Press release

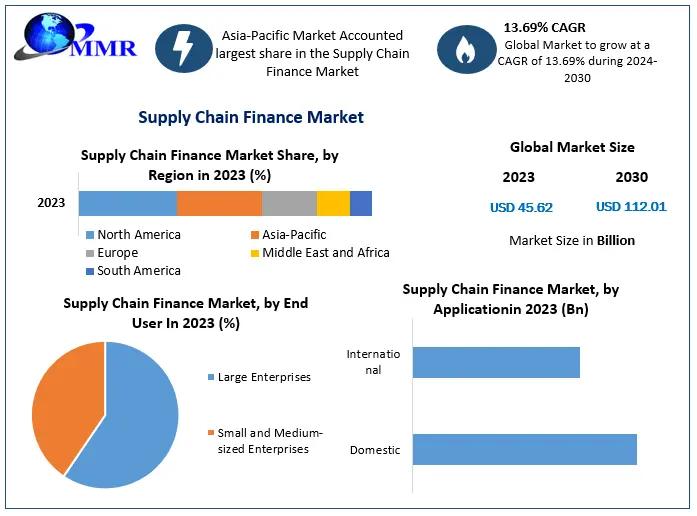

Supply Chain Finance Market Global Share, Size, Trends Analysis, 2030

Supply Chain Finance Market Insights Unveiled:Embark on a riveting journey through the realms of the Supply Chain Finance Market with the cutting-edge market intelligence of a distinguished global research firm. Immerse yourself in a rich tapestry of data and captivating visual representations that decode the enigmatic trends of both regional and global markets. This comprehensive report reveals the market's deepest ambitions, shedding luminous beams on the foremost competitors, their market valuation, trendy strategies, targets, and trailblazing products. Venture further into the past and present as this report illuminates the market's recent growth and unfurls its illustrious history, igniting the minds of all stakeholders.

Explore the report format with a complimentary sample copy, featuring the table of contents and summary :https://www.maximizemarketresearch.com/request-sample/168082

Supply Chain Finance Market Scope and Research Methodology

The aim of this report is to assess and predict the size of the Supply Chain Finance market. It offers strategic profiles of significant market participants to provide an accurate depiction of the competitive landscape within the global Supply Chain Finance market. This includes a comprehensive analysis of recent developments such as new product launches, acquisitions, mergers, joint ventures, brand activities, and major players in the Supply Chain Finance industry. The report presents insights into industry trends, dynamics, and potentials, assisting professionals in staying informed about the latest trends and sector performance. This insight aids in predicting growth and decline in Supply Chain Finance market share over the forecast period.

In-depth understanding of the Supply Chain Finance industry was achieved through a combination of primary and secondary research methods. Various methodologies, including PESTLE, PORTER, and SWOT analysis, were employed to ensure accurate findings. SWOT analysis was employed to outline strengths, weaknesses, opportunities, and challenges for key players within the Supply Chain Finance industry. Additionally, the use of PORTER and PESTLE analysis allowed for an understanding of the microeconomic and macroeconomic factors influencing the Supply Chain Finance industry.

Away from Supply Chain Finance Industry Analysis and Progression:

Global Away from Supply Chain Finance Market size was valued at US$ 5.91 Bn in 2022 and the total revenue is expected to grow at 18.3% through 2022 to 2029, reaching nearly US$ 19.17 Bn.

To gain further understanding of this research, please consult:

Segmentation: The Art of Unveiling

The implementation of strict environmental and pollution control regulations, as well as government incentives to encourage the purchase and use of electric and hybrid vehicles, are some of the key factors influencing the market's growth. Administrative groups have implemented stricter emission rules as public awareness of discharges has grown. OEMs are being inspired to develop hybrid and electric vehicles by the tightening regulations on vehicle contamination. Automobiles that use both petrol and diesel emit less pollution from the environment than hybrid vehicles. To minimise the impact of ozone-depleting substances and increase vehicle eco-friendliness, legislators in the US and Europe are gradually reducing discharge regulations. States in both India and Brazil are considering various ideas, such as reducing the public sector's reliance on CNG creamer and module vehicles. There are additional hybrid electric vehicle options. The Indian government is expected to spend USD 446 million on the project. The Brazilian government is releasing new advertisements and informational gatherings to raise awareness of the benefits of hybrid vehicles. Together with the US Environmental Protection Agency, the European Union has created rigid transmission regulations. In light of these necessities, the market for cross-sectional vehicles is significantly growing and becoming more well-known for cream vehicle use.

by Offering

• Export and Import Bills

• Letter of Credit

• Performance Bonds

• Shipping Guarantees

• Others

by Provider

• Banks

• Trade Finance House

• Others

by End User

• Large Enterprises

• Small and Medium-sized Enterprises

by Application

• Domestic

• International

by Region

• North America

• Europe

• Asia Pacific

• South America

• Middle East & Africa

The following companies are included in the market for Away from Supply Chain Finance :

The analysis also focuses on the worldwide key industry players of the Supply Chain Finance Market including information such as company biographies, product pictures and specifications, capacity, production, price, cost, revenue, and contact information. This research looks at the Supply Chain Finance Market Trend, volume, and value on a global, regional, and corporate level. This study shows the entire Supply Chain Finance Market Size from a worldwide perspective by analyzing historical data and prospects. The research covers leading Supply Chain Finance market companies and evaluates their market rankings. The players highlighted in this report are as follows:

• IBM

• Ripple

• Rubix by Deloitte

• Distributed Ledger Technologies

• Oklink

• Nasdaq Linq

• Oracle

• AWS

• Citi Bank

• ELayaway

• HSBC

• Ant Financial

• JD Financial

• Qihoo 360

• Tencent

• Baidu

• Huawei

• Bitspark

• SAP

• ALIBABA

Please connect with our representative, who will ensure you to get a report sample here :https://www.maximizemarketresearch.com/request-sample/168082

Supply Chain Finance Market Regional Analysis:

The report is segmented into several key countries, with market size, growth rate, import and export of Supply Chain Finance market in these countries, which covering North America, U.S., Canada, Mexico, Europe, UK, Germany, France, Spain, Italy, Rest of Europe, Asia Pacific, China, India, Japan, Australia, South Korea, ASEAN Countries, Rest of APAC, South America, Brazil, and Middle East and Africa.

Key Questions answered in the Supply Chain Finance Market Report are:

Which segment grabbed the largest share in the Supply Chain Finance market?

Which segment is expected to grow at a high rate during the forecast period?

How is the competitive scenario of the Supply Chain Finance market?

Which are the key factors driving the Supply Chain Finance market growth?

Which are the factors restraining the Supply Chain Finance market growth?

Which region holds the maximum share in the Supply Chain Finance market?

What will be the CAGR of the Supply Chain Finance market during the forecast period?

Which are the prominent players in the Supply Chain Finance market?

Want your report customized? Speak to an analyst and personalize your report according to your needs @https://www.maximizemarketresearch.com/market-report/supply-chain-finance-market/168082/

Key Offerings:

A detailed Analysis of the Market Overview

Market Share, Size & Forecast by Revenue | 2023-2029

Market Dynamics - Growth Drivers, Restraints, Investment Opportunities, and Key Trends

Market Segmentation - A detailed analysis by Route of administration, Application, Facility of use and Region and Region

Competitive Landscape - Top Key Vendors and Other Prominent Vendors

Browse Our Top Trending Reports :

Global 3D Concrete Printing Market https://www.maximizemarketresearch.com/market-report/global-3d-concrete-printing-market/28437/

Music Publishing Market https://www.maximizemarketresearch.com/market-report/global-music-publishing-market/105765/

Contact Maximize Market Research:

3rd Floor, Navale IT Park, Phase 2

Pune Banglore Highway, Narhe,

Pune, Maharashtra 411041, India

sales@maximizemarketresearch.com

+91 96071 95908, +91 9607365656

About Maximize Market Research:

Maximize Market Research is a multifaceted market research and consulting company with professionals from several industries. Some of the industries we cover include medical devices, pharmaceutical manufacturers, science and engineering, electronic components, industrial equipment, technology and communication, cars and automobiles, chemical products and substances, general merchandise, beverages, personal care, and automated systems. To mention a few, we provide market-verified industry estimations, technical trend analysis, crucial market research, strategic advice, competition analysis, production and demand analysis, and client impact studies.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Supply Chain Finance Market Global Share, Size, Trends Analysis, 2030 here

News-ID: 3437186 • Views: …

More Releases from MAXIMIZE MARKET RESEARCH PVT. LTD.

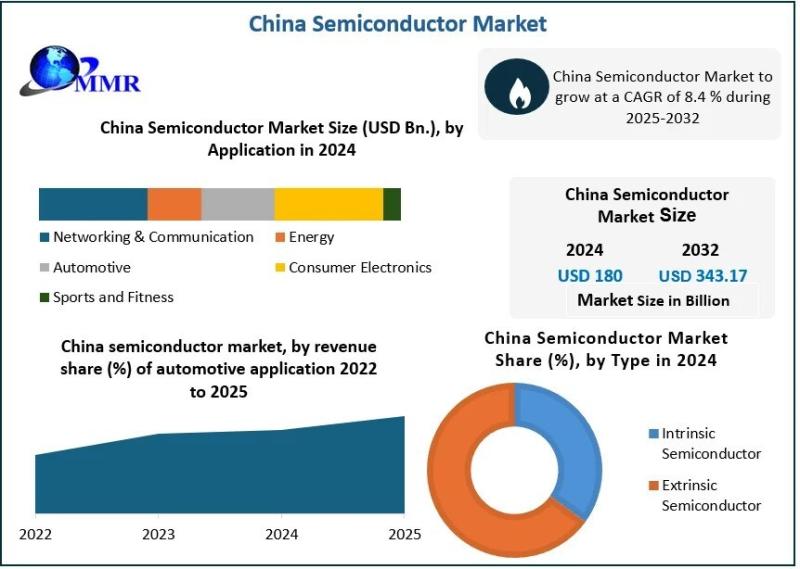

China Semiconductor Market Analysis: Projected to Grow from USD 180 Billion in 2 …

China Semiconductor Market size was valued at USD 180 Bn. in 2024, and the total China Semiconductor revenue is expected to grow by 8.4 % from 2025 to 2032, reaching nearly USD 343.17 Bn.

china-semiconductor-market Overview:

The China semiconductor market is one of the largest and most dynamic in the world, driving significant growth in the global tech industry. As China continues to expand its influence in high-tech manufacturing, the semiconductor market…

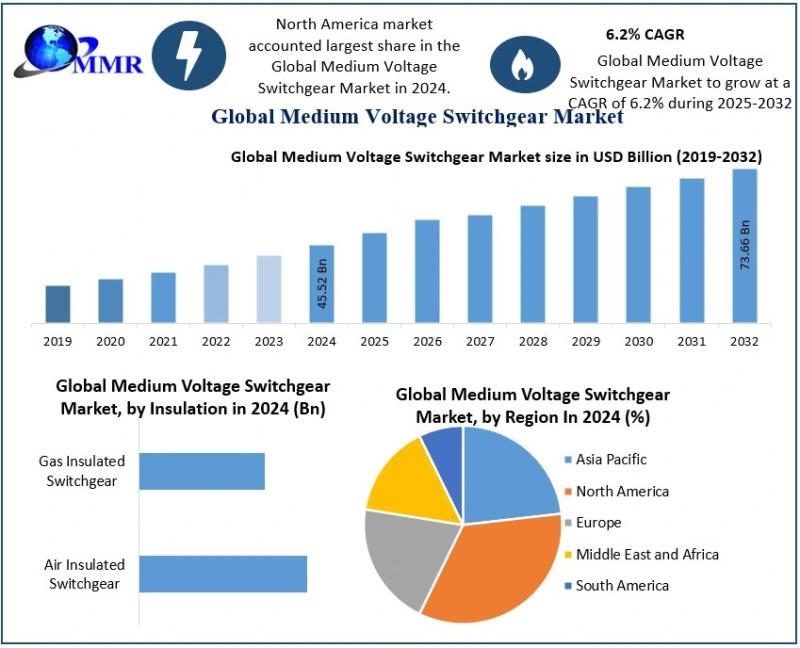

Medium Voltage Switchgear Market Analysis: 6.2% CAGR Driving Growth from USD 48. …

Medium Voltage Switchgear Market size was valued at USD 48.34 Billion in 2025 and the total Medium Voltage Switchgear revenue is expected to grow at a CAGR of 6.2% from 2025 to 2032, reaching nearly USD 73.65 Billion by 2032.

Medium-voltage Switchgear Market Overview:

The medium-voltage switchgear market plays a pivotal role in the global energy distribution landscape. These switchgear devices, typically operating between 1 kV and 72.5 kV, are critical for…

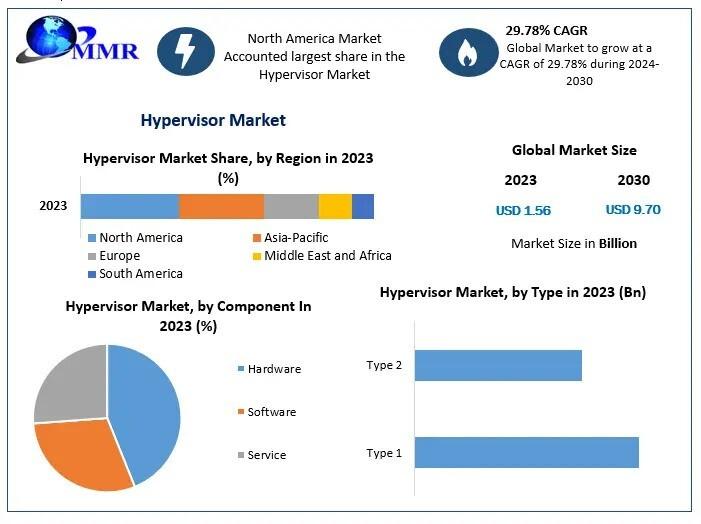

Hypervisor Market Analysis 2025-2030: Growth Rate of 29.78% and Market Value of …

Hypervisor Market size is estimated to grow at a CAGR of 29.78%. The market is expected to reach a value of US $ 9.70 Bn. in 2030.

Hypervisor Market Overview:

The hypervisor market, a critical component of virtualization technology, plays an essential role in the expansion of cloud computing, data centers, and IT infrastructure. By enabling multiple operating systems to run concurrently on a single physical machine, hypervisors streamline resource allocation and…

Cider Market Poised for Steady Growth, Expected to Reach USD 26.90 Billion by 20 …

The global Cider Market is witnessing a significant transformation driven by evolving consumer preferences, premiumization trends, and innovation in flavors and formats. Valued at USD 17.42 Billion in 2025, the market is projected to grow at a compound annual growth rate (CAGR) of 6.4% from 2025 to 2032, reaching nearly USD 26.90 Billion by 2032. This growth reflects cider's rising appeal as a refreshing, gluten-free, and lower-calorie alcoholic beverage alternative…

More Releases for Finance

Consumer Finance Market to Witness Revolutionary Growth by 2030 | Bajaj Capital, …

Global "Consumer Finance Market" Research report is an in-depth study of the market Analysis. Along with the most recent patterns and figures that uncovers a wide examination of the market offer. This report provides exhaustive coverage on geographical segmentation, latest demand scope, growth rate analysis with industry revenue and CAGR status. While emphasizing the key driving and restraining forces for this market, the report also offers a complete study of…

Big Boom in Environmental Finance Market 2020-2027 | Environmental Finance (Fult …

According to a report on Environmental Finance Market, recently added to the vast repository of Research N Reports, the global market is likely to gain significant impetus in the near future. The report, titled “Global Environmental Finance Market Research Report 2020,” further explains the major drivers manipulating industry, the possibility of development, and the challenges going up against the administrations and industrialists in the market. This research study portrays an…

PLATINUM GLOBAL BRIDGING FINANCE - BRIDGING FINANCE, DEVELOPMENT FINANCE AND COM …

If your business is looking to finance bridging, development or commercial financing we have contacts with lenders and banks in over 25 countries around the world. Our specialist knowledge can help you get the ideal financing in place.

Platinum Global Bridging Finance is a specialist bridging loan lender. They deliver the loan financing that suits you and your clients desired financing. Their aim is to be crystal clear, so they offer…

Global Environmental Finance Market Leading Players are Environmental Finance (F …

Global Environmental Finance Market Insights, Size, Share, Forecast to 2025

This report studies the Environmental Finance Market size by players, regions, product types and end industries, history data 2013-2017 and forecast data 2019-2025; this report also studies the global market competition landscape, market drivers and trends, opportunities and challenges, risks and entry barriers, sales channels, distributors and Porter's Five Forces Analysis.

The main goal for the dissemination of this information is to…

Global Consumer Finance Services Market Forecast to 2025, Top Key Players- Bajaj …

The Consumer Finance Services Market Research Report is a valuable source of insightful data for business strategists. It provides the Consumer Finance Services overview with growth analysis and historical & futuristic cost, revenue, demand and supply data (as applicable). The research analysts provide an elaborate description of the value chain and its distributor analysis. This Consumer Finance Services market study provides comprehensive data which enhances the understanding, scope and application…

Why Consumer Finance Market is Growing Worldwide? Watch out by top key players B …

The split of retail banking that deals with lending money to consumers.

Consumer finance market is growing due to increasing per capita income, high economic growth, rapid urbanization and rise in consumer spending power. Rising consumer favorite towards the use of credit cards owing to the associated benefits related to it such as reward points and a host of promotional offers like movie tickets, discounts on flight bookings etc., is likely…