Press release

Life Insurance Policy Administration System market is projected to rise at a CAGR of 12.2% through 2034

As per a recent study conducted by Fact.MR, a reputable market research and competitive intelligence firm, the global Life Insurance Policy Administration System Market is poised to grow at a robust Compound Annual Growth Rate (CAGR) of 12.2% until the year 2034. The market is forecasted to achieve a valuation of US$ 6,689.2 million by the end of 2024, with further projections indicating a potential surge to US$ 21,115.2 million by 2034.The necessity for technological upgrades, the growing tendency to outsource policy administration responsibilities, and the dynamic nature of the organization are the factors propelling the market expansion. Systems for administering life insurance policies have grown in popularity recently because of their flexibility in responding to shifts in the business landscape.

For More Insights into the Market, Request a Sample of this Report:

https://www.factmr.com/connectus/sample?flag=S&rep_id=9452

Market Segmentations:

By Deployment Type : SaaS, On-Premise

By End User : Insurance Company, Banks, Others

By Region : North America, Europe, East Asia, East Asia, South Asia & Oceania, Middle East & Africa

The necessity for insurance businesses to stay updated with the newest technical breakthroughs, the continuously changing market circumstances, and the rising tendency towards outsourcing policy administration duties are some drivers driving the demand for these systems.

These systems' capacity to give insurance businesses more adaptability and agility in reacting to market developments is one of their main advantages. This is particularly crucial in today's fast-paced business environment when organizations must be able to modify their operations swiftly and plan to stay one step ahead of the competition.

The market for life insurance policy administration systems is expanding due to the growing need for outsourcing services. It is more economical and efficient for many insurance businesses to outsource their policy administration tasks to outside vendors than to handle them internally.

Key Takeaways from the Market Study

The global life insurance policy administration system market is expected to grow at a 12.2% CAGR through 2034.

The market for life insurance policy administration systems in North America is predicted to expand at a CAGR of 27.1% through 2034.

The life insurance policy administration system industry in East Asia is projected to grow at a CAGR of 12.8% until 2034.

In 2024, the United States life insurance policy administration system market will command 72.2% of the market.

China is anticipated to hold 66.9% of the global market share in 2024.

Competition Analysis of the Life Insurance Policy Administration System Market

The life insurance policy administration systems sector is experiencing intense competition as numerous manufacturers compete for a considerable market share. Market participants have been implementing various strategic initiatives to stay ahead of the competition. These include introducing innovative and cutting-edge products, geographic expansion, mergers and acquisitions, cooperation with other businesses, modernizing current products, and forming alliances with significant players in the sector.

Market players aim to enhance market position, increase profits and revenue, and become more competitive by producing reliable life insurance policy administration systems to meet growing patient and professional demand. Key players are investing in research and development to create advanced systems and improve customer service to provide prompt and practical assistance to their clients.

Manufacturers leverage advanced technologies like artificial intelligence and machine learning to improve product capabilities and streamline operations while collaborating with industry experts for market insights.

The life insurance policy administration systems market is rapidly transforming due to these strategic initiatives and technological advancements. Manufacturers strive to provide their clients with the best possible solutions and services, and the competition in the market is only set to intensify in the coming decade.

Get Customization on this Report for Specific Research Solutions:

https://www.factmr.com/connectus/sample?flag=RC&rep_id=9452

Competitive Landscape

In the dynamic realm of life insurance policy administration systems, fierce competition prevails among a multitude of manufacturers. This competition fuels strategic endeavors like the launch of groundbreaking products. Market participants are actively broadening their geographical reach, engaging in mergers and acquisitions, enhancing existing products, and forging strategic alliances.

Recent Developments

In November 2023, Guidewire Software rolled out "Accelerate," a pioneering program designed to assist insurers in overhauling their core systems and transitioning to cloud-based solutions, marking a significant move towards modernizing the insurance sector.

In October 2023, Sapiens International, a prominent player in insurance software solutions, finalized the acquisition of Insurity, a United Kingdom-based life and pensions administration platform.

Read More - https://www.globenewswire.com/news-release/2024/01/24/2816053/0/en/Life-Insurance-Policy-Administration-System-Market-to-Hit-US-21-115-2-Million-by-2034-Fact-MR-Report.html

About Fact.MR

Market research and consulting agency with a difference! That's why 80% of Fortune 1,000 companies trust us for making their most critical decisions. While our experienced consultants employ the latest technologies to extract hard-to-find insights, we believe our USP is the trust clients have on our expertise. Spanning a wide range - from automotive & industry 4.0 to healthcare & retail, our coverage is expansive, but we ensure even the most niche categories are analyzed. Our sales offices in United States and Dublin, Ireland. Headquarter based in Dubai, UAE. Reach out to us with your goals, and we'll be an able research partner.

Contact:

US Sales Office :

11140 Rockville Pike

Suite 400

Rockville, MD 20852

United States

Tel: +1 (628) 251-1583

E-Mail: sales@factmr.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Life Insurance Policy Administration System market is projected to rise at a CAGR of 12.2% through 2034 here

News-ID: 3474743 • Views: …

More Releases from Fact.MR

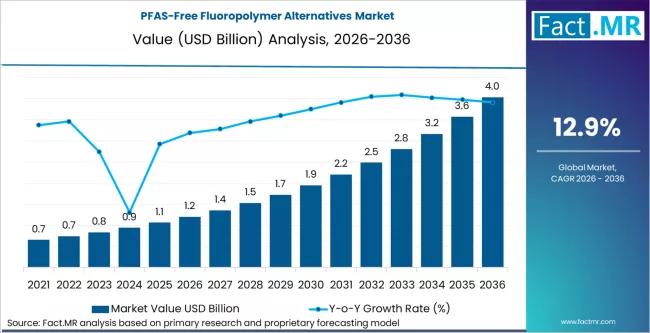

PFAS-Free Fluoropolymer Alternatives Market projects a CAGR of 12.9% by 2036

The global PFAS-free fluoropolymer alternatives market is projected to grow from USD 1.25 billion in 2026 to approximately USD 3.12 billion by 2036. This reflects a rapid compound annual growth rate (CAGR) of 9.6% over the ten-year forecast period.

The market is being aggressively driven by a global regulatory crackdown on "forever chemicals" (PFAS), forcing major industries to find non-fluorinated substitutes for coatings, membranes, and high-performance plastics.

Get Access of Report…

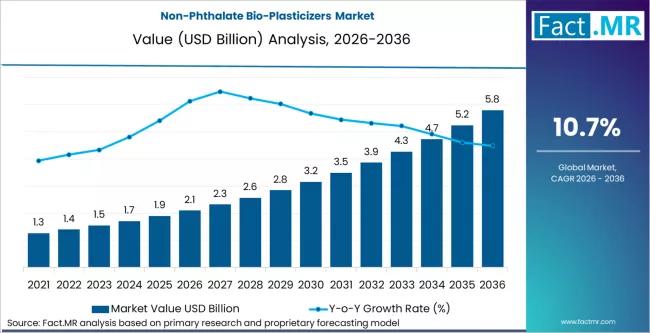

Non-Phthalate Bio-Plasticizers Market is Expected to Reach USD 5.8 billion by 20 …

The global HFO (Hydrofluoroolefin) Blowing Agent Market is forecast to grow substantially over the coming decade, driven by stringent environmental regulations, rising demand for energy-efficient insulation materials, and accelerated adoption of low-global-warming-potential (GWP) technologies across construction, refrigeration, and automotive sectors.

Industry analysts estimate that the market, valued at approximately USD 1.9 billion in 2025, is expected to exceed USD 3.6 billion by 2035, registering a compound annual growth rate (CAGR)…

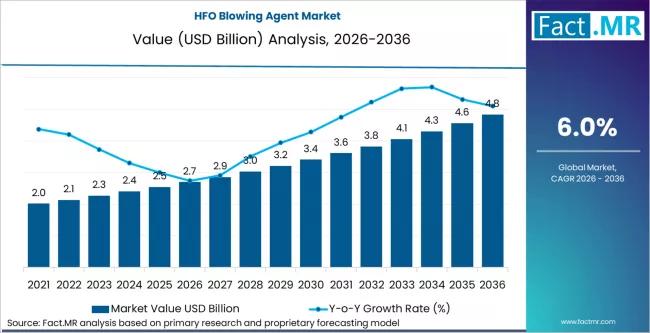

HFO Blowing Agent Market is Estimated to Grow to USD 2.7 billion in 2026

The global HFO (Hydrofluoroolefin) Blowing Agent Market is forecast to grow substantially over the coming decade, driven by stringent environmental regulations, rising demand for energy-efficient insulation materials, and accelerated adoption of low-global-warming-potential (GWP) technologies across construction, refrigeration, and automotive sectors. Industry analysts estimate that the market, valued at approximately USD 1.9 billion in 2025, is expected to exceed USD 3.6 billion by 2035, registering a compound annual growth rate (CAGR)…

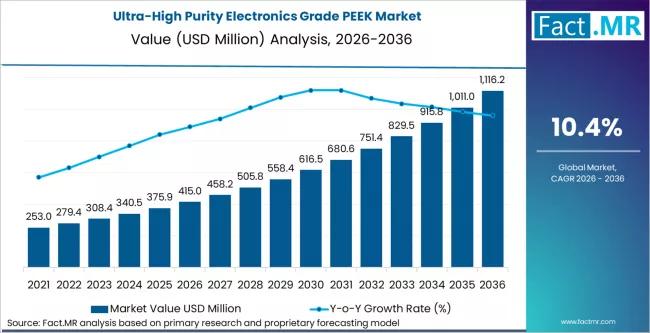

Ultra-High Purity Electronics Grade PEEK Market FOrecasted CAGR is 10.4% 2036

The global ultra-high purity (UHP) electronics-grade Polyether Ether Kitone (PEEK) market is projected to grow from USD 215.4 million in 2026 to approximately USD 458.6 million by 2036. This represents a strong compound annual growth rate (CAGR) of 7.8% over the ten-year forecast period.

The market is being driven by the relentless miniaturization of semiconductors and the shift toward 2nm and 3nm process nodes, where even microscopic material impurities can…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…