Press release

FinTech Lending Market to Witness a Pronounce Growth Rate ~27.4% of CAGR by 2030 | Braviant Holdings, Fundbox, Funding Circle, Kabbage Funding

FinTech lender checks financial and banking history of individuals & businesses borrowing through FinTech firms. Moreover, to maximize the benefits of borrowing from FinTech lenders, consumers need to provide direct access of records through a cloud-based accounting software package and banking data permissions. In addition, bank permission allows FinTech lenders to run their analytical tools to speed up the credit decisions, which is driving the FinTech Lending market growth.Allied Market Research published a report, titled, "FinTech Lending Market by Offering (Business Lending and Consumer Lending), Business Model (Balance Sheet Lenders and Marketplace Lenders), Enterprise Size (Large Enterprises and Small & Medium-sized Enterprises (SMEs)), and Lending Channel (Online and Offline): Global Opportunity Analysis and Industry Forecast, 2021-2030." According to the report, the global fintech lending industry generated $449.89 billion in 2020, and is expected to generate $4,957.16 billion by 2030, witnessing a CAGR of 27.4% from 2021 to 2030.

➡️𝐃𝐨𝐰𝐧𝐥𝐨𝐚𝐝 𝐑𝐞𝐬𝐞𝐚𝐫𝐜𝐡 𝐑𝐞𝐩𝐨𝐫𝐭 𝐒𝐚𝐦𝐩𝐥𝐞 & 𝐓𝐎𝐂 : https://www.alliedmarketresearch.com/request-sample/14632

Drivers, Restraints, and Opportunities

Shift from traditional lending to digital lending, surge in government initiatives, and focus on digitalization of lending processes drive the growth of the global fintech lending market. However, rise in security & compliance issues hinders the market growth. On the other hand, technological innovations in fintech lending and rise in demand for cloud-based integrated products present new opportunities in the coming years.

COVID-19 Scenario:

Fintech firms have been shifting their preferences toward digitization of their financial assets and lending schemes. This has been helping them in capturing the huge customer base even in the lockdown.

However, various government authorities across the world restricted banks and lenders to change their debt reconstruction and other policies. This is expected to negatively impact the growth of the market.

The Business Lending segment to continue its leadership status during the forecast period

➡️𝐈𝐧𝐪𝐮𝐢𝐫𝐞 𝐁𝐞𝐟𝐨𝐫𝐞 𝐁𝐮𝐲𝐢𝐧𝐠: https://www.alliedmarketresearch.com/purchase-enquiry/14632

Based on offering, the business lending segment accounted for the largest share in 2020, contributing to nearly two-thirds of the global fintech lending market, and is projected to continue its leadership status during the forecast period. This is due to rapid business loans, changes in business preferences, and surge in small business administration (SBA) lending programs. However, the consumer lending segment is estimated to register the fastest CAGR of 29.7% from 2021 to 2030, owing to preference toward online platforms for availing loans, customized lending services, changing borrowers' trends, and technological advancements.

The Online segment to continue its lead position throughout the forecast period

Based on lending channel, the online segment contributed to the highest share in 2020, accounting for nearly four-fifths of the global fintech lending market, and is expected to continue its lead position throughout the forecast period. Moreover, this segment is estimated to manifest the largest CAGR of 28.5% from 2021 to 2030. This is due to hassle-free lending process, customization of small-ticket loans, and mitigation of risks associated with unsecured lending. The research also analyzes the offline segment.

North America to maintain its dominant share by 2030

Based on region, North America held the highest market share in 2020, accounting for nearly half of the global fintech lending market, and is expected to maintain its dominant share by 2030. This is due to development of interactive and consumer-friendly user interface of websites and applications, advanced collection and recovery consumer base, presence of major global players, and massive product awareness. However, Asia-Pacific is projected to witness the largest CAGR of 32.0% during the forecast period, owing to rise of the digital lending landscape along with surge in the number of start-ups and several government initiatives toward FinTech lending across developing countries such as India, China, and Japan.

➡️𝐁𝐮𝐲 𝐂𝐨𝐦𝐩𝐥𝐞𝐭𝐞 𝐑𝐞𝐩𝐨𝐫𝐭 𝐚𝐭 𝐃𝐢𝐬𝐜𝐨𝐮𝐧𝐭𝐞𝐝 𝐏𝐫𝐢𝐜𝐞 @ https://www.alliedmarketresearch.com/checkout-final/f36fa71ce343fd0077573106fe94a168

Leading Market Players

Avant, LLC

Braviant Holdings

Fundbox

Funding Circle

Kabbage Funding

LendingClub Bank

OnDeck

RateSetter

Social Finance, Inc.

Tavant

➡️𝐓𝐨𝐩 𝐓𝐫𝐞𝐧𝐝𝐢𝐧𝐠 𝐑𝐞𝐩𝐨𝐫𝐭𝐬:

South Africa Asset-based Lending Market https://www.alliedmarketresearch.com/south-africa-asset-based-lending-market-A74622

Commercial Lending Market https://www.alliedmarketresearch.com/commercial-lending-market-A11617

Asset-Based Lending Market https://www.alliedmarketresearch.com/asset-based-lending-market-A12934

Digital Lending Platform Market https://www.alliedmarketresearch.com/digital-lending-platform-market

Europe Travel Insurance Market https://www.alliedmarketresearch.com/europe-travel-insurance-market

Contact:

David Correa

1209 Orange Street, Corporation Trust Center, Wilmington, New Castle, Delaware 19801 USA.

Int'l: +1-503-894-6022 Toll Free: +1-800-792-5285

UK: +44-845-528-1300

India (Pune): +91-20-66346060 Fax: +1-800-792-5285 help@alliedmarketresearch.com

https://pooja-bfsi.blogspot.com/

https://www.quora.com/profile/Pooja-BFSI

https://medium.com/@psaraf568

About Us:

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Wilmington, Delaware. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality of "Market Research Reports Insights" and "Business Intelligence Solutions." AMR has a targeted view to provide business insights and consulting to assist its clients to make strategic business decisions and achieve sustainable growth in their respective market domain.

We are in professional corporate relations with various companies and this helps us in digging out market data that helps us generate accurate research data tables and confirms utmost accuracy in our market forecasting. Allied Market Research CEO Pawan Kumar is instrumental in inspiring and encouraging everyone associated with the company to maintain high quality of data and help clients in every way possible to achieve success. Each and every data presented in the reports published by us is extracted through primary interviews with top officials from leading companies of domain concerned. Our secondary data procurement methodology includes deep online and offline research and discussion with knowledgeable professionals and analysts in the industry.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release FinTech Lending Market to Witness a Pronounce Growth Rate ~27.4% of CAGR by 2030 | Braviant Holdings, Fundbox, Funding Circle, Kabbage Funding here

News-ID: 3478558 • Views: …

More Releases from Allied Market Research

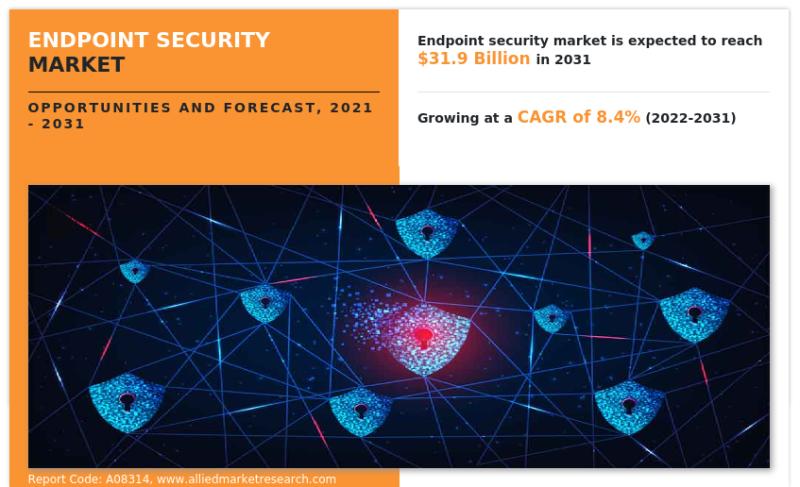

Endpoint Security Market Size Growing at 8.4% CAGR Reach USD 31.9 Billion by 203 …

Allied Market Research published a new report, titled, "Endpoint Security Market Size Growing at 8.4% CAGR Reach USD 31.9 Billion by 2031." The report offers an extensive analysis of key growth strategies, drivers, opportunities, key segments, Porter's Five Forces analysis, and competitive landscape. This study is a helpful source of information for market players, investors, VPs, stakeholders, and new entrants to gain a thorough understanding of the industry and determine…

Smart Manufacturing Market Size Growing at 13.7% CAGR Reach USD 860 Billion by 2 …

Allied Market Research published a new report, titled, "Smart Manufacturing Market Size Growing at 13.7% CAGR Reach USD 860 Billion by 2031." The report offers an extensive analysis of key growth strategies, drivers, opportunities, key segments, Porter's Five Forces analysis, and competitive landscape. This study is a helpful source of information for market players, investors, VPs, stakeholders, and new entrants to gain a thorough understanding of the industry and determine…

Data Virtualization Market Sizze Growing at 21.7% CAGR Reach USD 22.2 Billion by …

According to the report published by Allied Market Research, Data Virtualization Market Sizze Growing at 21.7% CAGR Reach USD 22.2 Billion by 2031. The report provides an extensive analysis of changing market dynamics, major segments, value chain, competitive scenario, and regional landscape. This research offers valuable able guidance to leading players, investors, shareholders, and startups in devising strategies for sustainable growth and gaining a competitive edge in the market.

Driving Factors…

Europe IoT Market Growing at 19.0% CAGR Reach USD 12.30 Billion by 2031

According to the report published by Allied Market Research, Europe IoT Market Growing at 19.0% CAGR Reach USD 12.30 Billion by 2031. The report provides an extensive analysis of changing market dynamics, major segments, value chain, competitive scenario, and regional landscape. This research offers valuable able guidance to leading players, investors, shareholders, and startups in devising strategies for sustainable growth and gaining a competitive edge in the market.

The Europe IoT…

More Releases for Lending

Mortgage Lending Market : Increased focus toward digitalizing lending process

According to the report published by Allied Market Research, the global mortgage lending market generated $11.48 billion in 2021, and is estimated to reach $27.50 billion by 2031, witnessing a CAGR of 9.5% from 2022 to 2031. The report offers a detailed analysis of changing market trends, top segments, value chain, key investment pockets, competitive scenario, and regional landscape. The report is a vital for leading market players, investors, new…

P2p Lending Market | Industry Overview 2021 | Worldwide Companies- CircleBack Le …

P2p Lending Market report will provide one with overall market analysis, statistics, various trends, drivers, opportunities, restraints, and every minute data relating to the Synthetic Fibers market necessary for forecasting its revenue, factors propelling & growth. The P2p Lending market study provides unique guidance in thoughtful details regarding the development factors and has used a top-down and bottom-up approach to keep it error-free and accurate. Our expert analysts have used…

Peer-to-peer Lending – Growing Popularity and Emerging Trends in the Market | …

Global Peer-to-peer Lending Market Size, Status and Forecast 2018-2025 is latest research study released by HTF MI evaluating the market, highlighting opportunities, risk side analysis, and leveraged with strategic and tactical decision-making support. The study provides information on market trends and development, drivers, capacities, technologies, and on the changing investment structure of the Global Peer-to-peer Lending Market. Some of the key players profiled in the study are CircleBack Lending, Lending…

Alternative Lending Market Is Booming Worldwide | Lending Club, Prosper, Upstart …

The ‘ Alternative Lending market’ research report added by Report Ocean, is an in-depth analysis of the latest developments, market size, status, upcoming technologies, industry drivers, challenges, regulatory policies, with key company profiles and strategies of players. The research study provides market overview, Alternative Lending market definition, regional market opportunity, sales and revenue by region, manufacturing cost analysis, Industrial Chain, market effect factors analysis, Alternative Lending market size forecast, market…

P2P Lending Market is Thriving Worldwide | CircleBack Lending, Lending Club, Pee …

Global P2P Lending Market Size, Status and Forecast 2025 is latest research study released by HTF MI evaluating the market, highlighting opportunities, risk side analysis, and leveraged with strategic and tactical decision-making support. The study provides information on market trends and development, drivers, capacities, technologies, and on the changing investment structure of the Global P2P Lending Market. Some of the key players profiled in the study are CircleBack Lending, Lending…

Canada Peer-to-peer Lending Market 2018-2022 Overview by CircleBack Lending, Len …

with the slowdown in world economic growth, the Peer-to-peer Lending industry has also suffered a certain impact, but still maintained a relatively optimistic growth, the past four years, Peer-to-peer Lending market size to maintain the average annual growth rate of 2.94% from 22 million $ in 2014 to 24 million $ in 2017, Research analysts believe that in the next few years, Peer-to-peer Lending market size will be further expanded,…