Press release

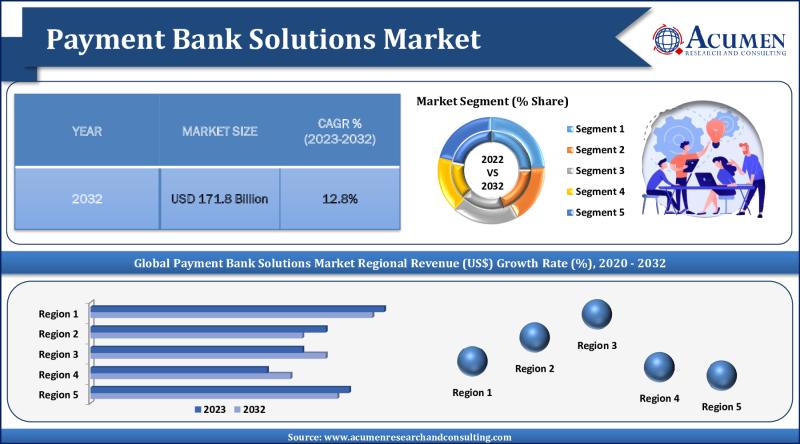

Payment Bank Solutions Market Soars: Projected to Hit USD 171.8 Billion by 2032

Key Points and Statistics on the Payment Bank Solutions Market:● The global payment bank solutions market size is projected to expand to USD 171.8 Billion by 2032, growing at a CAGR of 12.8% from 2023 to 2032.

● In 2022, the software segment contributed the largest revenue share of 66%.

● The retail segment captured the largest market share of 34% in 2022.

● North America led the market with over 38% share in 2022, while the Asia-Pacific region is expected to record a CAGR of more than 13.4% from 2023 to 2032.

● Key players in the market include EdgeVerve Systems, Comviva, MasterCard Incorporated, IBM, Gemalto (Thales Group), BPC, ACI Worldwide, Authorize.net, and Adyen N.V.

Download Sample Report Copy of This Report from Here: https://www.acumenresearchandconsulting.com/request-sample/3421

Payment Bank Solutions Market Overview and Analysis:

Payment bank solutions, once a niche concept, are now pivotal in transforming the financial landscape. As businesses and consumers increasingly adopt digital payment methods, this market is experiencing rapid growth. The Payment Bank Solutions Market is committed to providing solutions that enhance the security, convenience, and efficiency of financial transactions across various sectors. The market is constantly innovating to improve transaction security, user experience, and adaptability of payment bank solutions. However, market growth may be hindered by challenges such as security concerns, limited digital literacy in certain regions, and regulatory compliance issues. In essence, payment bank solutions are becoming an indispensable tool in modern financial practices, offering numerous benefits but also facing certain challenges. The market is expected to grow significantly in the coming years, driven by technological advancements and increasing demand for digital payment solutions.

Latest Payment Bank Solutions Market Trends and Innovations

Advancements in technologies are leading to more secure and user-friendly payment solutions. For example, the use of biometrics, such as facial recognition and fingerprint scanning, is becoming increasingly common for authentication purposes. This helps to reduce the risk of fraud and unauthorized access to accounts. Additionally, the development of mobile payment applications and digital wallets is making it easier for consumers to make payments on the go. These solutions are often more convenient and secure than traditional methods, such as cash or checks.

The retail sector is a major user of payment bank solutions. In recent years, there has been a growing trend towards the adoption of mobile payment applications and digital wallets by retailers. This is due to the convenience and security benefits that these solutions offer. For example, mobile payment applications allow consumers to make payments without having to carry cash or credit cards. Digital wallets also provide a secure way to store payment information, which can be used to make purchases online or in-store.

The integration of artificial intelligence (AI) and machine learning (ML) in payment software is enhancing fraud detection and personalized user experiences. AI and ML algorithms can be used to analyze large amounts of data to identify potential fraud patterns. This information can then be used to develop more effective fraud prevention measures. Additionally, AI and ML can be used to personalize user experiences by providing tailored recommendations and offers.

Continuous research and development are leading to the introduction of innovative payment solutions, such as contactless payments and real-time settlement systems. Contactless payments allow consumers to make payments by simply tapping their card or device against a reader. This is a more convenient and secure way to make payments, as it eliminates the need to enter a PIN number. Real-time settlement systems allow payments to be processed instantly, which can improve cash flow and reduce transaction costs.

Major Growth Drivers of the Payment Bank Solutions Market

Increasing internet and smartphone penetration is a major growth driver for the payment bank solutions market. As more consumers have access to the internet and smartphones, they are increasingly using these devices to make payments. This trend is being driven by the growing popularity of e-commerce and mobile commerce.

Government initiatives promoting digital payments and financial inclusion efforts in developing economies are also contributing to market growth. Governments in many developing countries are looking to promote digital payments as a way to reduce the cost of cash transactions and increase financial inclusion. This is driving demand for payment bank solutions that are affordable and easy to use.

The growing e-commerce industry is also driving the demand for secure and efficient online payment solutions. As e-commerce sales continue to grow, businesses need to provide their customers with secure and convenient ways to pay for their purchases. This is creating demand for payment bank solutions that offer a variety of payment options, such as credit cards, debit cards, and digital wallets.

Key Challenges Facing the Payment Bank Solutions Industry

Security concerns and cyber threats pose significant challenges for the payment bank solutions industry. Consumers are increasingly concerned about the security of their personal information and financial data. This concern is being driven by a number of high-profile data breaches that have resulted in the loss of personal information. Payment bank solutions providers need to address these concerns by implementing strong security measures to protect consumer data.

Limited digital literacy in certain regions can hinder the adoption of advanced payment solutions. In some developing countries, there is a lack of awareness of digital payments and a lack of skills needed to use these solutions. This can hinder the adoption of payment bank solutions in these regions.

Regulatory challenges and compliance issues can also affect market expansion and innovation. Payment bank solutions providers need to comply with a variety of regulations, which can be complex and costly. Additionally, new regulations are constantly being introduced, which can make it difficult for payment bank solutions providers to keep up.

Market Segmentation Insights:

Based on Type:

● Hardware

○ Forex Cards

○ Debit Cards

○ ATM Cards

● Software

○ Mobile Apps

○ Platforms

Based on End-User:

● Government

● Retail

● Healthcare

● BFSI

● Others

Overview by Region of the Payment Bank Solutions Market:

North America dominates the market, thanks to its advanced technological infrastructure and high internet penetration rates.

The Asia-Pacific region is witnessing rapid growth, driven by increasing digital adoption and government initiatives promoting digital payments.

Payment Bank Solutions Market Table of Content:

CHAPTER 1. Industry Overview of Payment Bank Solutions Market

CHAPTER 2. Research Approach

CHAPTER 3. Market Dynamics And Competition Analysis

CHAPTER 4. Manufacturing Plant Analysis

CHAPTER 5. Payment Bank Solutions Market By Type

CHAPTER 6. Payment Bank Solutions Market By End User

CHAPTER 7. North America Payment Bank Solutions Market By Country

CHAPTER 8. Europe Payment Bank Solutions Market By Country

CHAPTER 9. Asia Pacific Payment Bank Solutions Market By Country

CHAPTER 10. Latin America Payment Bank Solutions Market By Country

CHAPTER 11. Middle East & Africa Payment Bank Solutions Market By Country

CHAPTER 12. Player Analysis Of Payment Bank Solutions Market

CHAPTER 13. Company Profile

List of Key Players in the Global Market:

The key companies include EdgeVerve Systems, Comviva, MasterCard Incorporated, IBM, Gemalto (Thales Group), BPC, ACI Worldwide, Authorize.net, and Adyen N.V.

Ask Query Here: Richard@acumenresearchandconsulting.com or sales@acumenresearchandconsulting.com

To Purchase this Premium Report@ https://www.acumenresearchandconsulting.com/buy-now/0/3421

Browse for more Related Reports

https://reserchindustries.blogspot.com/2024/03/inkjet-printers-market-size-trends-and.html

201, Vaidehi-Saaket, Baner - Pashan Link Rd, Pashan, Pune, Maharashtra 411021

Acumen Research and Consulting (ARC) is a global provider of market intelligence and consulting services to information technology, investment, telecommunication, manufacturing, and consumer technology markets. ARC helps investment communities, IT professionals, and business executives to make fact based decisions on technology purchases and develop firm growth strategies to sustain market competition. With the team size of 100+ Analysts and collective industry experience of more than 200 years, Acumen Research and Consulting assures to deliver a combination of industry knowledge along with global and country level expertise.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Payment Bank Solutions Market Soars: Projected to Hit USD 171.8 Billion by 2032 here

News-ID: 3450090 • Views: …

More Releases from Acumen Research and Consulting

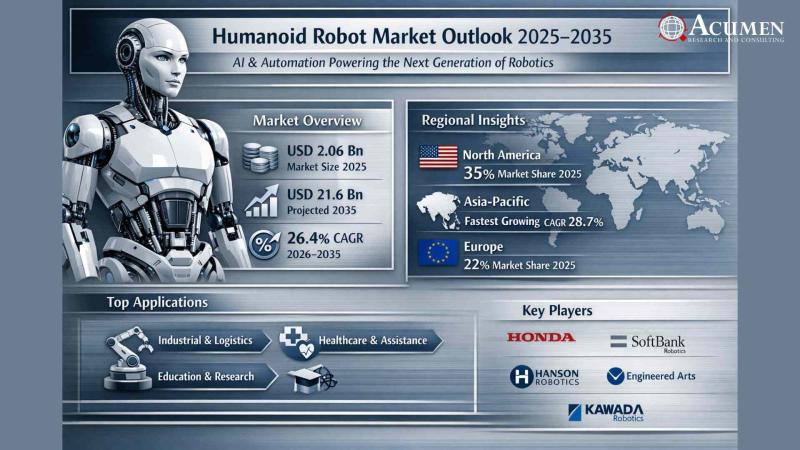

Humanoid Robot Market to Reach USD 21.6 Billion by 2035 | AI & Automation Drive …

Humanoid Robot Market to Surpass USD 21.6 Billion by 2035: AI-Driven Automation Unlocks a New Era of Human-Machine Collaboration

The Humanoid Robot Market is undergoing a transformative boom, reflecting a seismic shift in how industries leverage robotics, artificial intelligence (AI), and automation to meet the growing demands of a rapidly evolving global economy.

According to Acumen Research and Consulting, the global Humanoid Robot Market is projected to grow from USD 2,060.4 million…

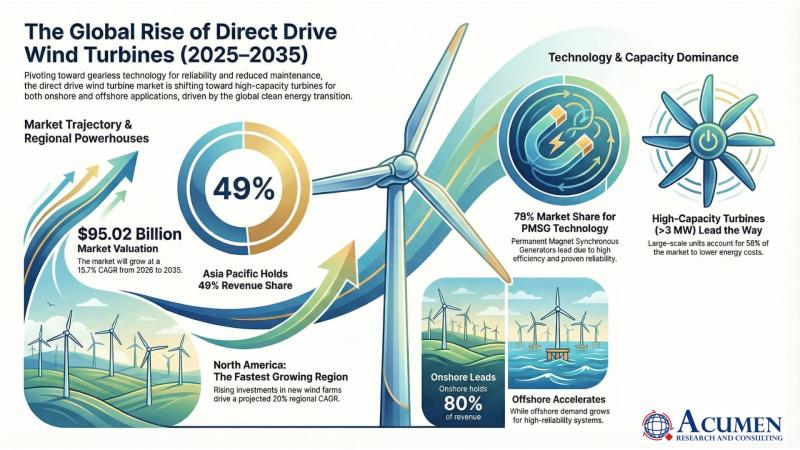

Direct Drive Wind Turbine Market to Reach USD 95.02 Billion by 2035 | Acumen Res …

Direct Drive Wind Turbine Market to Reach USD 95.02 Billion by 2035, Driven by Global Renewable Expansion and Offshore Innovation | Acumen Research and Consulting

The Direct Drive Wind Turbine Market is witnessing unprecedented growth momentum as the global renewable energy transition accelerates. According to a new report by Acumen Research and Consulting, the global Direct Drive Wind Turbine Market size is projected to grow from USD 21.91 billion in 2025…

Physical AI Market Set to Surge to USD 83,642.5 Million by 2035 - Groundbreaking …

Global Physical AI Market Report 2026-2035: Robust Growth, Transformational Trends, and Unmatched Opportunities

The Physical AI Market is on the brink of remarkable expansion with groundbreaking advancements in artificial intelligence systems that interact intelligently with the physical world. According to a new market study by Acumen Research and Consulting, the global physical AI market is projected to grow from USD 3,137.5 Million in 2025 to USD 83,642.5 Million by 2035, exhibiting…

Semiconductor Packaging Market to Double from USD 44.21 Billion in 2024 to USD 1 …

Acumen Research And Consulting announces the release of its latest industry report highlighting the robust growth of the Semiconductor Packaging Market. The report reveals that the global market, valued at USD 44.21 billion in 2024, is projected to reach USD 104.76 billion by 2033, expanding at a steady Compound Annual Growth Rate (CAGR) of 10.1% between 2025 and 2033. This rapid growth underscores the increasing importance of packaging innovations in…

More Releases for Payment

Evolving Market Trends In The Bitcoin Payment Ecosystem Industry: NFC-Enabled Cr …

The Bitcoin Payment Ecosystem Market Report by The Business Research Company delivers a detailed market assessment, covering size projections from 2025 to 2034. This report explores crucial market trends, major drivers and market segmentation by [key segment categories].

What Is the Expected Bitcoin Payment Ecosystem Market Size During the Forecast Period?

The market size of the Bitcoin payment ecosystem has seen swift acceleration in the past few years. Its growth is projected…

Payment Security Market : Increased Adoption of Digital Payment Modes Leading pl …

According to a recent report published by Allied Market Research, titled, "Payment Security Market by Component, Platform, Enterprise Size and Industry Vertical: Global Opportunity Analysis and Industry Forecast, 2021-2030," the global payment security market size was valued at $17.64 billion in 2020, and is projected to reach $60.56 billion by 2030, growing at a CAGR of 13.2% from 2021 to 2030.

Download Free PDF Report Sample :

https://www.alliedmarketresearch.com/request-sample/10390

Payment security software is used…

Hosted Payment Gateway Segment dominates Payment Gateway Market - TechSci Resear …

Government initiatives towards digitization and surging popularity of digital payment to drive global payment gateway market through 2024

According to TechSci Research report, “Global Payment Gateway Market By Type, By Enterprise Size, By End-User, By Region, Competition, Forecast & Opportunities, 2024”, global payment gateway market is projected to grow at a CAGR of over 8% during 2019-2024, on account of increasing internet penetration, which is aiding growing demand for online transactions.…

Digital Payment Market by Component (Solutions (Payment Processing, Payment Gate …

Magarpatta SEZ, Pune, “ReportsnReports”, one of the world’s prominent market research firms has released a new report on Global Digital Payment Market. The report contains crucial insights on the market which will support the clients to make the right business decisions. This research will help both existing and new aspirants for Digital Payment Market to figure out and study market needs, market size, and competition. The report talks about the…

Digital Payment Market by Payment Gateway Solutions, Payment Wallet Solutions, P …

Digital Payment Market 2019-2025: In 2018, the global Digital Payment market size was xx million US$ and it is projected to surpass xx million US$ by the end of 2025, growing at a CAGR of 18.1% during 2019-2025.

Things Covered in Sample Report

> Deep Dive Strategy & Competition

> Deep Dive Data & Forecasting

> Executive Summary & Core Findings

Get a Quick Sample report at https://decisionmarketreports.com/request-sample?productID=1008739

The key players covered in…

Online Payment Gateway Market Analysis By 2028 | Amazon.com, Avenues India Pvt. …

Future Market Insights (FMI) has recently published a new research report on the online payment gateway market titled “Online Payment Gateway Market: Global Industry Analysis (2013-2017) and Opportunity Assessment (2018-2028).” The report states that the growing prevalence of third party payment processes is expected to have a positive impact on the growth of the global market. Websites have always been a good source for channel merchants for generating revenue. Concentrating…