Press release

FinTech Blockchain Market Driven by Tech Integration and Innovation

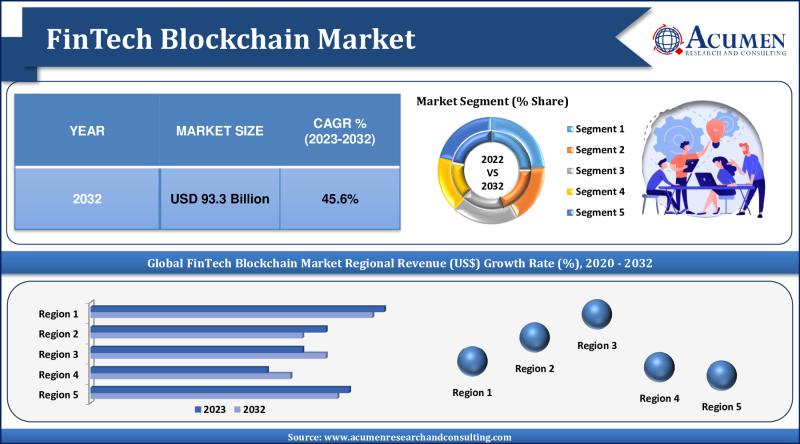

Key Points and Statistics on the FinTech Blockchain Market:● The global FinTech Blockchain market size is projected to reach USD 93.3 Billion by 2032, growing at a CAGR of 45.6% from 2023 to 2032.

● North America led the market with over 43% share in 2022, while the Asia-Pacific market is expected to record a CAGR of around 47% from 2023 to 2032.

● The banking segment held the highest revenue share of 52% in 2022.

● SMEs are expected to grow remarkably, at a CAGR of 46.3% over the forecast period.

● Key drivers include the increasing demand for digital transactions and the growing adoption of DeFi solutions.

Download Sample Report Copy of This Report from Here: https://www.acumenresearchandconsulting.com/request-sample/3447

FinTech Blockchain Market Overview and Analysis:

FinTech Blockchain, a synergy of financial technology and blockchain, is redefining the financial industry. It offers a secure, transparent, and efficient way to conduct financial transactions, eliminating the need for intermediaries and reducing transaction times and costs. The market is innovating continuously, with advancements in blockchain applications for payments, smart contracts, and identity management. However, the market's growth may be hindered by regulatory uncertainties and security concerns related to blockchain technology. Despite these challenges, FinTech Blockchain is becoming an indispensable tool in modern financial practices, offering numerous benefits and facing certain hurdles. The market is expected to witness significant growth in the coming years, driven by technological advancements and increasing demand for secure and efficient financial services.

Latest FinTech Blockchain Market Trends and Innovations

The FinTech blockchain market is constantly evolving, with new trends and innovations emerging all the time. Some of the latest trends and innovations in the market include:

● Increasing integration of artificial intelligence (AI) and machine learning (ML) in FinTech. AI and ML are being used to automate tasks, improve decision-making, and detect fraud. For example, AI-powered chatbots can be used to provide customer service, while ML can be used to identify fraudulent transactions.

● Expansion of blockchain in trade finance and supply chain management. Blockchain is being used to create more efficient and secure trade finance and supply chain management processes. For example, blockchain can be used to track the movement of goods, verify the authenticity of documents, and settle payments.

● Integration of the Internet of Things (IoT) with blockchain for enhanced security. IoT devices are increasingly being used in financial services, and blockchain can be used to secure these devices and the data they collect. For example, blockchain can be used to create a tamper-proof record of IoT device activity, which can help to protect against fraud and cyberattacks.

Major Growth Drivers of the FinTech Blockchain Market

The FinTech blockchain market is being driven by a number of factors, including:

● Rising demand for digital payments and transactions. Consumers are increasingly using digital payments, and blockchain can be used to facilitate these payments in a secure and efficient manner.

● Growing adoption of decentralized finance (DeFi) solutions. DeFi is a new financial system that is built on blockchain technology, and it is gaining in popularity due to its potential to provide more efficient and transparent financial services.

● Investments in blockchain technology by financial institutions. Financial institutions are increasingly investing in blockchain technology, as they see the potential for blockchain to improve their operations and reduce costs.

Key Challenges Facing the FinTech Blockchain Industry

The FinTech blockchain industry is facing a number of challenges, including:

● Regulatory uncertainties and compliance challenges. The regulatory environment for blockchain is still evolving, and financial institutions are facing challenges in understanding and complying with the relevant regulations.

● Security concerns related to blockchain technology. Blockchain is a relatively new technology, and there are still some security concerns that need to be addressed. For example, blockchain can be vulnerable to cyberattacks, and it is important to ensure that blockchain-based systems are secure.

Despite these challenges, the FinTech blockchain market is expected to continue to grow in the coming years. The market is expected to reach a value of $23.3 billion by 2026, and blockchain is expected to play an increasingly important role in the financial services industry.

Market Segmentation Insights:

Based on Provider:

● Middleware Providers

● Infrastructure and Protocol Providers

● Application and Solution Providers

Based on Application:

● Payments, Clearing, and Settlement

● Smart Contract

● Exchanges and Remittance

● Compliance Management/KYC

● Identity Management

Based on Organization Size:

● Large Enterprises

● SMEs

Based on Verticals:

● Banking

● Insurance

● Non-Banking Financial Services

Overview by Region of the FinTech Blockchain Market:

North America dominates the market, thanks to its advanced financial infrastructure and technological adoption. However, significant growth potential lies in the Asia-Pacific region, driven by rapid technological advancements and increasing adoption of FinTech solutions.

FinTech Blockchain Market Table of Content:

CHAPTER 1. Industry Overview of FinTech Blockchain Market

CHAPTER 2. Research Approach

CHAPTER 3. Market Dynamics And Competition Analysis

CHAPTER 4. Manufacturing Plant Analysis

CHAPTER 5. FinTech Blockchain Market By Provider

CHAPTER 6. FinTech Blockchain Market By Application

CHAPTER 7. FinTech Blockchain Market By Organization Size

CHAPTER 8. FinTech Blockchain Market By Verticals

CHAPTER 9. North America FinTech Blockchain Market By Country

CHAPTER 10. Europe FinTech Blockchain Market By Country

CHAPTER 11. Asia Pacific FinTech Blockchain Market By Country

CHAPTER 12. Latin America FinTech Blockchain Market By Country

CHAPTER 13. Middle East & Africa FinTech Blockchain Market By Country

CHAPTER 14. Player Analysis Of FinTech Blockchain Market

CHAPTER 15. Company Profile

List of Key Players in the Global Market:

The prominent players include AlphaPoint Corporation, Oracle Corporation, Bitfury Group Limited, Digital Asset Holdings LLC, Amazon Web Services, Inc., Circle Internet Financial Limited, Cambridge Blockchain, LLC, Earthport Plc, IBM Corporation, Factom, Inc., and Microsoft Corporation.

Ask Query Here: Richard@acumenresearchandconsulting.com or sales@acumenresearchandconsulting.com

To Purchase this Premium Report@ https://www.acumenresearchandconsulting.com/buy-now/0/3447

Browse for more Related Reports

https://reserchindustries.blogspot.com/2024/04/business-process-outsourcing-market.html

201, Vaidehi-Saaket, Baner - Pashan Link Rd, Pashan, Pune, Maharashtra 411021

Acumen Research and Consulting (ARC) is a global provider of market intelligence and consulting services to information technology, investment, telecommunication, manufacturing, and consumer technology markets. ARC helps investment communities, IT professionals, and business executives to make fact based decisions on technology purchases and develop firm growth strategies to sustain market competition. With the team size of 100+ Analysts and collective industry experience of more than 200 years, Acumen Research and Consulting assures to deliver a combination of industry knowledge along with global and country level expertise.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release FinTech Blockchain Market Driven by Tech Integration and Innovation here

News-ID: 3455186 • Views: …

More Releases from Acumen Research and Consulting

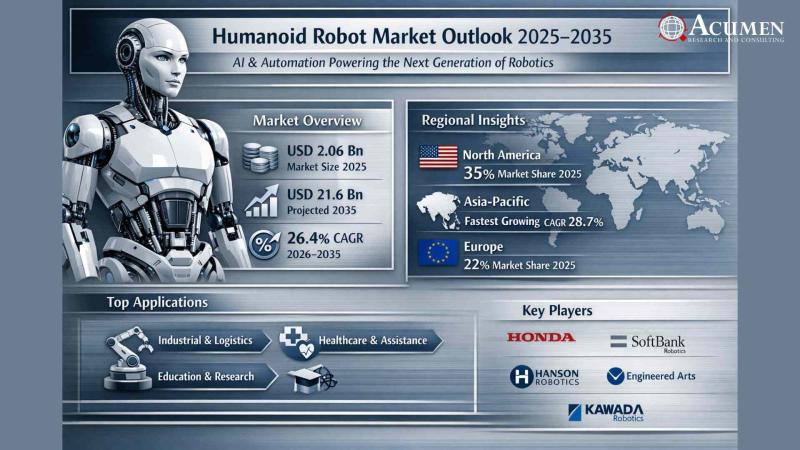

Humanoid Robot Market to Reach USD 21.6 Billion by 2035 | AI & Automation Drive …

Humanoid Robot Market to Surpass USD 21.6 Billion by 2035: AI-Driven Automation Unlocks a New Era of Human-Machine Collaboration

The Humanoid Robot Market is undergoing a transformative boom, reflecting a seismic shift in how industries leverage robotics, artificial intelligence (AI), and automation to meet the growing demands of a rapidly evolving global economy.

According to Acumen Research and Consulting, the global Humanoid Robot Market is projected to grow from USD 2,060.4 million…

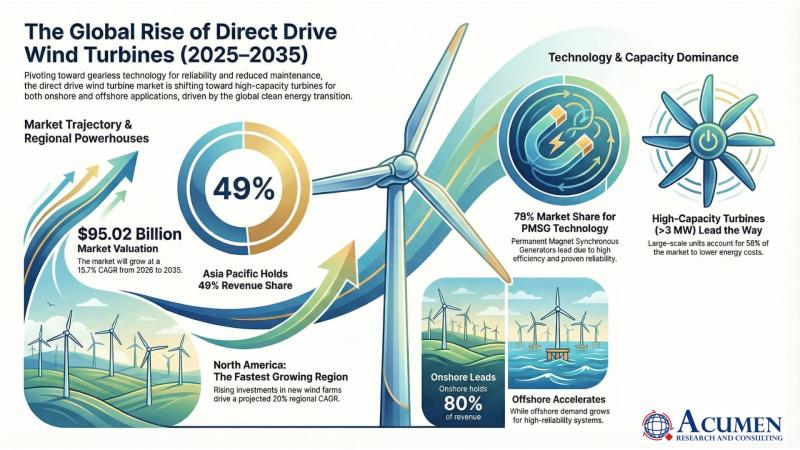

Direct Drive Wind Turbine Market to Reach USD 95.02 Billion by 2035 | Acumen Res …

Direct Drive Wind Turbine Market to Reach USD 95.02 Billion by 2035, Driven by Global Renewable Expansion and Offshore Innovation | Acumen Research and Consulting

The Direct Drive Wind Turbine Market is witnessing unprecedented growth momentum as the global renewable energy transition accelerates. According to a new report by Acumen Research and Consulting, the global Direct Drive Wind Turbine Market size is projected to grow from USD 21.91 billion in 2025…

Physical AI Market Set to Surge to USD 83,642.5 Million by 2035 - Groundbreaking …

Global Physical AI Market Report 2026-2035: Robust Growth, Transformational Trends, and Unmatched Opportunities

The Physical AI Market is on the brink of remarkable expansion with groundbreaking advancements in artificial intelligence systems that interact intelligently with the physical world. According to a new market study by Acumen Research and Consulting, the global physical AI market is projected to grow from USD 3,137.5 Million in 2025 to USD 83,642.5 Million by 2035, exhibiting…

Semiconductor Packaging Market to Double from USD 44.21 Billion in 2024 to USD 1 …

Acumen Research And Consulting announces the release of its latest industry report highlighting the robust growth of the Semiconductor Packaging Market. The report reveals that the global market, valued at USD 44.21 billion in 2024, is projected to reach USD 104.76 billion by 2033, expanding at a steady Compound Annual Growth Rate (CAGR) of 10.1% between 2025 and 2033. This rapid growth underscores the increasing importance of packaging innovations in…

More Releases for FinTech

EMBank Reinforces Fintech Leadership at Baltic Fintech Days 2025

As fintech innovation accelerates across Europe, Vilnius once again positioned itself as a central hub for forward-thinking financial dialogue during Baltic Fintech Days 2025. Held over two impactful days, the conference attracted over 1,000 stakeholders, bringing together startup leaders, financial institutions, regulators, and technology innovators from across the Baltics and beyond.

The event's agenda was shaped by more than 60 expert speakers who addressed emerging topics such as AI-powered banking, embedded…

Seoul Fintech Lab Accelerates Global Expansion with Participation in Singapore F …

Image: https://www.getnews.info/uploads/5b520c858c856e54cadb7d57558b7209.jpg

Seoul Fintech Lab successfully participated in the Singapore Fintech Festival from November 6 to 8, 2024. The event was organized to promote overseas investment and market entry for its resident, membership, and graduate companies, with a particular focus on Seoul-based fintech companies established within the last seven years.

A total of 10 companies participated in the event. The five resident companies were Antok, Whatssub, Ipxhop, MerakiPlace, and Korea Securities Lending,…

Seoul Fintech Lab and 2nd Seoul Fintech Lab Successfully Participate in Korea Fi …

Seoul Fintech Lab and 2nd Seoul Fintech Lab achieved great success by showcasing innovative solutions from 22 resident companies, attracting approximately 1,000 visitors to their booth during Korea Fintech Week 2024.

Image: https://www.getnews.info/uploads/e73eea3a5c8a6a46e5b43375b2a156be.jpg

Seoul Fintech Lab and the 2nd Seoul Fintech Lab jointly participated in the 'Korea Fintech Week 2024,' held at Dongdaemun Design Plaza (DDP) in Seoul, South Korea, from August 27 to 29. The event was a huge success, with…

FinTech in Insurance

The market for "FinTech in Insurance Market" is examined in this report, along with the factors that are expected to drive and restrain demand over the projected period.

Introduction to FinTech in Insurance Market Insights

The futuristic approach to gathering insights in the FinTech in Insurance sector integrates advanced technologies such as artificial intelligence, big data analytics, and blockchain. These tools enhance data collection from diverse sources, enabling insurers to gain deeper,…

BW Festival Of Fintech: A Comprehensive Fintech Colloquy

Business World’s Festival of Fintech is a two-day informative summit that will inform, illustrate and recognize the changes in the dynamic Fintech industry.

Business World brings forth Festival of Fintech, an exclusive conclave on Fintech innovation and growth on the 12th and 13th of February, 2021. The event will include expert panels and an industry award ceremony that recognizes excellence in all the ambits of the Fintech field.

The…

Bouchard Fintech

Information provided by Bouchard Fintech

The US, at least this current administration, has mystified its European Union business and political partners. The EU represents one of the very largest economies on the planet. The EU is also very much a trusted ally of the US. The EU market continues to be a fertile ground for US exports. So, it was quite a surprise that the US seemed to be picking a…