Press release

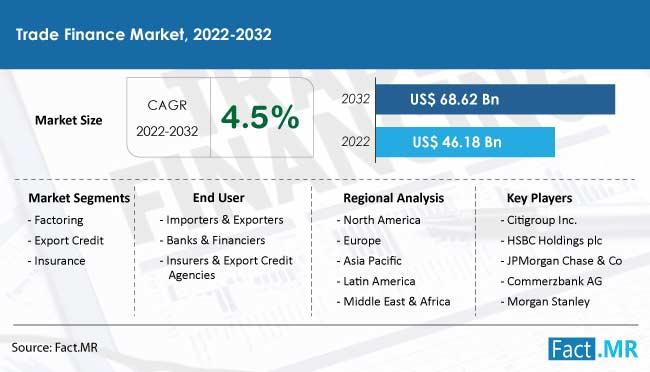

Trade Finance Market is projected to evolve at a CAGR of 4.5% to reach a valuation of US$ 68.62 billion by 2032

The global trade finance market is valued at around US$ 46.18 billion in 2022 and is projected to evolve at a CAGR of 4.5% to reach a market valuation of US$ 68.62 billion by the end of 2032.The Trade Finance Industry sales study offers a comprehensive analysis on diverse features including production capacities, Trade Finance demand, product developments, sales revenue generation and Trade Finance market outlook across the globe.

market research report by Fact.MR, (Leading business and competitive intelligence provider) on global Trade Finance market sales initiates with an outlook of the market, followed by the scrutiny of the demand and consumption volumes and share and size of various end-use segments

𝐃𝐨𝐰𝐧𝐥𝐨𝐚𝐝 𝐒𝐚𝐦𝐩𝐥𝐞 𝐂𝐨𝐩𝐲 𝐨𝐟 𝐓𝐡𝐢𝐬 𝐑𝐞𝐩𝐨𝐫𝐭:

https://www.factmr.com/connectus/sample?flag=S&rep_id=400

The readability score of the Trade Finance market demand report is good as it offers chapter-wise layout with each section divided into a smaller sections.

The report encompasses graphs and tables to show the entire assembling. Pictorial demonstration of the definite and estimated values of key segments is visually appealing to readers.

This Trade Finance market outlook report explicates on vital dynamics such as the drivers, restraints and opportunities for key players and competitive analysis of Trade Finance along with key stakeholders as well as emerging players associated with the manufacturing of product.

The Key trends Analysis of Extended Trade Finance market also provides dynamics that are responsible for influencing the future sales and demand of over the forecast period

𝐆𝐫𝐨𝐰𝐭𝐡 𝐓𝐫𝐞𝐧𝐝𝐬:

Recent years have seen notable growth patterns in the trade finance industry, fueled by a number of causes including globalization, technology improvements, and the growing complexity of cross-border trade transactions.

The use of digital technologies in trade finance procedures is one prominent development. Trade finance has historically relied mostly on manual, paper-based documentation that was labor-intensive and prone to mistakes. However, the business has undergone a transformation thanks to the introduction of technologies like blockchain, artificial intelligence, and cloud computing. Trade finance transactions may now be processed more quickly, with more transparency and better risk management thanks to these technology. In order to simplify their trade finance operations, a large number of financial institutions and businesses are investing in digital solutions.

The increasing need for alternate funding solutions is another significant development. Particularly small and medium-sized businesses (SMEs) sometimes encounter difficulties obtaining conventional trade finance sources like bank guarantees and letters of credit. Peer-to-peer lending platforms and fintech companies are examples of alternative finance providers that have sprung up to fill the need. A wider spectrum of enterprises can now access trade finance because to the increased flexibility and accessibility provided by these alternative financing options.

In addition, trade finance is placing an increasing amount of focus on ethical and sustainable practices. Demand for sustainable trade finance solutions is rising as environmental, social, and governance (ESG) factors gain traction with investors and enterprises. This covers programs like ethical supply chain financing, which encourages fair labor practices and human rights compliance throughout the supply chain, and green trade finance, which supports ecologically beneficial trade activities. In order to satisfy the changing demands of its stakeholders and clients, financial institutions are progressively adding ESG criteria to their trade finance products.

Furthermore, changes in regulations and geopolitical situations continue to influence the trade finance landscape. Major economies' trade conflicts, like those between the US and China, have disrupted global trade flows and raised market volatility for trade financing. Regulating changes, such the Basel III framework's adoption, have forced financial institutions to review their capital needs and risk management procedures for trade financing operations.

In general, the trade finance industry is going through a period of change brought about by advances in technology, shifting consumer demands, and shifting regulatory landscapes. The trade finance sector is expected to grow and innovate further as companies look for more effective ways to handle trade-related risks and financing requirements, as well as expand their worldwide operations.

𝐊𝐞𝐲 𝐂𝐨𝐦𝐩𝐚𝐧𝐢𝐞𝐬 𝐏𝐫𝐨𝐟𝐢𝐥𝐞𝐝

• Citigroup Inc.

• HSBC Holdings plc

• JPMorgan Chase & Co

• Commerzbank AG

• Morgan Stanley

• Mitsubishi Corporation

• ANZ Bank

• NewMarket Latin America Inc.

• Banco Santander S.A

• SunTrust Bank Holding Company

• UniCredit S.p.A

• Wells Fargo & Company

𝐂𝐨𝐦𝐩𝐞𝐭𝐢𝐭𝐢𝐯𝐞 𝐀𝐧𝐚𝐥𝐲𝐬𝐢𝐬:

Trade finance providers are engaging in key associations and joint ventures coupled with introducing differentiated items to up their game within the market.

The market is exceedingly competitive, with major banks leading the landscape. Banks are focusing on changing their industry from a paper-based framework to a more efficient digitized model with reliable services.

For instance :

• Citigroup Inc. allows access to advanced specialized products and availability of finance while concentrating on financial statement efficiency targets through the advancement and a solid reputation in technology-driven strategies.

𝐊𝐞𝐲 𝐒𝐞𝐠𝐦𝐞𝐧𝐭𝐬 𝐂𝐨𝐯𝐞𝐫𝐞𝐝 𝐢𝐧 𝐓𝐫𝐚𝐝𝐞 𝐅𝐢𝐧𝐚𝐧𝐜𝐞 𝐈𝐧𝐝𝐮𝐬𝐭𝐫𝐲 𝐑𝐞𝐬𝐞𝐚𝐫𝐜𝐡

• Trade Finance Market by Trade Activity :

o Factoring

o Export Credit

o Insurance

o Other Activities

• Trade Finance Market by Transaction :

o Domestic Only

o International Only

• Trade Finance Market by End User :

o Importers & Exporters

o Banks & Financiers

o Insurers & Export Credit Agencies

o Other Service Providers

• Trade Finance Market by Region :

o North America

o Europe

o Asia Pacific

o Latin America

o Middle East & Africa

𝐑𝐞𝐚𝐝 𝐌𝐨𝐫𝐞: https://www.factmr.com/report/400/trade-finance-market

𝐂𝐨𝐧𝐭𝐚𝐜𝐭:

US Sales Office :

11140 Rockville Pike

Suite 400

Rockville, MD 20852

United States

Tel: +1 (628) 251-1583

E-Mail: sales@factmr.com

𝐀𝐛𝐨𝐮𝐭 𝐅𝐚𝐜𝐭.𝐌𝐑

We are a trusted research partner of 80% of fortune 1000 companies across the globe. We are consistently growing in the field of market research with more than 1000 reports published every year. The dedicated team of 400-plus analysts and consultants is committed to achieving the utmost level of our client's satisfaction.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Trade Finance Market is projected to evolve at a CAGR of 4.5% to reach a valuation of US$ 68.62 billion by 2032 here

News-ID: 3459670 • Views: …

More Releases from Fact.MR

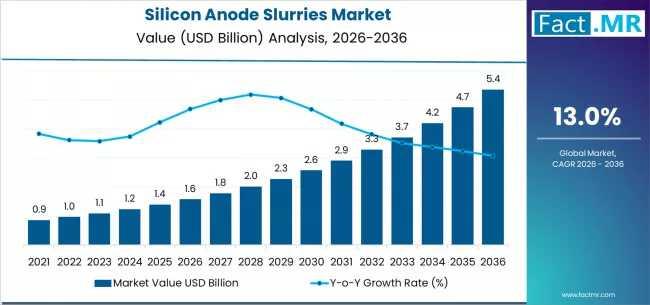

Silicon Anode Slurries Market Forecast 2026-2036: Market Size, Share, Competitiv …

The global silicon anode slurries market is set for significant expansion between 2026 and 2036, fueled by the rising adoption of high-energy-density lithium-ion batteries across electric vehicles (EVs), consumer electronics, and grid-scale energy storage. As battery manufacturers increasingly transition from graphite to silicon-enhanced anodes, the demand for high-performance, scalable silicon anode slurries is projected to grow sharply.

To access the complete data tables and in-depth insights, request a Discount On The…

Silicon Anode Slurries Market Forecast 2026-2036: Market Size, Share, Competitiv …

The global silicon anode slurries market is set for significant expansion between 2026 and 2036, fueled by the rising adoption of high-energy-density lithium-ion batteries across electric vehicles (EVs), consumer electronics, and grid-scale energy storage. As battery manufacturers increasingly transition from graphite to silicon-enhanced anodes, the demand for high-performance, scalable silicon anode slurries is projected to grow sharply.

To access the complete data tables and in-depth insights, request a Discount On The…

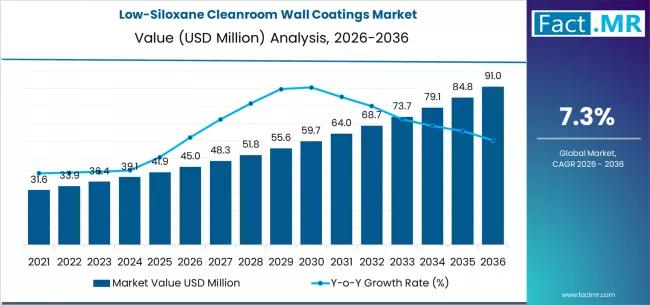

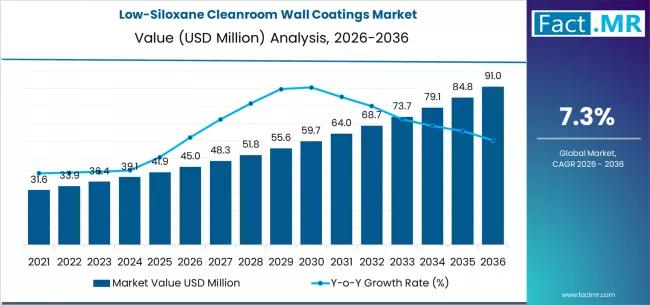

Low-Siloxane Cleanroom Wall Coatings Market Deep-Dive 2026-2036: Strategic Forec …

The low-siloxane cleanroom wall coatings market is poised for steady growth over the next decade, driven by rising contamination-control requirements across semiconductor, pharmaceutical, biotechnology, and precision manufacturing industries. These coatings are specifically engineered to minimize siloxane outgassing and volatile organic compound emissions, helping maintain ultra-clean environments where even trace contamination can disrupt production quality.

By 2036, the market for low-siloxane cleanroom wall coatings is expected to grow to USD 91.04 million.…

Low-Siloxane Cleanroom Wall Coatings Market Deep-Dive 2026-2036: Strategic Forec …

The low-siloxane cleanroom wall coatings market is poised for steady growth over the next decade, driven by rising contamination-control requirements across semiconductor, pharmaceutical, biotechnology, and precision manufacturing industries. These coatings are specifically engineered to minimize siloxane outgassing and volatile organic compound emissions, helping maintain ultra-clean environments where even trace contamination can disrupt production quality.

By 2036, the market for low-siloxane cleanroom wall coatings is expected to grow to USD 91.04 million.…

More Releases for Trade

Trade Intelligence for Global Trade: Benchmarking Competitors with Verified Trad …

In the modern supply chain battlefield, knowledge is not just power-it's leverage. Understanding how your competitors move in the global trade space can make the difference between a strategic win and a costly misstep. Yet, many companies still rely on fragmented or outdated information, missing out on key shifts that trade intelligence platforms can now uncover easily.

The Blind Spot in Traditional Competitive Research

Traditional competitor analysis typically relies on market reports,…

Decoding Chongqing's Cross-Border Trade through the Yumaotong Smart Trade Platfo …

Since its launch on May 13, the New Western International Land - Sea Corridor - Yumaotong Smart Trade Platform (hereinafter referred to as the 'Yumaotong Smart Trade Platform') has welcomed 420 enterprises, including over 100 foreign companies. At the 7th Western China International Fair held in Chongqing on May 22, Deng Ai, head of the platform, said that it offered global businesses a one-stop, full-chain, professional service from capturing trade…

Trade Show Displays: Maximizing Your Trade Show Booth Design

Trade shows are a critical aspect of any business that wants to showcase its products, services, and brand to potential customers, partners, and investors. Trade show displays are one of the most crucial elements in trade show marketing, and they play a significant role in determining the success of a company's presence at a trade show. In this article, we'll explore the different types of displays for trade shows and…

The future of international trade and worldwide network: Global Trade Plaza

The future of international trade and worldwide network: Global Trade Plaza

A radical change to support continuous growth in supply traffic.

Connecting all manufacturers, suppliers, traders, exporters, and importers.

Open the door to the future of safe international trade.

B2B marketplace Global Trade Plaza wants to redefine the supply chain. The growth due to digitalization has touched multiple fields, but couldn't do much for the intercountry supply. We are here with…

US-China trade war shifting cement seaborne trade flows

In 2018, the total number of active cement carriers surpassed 360 units, with the total dead weight tonnage topping 2.7 million, the highest figure recorded since 2010.

According to CW Research’s 2019 update of the World Cement, Clinker & Slag Sea-Based Trade Report, the upward trend was underpinned by a growing demand for cement carriers in key domestic trade markets.

Specialized cement carriers move about 25 million tons of cement per…

Suisse Trade – Holding Trade Seminar in Tokyo in December 2016

Suisse Trade is a full-fledged Forex trading firm that is renowned worldwide for rendering clients with the best assistance in commodity and Forex based trading. The company has been consistently successful in presenting clients with the most formidable instruments to trade in currency and commodities markets. The tasks undertaken by the company also involve spot and cash trades, limited risk options on futures as well as contracts. It has always…