Press release

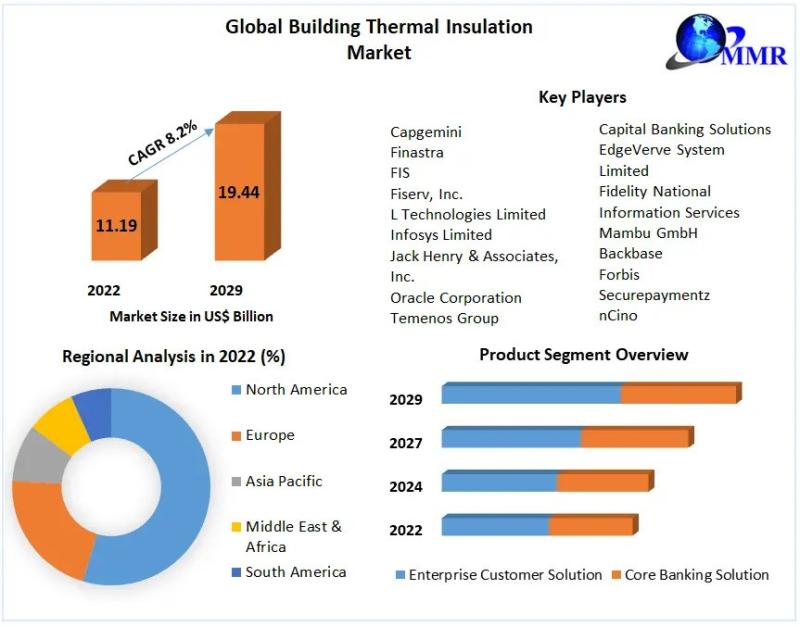

Core Banking Software Market size is expected to grow at a CAGR of 8.2% through the forecast period

Core Banking Software Market Report Scope and Research MethodologyThe Core Banking Software market report delves into a comprehensive analysis of the global landscape, focusing on the industry's scope and evolution. It provides insights into the market dynamics, including key drivers, challenges, opportunities, and trends shaping the core banking software sector. By examining factors such as technological advancements, regulatory frameworks, and competitive landscapes, the report offers valuable perspectives for stakeholders to navigate the evolving market landscape effectively. Employing a rigorous research methodology encompassing primary and secondary sources, the report ensures accuracy and reliability in its findings, thereby serving as a trusted resource for businesses, investors, and decision-makers seeking to understand and capitalize on emerging opportunities in the core banking software market.

The research methodology adopted for the Core Banking Software market report combines qualitative and quantitative approaches to gather and analyze data comprehensively. Through primary research, including interviews with industry experts, executives, and key stakeholders, the report captures firsthand insights into market dynamics, trends, and challenges. Additionally, secondary research involving thorough analysis of industry reports, company websites, press releases, and relevant publications enriches the understanding of the market landscape. Employing advanced analytical tools and techniques, the report synthesizes the gathered data to generate actionable insights and forecasts, enabling stakeholders to make informed decisions and formulate effective strategies in the dynamic core banking software market.

Immediate Delivery Available, Buy Now :https://www.maximizemarketresearch.com/request-sample/148072

Core Banking Software Market Dynamics:

The core banking software market dynamics reflect a confluence of factors driving its growth and evolution. Rapid technological advancements, including the adoption of cloud computing, artificial intelligence, and blockchain, are reshaping the banking landscape, driving demand for more efficient and agile core banking solutions. Furthermore, increasing regulatory requirements and the need for enhanced security and compliance measures are compelling financial institutions to invest in modernizing their core banking systems, fostering market growth. Additionally, changing consumer preferences and the rise of digital banking are driving banks to prioritize customer experience, prompting them to seek innovative core banking solutions that enable seamless omnichannel banking experiences while ensuring scalability and flexibility.

Amidst these dynamics, competition in the core banking software market is intensifying, with both established players and new entrants vying for market share. Mergers and acquisitions are prevalent as companies seek to expand their product portfolios, geographical presence, and technological capabilities. Moreover, strategic partnerships and collaborations between core banking software providers and fintech startups are becoming more common, driving innovation and accelerating product development cycles. As the industry continues to evolve, adaptability, interoperability, and scalability will remain key factors shaping the competitive landscape and influencing the trajectory of the core banking software market.

Request For Free Inquiry Report:https://www.maximizemarketresearch.com/inquiry-before-buying/148072

Core Banking Software Market Regional Insights:

Regional insights into the core banking software market reveal a nuanced landscape shaped by diverse factors across different geographies. In developed regions such as North America and Europe, established banking institutions are leading the adoption of advanced core banking solutions to stay competitive in the digital era. These regions witness significant investments in technology infrastructure, regulatory compliance, and customer-centric banking services, driving market growth. Conversely, emerging economies in Asia-Pacific and Latin America are experiencing rapid digital transformation in the banking sector, fueled by expanding middle-class populations, rising smartphone penetration, and government initiatives promoting financial inclusion. In these regions, the core banking software market is characterized by a surge in demand for scalable, cost-effective solutions tailored to the unique needs of diverse banking ecosystems, presenting lucrative opportunities for market players to expand their footprint and tap into growing markets.

Request a Free Sample Copy or View Report Summary:https://www.maximizemarketresearch.com/request-sample/148072

Core Banking Software Market Segmentation:

by Product

Enterprise Customer Solution

Core Banking Solution

by Deployment analysis

SaaS/hosted

Licensed

Browse Full Report & TOC :https://www.maximizemarketresearch.com/market-report/core-banking-software-market/148072/

Core Banking Software Market Key Players:

1.Capgemini

2. Finastra

3. FIS

4. Fiserv, Inc.

5. L Technologies Limited

6. Infosys Limited

7. Jack Henry & Associates, Inc.

8. Oracle Corporation

9. Temenos Group

10. UnisysSAP SE

11. TATA Consultancy Services

12. Capital Banking Solutions

13. EdgeVerve System Limited

14. Fidelity National Information Services

15. Mambu GmbH

16. Backbase

17. Forbis

18. Securepaymentz

19. nCino

20. Bricknode

21. Wipro Core Banking Service

22. C-Edge Technologies

Table of content for the Core Banking Software Market includes:

1. Global Core Banking Software Market: Research Methodology

2. Global Core Banking Software Market: Executive Summary

• Market Overview and Definitions

• Introduction to the Global Market

• Summary

• Key Findings

• Recommendations for Investors

• Recommendations for Market Leaders

• Recommendations for New Market Entry

3.Global Core Banking Software Market: Competitive Analysis

• MMR Competition Matrix

• Market Structure by region

• Competitive Benchmarking of Key Players

• Consolidation in the Market

• M&A by region

• Key Developments by Companies

• Market Drivers

• Market Restraints

• Market Opportunities

• Market Challenges

• Market Dynamics

• PORTERS Five Forces Analysis

• PESTLE

• Regulatory Landscape by region

• North America

• Europe

• Asia Pacific

• Middle East and Africa

• South America

• COVID-19 Impact

4 . Company Profile: Key players

• Company Overview

• Financial Overview

• Global Presence

• Capacity Portfolio

• Business Strategy

• Recent Developments

Key Offerings:

• Past Market Size and Competitive Landscape (2022 to 2029)

• Past Pricing and price curve by region (2022 to 2029)

• Market Size, Share, Size and Forecast by different segment | 2022-2029

• Market Dynamics - Growth Drivers, Restraints, Opportunities, and Key Trends by region

• Market Segmentation - A detailed analysis by growth and trend

• Competitive Landscape - Profiles of selected key players by region from a strategic perspective

• Competitive landscape - Market Leaders, Market Followers, Regional player

• Competitive benchmarking of key players by region

• PESTLE Analysis

• PORTER's analysis

• Value chain and supply chain analysis

• Legal Aspects of business by region

• Lucrative business opportunities with SWOT analysis

• Recommendations

Related Reports:

Motorized Quadricycle Market : https://www.maximizemarketresearch.com/market-report/motorized-quadricycle-market/191625/

Toilet Seat Sanitizer Market : https://www.maximizemarketresearch.com/market-report/toilet-seat-sanitizer-market/190667/

Ice Hockey Sticks Market : https://www.maximizemarketresearch.com/market-report/ice-hockey-sticks-market/190679/

Adult Entertainment Market : https://www.maximizemarketresearch.com/market-report/adult-entertainment-market/190504/

Air Care Market : https://www.maximizemarketresearch.com/market-report/air-care-market/190516/

Contact Maximize Market Research:

MAXIMIZE MARKET RESEARCH PVT. LTD.

⮝ 444 West Lake Street, Floor 17,

Chicago, IL, 60606, USA.

✆ +1 800 507 4489

✆ +91 9607365656

🖂 mailto:sales@maximizemarketresearch.com

🌐 https://www.maximizemarketresearch.com

About Maximize Market Research:

Maximize Market Research is one of the fastest-growing market research and business consulting firms serving clients globally. Our revenue impact and focused growth-driven research initiatives make us a proud partner of the majority of the Fortune 500 companies. We have a diversified portfolio and serve a variety of industries such as IT & telecom, chemical, food & beverage, aerospace & defense, healthcare and others.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Core Banking Software Market size is expected to grow at a CAGR of 8.2% through the forecast period here

News-ID: 3509472 • Views: …

More Releases from MAXIMIZE MARKET RESEARCH PVT. LTD.

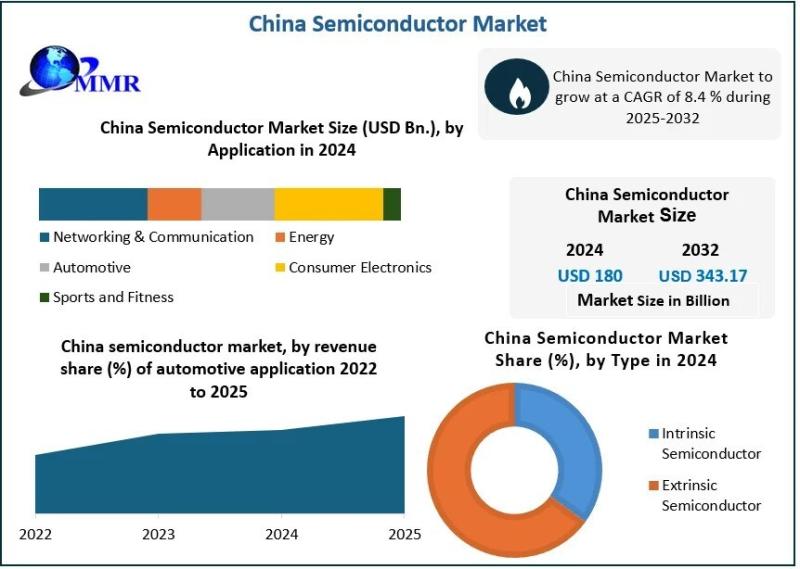

China Semiconductor Market Analysis: Projected to Grow from USD 180 Billion in 2 …

China Semiconductor Market size was valued at USD 180 Bn. in 2024, and the total China Semiconductor revenue is expected to grow by 8.4 % from 2025 to 2032, reaching nearly USD 343.17 Bn.

china-semiconductor-market Overview:

The China semiconductor market is one of the largest and most dynamic in the world, driving significant growth in the global tech industry. As China continues to expand its influence in high-tech manufacturing, the semiconductor market…

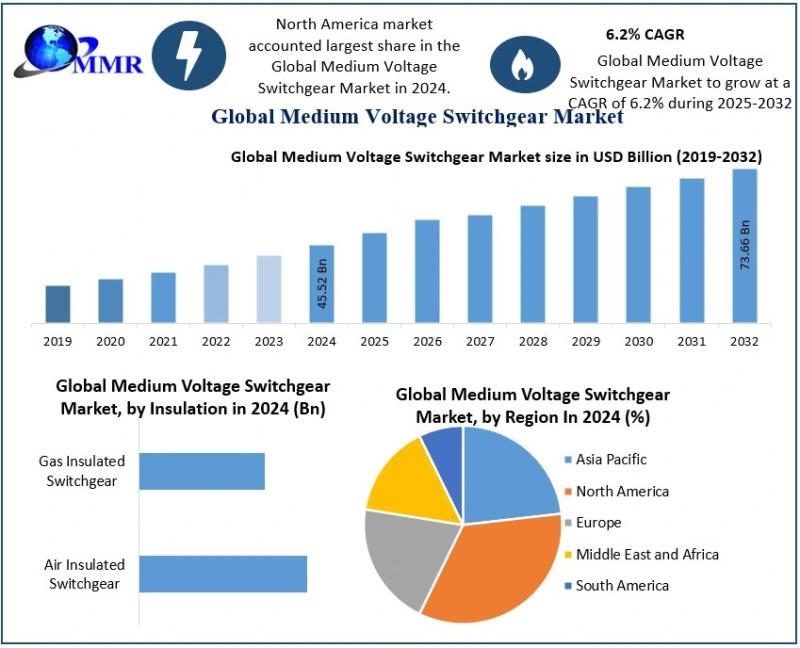

Medium Voltage Switchgear Market Analysis: 6.2% CAGR Driving Growth from USD 48. …

Medium Voltage Switchgear Market size was valued at USD 48.34 Billion in 2025 and the total Medium Voltage Switchgear revenue is expected to grow at a CAGR of 6.2% from 2025 to 2032, reaching nearly USD 73.65 Billion by 2032.

Medium-voltage Switchgear Market Overview:

The medium-voltage switchgear market plays a pivotal role in the global energy distribution landscape. These switchgear devices, typically operating between 1 kV and 72.5 kV, are critical for…

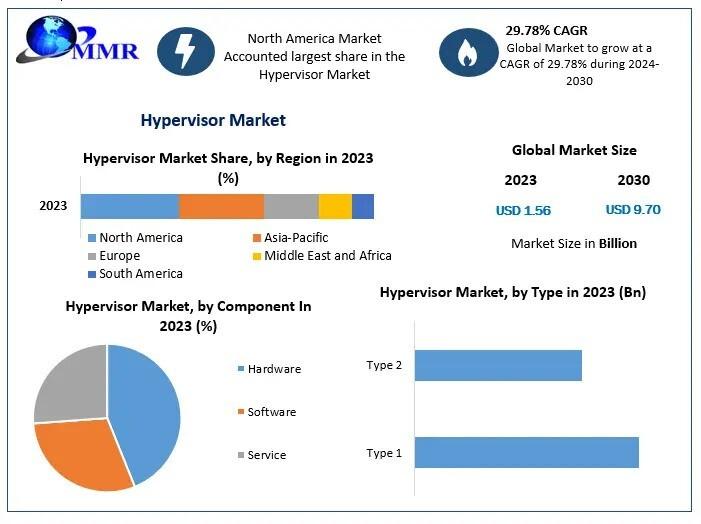

Hypervisor Market Analysis 2025-2030: Growth Rate of 29.78% and Market Value of …

Hypervisor Market size is estimated to grow at a CAGR of 29.78%. The market is expected to reach a value of US $ 9.70 Bn. in 2030.

Hypervisor Market Overview:

The hypervisor market, a critical component of virtualization technology, plays an essential role in the expansion of cloud computing, data centers, and IT infrastructure. By enabling multiple operating systems to run concurrently on a single physical machine, hypervisors streamline resource allocation and…

Cider Market Poised for Steady Growth, Expected to Reach USD 26.90 Billion by 20 …

The global Cider Market is witnessing a significant transformation driven by evolving consumer preferences, premiumization trends, and innovation in flavors and formats. Valued at USD 17.42 Billion in 2025, the market is projected to grow at a compound annual growth rate (CAGR) of 6.4% from 2025 to 2032, reaching nearly USD 26.90 Billion by 2032. This growth reflects cider's rising appeal as a refreshing, gluten-free, and lower-calorie alcoholic beverage alternative…

More Releases for Banking

Banking ERP Software Market: A Catalyst for Banking Excellence

The Banking ERP Software Market is at the forefront of a financial revolution, poised to redefine the way banking institutions operate in the digital age. As the industry grapples with evolving customer expectations, regulatory demands, and technological advancements, ERP software solutions have emerged as indispensable tools for financial institutions. These systems streamline operations, enhance data management, and empower banks to deliver more efficient and customer-centric services. In an era where…

Digital Banking Market Report, Worth, Size, Share, Trends, Segmented by Applicat …

Digital Banking Market Size:

In 2018, the global Digital Banking market size was 5.180 Billion USD and it is expected to reach 16.200 Billion US$ by the end of 2025, with a CAGR of 15.3% during 2019-2025.

Get Free Sample: https://reports.valuates.com/request/sample/QYRE-Auto-4N473/Global_Digital_Banking

Digital Banking Market Share:

• In 2017, North America's economy accounted for about 48.73% of the global Digital Banking market share, while Europe and Asia-Pacific accounted for about 30.22%, 16.54%, respectively.

• European countries such…

Online Banking Market by Banking Type - Retail Banking, Corporate Banking, and I …

The Online Banking Market size is expected to reach $29,976 million in 2023 from $7,305 million in 2016, growing at a CAGR of 22.6% from 2017 to 2023. Digital banking includes all kinds of online/internet transactions done for various purposes. It is the incorporation of new technologies, to deliver enhanced customer services.

Customer convenience, higher interest rates, and technologically advanced interface majorly drive the market. High security risk of customer’s data…

Explore Mobile Banking Market with Top Players like Barclays, BOC, SBI, HSBC Mob …

Mobile Banking allow various users to avail banking and financial services through any telecommunication devices. Different kind of services include both information and monetary transaction. Increase in the use of number of smart phones and mobile phones mobile Banking Market has gained its popularity. It is preferable and comfortable by the users than any other means of transaction.

Global Mobile Banking Market anticipated to grow at a CAGR of +35% over…

Mobile Banking Market Is Booming Worldwide | HSBC Mobile Banking, ICICI Bank Mob …

HTF MI recently introduced Global Mobile Banking Market study with in-depth overview, describing about the Product / Industry Scope and elaborates market outlook and status to 2023. The market Study is segmented by key regions which is accelerating the marketization. At present, the market is developing its presence and some of the key players from the complete study are HSBC Mobile Banking, ICICI Bank Mobile Banking, U.S. Bank, Santander Mobile…

Online Banking Market Report 2018: Segmentation by Banking Type (Retail Banking, …

Global Online Banking market research report provides company profile for ACI Worldwide (U.S.), Microsoft Corporation (U.S.), Fiserv, Inc. (U.S.), Tata Consultancy Services (India), Cor Financial Solutions Ltd. (UK), Oracle Corporation (U.S.) and Others.

This market study includes data about consumer perspective, comprehensive analysis, statistics, market share, company performances (Stocks), historical analysis 2012 to 2017, market forecast 2018 to 2025 in terms of volume, revenue, YOY growth rate, and CAGR for…