Press release

Usage Insurance Market to Reach US$ 150 Billion Globally by 2031 at 17% CAGR: Fact.MR

Global demand for term insurance market (最作保院市場) reached nearly US$30 billion in 2020 and is expected to grow significantly to nearly US$150 billion by 2031. This is a fivefold increase over the forecast period 2021-203.In the ever-evolving landscape of the insurance sector, a new paradigm is emerging - usage-based insurance (UBI). This innovative approach to insurance fundamentally changes the traditional model by adjusting premiums based on individual behavior and usage patterns, rather than relying solely on demographic factors. The Usage Based Insurance (UBI) market is poised to revolutionize the insurance industry by providing greater efficiency, better risk management and personalized coverage options.

𝐃𝐨𝐰𝐧𝐥𝐨𝐚𝐝 𝐚 𝐒𝐚𝐦𝐩𝐥𝐞 𝐂𝐨𝐩𝐲 𝐨𝐟 𝐓𝐡𝐢𝐬 𝐑𝐞𝐩𝐨𝐫𝐭:

https://www.factmr.com/connectus/sample?flag=S&rep_id=5352

𝐊𝐞𝐲 𝐏𝐥𝐚𝐲𝐞𝐫𝐬:

Insure the Box Limited

Allstate Insurance Company

State Farm

Uniqa Insurance Group AG

Groupama

Generali Group

UnipolSai Assicurazioni S.p.A

Liberty Mutual Group

Allianz SE

Progressive Corporation

𝐔𝐧𝐝𝐞𝐫𝐬𝐭𝐚𝐧𝐝𝐢𝐧𝐠 𝐔𝐬𝐚𝐠𝐞-𝐁𝐚𝐬𝐞𝐝 𝐈𝐧𝐬𝐮𝐫𝐚𝐧𝐜𝐞:

Usage-based insurance, also known as telematics insurance or joint insurance, uses advanced telematics technology to monitor and evaluate the behavior, driving and usage habits of policyholders. This data-driven approach enables insurers to offer personalized premiums tailored to individual risk profiles, rewarding safe driving behavior and encouraging policyholders to adopt safer practices.

𝐃𝐫𝐢𝐯𝐢𝐧𝐠 𝐅𝐨𝐫𝐜𝐞𝐬 𝐁𝐞𝐡𝐢𝐧𝐝 𝐔𝐁𝐈 𝐀𝐝𝐨𝐩𝐭𝐢𝐨𝐧:

Enhanced Risk Assessment: By leveraging real-time data on driving behavior, UBI enables insurers to gain deeper insights into individual risk profiles and tailor premiums accordingly. This proactive approach to risk assessment allows insurers to more accurately price policies, mitigate risk, and prevent potential losses.

Improved Customer Engagement: UBI offers policyholders greater transparency and control over their insurance premiums, fostering a sense of empowerment and engagement. By providing feedback on driving behavior and offering incentives for safe driving, UBI encourages policyholders to adopt safer habits and reduce the risk of accidents.

Efficiency and Cost Savings: UBI enables insurers to streamline underwriting processes, reduce claims frequency, and lower administrative costs. By accurately pricing risk and incentivizing safe driving behavior, UBI can lead to cost savings for both insurers and policyholders, resulting in more affordable premiums and improved profitability.

𝐊𝐞𝐲 𝐓𝐫𝐞𝐧𝐝𝐬 𝐚𝐧𝐝 𝐈𝐧𝐧𝐨𝐯𝐚𝐭𝐢𝐨𝐧𝐬 𝐢𝐧 𝐔𝐁𝐈:

Advances in telematics technology: Rapid advances in telematics technology, including GPS tracking, accelerometers and on-board diagnostics, are driving innovation in UBI. Insurers use these technologies to collect and analyze large amounts of data on driving behavior, enabling more accurate risk assessment and more personalized pricing.

Expansion beyond auto insurance: while UBI initially gained traction in the auto insurance industry, its applications are spreading across. other types of insurance, including property, health and life insurance. Insurance companies are exploring new ways to leverage telematics data to provide personalized coverage options and encourage positive behavior across policy segments.

𝐂𝐨𝐦𝐩𝐞𝐭𝐢𝐭𝐢𝐯𝐞 𝐋𝐚𝐧𝐝𝐬𝐜𝐚𝐩𝐞:

Major players prioritize expanding their customer base.

Earnix, a global leader in advanced valuation, pricing and customized product solutions for insurance companies and banks, recently announced the acquisition of assets from artificial intelligence-enabled telematics provider Driveway Software Corporation. This strategic move combines Driveway's expertise and strengthens Earnix's capabilities with an experienced team. The acquisition underscores Earnix's commitment to expanding its offerings and market reach.

In a separate development, USAA on June 16, 2020 announced plans to acquire Noblr, a digital insurance company specializing in behavioral auto insurance. The acquisition of Noblr is aimed at military personnel and their families and is consistent with USAA's goal of strengthening competitiveness and improving service delivery. USAA cited financial sustainability as a key enabler for such acquisitions, allowing the company to innovate and expand its presence in the industry.

Key Segments Covered

By Policy Type

Pay-how-you-drive(PHYD)

Pay-as-you-drive(PAYD)

Manage-how-you-drive(MHYD)

By Product

Black Box

OBD Dongle

Smartphone

Others

By Vehicle

Passenger Vehicle

Commercial Vehicle

By Region

North America

Latin America

Europe

East Asia

South Asia

Oceania

MEA

𝐑𝐞𝐚𝐝 𝐌𝐨𝐫𝐞: https://www.factmr.com/report/5352/usage-insurance-market

Usage-Based Insurance represents a transformative shift in the insurance industry, offering a data-driven approach to risk assessment, personalized pricing, and enhanced customer engagement. By leveraging telematics technology and data analytics, insurers can unlock new opportunities for efficiency, customization, and innovation, ultimately delivering greater value to policyholders and driving positive outcomes for the insurance industry as a whole.

𝐂𝐨𝐧𝐭𝐚𝐜𝐭:

US Sales Office

11140 Rockville Pike

Suite 400

Rockville, MD 20852

United States

Tel: +1 (628) 251-1583, +353-1-4434-232

Email: sales@factmr.com

𝐀𝐛𝐨𝐮𝐭 𝐅𝐚𝐜𝐭.𝐌𝐑

We are a trusted research partner of 80% of fortune 1000 companies across the globe. We are consistently growing in the field of market research with more than 1000 reports published every year. The dedicated team of 400-plus analysts and consultants is committed to achieving the utmost level of our client's satisfaction.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Usage Insurance Market to Reach US$ 150 Billion Globally by 2031 at 17% CAGR: Fact.MR here

News-ID: 3446775 • Views: …

More Releases from Fact.MR

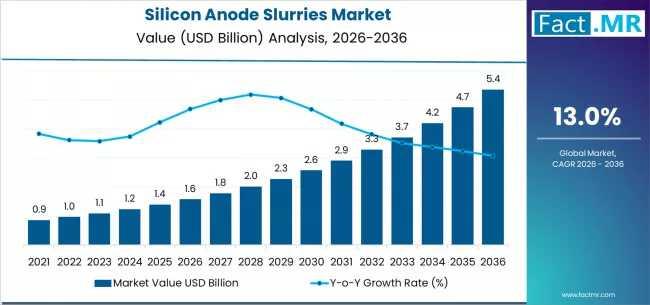

Silicon Anode Slurries Market Forecast 2026-2036: Market Size, Share, Competitiv …

The global silicon anode slurries market is set for significant expansion between 2026 and 2036, fueled by the rising adoption of high-energy-density lithium-ion batteries across electric vehicles (EVs), consumer electronics, and grid-scale energy storage. As battery manufacturers increasingly transition from graphite to silicon-enhanced anodes, the demand for high-performance, scalable silicon anode slurries is projected to grow sharply.

To access the complete data tables and in-depth insights, request a Discount On The…

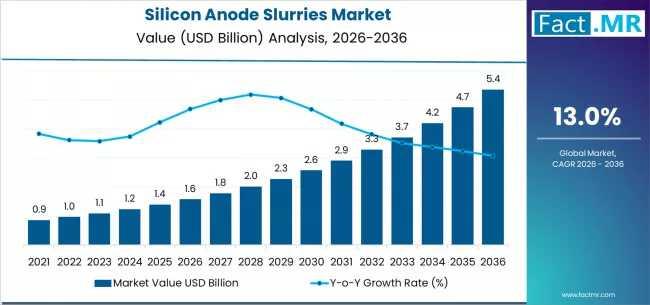

Silicon Anode Slurries Market Forecast 2026-2036: Market Size, Share, Competitiv …

The global silicon anode slurries market is set for significant expansion between 2026 and 2036, fueled by the rising adoption of high-energy-density lithium-ion batteries across electric vehicles (EVs), consumer electronics, and grid-scale energy storage. As battery manufacturers increasingly transition from graphite to silicon-enhanced anodes, the demand for high-performance, scalable silicon anode slurries is projected to grow sharply.

To access the complete data tables and in-depth insights, request a Discount On The…

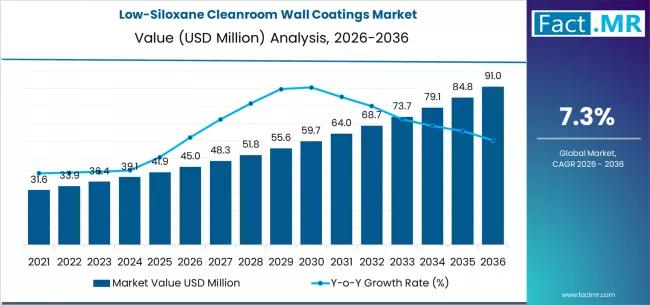

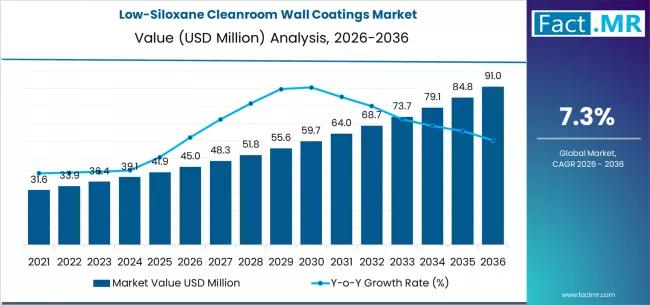

Low-Siloxane Cleanroom Wall Coatings Market Deep-Dive 2026-2036: Strategic Forec …

The low-siloxane cleanroom wall coatings market is poised for steady growth over the next decade, driven by rising contamination-control requirements across semiconductor, pharmaceutical, biotechnology, and precision manufacturing industries. These coatings are specifically engineered to minimize siloxane outgassing and volatile organic compound emissions, helping maintain ultra-clean environments where even trace contamination can disrupt production quality.

By 2036, the market for low-siloxane cleanroom wall coatings is expected to grow to USD 91.04 million.…

Low-Siloxane Cleanroom Wall Coatings Market Deep-Dive 2026-2036: Strategic Forec …

The low-siloxane cleanroom wall coatings market is poised for steady growth over the next decade, driven by rising contamination-control requirements across semiconductor, pharmaceutical, biotechnology, and precision manufacturing industries. These coatings are specifically engineered to minimize siloxane outgassing and volatile organic compound emissions, helping maintain ultra-clean environments where even trace contamination can disrupt production quality.

By 2036, the market for low-siloxane cleanroom wall coatings is expected to grow to USD 91.04 million.…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…