan availability are driving the market growth. Further, due to their ability to facilitate quicker, cashless, and paperless borrowing, lending-as-a-service (LaaS) platforms are becoming more popular. The use of online technology on a bank's or credit union's website for online applications, assessments, fulfilment, and repayments is referred to as the digitalization of a LaaS platform. This makes it possible to lend using advanced technology and possibly useful non-financial data (big data) for credit-based on e-commerce platform payments. This advances the use of digital lending without physical currency. Thus, this factor is fueling the growth of asset-based lending market.According to the report published by Allied Market Research, the global asset-based lending market was estimated at $561.5 billion in 2021 and is expected to hit $1,721.38 billion by 2031, registering a CAGR of 12.2% from 2022 to 2031. The report provides a detailed analysis of the top investment pockets, top winning strategies, drivers & opportunities, market size & estimations, competitive landscape, and evolving market trends. The market study is a helpful source of information for the frontrunners, new entrants, investors, and shareholders in crafting strategies for the future and heightening their position in the market.

𝑹𝒆𝒒𝒖𝒆𝒔𝒕 𝑺𝒂𝒎𝒑𝒍𝒆 𝑪𝒐𝒑𝒚 𝒐𝒇 𝑹𝒆𝒑𝒐𝒓𝒕- https://www.alliedmarketresearch.com/request-sample/13299

Covid-19 scenario-

The asset-based lending market experienced a boost during the pandemic, as businesses started looking for loans to cope with the financial challenges arising from lockdowns.

To adapt to the situation, some companies switched from cash-flow-based credit facilities to asset-based lines of credit.

The report comprehensively analyzes the global asset-based lending market, covering its various segments such as Type, Interest Rate, End User, and Region. The report presents the analysis of each segment and sub-segment through tabular and graphical representation. This analysis can be useful for investors and market players to identify the highest revenue-generating and fastest-growing segments, allowing them to devise effective strategies.

By type, the receivables segment contributed to more than two-fifths of the global asset-based lending market share in 2021, and is projected to rule the roost by 2031. The others segment, however, would display the fastest CAGR of 15.5% throughout the forecast period. The inventory financing and equipment financing segments are also discussed in the report.

By interest rate, the fixed rate segment accounted for the highest share in 2021, generating around two-thirds of the total market revenue. The floating rate segment, on the other hand, would portray the fastest CAGR of 14.2% during the forecast period.

By end-user, the large enterprises segment garnered the highest share in 2021, accounting for more than three-fifths of the global asset-based lending market revenue. The small and medium-sized enterprises segment, simultaneously, would cite the fastest CAGR of 14.8% from 2022 to 2031.

By region, Asia-Pacific held the major share in 2021, garnering around two-fifths of the global asset-based lending market revenue. LAMEA, simultaneously, would showcase the fastest CAGR of 15.3% from 2022 to 2031. The other provinces studied through the report include Europe and North America.

The key market players analyzed in the global asset-based mending market report include Lloyds Bank, Hilton-Baird, Capital Funding Solutions Inc., JPMorgan Chase & Co., Crystal Financial, Berkshire Bank, Barclays Bank PLC, White Oak Financial, LLC, Wells Fargo, and Porter Capital. These market players have embraced several strategies including partnership, expansion, collaboration, joint ventures, and others to highlight their prowess in the industry. The report is helpful in formulating the business performance and developments by the top players.

𝐈𝐧𝐪𝐮𝐢𝐫𝐞 𝐘𝐨𝐮𝐫 𝐄𝐯𝐞𝐫𝐲 𝐃𝐨𝐮𝐛𝐭 𝐇𝐞𝐫𝐞: https://www.alliedmarketresearch.com/purchase-enquiry/A12934

Key benefits for stakeholders

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the asset-based lending market analysis from 2022 to 2031 to identify the prevailing asset-based lending market opportunity.

The market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the asset-based lending market segmentation assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contri

bution to the global market.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global asset-based lending market trends, key players, market segments, application areas, and market growth strategies.

𝘽𝙪𝙮 𝙉𝙤𝙬@ http://bit.ly/3ZOIDFi

Asset-Based Lending Market Key Segments:

Type

Inventory Financing

Receivables Financing

Equipment Financing

Others

Interest Rate

Fixed Rate

Floating Rate

End User

Large Enterprises

Small and Medium-sized Enterprises

By Region

North America (U.S., Canada)

Europe (UK, Germany, France, Italy, Spain, Rest of Europe)

Asia-Pacific (China, Japan, India, Australia, South Korea, Rest of Asia-Pacific)

LAMEA (Latin America, Middle East, Africa)

Related Reports:

Auto Finance Market https://www.alliedmarketresearch.com/auto-finance-market-A10390

Specialty Insurance Market https://www.alliedmarketresearch.com/specialty-insurance-market

Employment Screening Services Market https://www.alliedmarketresearch.com/employment-screening-services-market

Remittance Market https://www.alliedmarketresearch.com/remittance-market

Europe Travel Insurance Market https://www.alliedmarketresearch.com/europe-travel-insurance-market

David Correa

1209 Orange Street, Corporation Trust Center, Wilmington, New Castle, Delaware 19801 USA.

Int'l: +1-503-894-6022 Toll Free: +1-800-792-5285

UK: +44-845-528-1300

India (Pune): +91-20-66346060 Fax: +1-800-792-5285 help@alliedmarketresearch.com

About Us:

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Wilmington, Delaware. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality of "Market Research Reports Insights" and "Business Intelligence Solutions." AMR has a targeted view to provide business insights and consulting to assist its clients to make strategic business decisions and achieve sustainable growth in their respective market domain.

We are in professional corporate relations with various companies and this helps us in digging out market data that helps us generate accurate research data tables and confirms utmost accuracy in our market forecasting. Allied Market Research CEO Pawan Kumar is instrumental in inspiring and encouraging everyone associated with the company to maintain high quality of data and help clients in every way possible to achieve success. Each and every data presented in the reports published by us is extracted through primary interviews with top officials from leading companies of domain concerned. Our secondary data procurement methodology includes deep online and offline research and discussion with knowledgeable professionals and analysts in the industry.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Asset-Based Lending Market Projected to Hit $1,721.38 Billion by 2031, Says Allied Market Research here

News-ID: 3520524 • Views: …

More Releases from Allied Market Research

Renal Denervation Market to Exceed USD $4.5 Billion by 2030 | Allied Market Rese …

Renal denervation is a medical procedure that uses radiofrequency ablation or other methods to disrupt the activity of nerves that surround the kidneys. These nerves are part of the sympathetic nervous system, which controls various bodily functions, including blood pressure regulation. During renal denervation, upper chamber and lower chamber of the heart beat irregularly, chaotically, and out of sync, which can cause shortness of breath, chest pain, weakness, lightheadedness, or…

The Booming Surgical Equipment Market Is Projected to Reach $59 Billion by 2032

Allied Market Research recently said the surgical equipment industry has been growing steadily in recent years, driven by advances in technology, increasing demand for minimally invasive surgeries, and rising healthcare expenditures. The global surgical equipment market size was valued at $35.6 billion in 2022, and is projected to reach $59 billion by 2032, growing at a CAGR of 5.2% from 2023 to 2032. Surgical equipment refers to the various tools,…

ALS Treatment Market to Reach US$ 1.04 Billion by 2032, Growing at 4.6% CAGR

The global amyotrophic lateral sclerosis (ALS) treatment market is entering a critical phase of growth as unmet therapeutic needs and research momentum converge. Current figures indicate a market value of US$ 662.3 million in 2022, with a projected increase to US$ 1,038.94 million by 2032, which equates to a CAGR of 4.6% from 2023 to 2032. ALS is a severe neurodegenerative disease affecting nerve cells in the brain and spinal…

Aircraft Engine Forging Market to Garner $5 Billion, Globally, By 2032 At 6.9% C …

Aircraft engine forging industry size was valued at $2.6 billion in 2022, and is estimated to garner $5 billion by 2032, growing at a CAGR of 6.9% from 2023 to 2032.

The demand for lightweight materials, such as titanium, aluminum, and advanced alloys, aimed at improving fuel efficiency and overall performance of aircraft engines. Moreover, there is surge in air travel demand that led airlines to expand their fleets, necessitating the…

More Releases for Lending

Mortgage Lending Market : Increased focus toward digitalizing lending process

According to the report published by Allied Market Research, the global mortgage lending market generated $11.48 billion in 2021, and is estimated to reach $27.50 billion by 2031, witnessing a CAGR of 9.5% from 2022 to 2031. The report offers a detailed analysis of changing market trends, top segments, value chain, key investment pockets, competitive scenario, and regional landscape. The report is a vital for leading market players, investors, new…

P2p Lending Market | Industry Overview 2021 | Worldwide Companies- CircleBack Le …

P2p Lending Market report will provide one with overall market analysis, statistics, various trends, drivers, opportunities, restraints, and every minute data relating to the Synthetic Fibers market necessary for forecasting its revenue, factors propelling & growth. The P2p Lending market study provides unique guidance in thoughtful details regarding the development factors and has used a top-down and bottom-up approach to keep it error-free and accurate. Our expert analysts have used…

Peer-to-peer Lending – Growing Popularity and Emerging Trends in the Market | …

Global Peer-to-peer Lending Market Size, Status and Forecast 2018-2025 is latest research study released by HTF MI evaluating the market, highlighting opportunities, risk side analysis, and leveraged with strategic and tactical decision-making support. The study provides information on market trends and development, drivers, capacities, technologies, and on the changing investment structure of the Global Peer-to-peer Lending Market. Some of the key players profiled in the study are CircleBack Lending, Lending…

Alternative Lending Market Is Booming Worldwide | Lending Club, Prosper, Upstart …

The ‘ Alternative Lending market’ research report added by Report Ocean, is an in-depth analysis of the latest developments, market size, status, upcoming technologies, industry drivers, challenges, regulatory policies, with key company profiles and strategies of players. The research study provides market overview, Alternative Lending market definition, regional market opportunity, sales and revenue by region, manufacturing cost analysis, Industrial Chain, market effect factors analysis, Alternative Lending market size forecast, market…

P2P Lending Market is Thriving Worldwide | CircleBack Lending, Lending Club, Pee …

Global P2P Lending Market Size, Status and Forecast 2025 is latest research study released by HTF MI evaluating the market, highlighting opportunities, risk side analysis, and leveraged with strategic and tactical decision-making support. The study provides information on market trends and development, drivers, capacities, technologies, and on the changing investment structure of the Global P2P Lending Market. Some of the key players profiled in the study are CircleBack Lending, Lending…

Canada Peer-to-peer Lending Market 2018-2022 Overview by CircleBack Lending, Len …

with the slowdown in world economic growth, the Peer-to-peer Lending industry has also suffered a certain impact, but still maintained a relatively optimistic growth, the past four years, Peer-to-peer Lending market size to maintain the average annual growth rate of 2.94% from 22 million $ in 2014 to 24 million $ in 2017, Research analysts believe that in the next few years, Peer-to-peer Lending market size will be further expanded,…