Press release

Asset-Based Lending Market to Reach USD 1324.75 Billion by 2030: Key Players Include Lloyds Bank, Barclays, JPMorgan Chase & Co

The Global Asset-Based Lending Market has witnessed substantial growth, with a value of USD 625.35 billion in 2023. It is projected to continue expanding at a significant compound annual growth rate (CAGR) of 11.32% from 2024 to 2030, reaching an estimated value of nearly USD 1324.75 billion. This growth can be attributed to various factors such as the increasing need for liquidity among businesses, especially small and medium-sized enterprises (SMEs), to support their operations and expansion plans. Asset-based lending offers a flexible and accessible financing solution, allowing companies to leverage their assets, including accounts receivable, inventory, and equipment, to secure loans. The market's growth is also driven by the rising trend of outsourcing non-core business functions, leading to an increased demand for working capital financing. Additionally, the market is witnessing advancements in technology, such as the adoption of digital platforms for lending processes, which are further fueling market growth.Asset-Based Lending Market Report Scope and Research Methodology:

The Asset-Based Lending Market Report provides a comprehensive analysis of the global market, detailing its scope and methodology. The report covers various aspects such as market size, trends, growth drivers, challenges, and opportunities. It employs a mix of primary and secondary research methodologies to gather and analyze data. Primary research involves interviews with industry experts, lenders, borrowers, and other stakeholders, while secondary research includes data from company websites, press releases, industry reports, and government publications. The scope of the report encompasses the asset-based lending market's historical, present, and forecasted performance, with a focus on key regions such as North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa. It also profiles major players in the market, providing insights into their business strategies, product portfolios, and recent developments.

Explore the intricacies of this comprehensive market analysis: https://www.maximizemarketresearch.com/market-report/asset-based-lending-market/189641/

What are Asset-Based Lending Market Dynamics:

The dynamics of the Asset-Based Lending Market are driven by several key factors that influence its growth and performance. One of the primary drivers is the increasing demand for flexible financing solutions among businesses, particularly SMEs, to support their working capital needs and growth initiatives. Asset-based lending provides an accessible and versatile financing option, allowing companies to leverage their assets, such as accounts receivable, inventory, and equipment, to secure loans. This is especially beneficial for businesses with limited access to traditional forms of financing. Additionally, the market is influenced by macroeconomic factors such as interest rates, economic growth, and industry trends, which impact the overall demand for asset-based lending services. Regulatory changes and technological advancements, including the adoption of digital platforms for lending processes, are also shaping the market dynamics. Despite its benefits, asset-based lending faces challenges such as credit risk, regulatory compliance, and competition from alternative financing sources, which could impact its growth trajectory.

Request a complimentary sample copy or access the summary of the report: https://www.maximizemarketresearch.com/request-sample/189641

Asset-Based Lending Market Regional Insights:

North America has emerged as a frontrunner in the global Asset-Based Lending Market, holding the highest market share of 37.8% in 2023. The region's dominant position is expected to persist, with a projected CAGR of 10.12% through 2030. This stronghold can be attributed to several factors, including the region's well-established financial sector, robust economic growth, and a regulatory framework conducive to asset-based lending. Going forward, North America is anticipated to maintain its lead in the market, driven by factors such as increasing awareness and adoption of asset-based lending solutions among businesses, the growing demand for flexible financing options, and the overall economic expansion.

Submit your request for a free inquiry report today: https://www.maximizemarketresearch.com/inquiry-before-buying/189641

What is Asset-Based Lending Market Segmentation:

The Asset-Based Lending Market is segmented based on several key factors. Firstly, by type, it includes Inventory Financing, Receivables Financing, Equipment Financing, and Others. Inventory financing involves using inventory as collateral to secure a loan, while receivables financing involves using accounts receivable as collateral. Equipment financing, on the other hand, involves using equipment as collateral for a loan. The "Others" category may include various forms of asset-based lending not covered by the other categories.

Secondly, by interest rate, the market is segmented into Fixed Rate and Floating Rate. Fixed-rate loans have a set interest rate that remains constant throughout the loan term, providing borrowers with predictable payments. Floating-rate loans, on the other hand, have an interest rate that fluctuates based on market conditions, offering potential cost savings when interest rates are low but posing a risk of higher payments if rates rise.

Lastly, by end-user, the market is segmented into Large Enterprises and Small and Medium-sized Enterprises (SMEs). Large enterprises typically have greater access to capital and may use asset-based lending for various purposes, including working capital needs and expansion initiatives. SMEs, on the other hand, often face challenges in accessing traditional forms of financing and may turn to asset-based lending to meet their funding requirements.

Request a customized report tailored to your specific requirements: https://www.maximizemarketresearch.com/request-sample/189641

Who are Asset-Based Lending Market Key Players:

1.Lloyds Bank

2.Barclays Bank PLC

3. Hilton-Baird Group

4. JPMorgan Chase & Co

5. Berkshire Bank

6.White Oak Financial, LLC

7.Wells Fargo

8. Porter Capital

9.Capital Funding Solutions Inc.

10.SLR Credit Solutions

11.Fifth Third Bank

12.HSBC Holdings plc

12. SunTrust Banks, Inc. (now part of Truist Financial Corporation)

13. Santander Bank, N.A.

14.KeyCorp

15.BB&T Corporation (now part of Truist Financial Corporation)

16. Goldman Sachs Group, Inc.

Don't miss out on the trending research published by Maximize Market Research:

global Invisible Orthodontics Market https://www.maximizemarketresearch.com/market-report/global-invisible-orthodontics-market/102627/

5G IoT Market https://www.maximizemarketresearch.com/market-report/global-5g-iot-market/30498/

Commercial Vehicles Market https://www.maximizemarketresearch.com/market-report/global-commercial-vehicles-market/112685/

Temperature Sensor Market https://www.maximizemarketresearch.com/market-report/temperature-sensor-market/2806/

Cosmeceuticals Market https://www.maximizemarketresearch.com/market-report/cosmeceuticals-market/126239/

Maximize Market Research:

3rd Floor, Navale IT Park, Phase 2

Pune Banglore Highway, Narhe,

Pune, Maharashtra 411041, India

Phone No.: +91 96071 95908, +91 9607365656

Maximize Market Research is a diverse market research and consulting firm with a team of experts from various industries. Our expertise spans across medical devices, pharmaceuticals, science and engineering, electronic components, industrial equipment, technology and communication, automotive, chemicals, general merchandise, beverages, personal care, and automated systems. Our services include market-verified industry estimations, technical trend analysis, vital market research, strategic consulting, competitive analysis, production and demand assessments, and client impact studies. We provide tailored insights and strategic advice to help businesses succeed in their respective markets.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Asset-Based Lending Market to Reach USD 1324.75 Billion by 2030: Key Players Include Lloyds Bank, Barclays, JPMorgan Chase & Co here

News-ID: 3509615 • Views: …

More Releases from MAXIMIZE MARKET RESEARCH

Military Lighting Market to Reach USD 873.02 Million by 2032

◉ Global Military Lighting Market Poised for Strategic Growth Amid Technological Advancements and Regional Developments

The global military lighting market is on a trajectory of steady growth, driven by technological innovations, increased defense budgets, and the modernization of military infrastructures worldwide. Valued at approximately USD 622.42 million in 2024, the market is projected to reach nearly USD 873.02 million by 2032, reflecting a compound annual growth rate (CAGR) of 4.32% during…

Ethylene Vinyl Acetate Market Set to Reach USD 12.92 Billion by 2030 Amidst Stra …

◉ Global Ethylene Vinyl Acetate Market Poised for Robust Growth Amidst Regional Opportunities and Industry Consolidations

The global Ethylene Vinyl Acetate (EVA) market is on a trajectory of significant expansion, with projections indicating a rise from USD 8.31 billion in 2023 to approximately USD 12.92 billion by 2030, reflecting a Compound Annual Growth Rate (CAGR) of 6.5% during the forecast period. This growth is primarily driven by escalating demand across various…

Lithium Metal Market Projection: USD 7723.7 Million by 2029, Alpha-En Corporatio …

Anticipated Growth in Revenue:

Lithium Metal Market size was valued at USD 2071.5 Million in 2022 and the total Lithium Metal Market revenue is expected to grow at a CAGR of 20.7% from 2023 to 2029, reaching nearly USD 7723.7 Million.

Lithium Metal Market Overview:

In the realm of the lithium metal market, the substance stands as a pivotal element renowned for its lightweight and highly reactive nature. Its significance is underscored…

Global Coordinate Measuring Machine Market (CMM) Projection: CAGR 8.3% (2029), F …

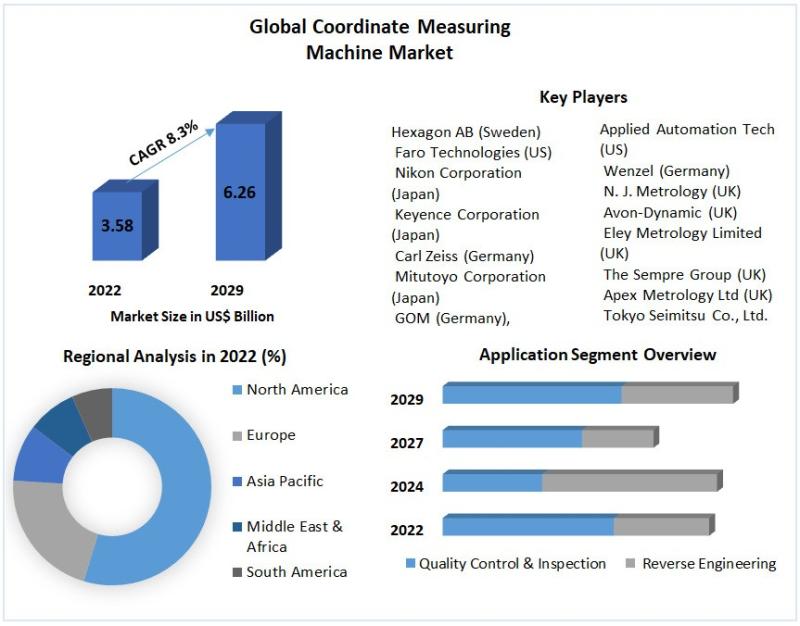

Anticipated Growth in Revenue:

Coordinate Measuring Machine Market (CMM) size is expected to reach nearly US$ 6.26 Bn by 2029 with the CAGR of 8.3% during the forecast period.

Global Coordinate Measuring Machine Market (CMM) Overview:

The Global Coordinate Measuring Machine (CMM) Market report provides an in-depth analysis of the impact of the COVID-19 lockdown on market leaders, followers, and disruptors. The lockdown measures were implemented differently across regions and countries, resulting…

More Releases for Lending

Mortgage Lending Market : Increased focus toward digitalizing lending process

According to the report published by Allied Market Research, the global mortgage lending market generated $11.48 billion in 2021, and is estimated to reach $27.50 billion by 2031, witnessing a CAGR of 9.5% from 2022 to 2031. The report offers a detailed analysis of changing market trends, top segments, value chain, key investment pockets, competitive scenario, and regional landscape. The report is a vital for leading market players, investors, new…

P2p Lending Market | Industry Overview 2021 | Worldwide Companies- CircleBack Le …

P2p Lending Market report will provide one with overall market analysis, statistics, various trends, drivers, opportunities, restraints, and every minute data relating to the Synthetic Fibers market necessary for forecasting its revenue, factors propelling & growth. The P2p Lending market study provides unique guidance in thoughtful details regarding the development factors and has used a top-down and bottom-up approach to keep it error-free and accurate. Our expert analysts have used…

Peer-to-peer Lending – Growing Popularity and Emerging Trends in the Market | …

Global Peer-to-peer Lending Market Size, Status and Forecast 2018-2025 is latest research study released by HTF MI evaluating the market, highlighting opportunities, risk side analysis, and leveraged with strategic and tactical decision-making support. The study provides information on market trends and development, drivers, capacities, technologies, and on the changing investment structure of the Global Peer-to-peer Lending Market. Some of the key players profiled in the study are CircleBack Lending, Lending…

Alternative Lending Market Is Booming Worldwide | Lending Club, Prosper, Upstart …

The ‘ Alternative Lending market’ research report added by Report Ocean, is an in-depth analysis of the latest developments, market size, status, upcoming technologies, industry drivers, challenges, regulatory policies, with key company profiles and strategies of players. The research study provides market overview, Alternative Lending market definition, regional market opportunity, sales and revenue by region, manufacturing cost analysis, Industrial Chain, market effect factors analysis, Alternative Lending market size forecast, market…

P2P Lending Market is Thriving Worldwide | CircleBack Lending, Lending Club, Pee …

Global P2P Lending Market Size, Status and Forecast 2025 is latest research study released by HTF MI evaluating the market, highlighting opportunities, risk side analysis, and leveraged with strategic and tactical decision-making support. The study provides information on market trends and development, drivers, capacities, technologies, and on the changing investment structure of the Global P2P Lending Market. Some of the key players profiled in the study are CircleBack Lending, Lending…

Canada Peer-to-peer Lending Market 2018-2022 Overview by CircleBack Lending, Len …

with the slowdown in world economic growth, the Peer-to-peer Lending industry has also suffered a certain impact, but still maintained a relatively optimistic growth, the past four years, Peer-to-peer Lending market size to maintain the average annual growth rate of 2.94% from 22 million $ in 2014 to 24 million $ in 2017, Research analysts believe that in the next few years, Peer-to-peer Lending market size will be further expanded,…