Press release

Global e-Mortgage Market is forecasted to advance at a CAGR of 17.8% from 2024 to 2034

According to the latest report published by Fact.MR, a market research and competitive intelligence provider, the global demand of e-Mortgage market is estimated to reach a valuation of US$ 46.2 billion by the end of 2022 and expand at a CAGR of 18.2% over the assessment period (2022-2032).Banks, fintech, NBFC, and others are leveraging the wave of digitalization. This has allowed enhanced customer experience and cost savings at a much higher level, as well as optimal decision-making. Both lenders and customers are opting for a hassle-free, quick, and more reliable digital experience along with their convenience and security.

For Critical Insights on e-Mortgage Market, Request a Sample Report

https://www.factmr.com/connectus/sample?flag=S&rep_id=7474

As per the report, almost 90% of lenders show confidence that technology can aid in process improvement for processing mortgage applications. Moreover, the entire process minimizes data entry operations by 2/3, while reducing time required by 70% as compared to conventional mortgage processes. As such, the adoption curve of e-mortgage technology will showcase complete penetration across the lending and mortgage market over the coming years.

Why is the e-Mortgage Market Set to Boom Going Forward?

"Increasing Digitalization in Banking & Lending"

Demand from the consumer end for e-Mortgages has witnessed exponential growth over the past few years. In 2018, nearly 17,000 electronic promissory notes were registered. After just one year, the number jumped to around 95,000 in 2019, witnessing an increase of around 500%. This continued with a single-month tally reaching around 19,240 eNotes in February 2020.

The prime reason is the security, speed, and cost-effective attributes of e-Mortgages as compared to traditional paper-based mortgages. The overall process and loan documents, including eNotes, are created, signed, transmitted, and stored electronically, limiting the risk of misplacement or theft as well as enabling automated data verification covered under a single platform.

To learn more about e-Mortgage Market, you can get in touch with our Analyst at https://www.factmr.com/connectus/sample?flag=AE&rep_id=7474

Key Segments Covered in the e-Mortgage Industry Survey

e-Mortgage Market by Solution :

Origination Solutions

Underwriting

Closing Solutions

Data & Analytics

Others

e-Mortgage Market by Mortgage Type :

Purchase

Refinance

e-Mortgage Market by Lender Type :

Fintech

Credit Unions

Banks

Government Institutes & NBFCs

Others Secondary Lenders

e-Mortgage Market by End User :

Residential

Commercial

Industrial

Competitive Landscape

Leading players operating in the e-Mortgage market are AmoCRM, BNTouch, Calyx PointCentral, Cimmaron, Encompass, Floify LLC, HubSpot, ICE Mortgage Technology, Inc, Jungo, Keap, Maxwell Financial Labs, Inc., MLO Shift, Pipedrive, Podium, RealINSIGHT, Salesforce, Simple Nexus, Surefire, TeamSupport, Total Expert, Turnkey Lender, Unify, Velocify LoanEngage, Whiteboard, and Zendesk Sell

Market players are on the continuous path to delivering next-generation services by offering additional and quicker APIs and high-end customization competencies with tools and e-forms. The capability to initiate, manage, and execute loans with exceptions, and enhanced customer experience, has been the forefront strategy of market leaders.

Get Customization on e-Mortgage Market Report for Specific Research Solutions

https://www.factmr.com/connectus/sample?flag=RC&rep_id=7474

Key players in the e-Mortgage Market

Cimmaron

Encompass

Floify LLC

ICE Mortgage Technology, Inc

Keap

Simple Nexus

Unify

Whiteboard

Key Takeaways from e-Mortgage Market Study

Global e-Mortgage is poised to expand at 18.2% CAGR reaching a valuation of US$ 46.2 billion by 2032.

On the basis of lender type, the market is projected to be dominated by fintech, which is projected to account for around 50% market share by 2032.

North America is likely to be the most attractive region for e-Mortgage technology and is expected to create an absolute dollar opportunity of US$ 9.2 billion by the end of 2032.

The purchase segment is expected grow 4.2X while the refinance segment is set to expand 6.1X during the forecast period.

Banks are estimated to top a market valuation of US$ 8.3 billion by 2032; however, this segment is expected to lose 328 BPS over the next ten years.

About Fact.MR

Market research and consulting agency with a difference! That's why 80% of Fortune 1,000 companies trust us for making their most critical decisions. While our experienced consultants employ the latest technologies to extract hard-to-find insights, we believe our USP is the trust clients have on our expertise. Spanning a wide range - from automotive & industry 4.0 to healthcare & retail, our coverage is expansive, but we ensure even the most niche categories are analyzed. Our sales offices in United States and Dublin, Ireland. Headquarter based in Dubai, UAE. Reach out to us with your goals, and we'll be an able research partner.

Contact:

US Sales Office :

11140 Rockville Pike

Suite 400

Rockville, MD 20852

United States

Tel: +1 (628) 251-1583

E-Mail: sales@factmr.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Global e-Mortgage Market is forecasted to advance at a CAGR of 17.8% from 2024 to 2034 here

News-ID: 3480454 • Views: …

More Releases from Fact.MR

Organic Rice Syrup Market is forecasted to increase at a CAGR of 5.1% and US$ 1. …

The global Organic Rice Syrup Market is projected to expand steadily over the coming decade, driven by rising consumer demand for natural, clean-label sweeteners and growing awareness of health and wellness trends. Industry analysts estimate that the organic rice syrup market, valued at approximately USD 450 million in 2025, is expected to reach nearly USD 880 million by 2035, registering a compound annual growth rate (CAGR) of about 7.1% during…

Compound Horse Feedstuff Market is Estimated to Grow at a CAGR of 4.6%, Reaching …

The global compound horse feedstuff market is galloping toward steady growth, projected to expand from a valuation of USD 3.8 billion in 2026 to approximately USD 5.4 billion by 2036. This represents a compound annual growth rate (CAGR) of 3.6% over the ten-year forecast period.

The market is being driven by the "humanization" of equine companions, the professionalization of equestrian sports, and a significant shift toward specialized performance nutrition that…

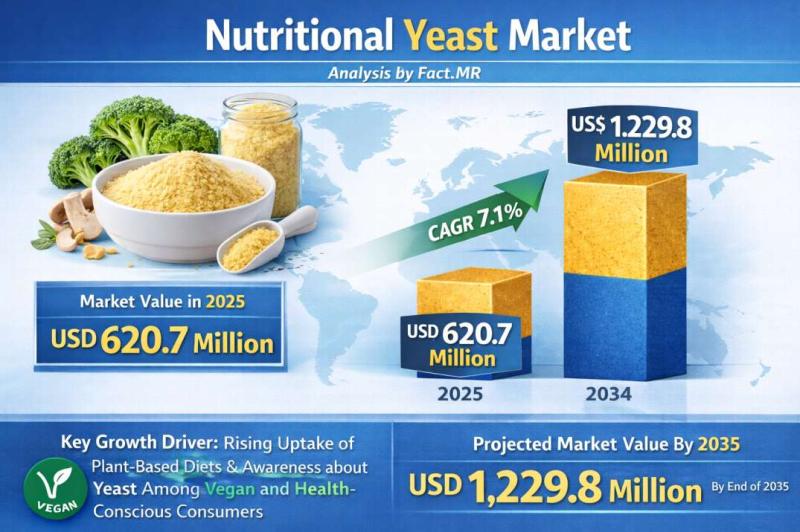

Nutritional Yeast Market Forecasted CAGR is 7.1% by 2035 | Fact.MR Report

The global nutritional yeast market is experiencing a significant surge in demand, projected to grow from a valuation of USD 515.2 million in 2026 to approximately USD 1.2 billion by 2036. This represents a robust compound annual growth rate (CAGR) of 8.8% over the ten-year forecast period.

The market is being propelled by the global explosion of plant-based diets and the "clean-label" movement, with nutritional yeast emerging as the primary…

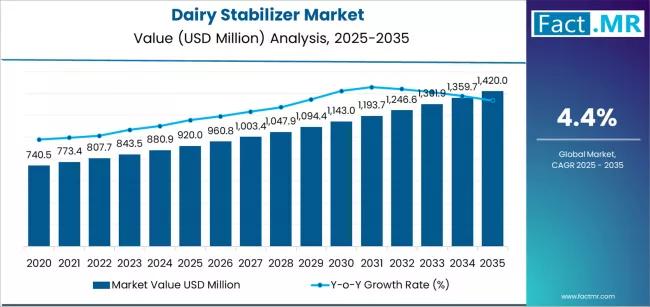

Dairy Stabilizer Market is Expected to Reach USD 1,420.0 million by 2035 | Resea …

The global Dairy Stabilizers Market is projected to sustain solid growth over the next decade as consumer demand for high-quality dairy and dairy-based products continues to expand across foodservice and retail sectors. Industry analysts estimate that the dairy stabilizers market, valued at approximately USD 2.4 billion in 2025, is expected to reach around USD 4.3 billion by 2035, registering a compound annual growth rate (CAGR) of about 6.5% during the…

More Releases for Mortgage

Relocation Mortgage Market 2023: Sales and Industry Revenue Forecasts- Wells Far …

The Relocation Mortgage market has witnessed growth from USD XX million to USD XX million from 2017 to 2023. With the CAGR of X.X%, this market is estimated to reach USD XX million in 2029.

The report focuses on the Relocation Mortgage market size, segment size (mainly covering product type, application, and geography), competitor landscape, recent status, and development trends. Furthermore, the report provides detailed cost analysis, supply chain.

Technological innovation and…

Residential Mortgage Service Market to Witness Huge Growth by 2029 - Residential …

The Global Residential Mortgage Service Market: 2022 has been recently published by the Mr Accuracy Reports. The report offers a cutting edge about the Residential Mortgage Service market, which helps the business strategists to make the best investment evaluation.

"The recession is going to come very badly . Please get to know your market RIGHT NOW with an extremely important information."

The Residential Mortgage Service market industry report includes details about…

Mortgage Broker Market Set for Explosive Growth : Associated Mortgage Group, Mor …

Advance Market Analytics published a new research publication on "Mortgage Broker Market Insights, to 2027" with 232 pages and enriched with self-explained Tables and charts in presentable format. In the Study you will find new evolving Trends, Drivers, Restraints, Opportunities generated by targeting market associated stakeholders. The growth of the Mortgage Broker market was mainly driven by the increasing R&D spending across the world.

Get Free Exclusive PDF Sample Copy of…

Reverse Mortgage Providers Market Is Booming Worldwide | Live Well Financial, Op …

Reverse Mortgage Providers Market: The extensive research on Reverse Mortgage Providers Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Reverse Mortgage Providers Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the market, such as…

Mortgage Broker Market Size [2022-2029] will reach at $ 565.3 bn by 2032 100% -T …

A recent market research report added to repository of MR Accuracy Reports is an in-depth analysis of global Mortgage Broker. On the basis of historic growth analysis and current scenario of Mortgage Broker place, the report intends to offer actionable insights on global market growth projections. Authenticated data presented in report is based on findings of extensive primary and secondary research. Insights drawn from data serve as excellent tools that…

Reverse Mortgage Providers Market 2021 Is Booming Worldwide | Live Well Financia …

Reverse Mortgage Providers Market describes an in-depth evaluation and Covid19 Outbreak study on the present and future state of the Reverse Mortgage Providers market across the globe, including valuable facts and figures. Reverse Mortgage Providers Market provides information regarding the emerging opportunities in the market & the market drivers, trends & upcoming technologies that will boost these growth trends. The report provides a comprehensive overview including Definitions, Scope, Application, Production…