Press release

Corporate Lending Platform Market to Grow at CAGR of 24.1% Reaching USD 20,979.94 Million By 2032

Polaris Market Research, a leading market research organization, has released a report titled "Corporate Lending Platform Market: Global Industry Share, Trends, Size, Growth, Opportunity and Forecast 2024-2032." The study delivers a thorough analysis of the industry, including competitor and regional analysis, and highlights the latest advancements in the market.Global Corporate Lending Platform Market size and share is currently valued at USD 3,016.02 million in 2023 and is anticipated to generate an estimated revenue of USD 20,979.94 million by 2032, according to the latest study by Polaris Market Research. Besides, the report notes that the market exhibits a robust 24.1% Compound Annual Growth Rate (CAGR) over the forecasted timeframe, 2024 - 2032.

𝐆𝐞𝐭 𝐚𝐧 𝐄𝐱𝐜𝐥𝐮𝐬𝐢𝐯𝐞 𝐒𝐚𝐦𝐩𝐥𝐞 𝐏𝐃𝐅 𝐨𝐟 𝐓𝐡𝐢𝐬 𝐑𝐞𝐩𝐨𝐫𝐭: https://www.polarismarketresearch.com/industry-analysis/corporate-lending-platform-market/request-for-sample

Corporate lending includes conventional banks, online lenders, and alternate fiscal establishments providing loans and connected commodities to businesses for business-linked occasions. Lenders who offer business loans and alternate corporate lending commodities frequently establish competence that needs to be connected to years in business, yearly proceeds, and credit score. Loan size, interest rates, and loan entitlement normally rely on the product and the lender. Funding can be interim with compensation in a few months or extended with disbursements expanded over the years. Loanees will frequently be questioned for a personal guarantee and security for fastened funding for their business.

The corporate lending platform market share is flourishing because of the growing demand for efficient loan genesis and processing. Businesses are growingly looking for systematic solutions to obtain financing and handle financial operations. These platforms use progressive technologies such as AI and ML to mechanize chores, estimate creditworthiness, and accelerate loan consent. Also, the transformation towards online and mobile banking is propelling notable growth in the market. With additional businesses selecting digital banking solutions, there is a growing demand for well-organized lending procedures.

𝐂𝐨𝐦𝐩𝐞𝐭𝐢𝐭𝐨𝐫 𝐀𝐧𝐚𝐥𝐲𝐬𝐢𝐬

Some of the major global players include:

• Comarch

• FICO

• Finastra

• FIS

• Fiserv

• HES FinTech

• Intellect Design Arena

• JurisTech

• Newgen

• Oracle

• Sigma Infosolutions

• Tavant

• TCS

• Temenos AG

• Wipro

𝐁𝐮𝐲 𝐭𝐡𝐢𝐬 𝐏𝐫𝐞𝐦𝐢𝐮𝐦 𝐑𝐞𝐬𝐞𝐚𝐫𝐜𝐡 𝐑𝐞𝐩𝐨𝐫𝐭: https://www.polarismarketresearch.com/buy/3820/2

𝐌𝐚𝐫𝐤𝐞𝐭'𝐬 𝐌𝐚𝐣𝐨𝐫 𝐅𝐚𝐜𝐭𝐬

• The global corporate lending platform industry was valued at USD 3,016.02 million in 2023 and is expected to grow to USD 20,979.94 million by 2032.

• The market is anticipated to expand at a CAGR of 24.1% during the forecast period.

• In 2023, North America is anticipated to dominate the market.

• Asia Pacific observed the highest growth rate in the market.

𝐀𝐩𝐩𝐥𝐢𝐜𝐚𝐭𝐢𝐨𝐧𝐬:

Loan Origination and Underwriting: Platforms facilitate the application process, assess creditworthiness, and automate loan approvals.

Loan Servicing: Managing and servicing loans throughout their lifecycle, including payment processing and customer support.

Risk Management: Utilizing data and advanced analytics to assess and mitigate lending risks.

Compliance and Documentation: Ensuring adherence to regulatory requirements and managing documentation electronically.

𝐀𝐜𝐜𝐞𝐬𝐬 𝐓𝐡𝐞 𝐅𝐮𝐥𝐥 𝐑𝐞𝐩𝐨𝐫𝐭, 𝐡𝐞𝐫𝐞: https://www.polarismarketresearch.com/industry-analysis/corporate-lending-platform-market

𝐏𝐨𝐥𝐚𝐫𝐢𝐬 𝐌𝐚𝐫𝐤𝐞𝐭 𝐑𝐞𝐬𝐞𝐚𝐫𝐜𝐡 𝐇𝐚𝐬 𝐒𝐞𝐠𝐦𝐞𝐧𝐭𝐞𝐝 𝐭𝐡𝐞 𝐂𝐨𝐫𝐩𝐨𝐫𝐚𝐭𝐞 𝐋𝐞𝐧𝐝𝐢𝐧𝐠 𝐏𝐥𝐚𝐭𝐟𝐨𝐫𝐦 𝐌𝐚𝐫𝐤𝐞𝐭 𝐑𝐞𝐩𝐨𝐫𝐭 𝐁𝐚𝐬𝐞𝐝 𝐎𝐧 𝐎𝐟𝐟𝐞𝐫𝐢𝐧𝐠, 𝐋𝐞𝐧𝐝𝐢𝐧𝐠 𝐓𝐲𝐩𝐞, 𝐃𝐞𝐩𝐥𝐨𝐲𝐦𝐞𝐧𝐭 𝐌𝐨𝐝𝐞𝐥, 𝐀𝐧𝐝 𝐄𝐧𝐝-𝐔𝐬𝐞𝐫:

Corporate Lending Platform, Offering Outlook (Revenue - USD Million, 2019 - 2032)

• Solutions

• Services

Corporate Lending Platform, Lending Type Outlook (Revenue - USD Million, 2019 - 2032)

• Microfinance Lending

• Commercial Lending

• SME Lending

• Others

Corporate Lending Platform, Deployment Model Outlook (Revenue - USD Million, 2019 - 2032)

• On-premise

• Cloud-based

Corporate Lending Platform, End User Outlook (Revenue - USD Million, 2019 - 2032)

• Banks

• Non-Banking Financial Corporations

• Credit Unions

• Others

𝐌𝐨𝐫𝐞 𝐓𝐫𝐞𝐧𝐝𝐢𝐧𝐠 𝐋𝐚𝐭𝐞𝐬𝐭 𝐑𝐞𝐩𝐨𝐫𝐭𝐬 𝐛𝐲 𝐏𝐨𝐥𝐚𝐫𝐢𝐬 𝐌𝐚𝐫𝐤𝐞𝐭 𝐑𝐞𝐬𝐞𝐚𝐫𝐜𝐡:

Parking Management Systems Market: https://www.polarismarketresearch.com/industry-analysis/parking-management-systems-market

Over-The-Top Devices And Services Market: https://www.polarismarketresearch.com/industry-analysis/over-the-top-devices-and-services-market

Cryptocurrency Market: https://www.polarismarketresearch.com/industry-analysis/cryptocurrency-market

Real Estate Crowdfunding Market: https://www.polarismarketresearch.com/industry-analysis/real-estate-crowdfunding-market

𝐂𝐨𝐧𝐭𝐚𝐜𝐭 𝐈𝐧𝐟𝐨:

Polaris Market Research

Phone: +1-929-297-9727

Email: sales@polarismarketresearch.com

𝐀𝐛𝐨𝐮𝐭 𝐔𝐬:

Polaris Market Research is a worldwide market research and consulting organization. We give unmatched nature of offering to our customers present all around the globe across industry verticals. Polaris Market Research has expertise in giving deep-dive market insight along with market intelligence to our customers spread crosswise over various undertakings. We at Polaris are obliged to serve our different client base present over the enterprises of medicinal services, healthcare, innovation, next-gen technologies, semi-conductors, chemicals, automotive, and aerospace & defence, among different ventures present globally.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Corporate Lending Platform Market to Grow at CAGR of 24.1% Reaching USD 20,979.94 Million By 2032 here

News-ID: 3460241 • Views: …

More Releases from Polaris Market Research & Consulting

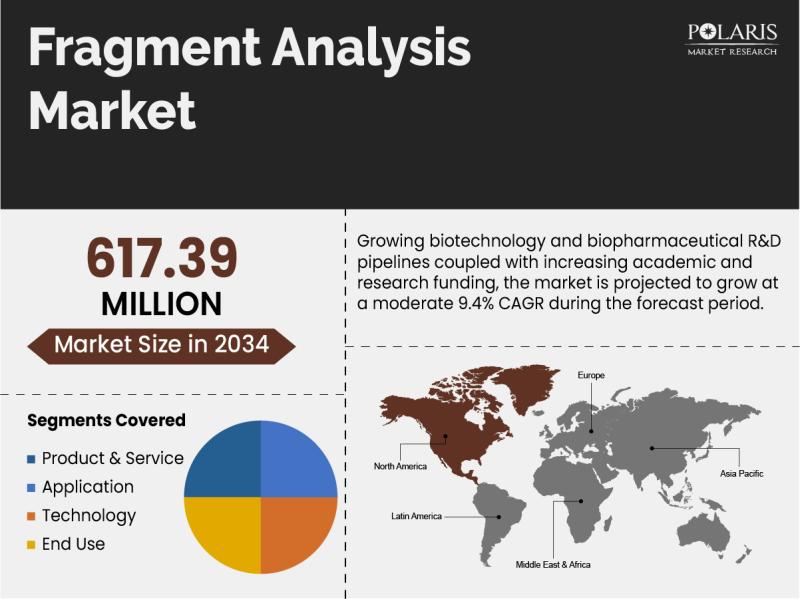

Fragment Analysis Market Size Projected to Reach USD 617.39 Million by 2034, Gro …

Global Fragment Analysis Market is currently valued at USD 275.72 Million in 2025 and is anticipated to generate an estimated revenue of USD 617.39 Million by 2034, according to the latest study by Polaris Market Research. Besides, the report notes that the market exhibits a robust 9.4% Compound Annual Growth Rate (CAGR) over the forecasted timeframe, 2026 - 2034.

Polaris Market Research recently introduced the latest update on Fragment Analysis Market…

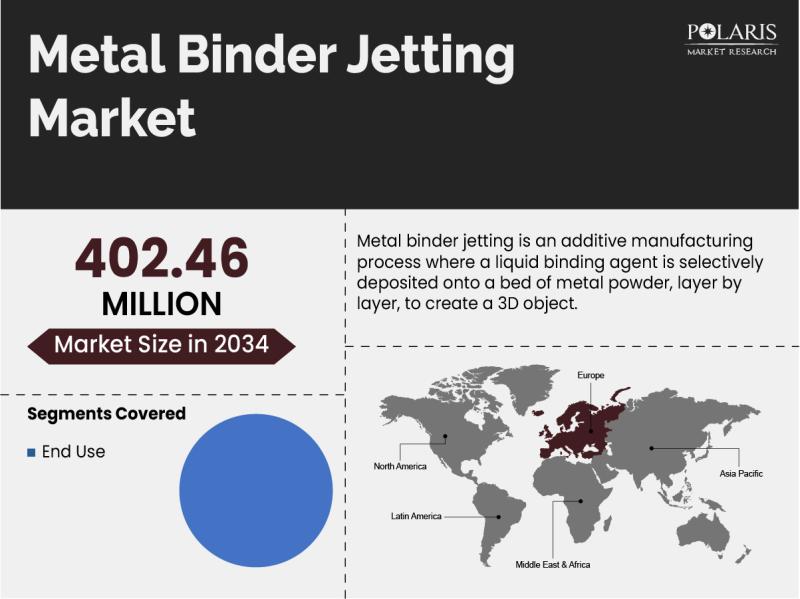

Metal Binder Jetting Market Growth Projected at 10.6% CAGR, Reaching USD 402.46 …

Global Metal Binder Jetting Market is currently valued at USD 147.51 Million in 2024 and is anticipated to generate an estimated revenue of USD 402.46 Million by 2034, according to the latest study by Polaris Market Research. Besides, the report notes that the market exhibits a robust 10.6% Compound Annual Growth Rate (CAGR) over the forecasted timeframe, 2025 - 2034.

Polaris Market Research recently introduced the latest update on Metal Binder…

Rigid Food Packaging Market to Reach USD 354.25 Billion by 2034, Growing at a CA …

The quantitative market research report published by Polaris Market Research on Rigid Food Packaging Market aims to educate users with an in-depth understanding of a rapidly growing market. The study details important facts and figures, expert opinions, and major developments across the globe. The research study serves as a vital source of information with the historical data, Rigid Food Packaging Market size, financial data, and projected future growth. All the…

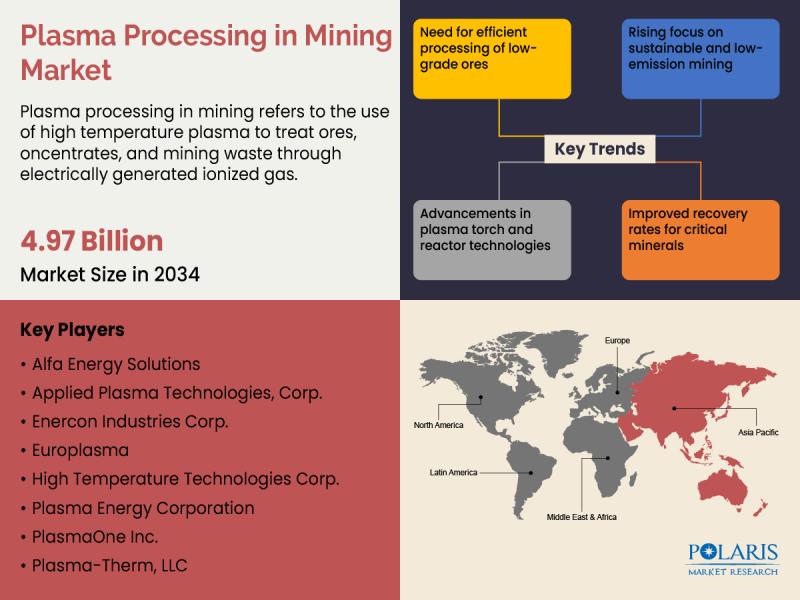

Global Plasma Processing in Mining Market to Reach USD 4.97 Billion by 2034, Reg …

Market Size and Share:

The global plasma processing in mining market is estimated to reach approximately USD 2.62 billion in 2025 and is expected to experience steady growth from 2026 to 2034, expanding at a projected CAGR of 7.4% during the forecast period.

Polaris Market Research has introduced the latest market research report titled Plasma Processing in Mining Market that highlights the major revenue stream for the forecast period. The report contains…

More Releases for Lending

Mortgage Lending Market : Increased focus toward digitalizing lending process

According to the report published by Allied Market Research, the global mortgage lending market generated $11.48 billion in 2021, and is estimated to reach $27.50 billion by 2031, witnessing a CAGR of 9.5% from 2022 to 2031. The report offers a detailed analysis of changing market trends, top segments, value chain, key investment pockets, competitive scenario, and regional landscape. The report is a vital for leading market players, investors, new…

P2p Lending Market | Industry Overview 2021 | Worldwide Companies- CircleBack Le …

P2p Lending Market report will provide one with overall market analysis, statistics, various trends, drivers, opportunities, restraints, and every minute data relating to the Synthetic Fibers market necessary for forecasting its revenue, factors propelling & growth. The P2p Lending market study provides unique guidance in thoughtful details regarding the development factors and has used a top-down and bottom-up approach to keep it error-free and accurate. Our expert analysts have used…

Peer-to-peer Lending – Growing Popularity and Emerging Trends in the Market | …

Global Peer-to-peer Lending Market Size, Status and Forecast 2018-2025 is latest research study released by HTF MI evaluating the market, highlighting opportunities, risk side analysis, and leveraged with strategic and tactical decision-making support. The study provides information on market trends and development, drivers, capacities, technologies, and on the changing investment structure of the Global Peer-to-peer Lending Market. Some of the key players profiled in the study are CircleBack Lending, Lending…

Alternative Lending Market Is Booming Worldwide | Lending Club, Prosper, Upstart …

The ‘ Alternative Lending market’ research report added by Report Ocean, is an in-depth analysis of the latest developments, market size, status, upcoming technologies, industry drivers, challenges, regulatory policies, with key company profiles and strategies of players. The research study provides market overview, Alternative Lending market definition, regional market opportunity, sales and revenue by region, manufacturing cost analysis, Industrial Chain, market effect factors analysis, Alternative Lending market size forecast, market…

P2P Lending Market is Thriving Worldwide | CircleBack Lending, Lending Club, Pee …

Global P2P Lending Market Size, Status and Forecast 2025 is latest research study released by HTF MI evaluating the market, highlighting opportunities, risk side analysis, and leveraged with strategic and tactical decision-making support. The study provides information on market trends and development, drivers, capacities, technologies, and on the changing investment structure of the Global P2P Lending Market. Some of the key players profiled in the study are CircleBack Lending, Lending…

Canada Peer-to-peer Lending Market 2018-2022 Overview by CircleBack Lending, Len …

with the slowdown in world economic growth, the Peer-to-peer Lending industry has also suffered a certain impact, but still maintained a relatively optimistic growth, the past four years, Peer-to-peer Lending market size to maintain the average annual growth rate of 2.94% from 22 million $ in 2014 to 24 million $ in 2017, Research analysts believe that in the next few years, Peer-to-peer Lending market size will be further expanded,…