Press release

Debt Collection Services Market Is Expected To Reach A Valuation Of US$ 34.9 Billion By 2033: Fact.MR Report

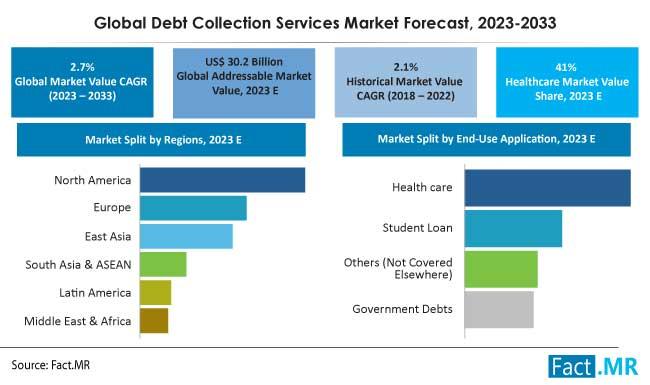

The global debt collection services market is set to reach a valuation of US$ 30.2 billion in 2023. The market is further expected to grow at a CAGR of 2.7% for the next 10 years and end up at US$ 39.4 billion by 2033.The Debt Collection Services Industry sales study offers a comprehensive analysis on diverse features including production capacities, Debt Collection Services demand, product developments, sales revenue generation and Debt Collection Services market outlook across the globe.

market research report by Fact.MR, (Leading business and competitive intelligence provider) on global Debt Collection Services market sales initiates with an outlook of the market, followed by the scrutiny of the demand and consumption volumes and share and size of various end-use segments

𝐃𝐨𝐰𝐧𝐥𝐨𝐚𝐝 𝐒𝐚𝐦𝐩𝐥𝐞 𝐂𝐨𝐩𝐲 𝐨𝐟 𝐓𝐡𝐢𝐬 𝐑𝐞𝐩𝐨𝐫𝐭:

https://www.factmr.com/connectus/sample?flag=S&rep_id=8052

The readability score of the Debt Collection Services market demand report is good as it offers chapter-wise layout with each section divided into a smaller sections.

The report encompasses graphs and tables to show the entire assembling. Pictorial demonstration of the definite and estimated values of key segments is visually appealing to readers.

This Debt Collection Services market outlook report explicates on vital dynamics such as the drivers, restraints and opportunities for key players and competitive analysis of Debt Collection Services along with key stakeholders as well as emerging players associated with the manufacturing of product.

The Key trends Analysis of Extended Debt Collection Services market also provides dynamics that are responsible for influencing the future sales and demand of over the forecast period

𝐆𝐫𝐨𝐰𝐭𝐡 𝐓𝐫𝐞𝐧𝐝𝐬:

Economic Conditions: As more people and businesses struggle to make their debt payments, economic downturns frequently result in an increase in the activities of debt collectors. In contrast, when the economy is expanding and people have more discretionary means to pay off debts, there may be a decline in the amount of debt collection operations.

Regulatory Environment: Modifications to the laws governing debt collection procedures may have a big effect on the sector. Tighter laws designed to safeguard consumers' rights might force debt collection companies to change how they operate, which could have an impact on their expansion and financial success.

Technological Developments: The debt collection process is changing as a result of technological developments including automation, data analytics, and artificial intelligence. These innovations have the potential to boost productivity, raise debt recovery rates, lower operating expenses, and spur industry expansion.

Digital Transformation: Debt collection strategies have been impacted by the move to digital platforms for payment and communication. The debt collection industry is expanding as a result of debt collection firms' growing use of digital channels including SMS, email, and web portals to communicate with debtors and make payments easier.

Alternative Lending: As online payday loans and peer-to-peer lending have grown in popularity, debt collection firms now face both new opportunities and difficulties. Effective debt collection strategies are becoming more and more necessary as the market for alternative lending grows.

Globalization: As companies operate on a worldwide basis, debt collection services are increasingly providing services to clients from other countries. In addition to offering development potential, cross-border debt collection poses particular hurdles for agencies with the know-how to negotiate cultural variations and foreign rules.

Emphasis on Compliance and Ethics: Adherence to legal standards and moral debt collecting methods are becoming increasingly important. Debt collection companies that put an emphasis on fairness, openness, and compliance are more likely to gain the trust of their clients and customers, which will promote long-term success.

Debt Types: Growth trends may also be impacted by the kinds of debt that are gathered. For instance, as healthcare expenditures and student loan obligations rise, debt collection agencies are focusing more and more on medical and student loan debt.

𝐊𝐞𝐲 𝐂𝐨𝐦𝐩𝐚𝐧𝐢𝐞𝐬 𝐏𝐫𝐨𝐟𝐢𝐥𝐞𝐝

• Aspen National Financial Inc

• Atradius Collections

• Capital Collections LLC

• Cedar Financial

• Encore Capital Group

• IC System

• PRA Group

• Prestige Services Inc.

• Rocket Receivables

• Rozlin Financial Group, Inc.

• Summit Account Resolution

• The Kaplan Group

• TrueAccord

• Wakefield & Associates

• Vericore

𝐂𝐨𝐦𝐩𝐞𝐭𝐢𝐭𝐢𝐯𝐞 𝐀𝐧𝐚𝐥𝐲𝐬𝐢𝐬:

The global debt collection services industry is still considered to be unorganized due to the presence of several small and medium enterprises. Local players tend to account for a high market share in comparison to those who are from different locations/geographies. Market players are trying to differentiate themselves by offering more tech-driven services.

• In October 2022, Wakefield & Associates, an ACA International member company, completed the acquisition of Choice Recovery, an Ohio-based recovery agency. The acquisition will help the company grow in the Great Lakes region of the U.S.

• In March 2021, Atradius Collections completed the acquisition of a Portuguese-based collection agency Gestifatura. With this acquisition, Atradius Collection now has operations in 34 countries.

Fact.MR has provided detailed information about the providers of debt collection services positioned across regions, revenue growth, and service offering expansion, in the recently published report.

𝐒𝐞𝐠𝐦𝐞𝐧𝐭𝐚𝐭𝐢𝐨𝐧 𝐨𝐟 𝐃𝐞𝐛𝐭 𝐂𝐨𝐥𝐥𝐞𝐜𝐭𝐢𝐨𝐧 𝐒𝐞𝐫𝐯𝐢𝐜𝐞𝐬 𝐈𝐧𝐝𝐮𝐬𝐭𝐫𝐲

• By Debt Type :

o Bad Debts

o Early Out Debts

• By End-use Application :

o Healthcare

o Student Loans

o Government Debts

o Others (Credit Cards, Retail, Telecom, Utility, Mortgages)

• By Region :

o North America

o Latin America

o Europe

o East Asia

o South Asia & Oceania

o Middle East & Africa

𝐑𝐞𝐚𝐝 𝐌𝐨𝐫𝐞: https://www.factmr.com/report/debt-collection-services-market

𝐌𝐨𝐫𝐞 𝐑𝐞𝐥𝐚𝐭𝐞𝐝:

EPC (Engineering, Procurement, and Construction) Market: https://www.factmr.com/report/epc-engineering-procurement-and-construction-market

Hospital Food Service Market: https://www.factmr.com/report/hospital-food-service-market

𝐂𝐨𝐧𝐭𝐚𝐜𝐭:

US Sales Office :

11140 Rockville Pike

Suite 400

Rockville, MD 20852

United States

Tel: +1 (628) 251-1583

E-Mail: sales@factmr.com

𝐀𝐛𝐨𝐮𝐭 𝐅𝐚𝐜𝐭.𝐌𝐑

We are a trusted research partner of 80% of fortune 1000 companies across the globe. We are consistently growing in the field of market research with more than 1000 reports published every year. The dedicated team of 400-plus analysts and consultants is committed to achieving the utmost level of our client's satisfaction.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Debt Collection Services Market Is Expected To Reach A Valuation Of US$ 34.9 Billion By 2033: Fact.MR Report here

News-ID: 3447001 • Views: …

More Releases from Fact.MR

Organic Rice Syrup Market is forecasted to increase at a CAGR of 5.1% and US$ 1. …

The global Organic Rice Syrup Market is projected to expand steadily over the coming decade, driven by rising consumer demand for natural, clean-label sweeteners and growing awareness of health and wellness trends. Industry analysts estimate that the organic rice syrup market, valued at approximately USD 450 million in 2025, is expected to reach nearly USD 880 million by 2035, registering a compound annual growth rate (CAGR) of about 7.1% during…

Compound Horse Feedstuff Market is Estimated to Grow at a CAGR of 4.6%, Reaching …

The global compound horse feedstuff market is galloping toward steady growth, projected to expand from a valuation of USD 3.8 billion in 2026 to approximately USD 5.4 billion by 2036. This represents a compound annual growth rate (CAGR) of 3.6% over the ten-year forecast period.

The market is being driven by the "humanization" of equine companions, the professionalization of equestrian sports, and a significant shift toward specialized performance nutrition that…

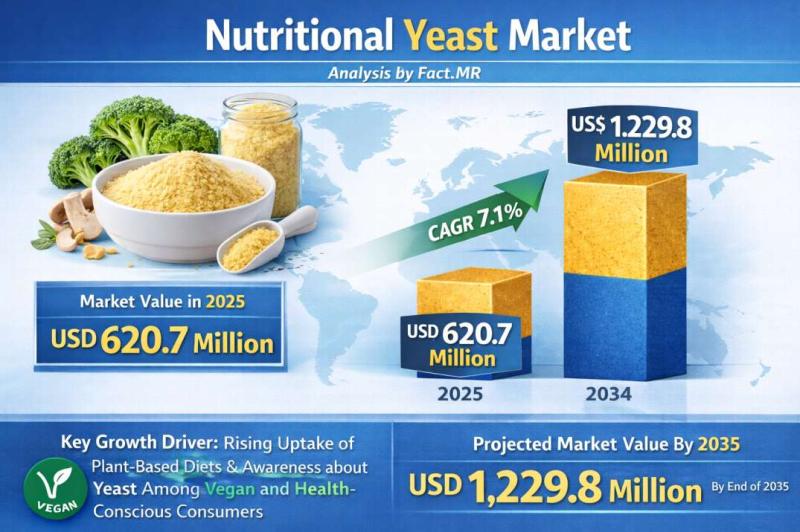

Nutritional Yeast Market Forecasted CAGR is 7.1% by 2035 | Fact.MR Report

The global nutritional yeast market is experiencing a significant surge in demand, projected to grow from a valuation of USD 515.2 million in 2026 to approximately USD 1.2 billion by 2036. This represents a robust compound annual growth rate (CAGR) of 8.8% over the ten-year forecast period.

The market is being propelled by the global explosion of plant-based diets and the "clean-label" movement, with nutritional yeast emerging as the primary…

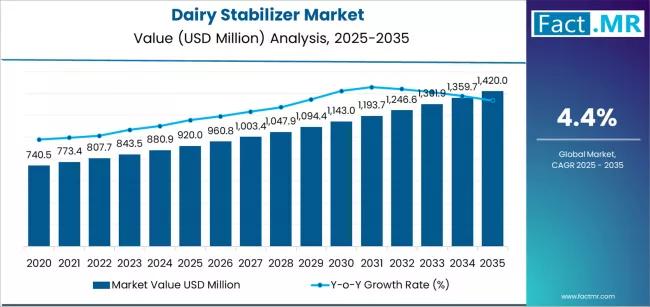

Dairy Stabilizer Market is Expected to Reach USD 1,420.0 million by 2035 | Resea …

The global Dairy Stabilizers Market is projected to sustain solid growth over the next decade as consumer demand for high-quality dairy and dairy-based products continues to expand across foodservice and retail sectors. Industry analysts estimate that the dairy stabilizers market, valued at approximately USD 2.4 billion in 2025, is expected to reach around USD 4.3 billion by 2035, registering a compound annual growth rate (CAGR) of about 6.5% during the…

More Releases for Debt

Debt Settlement Solution Market Impressive Growth 2021-2028 | National Debt Reli …

The Insight Partners announces the research on Global Debt Settlement Solution Market [Report Page Link as it covers the key boundaries Required for your Research Need. This Global Debt Settlement Solution Market Report covers worldwide, local, and nation level market size, pieces of the overall industry, ongoing pattern, the effect of covid19 on worldwide

Market Research Report Investigations Research Methodology review comprises of Secondary Research, Primary Research, Company Share Analysis,…

Debt Settlement Market Emerging Growth Analysis, Demand and Business Opportuniti …

Debt settlement is the process of negotiating with creditors to reduce overall debts in exchange for a lump sum payment. A successful settlement occurs when the creditor agrees to forgive a percentage of total account balance. Normally, only unsecured debts not secured by real assets like homes or autos can be settled. Debt Settlement Market report studies the Debt Settlement market. Debt settlement is an approach to debt reduction in…

Debt Settlement Market Emerging Growth Analysis, Demand and Business Opportuniti …

Debt settlement is the process of negotiating with creditors to reduce overall debts in exchange for a lump sum payment. A successful settlement occurs when the creditor agrees to forgive a percentage of total account balance. Normally, only unsecured debts not secured by real assets like homes or autos can be settled. Debt Settlement Market report studies the Debt Settlement market. Debt settlement is an approach to debt reduction in…

Debt Settlement Market 2019 By Freedom Debt Relief National Debt Relief Rescue O …

This report studies the Debt Settlement market. Debt settlement is an approach to debt reduction in which the debtor and creditor agree on a reduced balance that will be regarded as payment in full.

Request a Sample of this Report @ https://www.orbisresearch.com/contacts/request-sample/2575396 …

Debt Settlement Market 2018-National Debt Relief, Freedom Debt Relief, New Era D …

The report on Debt Settlement, documents a detailed study of different aspects of the ‘Debt Settlement’ market. It shows the steady growth in market in spite of the fluctuations and changing market trends. In the past four years the ‘Debt Settlement’ market has grown to a booming value of $xxx million and is expected to grow more.

Request a Sample of this Report@ http://www.orbisresearch.com/contacts/request-sample/2335800

Every market intelligence report is based on certain…

Debt Settlement Market 2018 | Global Demand, Top Companies Analysis- National De …

Global Debt Settlement Market Research Report 2018 is a professional and in-depth study on the current state of the global Debt Settlement industry with a focus on the regional market, analysis of industry share, growth factors, development trends, size, majors manufacturers and 2025 forecast. The report also analyze innovative business strategies, value added factors and business opportunities. The Debt Settlement report introduces market revenue, product & services, latest developments and…