Press release

Legal Tax Defense Now Offering IRS Debt Relief Services for Tax Levy

Quick Assistance Is Available for Taxpayers Facing Tax Levy.Legal Tax Defense, Inc. is proud to announce the introduction of its specialized IRS debt relief services aimed at combating state tax levies. With the complex nature of tax regulations and the severe repercussions of tax levies, Legal Tax Defense provides expert guidance to help taxpayers protect their assets and manage their tax obligations effectively.

A state tax levy is a legal means for tax authorities to seize taxpayer assets to cover outstanding tax debts. Unlike a tax lien, which is merely a claim on the taxpayer's assets, a tax levy actively involves the seizure of those assets, including bank accounts, wages, social security benefits, investment accounts, and physical properties. This method of collection can have devastating effects on individuals and businesses alike.

"The IRS and state tax authorities follow a strict process before enforcing a tax levy, beginning with an assessment of the taxes owed and sending a tax bill to the taxpayer's last known address. If the debt remains unpaid, a Final Notice of Intent to Levy and Notice of Your Right to a Hearing is issued, providing a 30-day window for the taxpayer to respond," explains Jason Delatorre, CFO of Legal Tax Defense, Inc.

"Our team of seasoned tax debt attorneys [https://www.legaltaxdefense.com/] is committed to providing rapid and effective solutions to end state tax levies," states Robert Cohen, one of the attorneys at Legal Tax Defense. "We offer complimentary consultations to determine the best course of action for each client's specific circumstances."

Different types of state tax levies can be implemented, with the IRS choosing the most efficient method to seize assets. These include:

Bank Account Levies: Freezing and seizing funds directly from bank accounts.

Property Levies: Seizing and selling physical assets such as homes, vehicles, and personal property.

Wage Garnishment: Withholding a portion of wages to satisfy tax debts.

1099 Levies: Seizing payments owed to independent contractors.

Passport Seizures: Revoking passports for debts over $50,000.

Other Asset Seizures: Including life insurance, dividends, retirement accounts, and commissions.

To halt a state levy tax [https://www.legaltaxdefense.com/state-tax-levy/], immediate action is required. Legal Tax Defense, Inc. strongly advises against handling a tax levy alone and recommends consulting with a tax professional. Possible solutions include:

Establishing a Payment Plan: Selecting a payment plan that aligns with the taxpayer's financial situation to stop the levy.

Submitting an Offer in Compromise: Proposing to pay a reduced amount to settle the tax debt, available for those facing significant financial hardship.

Proving Financial Hardship: Demonstrating financial inability to pay can temporarily halt wage garnishment.

Filing an Appeal: Appeals can be filed for reasons such as bankruptcy, expired statute of limitations, procedural errors, or lack of opportunity to discuss liability.

For further information on how to stop a state tax levy [https://www.legaltaxdefense.com/state-tax-levy/], visit https://www.legaltaxdefense.com/ For immediate assistance, call 800-804-2769.

Media Contact

Company Name: Legal Tax Defense, Inc

Contact Person: Jason Delatorre, CFO

Email:Send Email [https://www.abnewswire.com/email_contact_us.php?pr=legal-tax-defense-now-offering-irs-debt-relief-services-for-tax-levy]

Address:2677 N Main St

City: Santa Ana

State: Ca 92705

Country: United States

Website: http://www.legaltaxdefense.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Legal Tax Defense Now Offering IRS Debt Relief Services for Tax Levy here

News-ID: 3515829 • Views: …

More Releases from ABNewswire

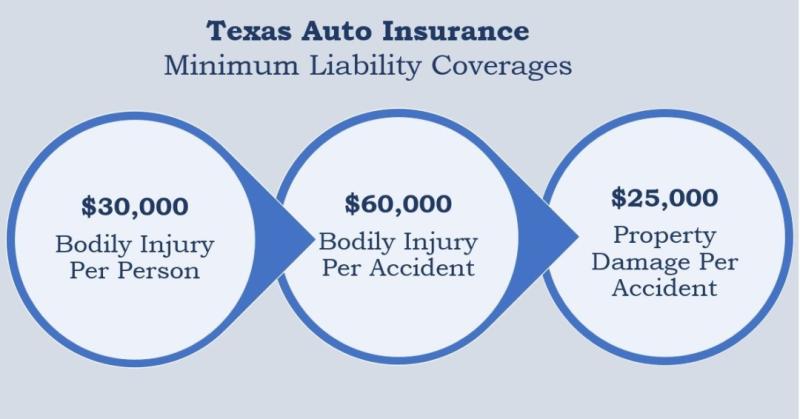

GetInsuredTexas.com Launches as the Essential Guide to Texas Insurance Policies, …

GetInsuredTexas.com, a new website from Baxter Insurance Agency, Inc., is now live, offering a one-stop shop for Texans to navigate the complexities of the state's insurance market, from understanding policies to comparing companies.

HOUSTON, TX - Jan 11, 2026 - Baxter Insurance Agency, Inc., a trusted name in the Texas insurance industry for over 40 years, is proud to announce the launch of GetInsuredTexas.com. This new platform is designed to be…

AI and the Future of the Translation Profession - Translation Conference to Deli …

Want to work smarter with AI - not just "go with the flow"? At the conference we'll share tools, methods, and practical workflows from the field - not just theory. Upgrade your professional toolkit.

The 2026 ITA hybrid translation conference will focus on one of the most urgent needs of today's language professionals: practical, applicable knowledge for working effectively - and responsibly - with artificial intelligence in real-world translation environments.

While public…

Caliente Brands Brings Bold Heat to Premium Beef Jerky Market with Authentic Spi …

Caliente Brands, LLC launches CalienteJerky.com, offering hickory-smoked beef jerky crafted exclusively from 100% USDA Approved Beef with uniquely spicy flavor profiles. The veteran-owned company targets consumers seeking bold, adventurous snack options with flavors ranging from Spicy Peppered to innovative Spicy Birria, delivering what the brand promises: where smoky and spicy meet delicious.

Caliente Brands, LLC has officially entered the premium beef jerky market with a clear mission: to deliver authentic spicy…

Patio Elegance Expands Luxury Collection to Create the Ultimate High-End Outdoor …

Patio Elegance announces an expanded portfolio of premium outdoor living solutions, ranging from professional-grade kitchen islands and grills to advanced wellness installations like cold plunges, jacuzzis, and handcrafted saunas. This comprehensive collection allows homeowners to design fully integrated, resort-style environments focused on culinary excellence, restorative wellness, and sophisticated comfort.

Patio Elegance is transforming how affluent homeowners approach outdoor living by offering a complete suite of luxury products that turn ordinary backyards…

More Releases for Tax

Tax Accountant Launches Expert Tax Advisory Services for Complex UK Tax Issues

Birmingham, UK - Tax Accountant, a premier provider of tailored tax solutions, is proud to announce the introduction of its new Specialist Tax Advice service. Aimed at tackling the multifaceted tax challenges faced by individuals and businesses in the UK, this service is set to revolutionize how tax compliance and optimization are approached.

As tax laws become increasingly complex and the implications of non-compliance more severe, the need for specialized tax…

Legal Tax Defense Offers Tax Relief Services to Successfully Settle IRS Tax Debt …

Legal Tax Defense provides expert guidance and strategies to navigate IRS negotiations and reduce tax liabilities.

Legal Tax Defense, Inc., a premier provider of tax resolution services, is now providing strategic assistance and professional help for those who find IRS tax debt to be stressful and intimidating. The firm assists taxpayers in understanding their alternatives for efficiently managing and lowering tax liabilities by offering a range of specialist services.

"Handling IRS tax…

Legal Tax Defense Providing Strategic Assistance to Settle Tax Debts for Tax Pay …

Fulfill Tax Obligations and Prevent Legal Issues.

Legal Tax Defense, a premier firm specializing in tax resolution, proudly announces its updated services aimed at helping clients effectively settle their tax debts. With a focus on alleviating the financial and legal pressures associated with unpaid taxes, Legal Tax Defense offers a lifeline to individuals and businesses struggling with tax liabilities.

Understanding the options available for settling tax debts [https://www.legaltaxdefense.com/settling-tax-debts/] is crucial in taking…

Bidding At The Tax Sale - Tax Sale Success Masterclass with The Tax Lien Lady

Joanne Musa, founder of TaxLienLady.com is holding a Tax Sale Success Masterclass on Bidding at the Tax Sale on Thursday, November 10 at 7:00 pm Eastern Time.

Tax lien and tax deed investing can be very profitable. Tax Lien investors can earn interest rates that are much higher than current bank rates without the risk of the stock market. Joanne Musa, known online as the tax lien lady, has been helping…

Tax Software Market – Major Technology Giants in Buzz Again | TurboTax, Tax Sl …

The Latest Released Tax Software market study has evaluated the future growth potential of Global Tax Software market and provides information and useful stats on market structure and size. The report is intended to provide market intelligence and strategic insights to help decision makers take sound investment decisions and identify potential gaps and growth opportunities. Additionally, the report also identifies and analyses changing dynamics, emerging trends along with essential drivers,…

Tax Software Market to Eyewitness Massive Growth by 2026 | Tax Act, Tax Slayer, …

The latest independent research document on Global Tax Software examine investment in Market. It describes how companies deploying these technologies across various industry verticals aim to explore its potential to become a major business disrupter. The Tax Software study eludes very useful reviews & strategic assessment including the generic market trends, emerging technologies, industry drivers, challenges, regulatory policies that propel the market growth, along with major players profile and strategies.…