Press release

Commercial Lending Market Forecast 2023-2029: Analyzing Growth Trends

Commercial Lending Market OverviewMaximize Market Research, a Commercial Lending business research firm has published a report on the "Commercial Lending Market" Which provides Industry Analysis (Market Performance, Segments, Price Analysis, Outlook) and detailed Process Flow (Product Overview, Unit Operations, Raw Materials, and Quality Assurance).

To explore this subject matter further, please click on the link provided

Commercial Lending Market Report Scope and Research Methodology

The Market Research Report (MMR) researches deep into vital growth determinants, exploring motivators and barriers. It furnishes extensive insights into competitive landscapes, major company offerings, and investment prospects. Embracing qualitative and quantitative analyses, it scrutinizes regional markets, providing indispensable insights for stakeholders. Employing historical data, technological advancements, governmental policies, and current Commercial Lending market. Utilizing sources like annual reports, press releases, industry associations, governmental agencies, and customs data, it employs market engineering and data triangulation to forecast segments and sub-segments.

Commercial Lending Market Regional Insights

The estimated growth in the Commercial Lending market segment is driven by improved reliability and increasing demand. The Commercial Lending market is largely segmented into North America, Europe, Asia Pacific, Latin America, the Middle East, and Africa.

Commercial Lending Market Segmentation

by Service Type

Unsecured Lending

Secured Lending

by Providers

Banks

Non-banks

by Enterprise Size

Large Enterprises

Small & Medium-Sized Enterprises

For additional insights, kindly explore the following link: www.maximizemarketresearch.com/market-…et/230608/

Commercial Lending Market Key Players

1. Huntington bank

2. Wells Fargo

3. Bank of China Limited

4. funding circle

5. Industrial Bank Co. Ltd

6. jp morgan chase

7. china development bank

8. Credit Suisse

9. Goldman Sachs

10. OnDecK

To delve deeper into this research, please follow this link: www.maximizemarketresearch.com/request…ple/230608

Table of Content: Commercial Lending Market

Part 01: Executive Summary

Part 02: Scope of the Commercial Lending Market Report

Part 03: Global Commercial Lending Market Landscape

Part 04: Global Commercial Lending Market Sizing

Part 05: Global Commercial Lending Market Segmentation by Type

Part 06: Five Forces Analysis

Part 07: Customer Landscape

Part 08: Geographic Landscape

Part 09: Decision Framework

Part 10: Drivers and Challenges

Part 11: Market Trends

Part 12: Vendor Landscape

Part 13: Vendor Analysis

Key questions answered in the Commercial Lending Market are:

• What is Commercial Lending?

• What was the Commercial Lending market size in 2023?

• What is the growth rate of the Commercial Lending Market?

• Which are the factors expected to drive the Commercial Lending market growth?

• What are the different segments of the Commercial Lending Market?

• What growth strategies are the players considering to increase their presence in Commercial Lending?

• What are the upcoming industry applications and trends for the Commercial Lending Market?

• What are the recent industry trends that can be implemented to generate additional revenue streams for the Commercial Lending Market?

• What segments are covered in the Commercial Lending Market?

• Who are the leading companies and what are their portfolios in Commercial Lending Market?

• What segments are covered in the Commercial Lending Market?

• Who are the key players in the Commercial Lending market?

Key Offerings:

• Past Market Size and Competitive Landscape (2018 to 2022)

• Past Pricing and price curve by region (2018 to 2022)

• Market Size, Share, Size & Forecast by different segment | 2024-2030

• Market Dynamics - Growth Drivers, Restraints, Opportunities, and Key Trends by Region

• Market Segmentation - A detailed analysis by segment with their sub-segments and Region

• Competitive Landscape - Profiles of selected key players by region from a strategic perspective

o Competitive landscape - Market Leaders, Market Followers, Regional player

o Competitive benchmarking of key players by region

• PESTLE Analysis

• PORTER's analysis

• Value chain and supply chain analysis

• Legal Aspects of Business by Region

• Lucrative business opportunities with SWOT analysis

• Recommendations

Related Rreport Link:

GPIO Expanders Market https://www.maximizemarketresearch.com/market-report/gpio-expanders-market/84305/

Global Earth Leakage Circuit Breakers Market https://www.maximizemarketresearch.com/market-report/global-earth-leakage-circuit-breakers-market/83473/

Global Power over Ethernet Chipsets Market https://www.maximizemarketresearch.com/market-report/global-power-over-ethernet-chipsets-market/23380/

Global palm vein biometrics Market https://www.maximizemarketresearch.com/market-report/global-palm-vein-biometrics-market/23356/

vacuum contactor market https://www.maximizemarketresearch.com/market-report/vacuum-contactor-market/67521/

Wind Turbine Inspection Services Market https://www.maximizemarketresearch.com/market-report/wind-turbine-inspection-services-market/77606/

Europe Touch Sensor Market https://www.maximizemarketresearch.com/market-report/europe-touch-sensor-market/3280/

Global Water Quality Sensor Market https://www.maximizemarketresearch.com/market-report/global-water-quality-sensor-market/71798/

Global Medical Mattress Market https://www.maximizemarketresearch.com/market-report/global-medical-mattress-market/108310/

Metallized Polyester Films Market https://www.maximizemarketresearch.com/market-report/global-metallized-polyester-films-market/25479/

Contact Maximize Market Research:

3rd Floor, Navale IT Park, Phase 2

Pune Banglore Highway, Narhe,

Pune, Maharashtra 411041, IndiaC

sales@maximizemarketresearch.com

+91 96071 95908, +91 9607365656

About Maximize Market Research:

Maximize Market Research is a multifaceted market research and consulting company with professionals from several industries. Some of the industries we cover include medical devices, pharmaceutical manufacturers, science and engineering, electronic components, industrial equipment, technology and communication, cars and automobiles, chemical products and substances, general merchandise, beverages, personal care, and automated systems. To mention a few, we provide market-verified industry estimations, technical trend analysis, crucial market research, strategic advice, competition analysis, production and demand analysis, and client impact studies.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Commercial Lending Market Forecast 2023-2029: Analyzing Growth Trends here

News-ID: 3468273 • Views: …

More Releases from Maximize Market Research pvt. Ltd.

Headwear Market to Reach US$ 34.97 Billion by 2032

Headwear Market was valued at US$ 22.84 billion in 2024 and is expected to reach US$ 34.97 billion by 2032, expanding at a compound annual growth rate (CAGR) of 5.47% during the forecast period.

The market growth is driven by increasing fashion consciousness, rising sports participation, growing demand for branded and designer headwear, and expanding e-commerce penetration worldwide. Additionally, changing lifestyle trends and the growing influence of social media and celebrity…

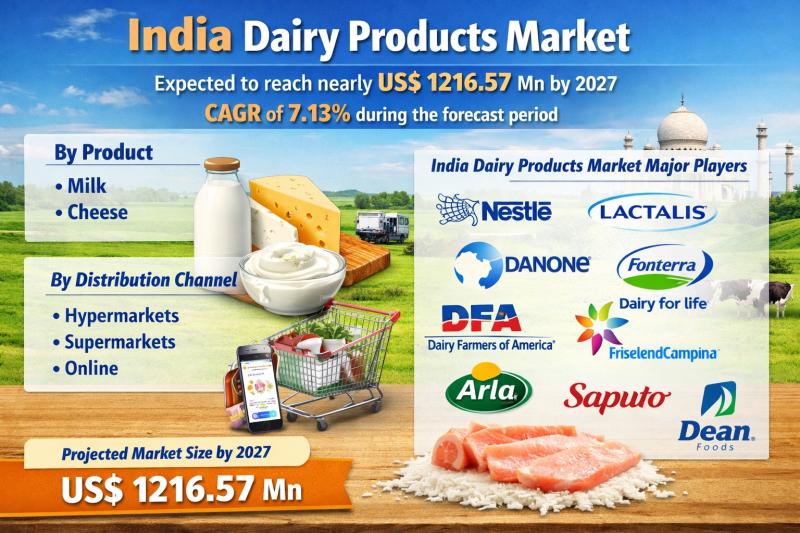

India Dairy Products Market to Reach US$ 1216.57 Mn by 2027, Expanding at a CAGR …

India Dairy Products Market size is expected to reach nearly US$ 1216.57 Mn by 2027, expanding at a CAGR of 7.13% during the forecast period. The market growth is driven by increasing dairy consumption, rising health awareness, expansion of organized retail, and growing demand for value-added dairy products across urban and semi-urban regions.

Request To Free Sample of This Strategic Report ➤https://www.maximizemarketresearch.com/market-report/india-dairy-products-market/92594/

Key Market Highlights

Market Size & CAGR:

The India Dairy Products…

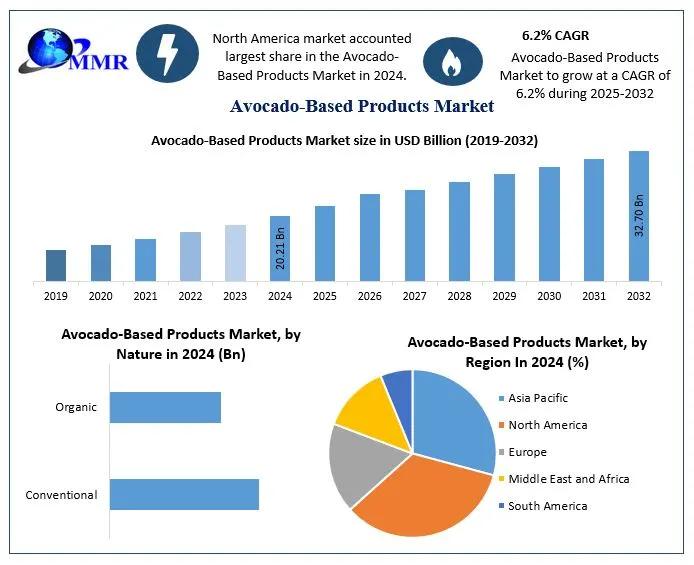

Avocado-Based Products Market Set for Strong Growth Through 2032 Driven by Healt …

The global Avocado-Based Products Market is projected to reach a market value of USD 32.70 Billion by 2032, expanding at a compound annual growth rate (CAGR) of 6.2% from 2025 to 2032, according to a new research report.

Avocado-Based Products Market Overview:

The global Avocado-Based Products Market is experiencing significant traction as consumers increasingly embrace nutrient-rich and plant-based options. With avocados recognized for their natural healthy fats, vitamins, and fiber, demand across…

Waste Paper Recycling Market to Reach USD 63.32 Billion by 2030, Growing at a CA …

Waste Paper Recycling Market reached a value of USD 45.60 Bn. in 2023. The global market is expected to grow at a CAGR of 4.8% during the forecast period, reaching nearly USD 63.32 Bn. by 2030. The market growth is driven by increasing environmental awareness, rising demand for sustainable packaging solutions, and stringent government regulations promoting recycling and waste reduction practices.

Request To Free Sample of This Strategic Report ➤https://www.maximizemarketresearch.com/market-report/global-waste-paper-recycling-market/84320/

Key…

More Releases for Lending

Mortgage Lending Market : Increased focus toward digitalizing lending process

According to the report published by Allied Market Research, the global mortgage lending market generated $11.48 billion in 2021, and is estimated to reach $27.50 billion by 2031, witnessing a CAGR of 9.5% from 2022 to 2031. The report offers a detailed analysis of changing market trends, top segments, value chain, key investment pockets, competitive scenario, and regional landscape. The report is a vital for leading market players, investors, new…

P2p Lending Market | Industry Overview 2021 | Worldwide Companies- CircleBack Le …

P2p Lending Market report will provide one with overall market analysis, statistics, various trends, drivers, opportunities, restraints, and every minute data relating to the Synthetic Fibers market necessary for forecasting its revenue, factors propelling & growth. The P2p Lending market study provides unique guidance in thoughtful details regarding the development factors and has used a top-down and bottom-up approach to keep it error-free and accurate. Our expert analysts have used…

Peer-to-peer Lending – Growing Popularity and Emerging Trends in the Market | …

Global Peer-to-peer Lending Market Size, Status and Forecast 2018-2025 is latest research study released by HTF MI evaluating the market, highlighting opportunities, risk side analysis, and leveraged with strategic and tactical decision-making support. The study provides information on market trends and development, drivers, capacities, technologies, and on the changing investment structure of the Global Peer-to-peer Lending Market. Some of the key players profiled in the study are CircleBack Lending, Lending…

Alternative Lending Market Is Booming Worldwide | Lending Club, Prosper, Upstart …

The ‘ Alternative Lending market’ research report added by Report Ocean, is an in-depth analysis of the latest developments, market size, status, upcoming technologies, industry drivers, challenges, regulatory policies, with key company profiles and strategies of players. The research study provides market overview, Alternative Lending market definition, regional market opportunity, sales and revenue by region, manufacturing cost analysis, Industrial Chain, market effect factors analysis, Alternative Lending market size forecast, market…

P2P Lending Market is Thriving Worldwide | CircleBack Lending, Lending Club, Pee …

Global P2P Lending Market Size, Status and Forecast 2025 is latest research study released by HTF MI evaluating the market, highlighting opportunities, risk side analysis, and leveraged with strategic and tactical decision-making support. The study provides information on market trends and development, drivers, capacities, technologies, and on the changing investment structure of the Global P2P Lending Market. Some of the key players profiled in the study are CircleBack Lending, Lending…

Canada Peer-to-peer Lending Market 2018-2022 Overview by CircleBack Lending, Len …

with the slowdown in world economic growth, the Peer-to-peer Lending industry has also suffered a certain impact, but still maintained a relatively optimistic growth, the past four years, Peer-to-peer Lending market size to maintain the average annual growth rate of 2.94% from 22 million $ in 2014 to 24 million $ in 2017, Research analysts believe that in the next few years, Peer-to-peer Lending market size will be further expanded,…